Hello, and welcome to the IVA Weekly Brief for Wednesday, November 12.

There are no changes recommended for any of our Portfolios.

Judging by the headlines last week, you’d think the stock market—and especially artificial intelligence (AI) stocks—was in free fall. But take a breath.

After peaking on October 28 at 6,890.89, the S&P 500 index dropped just 2.5% over the next seven trading days. That’s not even enough to qualify as a pullback—a 5% to 10% decline from a prior high. The S&P has since rebounded 1.9%, leaving it just 0.6% shy of a new record.

Even the tech-heavy Nasdaq Composite, the supposed epicenter of the “AI unwind,” was only down 4.0% from its October 29 high.

Declines of 2.5% and 4.0%? That’s what’s driving all the hand-wringing and talk of the AI boom bursting? Please.

Sure, it’s possible that the market peaked in late October—and maybe we’re at the start of a pullback—or something worse. The catch is, we won’t know that until well after the fact.

For now, a 2.5% decline is a nothingburger. If a move that small had you anxious about your portfolio, that’s a sign you may be taking more risk than you can comfortably handle. Because sooner or later, we’ll face a much steeper drop.

That’s not a prediction (or market call)—it’s just reality. As I showed you last week, corrections are a regular part of market life.

And remember: The financial media makes its living off drama. Every time they cry “wolf,” that doesn’t actually mean the wolf is at the New York Stock Exchange’s door. But saying “All’s normal on Wall Street,” just doesn’t have as much oomph.

So, every time you see a headline screaming that the sky is falling, take a deep breath. More often than not, it’s just noise—not trouble.

Noisy Data Ahead

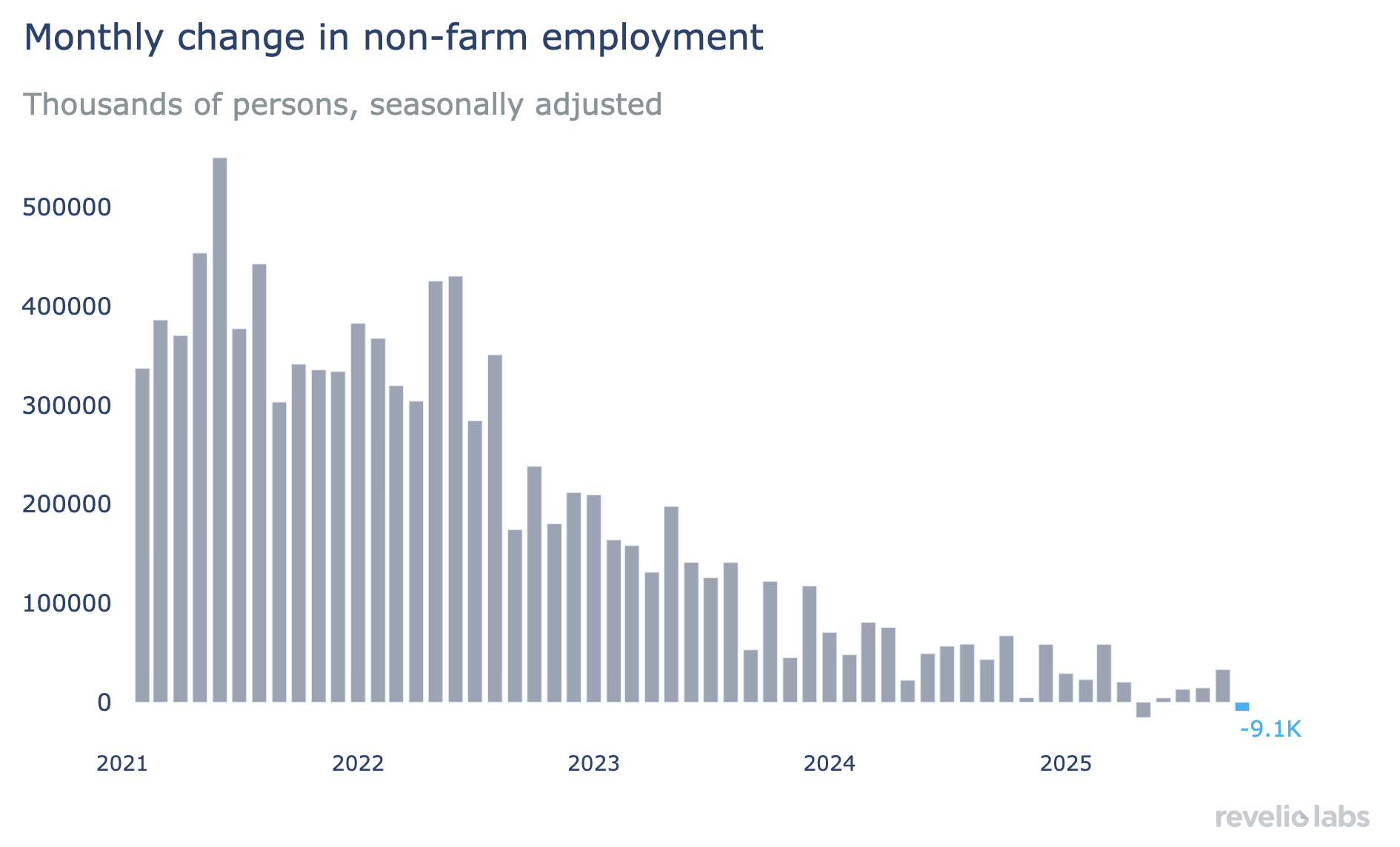

Last week, I mentioned tracking Revelio Labs’ Public Labor Statistics (RPLS) to keep tabs on the labor market while the government shutdown keeps the official data spigot shut. Well, according to Revelio Labs, the U.S. economy lost 9,100 jobs in October.

The culprit? The government sector, which lost 22,200 jobs—enough to pull the overall total into negative territory. That’s not exactly shocking given the shutdown, but it adds static to the signal. If those jobs return once the government reopens, hiring will get a one-time bump.

The bigger takeaway isn’t the headline number—it’s the message behind it. Revelio Labs’ data point to a labor market that’s still sluggish, and one where the readings will remain noisy for a while.

Guns Blazing

Vanguard’s naming names.

Its latest email campaign for Cash Plus Account asks, “Is your bank on the list?” Vanguard doesn’t mince words: “If your bank only pays pennies in interest, it might be time for a change.” The email then includes the following table comparing the meager yields offered by some of the nation’s biggest banks—Bank of America, JPMorgan Chase and Schwab—to its own.

Woah. Vanguard’s coming out swinging—publicly shaming the competition for their puny cash yields.

What Vanguard doesn’t say, of course, is that Wealthfront and Fidelity—to name just two—offer cash management accounts with yields on par with Cash Plus Account, and with extra perks like ATM access. Nor does the email mention that Federal Money Market (VMFXX) is currently paying an even better yield—3.88%.

And, remember that Cash Plus Account’s 3.50% yield is likely heading to 3.25% in the next few weeks.

But, hey, marketing is marketing. The email’s job is to grab attention—and Cash Plus Account signups—not to offer a full comparison that muddies the message.

I don’t mean to sound cynical—if you’re still earning next to nothing in a traditional savings (or checking) account, by all means, move more of your cash to Vanguard. If you want to open a Cash Plus Account, go for it—getting 3.50% (or 3.25%) is far better than scraps. But it’s not your only option. The higher-yielding Federal Money Market is available as a settlement fund in your brokerage account—easy.

Extra Income?

Vanguard’s marketing team has been busy.

In addition to the Cash Plus Account campaign, I received another email—this one inviting me to “Discover how you could earn more with Vanguard's Fully Paid Lending program” and asking if I would like to“maximize [my] passive income?”

According to the pitch, I can earn additional monthly income while being “safeguarded” and maintaining “economic ownership” of my stocks. Sounds great, right? What’s not to like?

Let’s take a step back. What Vanguard’s talking about here is called securities lending.

Large institutional investors—mutual funds, ETFs, pension plans, endowments—have long generated a little extra income by temporarily lending out their holdings. Essentially, they loan shares of a stock to another investor (usually someone shorting the stock, like a hedge fund) in exchange for a bit of income.

It’s not new or exotic. In fact, Vanguard’s index funds and ETFs have been doing this for years—adding roughly 0.01% to 0.05% to their annual returns on average.

In 2023, Vanguard opened the door to individual investors through its Fully Paid Lending (FPL) program, which the email is promoting. Here’s how it works:

If you own individual stocks and enroll, Vanguard may lend some of them. You’ll earn a bit of income—split 50/50 with Vanguard—and when the loan ends, your shares are returned. You’ll keep “economic ownership,” meaning you can sell the stock at any time.

So again, what’s not to like?

First, while your shares are on loan, you lose your voting rights. The shares also aren’t protected by SIPC during that period. If the stock pays a dividend, you’ll still receive it—but the payment may be taxed differently. Finally, there’s no guaranteed payout. The income is variable and unpredictable.

Those are manageable trade-offs. The big question is: What’s the risk?

Securities lending involves multiple moving parts—the lender (you), the borrower, a lending agent sitting between the two, collateral management and more. The main risk is that the borrower defaults, and the collateral isn’t enough to make you whole.

That’s unlikely, but not impossible. Vanguard has extensive experience lending securities, and the industry has tightened oversight over the years. Still, as with most “extra income” offers, there’s no free lunch.

So, should you enroll?

Maybe—but temper your expectations. Vanguard’s funds add just 0.01%–0.05% a year from securities lending across thousands of positions. You might earn a bit more if you happen to hold highly shorted or in-demand stocks. Or not. Either way, it’s probably not going to move the needle—or shield you from market losses.

As for me? I’m not a stock guy, so the program doesn’t really apply to me. But even if it did, I’d probably skip it. I don’t need another layer of complexity for an extra basis point or two of return—before taxes.

🎁 Gift Idea: Share the IVA

I’m getting into the holiday spirit. So, if you’re looking for a thoughtful holiday gift, how about giving the gift of clarity and confidence in investing with a subscription to The Independent Vanguard Adviser?

Annual and recurring memberships are easy to send—just click below to get started:

It’s a simple way to help someone you care about make the most of their Vanguard investments—all year long.

Our Portfolios

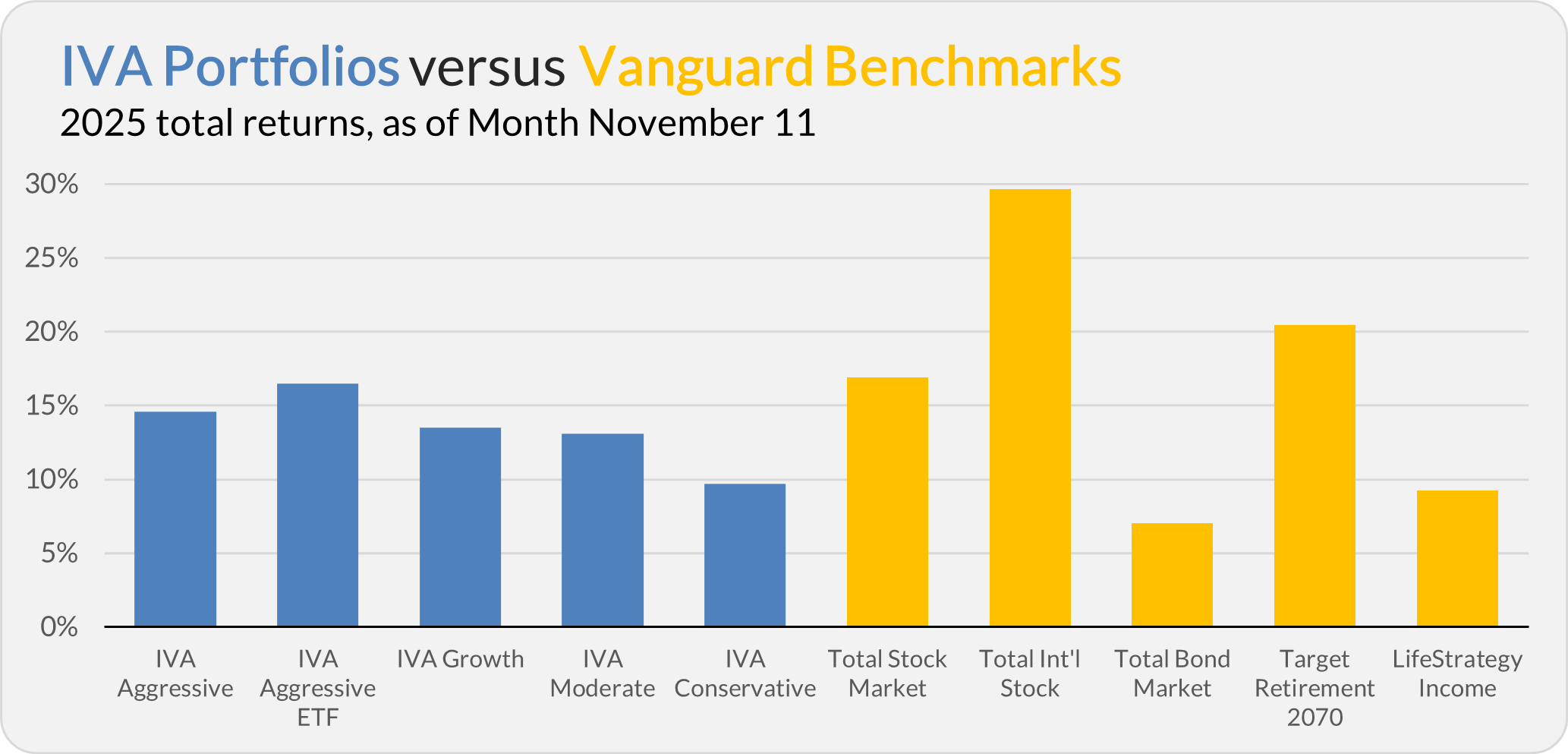

Our Portfolios are showing solid returns for the year through Tuesday. The Aggressive Portfolio is up 14.6%, the Aggressive ETF Portfolio is up 16.5%, the Growth Portfolio is up 13.5%, the Moderate Portfolio is up 13.1% and the Conservative Portfolio is up 9.7%.

This compares to a 16.9% return for Total Stock Market Index (VTSAX), a 29.7% gain for Total International Stock Index (VTIAX), and a 7.0% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 20.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 9.2%.

IVA Research

Yesterday, I armed Premium Members with everything they need to know to navigate 2025’s year-end capital gains distributions—here.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.