Hello, and welcome to the IVA Weekly Brief for Wednesday, October 15.

There are no changes recommended for any of our Portfolios.

Gold is having one of its moments in the spotlight.

The metal’s price recently climbed above $4,000 an ounce for the first time, up roughly 60% this year. The leading “theory” behind gold’s surge is that investors are turning to it as a safe haven.

But what is a “safe” asset?

In my book, despite the ongoing government shutdown, U.S. Treasurys still count as a safe asset.

Gold? It’s got a long history—but that history also includes some gut-wrenching declines. Between 2011 and 2016, gold fell 45%. After peaking in the early 1980s, it dropped around 70% and didn’t reach a new high until 2008—that’s almost three decades of being underwater.

Does that sound like a safe asset to you? I’ll let you decide.

What I can do is put gold’s long-term record in perspective—especially compared to productive assets like stocks.

The chart below shows the cumulative total return of gold and 500 Index (VFIAX) since the flagship index fund’s 1976 inception. Over this nearly 50-year stretch, gold’s price rose nearly 4,000%, or 7.8% a year. Not too bad, actually.

But if you had invested the same $1,000 in 500 Index and reinvested dividends, you earned a 22,000% return, or 11.6% annually.

To put some dollars and cents on it, that’s the difference of turning $1,000 into $40,000 with gold or $220,000 with stocks. That’s the power of owning businesses instead of bars.

Gold will shine from time to time, but over time, the compounding of productive assets leaves the glitter of gold in the dust.

As for me, I’d rather spend my next 50 years spending time in the market, not trying to time gold’s ups and downs.

Crash Ahead

Of course, gold isn’t the only thing getting attention lately. Market crash talk is back in the headlines, too.

Financial journalist Andrew Ross Sorkin—of Too Big to Fail fame—has a new book out—1929: Inside the Greatest Crash in Wall Street History—and How It Shattered a Nation. I haven’t read it yet, but a few IVA readers asked about Sorkin’s recent 60 Minutes interview, where he warned of another market crash. Here’s what he said:

The answer is we will have a crash; I just can’t tell you when, and I can’t tell you how deep. But I can assure you, unfortunately, I wish I weren’t saying this, we will have a crash.

I actually agree with Sorkin—the stock market will crash again. But that’s not exactly breaking news. There’s always another correction, bear market or panic ahead. That’s simply the price of admission to compound your wealth in the stock market.

As I just showed you, over the past five decades, 500 Index has compounded at an 11.6% annual rate. That includes every so-called "crash": 1987’s Black Monday (when stocks fell 20% in a single day), the dot-com bust, the financial crisis, COVID’s market panic, etc.

If you could neatly side-step those periods, you’d do it. But no one can do that consistently—and still capture the market’s upside. Remember, to correctly time the market, you need to be right twice—when to sell and when to buy back in.

So, let me revise my earlier statement: I want to spend my next 50 years spending time in the market, fully aware there will be bear markets, panics and crashes along the way. That’s the tradeoff—and the reward—of being a long-term investor.

For more on market corrections, see the following two articles I wrote when stocks were falling in March:

Boiling Over

And speaking of volatility, another familiar source of market anxiety has returned: U.S.–China trade tensions. In case you forgot, the U.S. and China are still at the negotiating table—and the temperature just went up, way up.

What had been simmering quietly in the background suddenly boiled over last week. China announced plans to restrict exports of rare-earth minerals—critical ingredients for everything from batteries to smartphones to electric vehicles. The U.S. quickly hit back, threatening an additional 100% tariff on Chinese goods.

The two sides continue to trade jabs since throwing those headline-grabbing punches.

Unsurprisingly, the renewed trade tension has added volatility to the markets. Still, the baseline assumption remains that a deal will eventually be struck. The U.S. and Chinese economies are simply too intertwined for a hard break—even if the path to resolution gets a little bumpier from here.

Could this be the catalyst for a market correction? Possibly. But I’m not letting it keep me from spending time in the market.

Our Portfolios

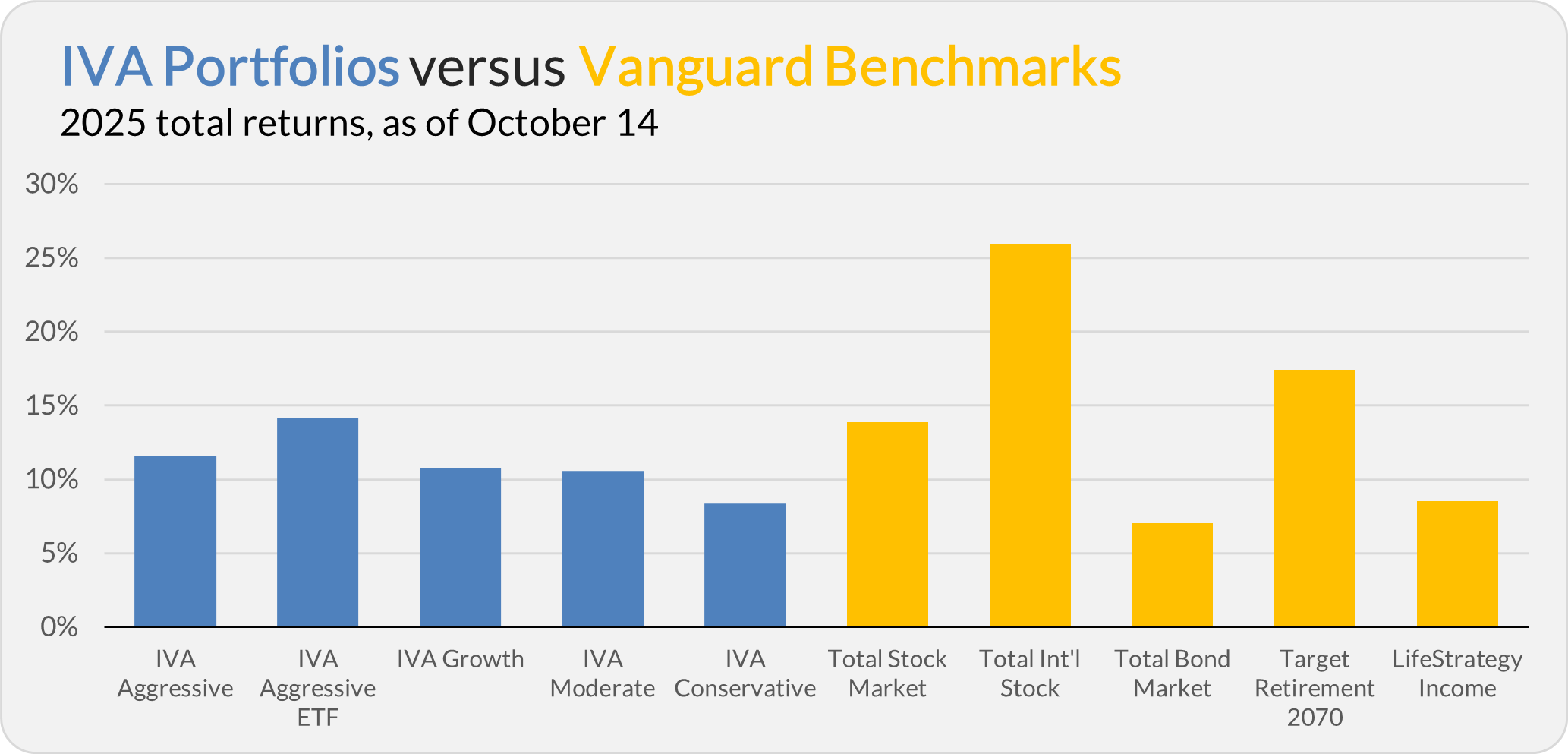

Four of our five Portfolios are showing double-digit returns for the year through Tuesday—and the fifth isn’t far off. The Aggressive Portfolio is up 11.6%, the Aggressive ETF Portfolio is up 14.2%, the Growth Portfolio is up 10.8%, the Moderate Portfolio is up 10.5% and the Conservative Portfolio is up 8.3%

This compares to a 13.9% gain for Total Stock Market Index (VTSAX), a 25.9% return for Total International Stock Index (VTIAX), and a 7.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 17.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 8.5%.

IVA Research

Yesterday, shared a deep dive into Dividend Growth with Premium Members. I weighed the fund’s legacy, leadership transition and the case for staying or moving on.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.