Hello, and welcome to the IVA Weekly Brief for Wednesday, June 4.

There are no changes recommended for any of our Portfolios.

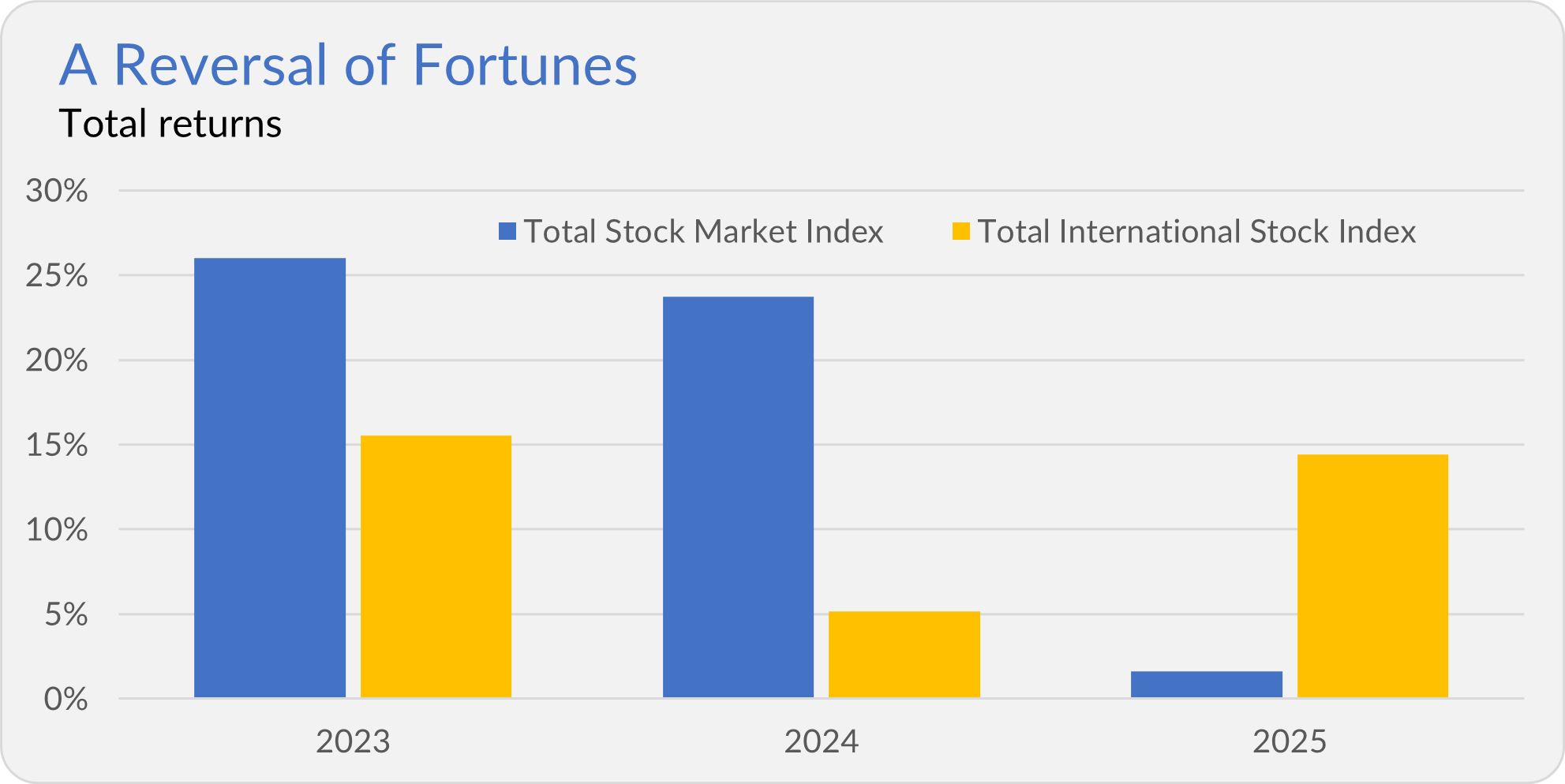

It took a while, but disciplined investors who stuck with their allocations to foreign stocks are finally reaping their rewards.

After trailing U.S. stocks by wide margins the past two calendar years (and really for the past decade or longer), foreign stocks are racing ahead in 2025. Total International Stock Index (VTIAX) is up 14.4%, while Total Stock Market Index (VTSAX) is up only 2.1%. In fact, this year’s worst-performing foreign stock fund (excluding global funds), Emerging Markets Stock Index (VEMAX), has nearly beaten the best diversified domestic stock fund, MidCap Growth Index (VMGMX), 7.2% to 7.6%.

It’s not just foreign stocks that are outpacing U.S. stocks this year; bonds and cash are ahead as well. As of Tuesday’s close, Total Bond Market Index (VBTLX) is up 2.2% and Federal Money Market (VMFXX) is up 1.8%.

It may only be five months, but balanced, globally diversified portfolios are outpacing U.S. stocks—a clear reminder of the value in staying diversified, remaining disciplined, and sticking with a portfolio that aligns with your goals and comfort level.

Slowing Trade

Can the economy muddle through?

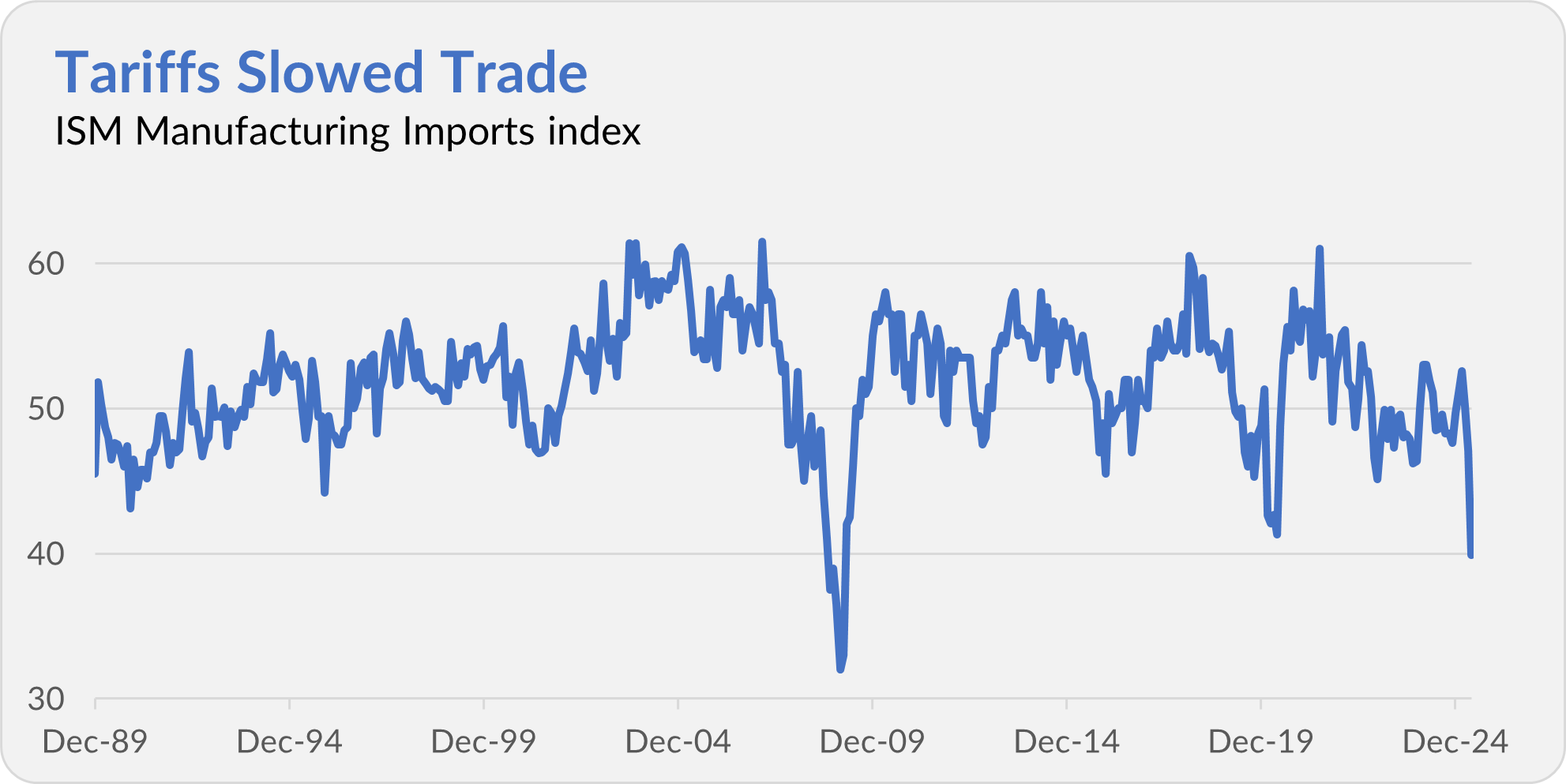

All the back-and-forth on tariffs—on again, off again, higher or lower, legal or not—and the shifting trade tensions with China and the E.U. remain a headwind for economic growth. Even so, the latest report from the Institute for Supply Management (ISM) suggests the economy may still have enough momentum to muddle through.

Trade flows suffered a setback in May, as the ISM reported that both new export orders and imports declined. In fact, the imports index plunged to its lowest level since the depths of the Global Financial Crisis in 2009.

And despite the desire to see manufacturing “return” to our shores, ISM’s overall manufacturing index slipped 0.2 points—from 48.7 to 48.5. It remains in contraction territory (anything below 50 is), but it’s yet to reflect recession-level weakness.

In the next week, we’ll see the impact that policy uncertainty has had on May’s unemployment and inflation rates. But, so far, it’s a qualified “yes” to my opening question—the economy can probably muddle through.

Let’s turn our attention to the news out of Malvern, PA—Vanguard’s headquarters:

More Choice …

Last week, Vanguard announced it was adding four funds—Growth Index, Value Index, LargeCap Index and MidCap Index—to its Investor Choice proxy voting program.

You can read about the program in-depth here, but this is the short story: Investor Choice aims to give mutual fund and ETF shareholders more input in how their votes are cast on the proxy statements of the companies that their funds hold. Importantly, you aren’t controlling how each vote is cast; you are choosing among five “voting policies” that Vanguard will follow.

As I told Premium Members on Monday, while Vanguard has been steadily expanding this program, the latest move is a significant expansion. Previously, the program covered assets of less than $250 billion. With these latest additions, that total is now around $1 trillion.

That’s a big milestone—but at Vanguard, it still means nine out of every ten dollars aren’t part of Investor Choice. In other words, Vanguard has a long way to go before comprehensive coverage becomes a reality.

… Less China …

Premium Members also got my early take (here) on Vanguard’s SEC filing to launch Emerging Markets ex China ETF.

Set to be released in August, the fees will be a low 0.07%, as the new ETF aims to provide broad exposure to emerging market stocks, excluding those from China.

Chinese stocks dominate broad emerging market funds, making up more than 30% of Emerging Markets Stock ETF’s (VWO) portfolio, for instance. However, his new fund will devote nearly 60% of its assets to companies in India and Taiwan.

If you’re interested in emerging markets but cautious on China, this fund could be a compelling alternative. Still, you need to be aware of the big country risks you are taking, whether in this new ETF or the old workhorse.

Bigger picture, what does this fund’s upcoming launch mean for Vanguard?

I don’t think this ex-China fund has anything to do with the tariff noise in particular. At least, I don’t see it as reflecting an anti-China stance within Vanguard. Instead, the fund giant is likely responding to client demand and the new CEO’s drive for growth in launching the fund.

I also suspect Vanguard has spotted an opportunity to take market share. In classic Vanguard style, the fund giant is significantly undercutting the competition on price. For example, the iShares Emerging Markets ex-China ETF (EXMC) has $14 billion in assets and charges an expense ratio of 0.25%. As I said, Vanguard is coming in at less than one-third that level at 0.07%.

This move is emblematic of Vanguard’s broader push to expand its ETF lineup under its new CEO, Salim Ramji. Vanguard currently offers 93 ETFs—a modest number compared to more than 460 at iShares, the ETF giant Ramji led between 2019 and 2024. (His title was “Global Head of iShares and Index Investments.)

In short, expect Vanguard’s ETF roster to continue growing.

… a New Bogey …

Vanguard is tweaking Multi-Sector Income’s (VMSIX) strategy and assigning it a new blended benchmark.

On Monday, Vanguard updated the bond fund’s prospectus to clearly state that the fund holds “asset-backed securities”—think mortgage-backed bonds. Here’s the specific sentence that was added to the fund’s “Principal Investment Strategies” section:

The Fund may also invest in structured products, including asset backed securities, agency and non-agency commercial and residential mortgage-backed securities, collateralized mortgage obligations, variable rate demand notes issued by governments or government agencies, and collateralized loan obligations.

The multi-sector bond fund’s old blended benchmark—40% junk bonds, 40% investment-grade corporate bonds and 20% emerging market bonds—is now obsolete. The fund’s new target is 50% junk bonds, 30% investment-grade corporate bonds, 10% emerging markets and 10% asset-backed securities.

In short, Vanguard shifted 10% of the fund’s benchmark from investment-grade bonds to asset-backed bonds. It also trimmed 10% from the emerging markets sleeve and moved it into high-yield (junk) bonds.

Vanguard confirmed that this is a “minor change to the strategy.” However, it doesn’t change the fund’s fundamental story—it remains a big step further out on the risk spectrum from Vanguard’s core bond funds.

For example, Core-Plus Bond’s (VCPIX) portfolio managers can hold up to 35% of the fund’s assets in junk bonds. Multi-Sector Income will allocate 50% to 55% of its portfolio to junk bonds most of the time. Which means the multi-sector fund’s “neutral” stance is (much) more aggressive than Core-Plus Bond’s most bullish.

As I’ve noted before, I don’t believe investors are being adequately compensated (receiving sufficient additional income) for the risks in junk bonds. So, while the fund is firmly on my radar, I’d steer clear of it for now.

… and Another Retirement.

According to Citywire, Bill Teichner of Frontier Capital Management—who co-manages a slice of Explorer Value (VEVFX)—is retiring at the end of June. Presumably, co-manager Rushan (Greg) Jiang will take the reins.

What’s puzzling is Vanguard’s silence. It’s possible I missed the notice, but I don't see any mention of it in the fund’s prospectus or semiannual report. If you’re going to buy an actively managed fund, knowing who’s at the helm is essential.

Teichner’s retirement doesn’t change the fact that Explorer Value is effectively an index fund charging shareholders active management-level fees. Still, investors deserve clarity.

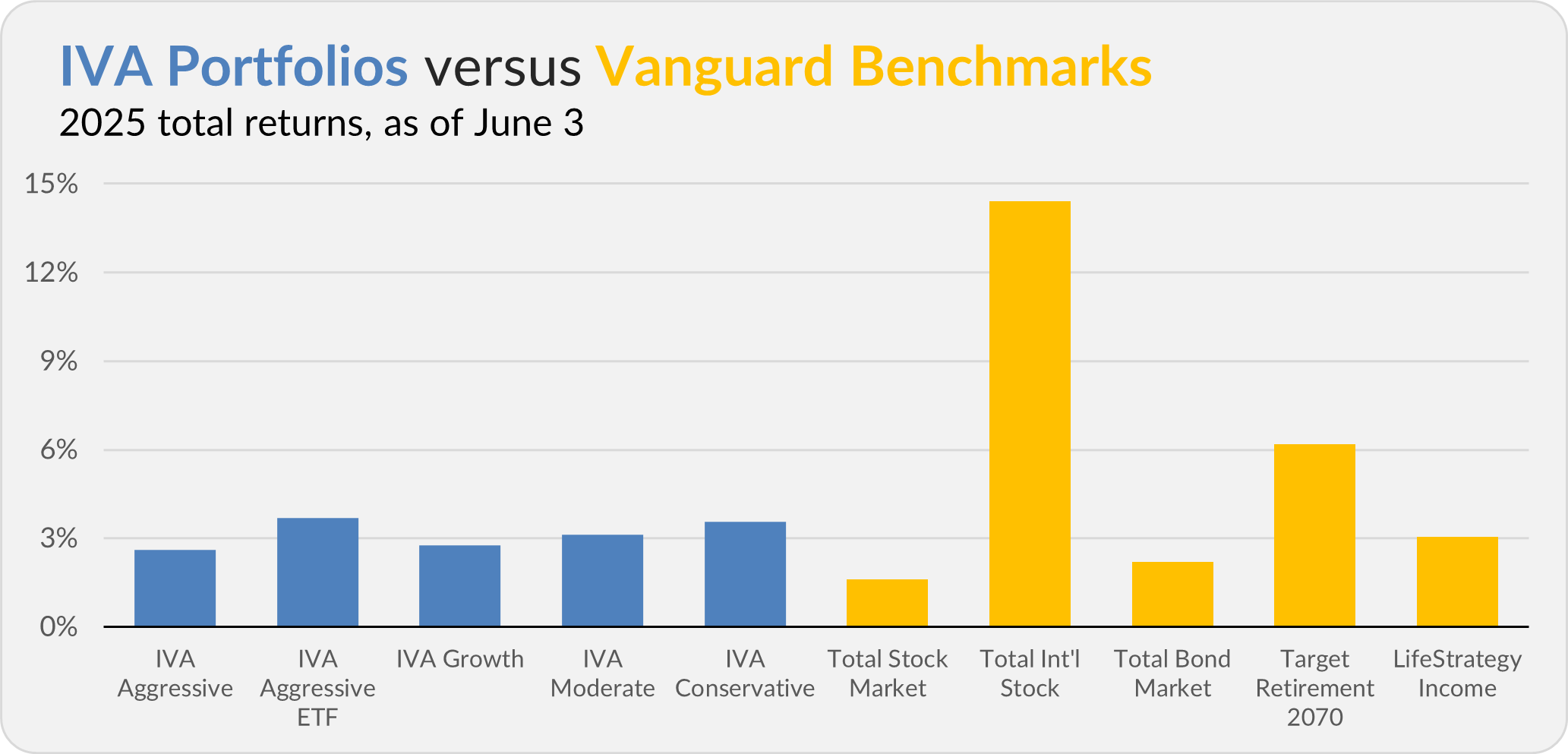

Our Portfolios

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 2.6%, the Aggressive ETF Portfolio is up 3.7%, the Growth Portfolio is up 2.8%, the Moderate Portfolio is up 3.1% and the Conservative Portfolio is up 3.5%.

This compares to a 1.6% return for Total Stock Market Index (VTSAX), a 14.4% gain for Total International Stock Index (VTIAX), and a 2.2% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.0%.

IVA Research

On Monday, in June’s monthly article for Premium Members, I analyzed the tariff and investment landscape, provided a list of Vanguard funds paying out quarterly income in the month ahead, examined the IVA Portfolios and more.

Yesterday, I shared my take on the dual mutual fund—ETF share class structure with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.