Hello, and welcome to the IVA Weekly Brief for Wednesday, June 25.

There are no changes recommended for any of our Portfolios.

I’m repeating myself here—but it bears repeating: you can’t profitably trade the headlines.

With war breaking out in the Middle East, threatening the flow of oil and potentially pushing prices as high as $100 per barrel, you might think buying Energy Index (VENAX) is a no-brainer. And yes, Energy Index has gained 5.3% in June, outpacing Total Stock Market Index’s (VTSAX) 3.3% return.

But it's not that simple.

The chart below tracks Energy Index’s cumulative return in June. On it, I’ve marked a few key dates.

If you were trying to profit from trading energy stocks in June, you needed to act before the headlines. You had to buy before the U.S State Department withdrew personnel from the region or Israel launched its first missile at Tehran. And you had to sell last Friday, anticipating that U.S. bunker-buster strikes on Iran’s uranium enrichment sites would lead to de-escalation.

In fact, if you bought Energy Index after the missiles started flying, you’ve actually lost money on the trade! Making that trade even more painful: Total Stock Market Index is up 2.1% since Israel’s first strike.

Of course, the conflict isn’t over, and the energy stocks could deliver gains from here. But this is just another case study in how hard—nearly impossible—it is to trade the headlines and come out ahead.

Stepping back, investors who kept from trading the headlines have done just fine in June.

As I mentioned, Total Stock Market Index is up 3.3%. But gains have been widespread. Foreign stocks, measured by Total International Stock Index (VTIAX), have gained 2.4%. Total Bond Market Index (VBTLX) is up 1.1% and Federal Money Market (VMFXX) is up 0.3%. Alternative assets are also positive for the month, with Commodity Strategy (VCMDX) up 2.8% and Real Estate Index (VGSLX) up 2.3%.

In sum, disciplined investors who ignored the headlines have been rewarded.

If you’d like to read more on how markets perform during times of armed conflict, check out my recent piece: Geopolitics and Your Portfolio: Lessons from 125 Years of Conflict.

Can Two Vanguards Be Better Than One?

Vanguard has built a world-class stock indexing outfit. But can it manage two of them? That’s the key question investors need to be asking.

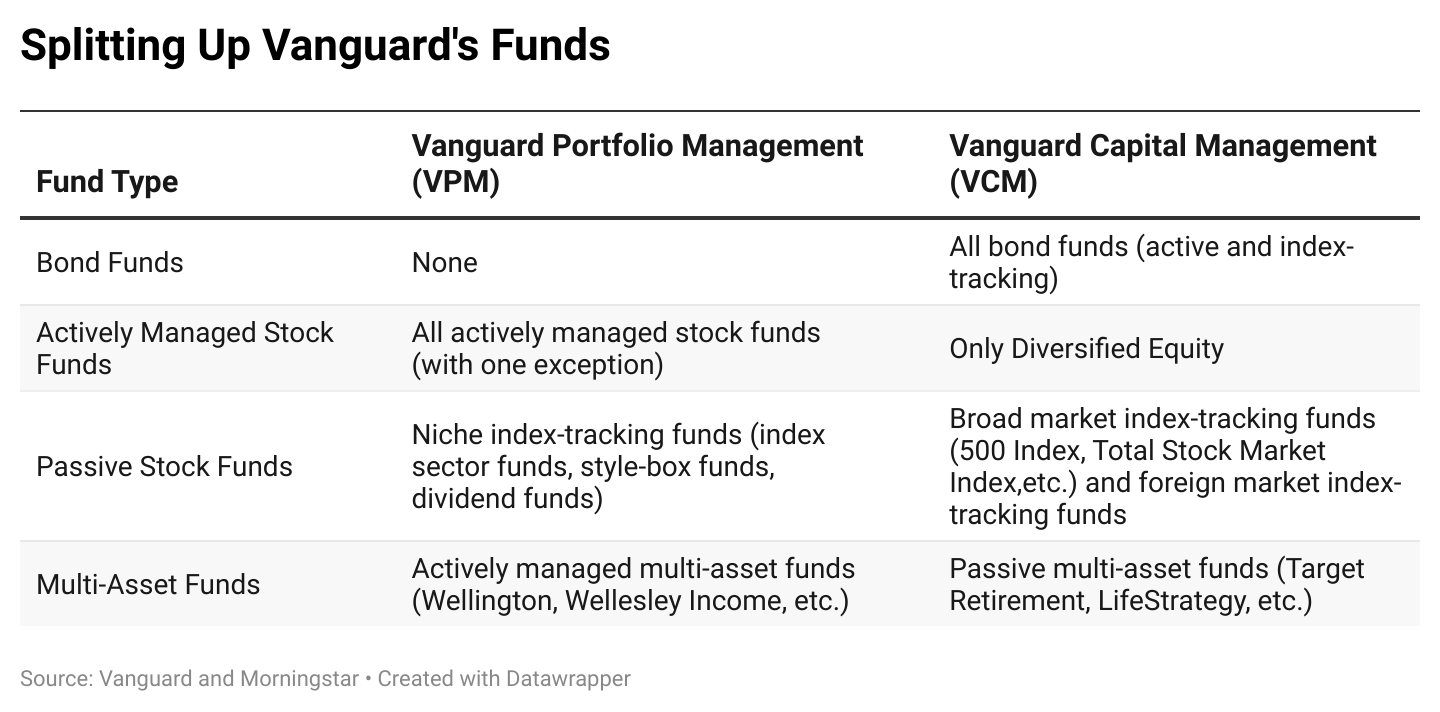

As I shared with Premium Members last week—and expanded upon on Monday—Vanguard is reorganizing itself into two wholly owned investment units: Vanguard Capital Management (VCM) and Vanguard Portfolio Management (VPM).

This handy table (hat tip to Morningstar) illustrates how the funds are split.

The reorganization does not impact Vanguard’s bond funds or its actively managed stock and balanced funds. They’ll still be managed by the same teams.

What’s new is the creation of two separate stock index teams within Vanguard. Each team will operate independently, right down to working out of different buildings.

Why is Vanguard splitting its stock index team?

Part of the answer lies in easing regulatory pressures and concerns over how the fund giant exercises its voting power. But it’s not just about politics.

Managing a single, massive indexing unit comes with operational strain. Splitting the team allows Vanguard to better manage its scale and create more leadership roles with clearer career paths for rising talent. Yes, there will be redundancy, but for an indexing giant like Vanguard, the tradeoff may be worth it.

Vanguard’s first test is pulling off the split without any hiccups. The greater challenge? Keeping both teams operating at the highest level while holding the line on costs.

That’s no small feat. But if anyone can do it, it’s Vanguard. No firm has more experience managing stock index teams and funds. And while the firm hasn’t announced a timeline or started the clock on this reorganization, we can—and should—use this time to prepare and stay focused.

As I said on Friday, the bottom line for fund shareholders is simple: Stay the course—this isn't a reason to panic or jump ship. However, we must remain vigilant.

Shuffling Managers

Vanguard has started laying the groundwork for this split.

In February, Vanguard added co-managers to many of its stock index funds. Last week, it removed managers from 44 stock index mutual funds and ETFs, plus seven active factor funds. As I told Premium Members, these moves were related. The February additions and June removals were two steps in a single, planned transition.

Yes, it is routine for Vanguard to shuffle the managers on its stock index funds. And yes, Vanguard built redundancies, ensuring all funds have co-managers. But it’s now clear that part of the motivation for this latest re-org was to align managers onto one team or the other ahead of the split.

Take Gerard O’Reilly. At the start of the year, he co-managed both Total Stock Market Index and SmallCap Index (VSMAX). Once the team divides, he can’t be on both sides. So, Nick Birkett stepped in to replace O’Reilly on Total Stock Market Index.

Splitting the team in two is a new trick. But shuffling managers on its stock index funds is business as usual for Vanguard.

One Stale Price

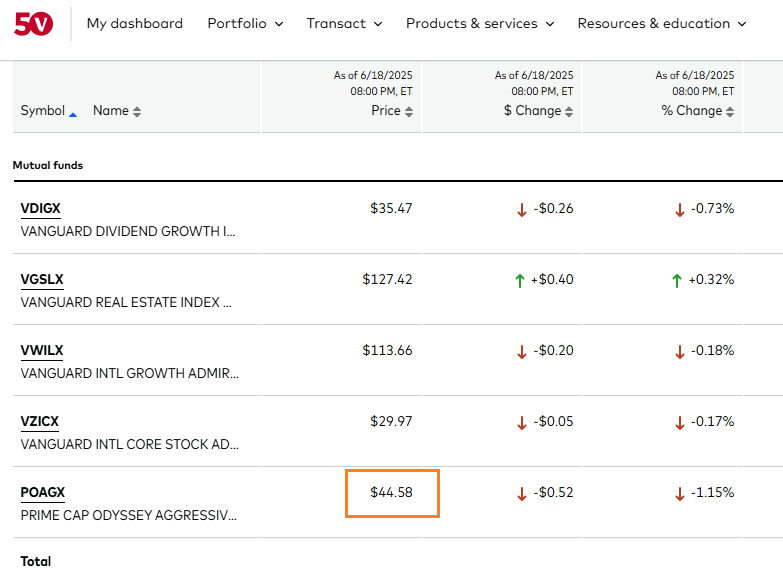

I have to tip my hat to one eagle-eyed IVA reader for catching this: Vanguard struggles to display PRIMECAP Odyssey Aggressive Growth’s (POAGX) price accurately on market holidays.

I captured the screenshot below from my accounts on Thursday, June 19, around 4 pm (Eastern time). The markets were closed for Juneteenth, and Vanguard’s header clearly stated that prices were “as of 6/18/2025”—the previous close.

That checked out for all of Vanguard’s own funds. But for the PRIMECAP Odyssey fund? Not so much. Vanguard was still showing Tuesday’s closing price of $44.58, even though the fund’s actual close on Wednesday was $44.64.

I can’t explain why Vanguard lets this happen, but apparently, PRIMECAP Odyssey Aggressive Growth’s stale pricing shows up every market holiday.

The correct price appeared in my account by Friday morning, so no harm done. Still, it’s a reminder that Vanguard’s tech continues to fall short. In 2025, something as basic as posting the right price shouldn’t be too much to ask.

Our Portfolios

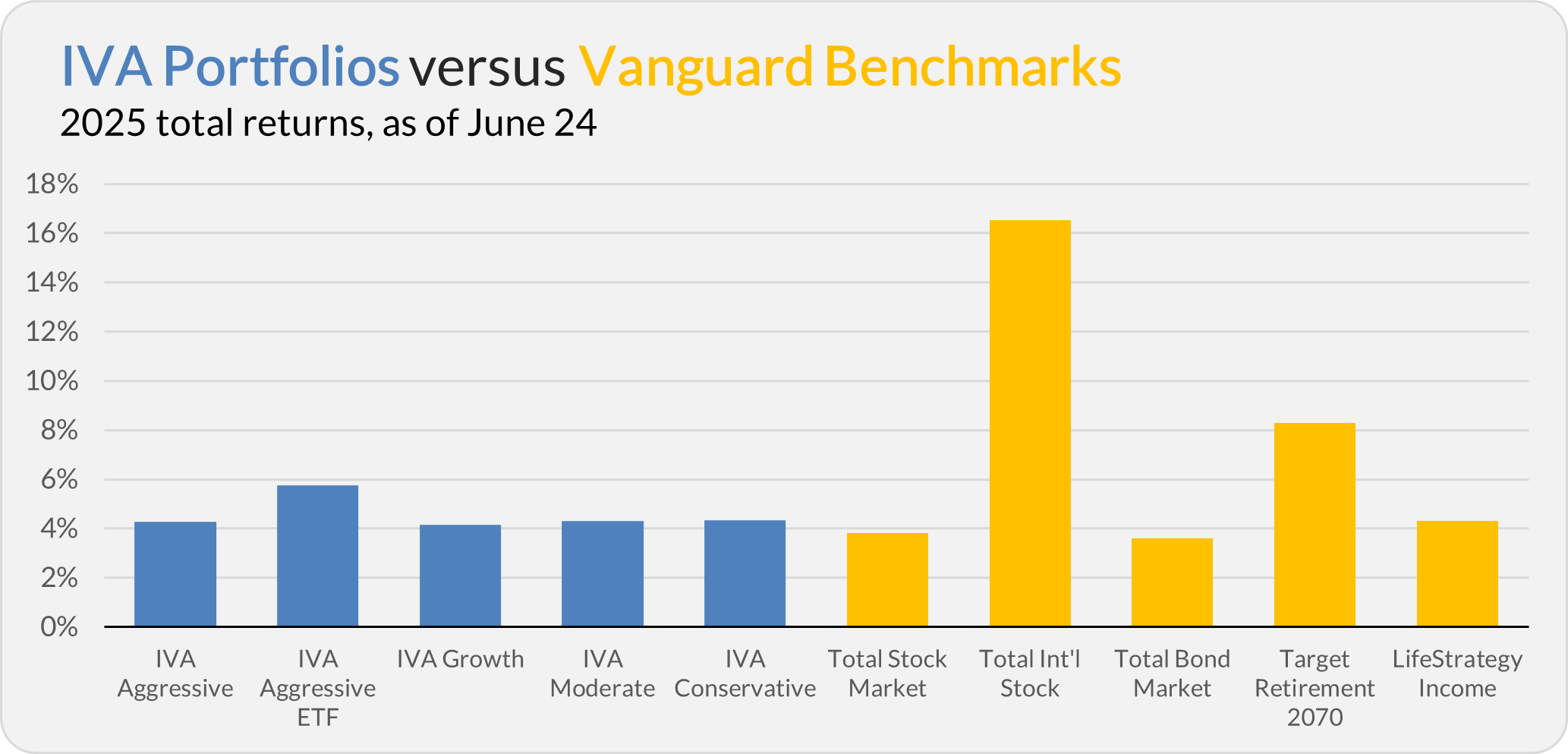

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 4.3%, the Aggressive ETF Portfolio is up 5.8%, the Growth Portfolio is up 4.1%, the Moderate and Conservative Portfolios are up 4.3%.

This compares to a 3.8% gain for Total Stock Market Index (VTSAX), a 16.5% return for Total International Stock Index (VTIAX), and a 3.6% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 8.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.3%.

IVA Research

Since last week’s Weekly Brief, I shared three Quick Takes with Premium Members. One covered Vanguard’s decision to remove managers from 44 stock index funds. The other two—here and here—dug into Vanguard’s plan to split its stock indexing team in two.

Yesterday, in Simple is Smart—But Is It Enough?, I introduced a framework to help investors determine which (if any) of Vanguard’s balanced funds might make sense in their portfolios.

Next week, I’ll take a closer look at each balanced fund in Vanguard’s lineup—so you can better understand how they stack up.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.