Hello, and welcome to the IVA Weekly Brief for Wednesday, September 10.

There are no changes recommended for any of our Portfolios.

Yesterday, the media’s headline indexes—the Dow Jones Industrial Average (Dow), the S&P 500 and the NASDAQ—all closed at record highs. Driving stocks higher is a curious narrative: a weakening economy will lead Federal Reserve (Fed) policymakers to cut the fed funds rate.

And make no mistake, the economy is softening, or at least the labor market has cooled.

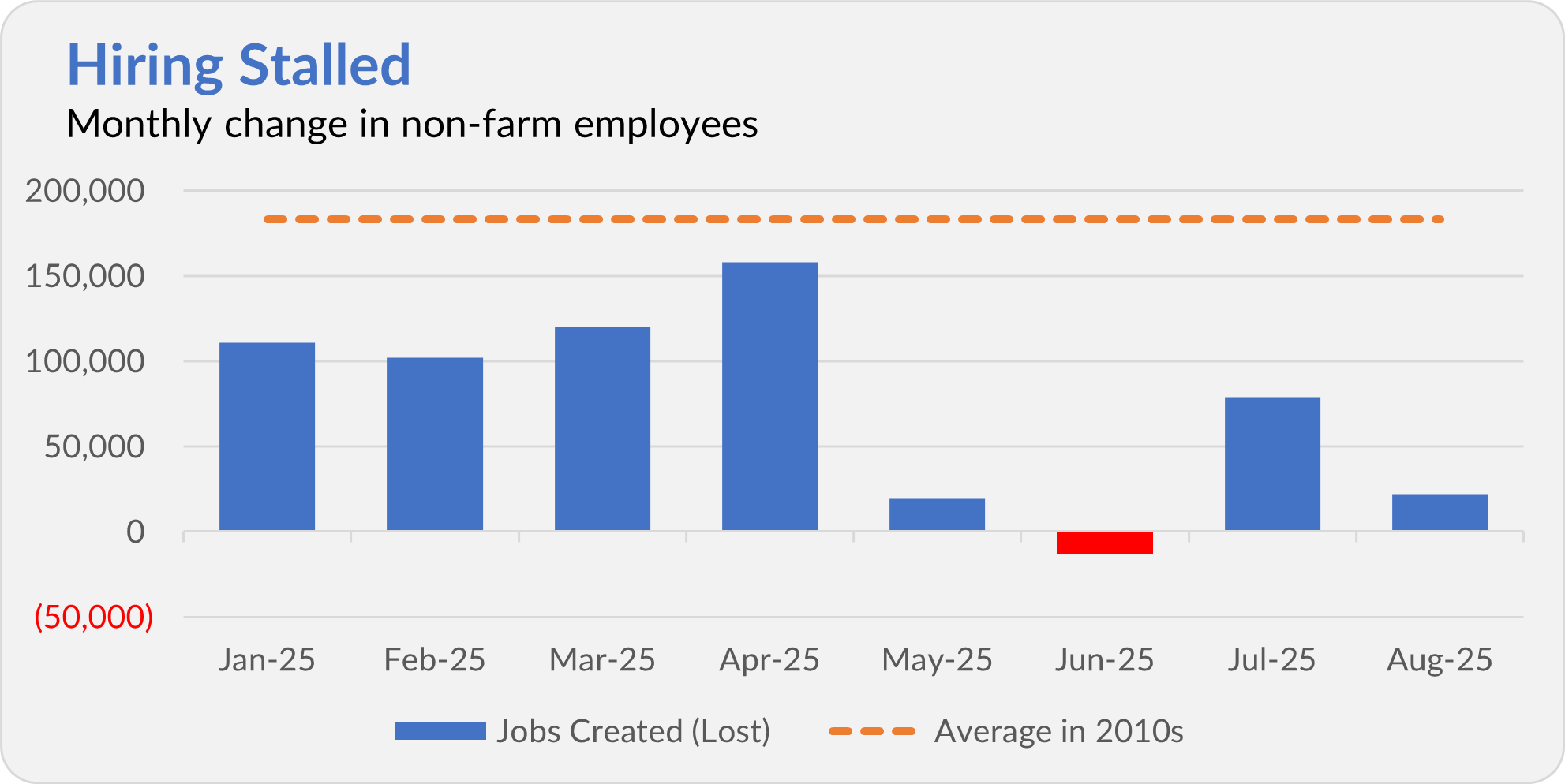

According to the Bureau of Labor Statistics (the BLS), the unemployment rate ticked higher from 4.2% to 4.3% in August, while hiring barely registered. The U.S. economy added just 22,000 jobs. Yes, that figure will be revised—which is a regular part of the agency's robust and transparent process—but it follows three soft reports in May, June and July.

April’s tally of 158,000 new jobs remains the best month of the year, though it's well below the 183,000 average monthly gains we saw in the 2010s.

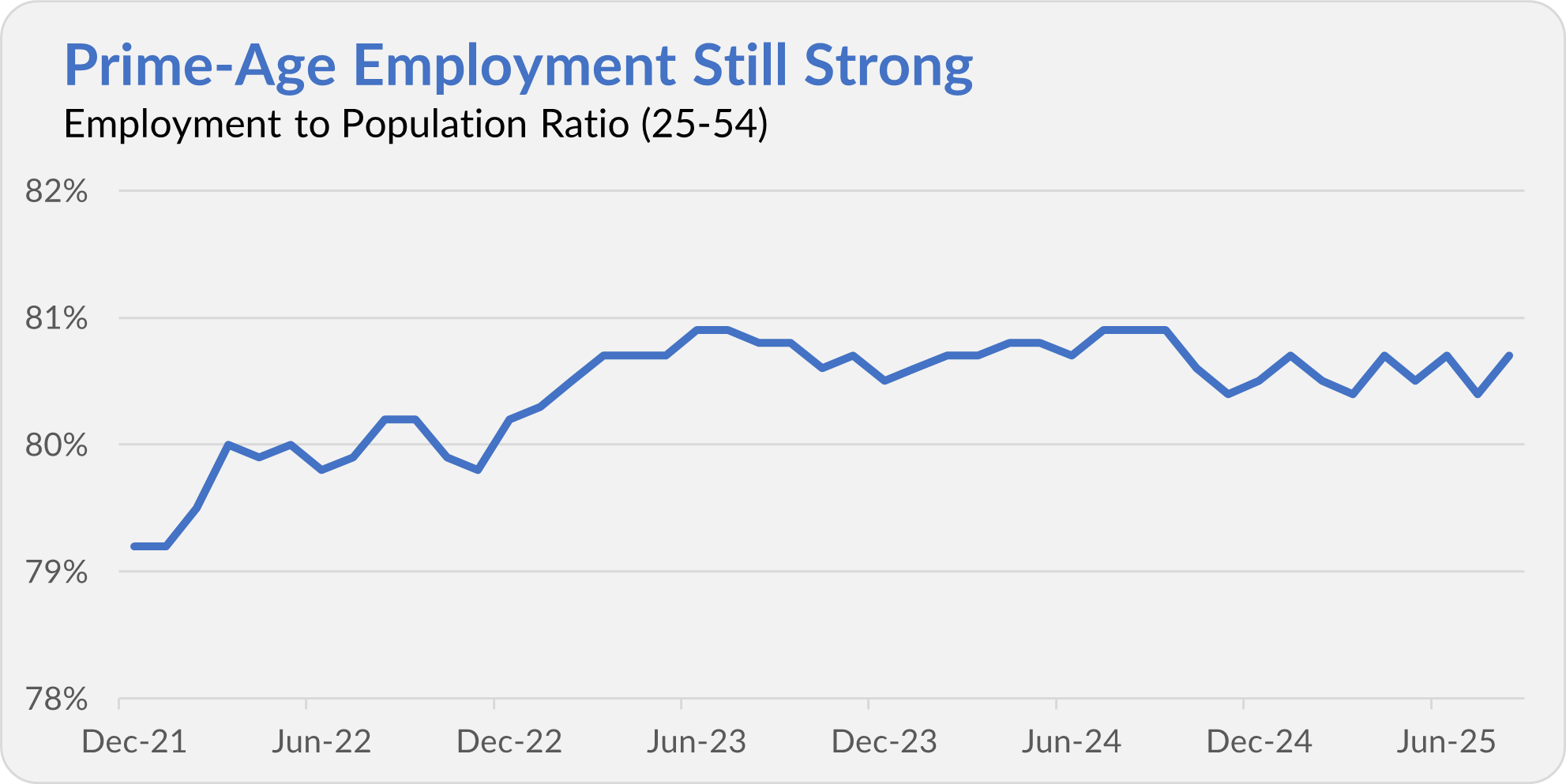

One bright spot: The prime-age employment rate—the share of 25- to 54-year-olds working—has held steady. That’s a broad measure of labor market health, and it hasn’t cracked yet.

So, the klaxons aren’t blaring … but the labor market is weakening. With hiring stalled, it’s a foregone conclusion that Fed policymakers will lower the fed funds rate next week.

But two factors argue against a long, steady march toward ever-lower interest rates.

First, inflation is running a little (but not overly) hot. We’ll get an update on consumer prices tomorrow, but it's likely to be in the same ballpark as July’s 2.7% reading.

Second, businesses are hesitant to hire and expand while tariff and trade rules remain in flux. Lower rates may provide some relief, but they won’t erase uncertainty about costs.

Put it together and here’s where we stand today: Stock markets are at record highs, the labor market is losing momentum, inflation hasn’t disappeared and the Fed is expected to ease policy.

So, what are investors to do?

Remember that record highs are not a signal to sell. Stocks at new highs can only do one of two things: climb higher or pull back. Yes, eventually a new high will prove to be the last before the next bear market—but good luck guessing which one. More often than not, new highs are followed by … more new highs.

The answer is simple: Stay disciplined, stay diversified and don’t try to outguess each data point or policy decision.

Turning to Malvern, PA…

VCM–VPM to split in Q1-2026

We finally have a timeline for Vanguard’s anticipated split into two investment units: Vanguard Capital Management (VCM) and Vanguard Portfolio Management (VPM).

When Vanguard first unveiled the reorganization in June, it pitched the move as a way to manage the firm’s sheer scale—but left the timing open. Now we know: The split is set for the first quarter of 2026.

How do we know? Because this restructuring goes beyond the investment team. Vanguard is also creating two independent stewardship groups, each casting proxy votes separately. Last week, Vanguard announced that Glenn Booraem and Carolyn Cross will head those stewardship teams beginning in early 2026.

Vanguard confirmed that the investment and stewardship changes are “running on parallel timelines.” So, by next April, Vanguard’s investment team will operate as two distinct units—each in its own building, with its own stewardship group.

Ideally, this will be a non-event for investors. If Vanguard executes smoothly, we won’t notice a thing. But the challenge is clear: Maintain two world-class stock indexing operations without letting costs creep up or its competitive edge slip.

If any firm can pull it off, it’s Vanguard. But make no mistake—this is no small task.

Premium members can read more about the reorganization here.

A new legal officer

Well, that didn’t last long.

After less than a year in the role, Tonya Robinson has left Vanguard as general counsel. No explanation was offered. She’s being succeeded by Natalie Lamarque, who joins with the (new) title of Chief Legal Officer.

Robinson’s short stint raises eyebrows—not least because she was CEO Salim Ramji’s first executive hire. And it comes in a year when Vanguard’s legal docket was unusually full with the Target Retirement settlement, a lawsuit from Just Invest’s founders, SEC fines and challenges over exit fees. Lamarque steps in with plenty on her plate.

At least the Target Retirement settlement saga is nearing an end. A revised $25 million settlement has been reached, down from the $40 million deal that was rejected in May. Although the headline number is smaller, the new structure is expected to deliver more dollars to shareholders than the original deal.

What’s wrong with this picture?

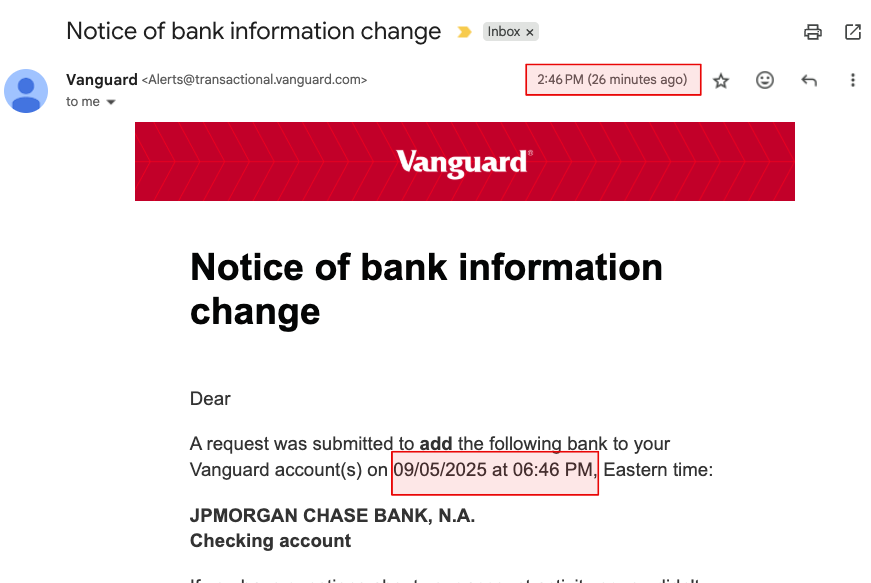

In case you were curious, Vanguard’s computers still aren’t firing on all cylinders.

Here’s a quirky example: An IVA reader forwarded an email they received at 2:46 pm EST on September 5 … which claimed their request had been submitted at 6:46 pm EST—four hours in the future!

Vanguard’s tech team may have bigger fish to fry, but this kind of glitch doesn’t inspire confidence. And no, my Message Center still doesn’t let me send Vanguard a message.

Our Portfolios

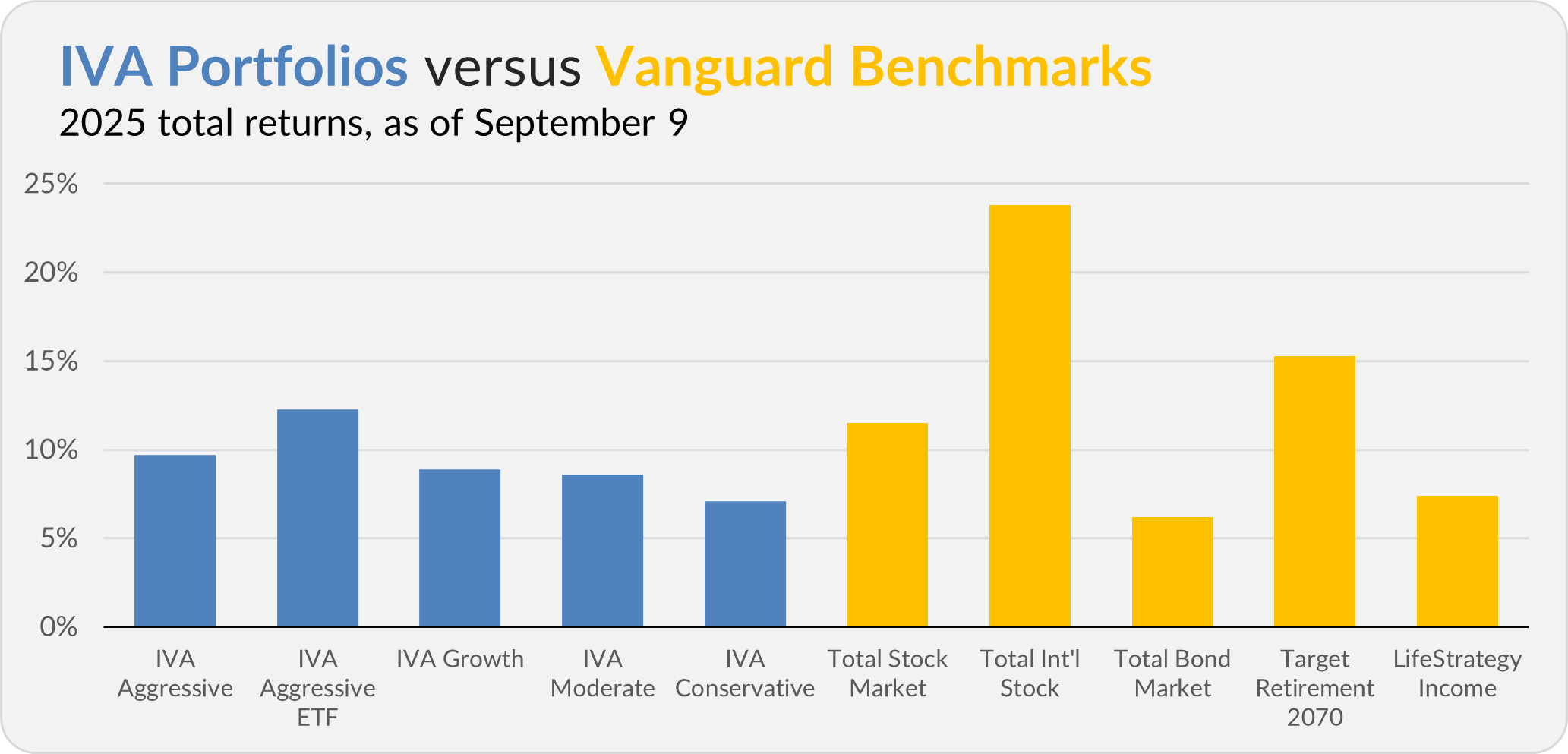

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 9.7%, the Aggressive ETF Portfolio is up 12.3%, the Growth Portfolio is up 8.9%, the Moderate Portfolio is up 8.6% and the Conservative Portfolio is up 7.1%.

This compares to an 11.5% gain for Total Stock Market Index (VTSAX), a 23.8% gain for Total International Stock Index (VTIAX), and a 6.2% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 7.4%.

IVA Research

Since my last Weekly Brief, I published two pieces for Premium Members—one breaking down Vanguard’s foreign stock index funds, and another sizing up their actively managed rivals.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.