Hello, and welcome to the IVA Weekly Brief for Wednesday, August 13.

There are no changes recommended for any of our Portfolios.

Pop Quiz

Do you remember the market drama from a little over a year ago—Monday, August 5, 2024?

Japan’s Nikkei 225 index—think of it as Japan’s S&P 500—plunged 12% in a single day after the Bank of Japan unexpectedly raised interest rates.

U.S. traders panicked. The CBOE VIX index (which is often called the “fear gauge” and measures expected market volatility based on S&P 500 index options) shot from 23.39 to 65.73 at one point. By the end of the day, it had calmed down to 38.57. “Calm,” of course, being relative—that was still the third largest one-day jump in the VIX since 1990.

Now fast-forward one year to today.

If you bought the Nikkei the Friday before that drop (Aug. 2, 2024) and held through last Friday (Aug. 8, 2025), you’d be up 16.5%. That nearly matches the S&P 500 index’s 19.5% gain. If you bought right in the middle of the panic on Aug. 5, 2024, you’d be up 32.9%—comfortably topping the S&P’s 23.2% advance.

However, those are only price returns; they don’t count dividends. Also, Vanguard doesn’t offer a Japan index fund. The closest thing, with 60% of its assets in Japanese stocks, is Pacific Index (VPADX).

So, let’s put this in total return terms for Vanguard investors:

Buying Pacific Index on Friday before the drop would have produced a 22.8% gain; buying the day of the drop led to a 27.2% return. Either way, you’d have outpaced 500 Index’s (VFIAX) returns of 21.1% and 24.8%, respectively.

My point? Those wild, stomach-churning days are impossible to ignore in the moment. But a year later, they’re just bumps in the market’s road—they’ve faded into the background or been wholly forgotten.

In the long run, the markets reward patience far more than panic. Was it only February when U.S. stocks flirted with a bear market? Those panicky days are long over, which is not to say we won’t see more worrisome periods in the months ahead, but cool heads usually win out.

Trust the Numbers?

That’s a question we are now going to have to ask with every new economic data release.

Here are the facts:

Last week, the Bureau of Labor Statistics (BLS) released its monthly Employment Situation report, as it has for decades.

It showed the U.S. unemployment rate had nudged up from 4.1% to 4.2%. However, the U.S. economy only added 73,000 jobs in July, and the numbers for May and June were revised lower by a combined 258,000.

While those revisions were larger than usual, in context, they still represented just 0.15% of the overall labor force of roughly 170 million.

And to be clear, revisions are baked into the process. The BLS issues initial reports quickly because timeliness matters. Then they refine those numbers as more responses to their massive surveys of businesses across the country come in because accuracy also matters.

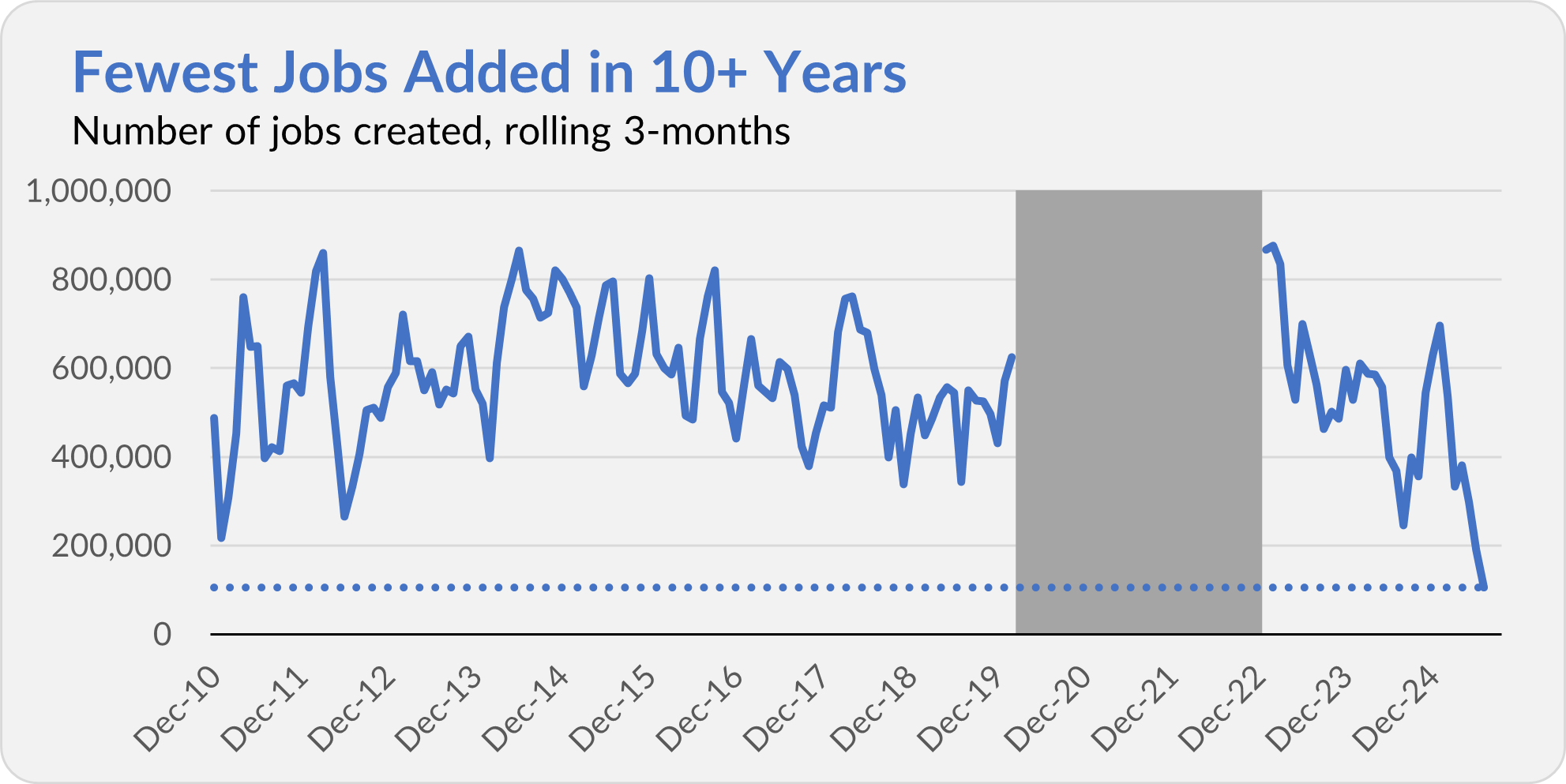

Add it up, and the economy created just 106,000 jobs over May, June and July—the slowest three-month stretch in nearly 15 years, if you exclude the COVID-19 crisis.

One more fact: A few hours after the BLS report dropped, President Trump fired the agency’s head, Erika McEntarfer, accusing the bureau of rigging the data (without providing evidence).

Where do those facts leave us?

Look, firing an agency leader because you think the agency’s methods need improvement? That’s one thing. Firing her because you don’t like the numbers? That sends a chilling message: “Report the numbers I want … or else.”

Either the President is right, and the BLS manipulated the numbers. Or he fired the agency’s head because he disliked the facts she reported. (I lean heavily toward the latter. It’s not hard to believe that hiring slowed while the rules of international trade were being rewritten.)

Warren Buffett put it best: “It takes 20 years to build a reputation and five minutes to ruin it.”

U.S. data agencies, like the BLS and the Bureau of Economic Analysis, have built rock-solid reputations for producing accurate, non-partisan economic stats. That reputation hasn’t been completely ruined—yet. But trust is being eroded, and I’ll be watching those numbers with a bigger grain of salt than usual.

What does this mean for investors?

Big picture, it’s another solid reason to hold a diversified, resilient portfolio. When uncertainty is high—and second-guessing the official economic data reports sets a new standard—it's prudent to spread your bets and prepare for different outcomes.

I’ve done this in the IVA Portfolios and will continue to explore opportunities.

That said, let’s zero in on Treasury Inflation Protected Securities (TIPS). Why? Because TIPS’ principal and interest payments are directly tied to the Consumer Price Index (CPI), which is produced by … the BLS.

I’ve heard concerns from several IVA readers about Vanguard’s inflation funds—Inflation-Protected Securities (VIPSX), Total Inflation-Protected Securities ETF (VTP) and Short-Term Inflation-Protected Securities Index (VTIPX). What if the government systematically underreports inflation?

If that happens, TIPS would still provide some inflation protection—but not the full coverage investors expect when buying inflation funds. If inflation is running at 4% but the government says it’s 2% and adjusts TIPS to that lower number, TIPS owners won’t get complete inflation protection. I guess the best I can say is that even partial protection beats none at all, which is what you get with regular Treasuries.

I get that’s not exactly comforting. But it’s the reality we’re facing—and why diversification and vigilance are as important as ever.

Persistent Inflation

Speaking of inflation and the BLS, the agency released its latest CPI update yesterday.

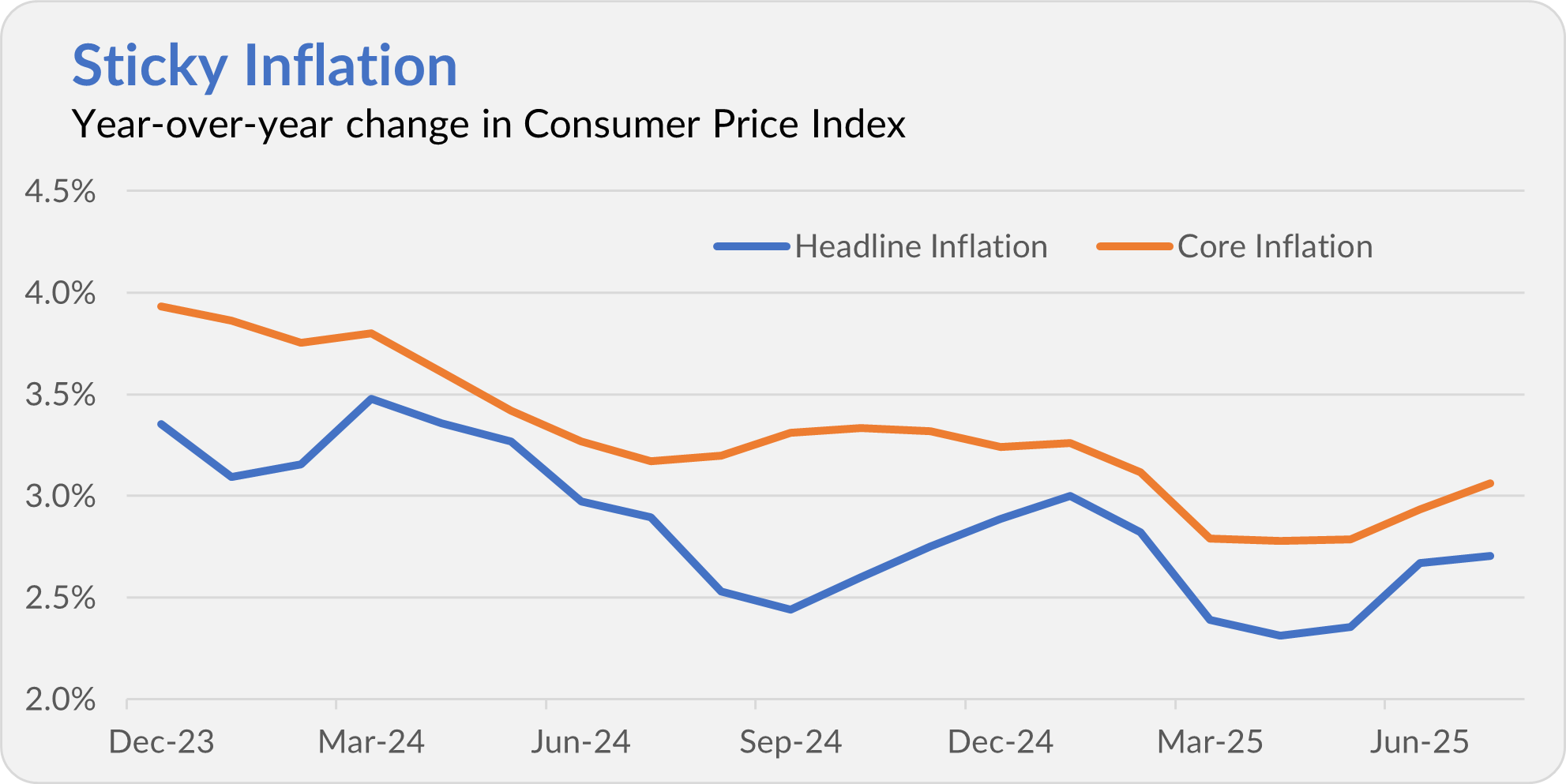

Consumer prices rose 0.2% in July and are up 2.7% over the last 12 months—the same annual pace as June. However, if you look at “core” inflation, which strips out volatile food and energy prices to reveal the underlying trend, the picture shifts a bit: inflation climbed to 3.1%, up from June’s 2.9% rate.

So, the report offered something for everyone.

Traders, for their part, are nearly unanimous in expecting Federal Reserve policymakers to cut the fed funds rate in September. I won’t second-guess the market consensus, but I’d consider any action by the Fed more of a tweak in policy than a real pivot.

The most recent BLS data shows hiring has slowed sharply while inflation remains stubbornly above the Fed’s 2% target. Granted, we'll get another round of employment and inflation reports before the Fed's next meeting—so, the narrative could change.

But, for the moment, policymakers find themselves stuck between a rock (a cooling labor market) and a hard place (persistent inflation)—and that’s before factoring in worries of tariffs pushing prices higher down the line.

You can be sure that traders will react to each tweak in Fed policy, but long-term investors don’t need to chase every market twitch. Stay focused on the bigger picture.

Our Portfolios

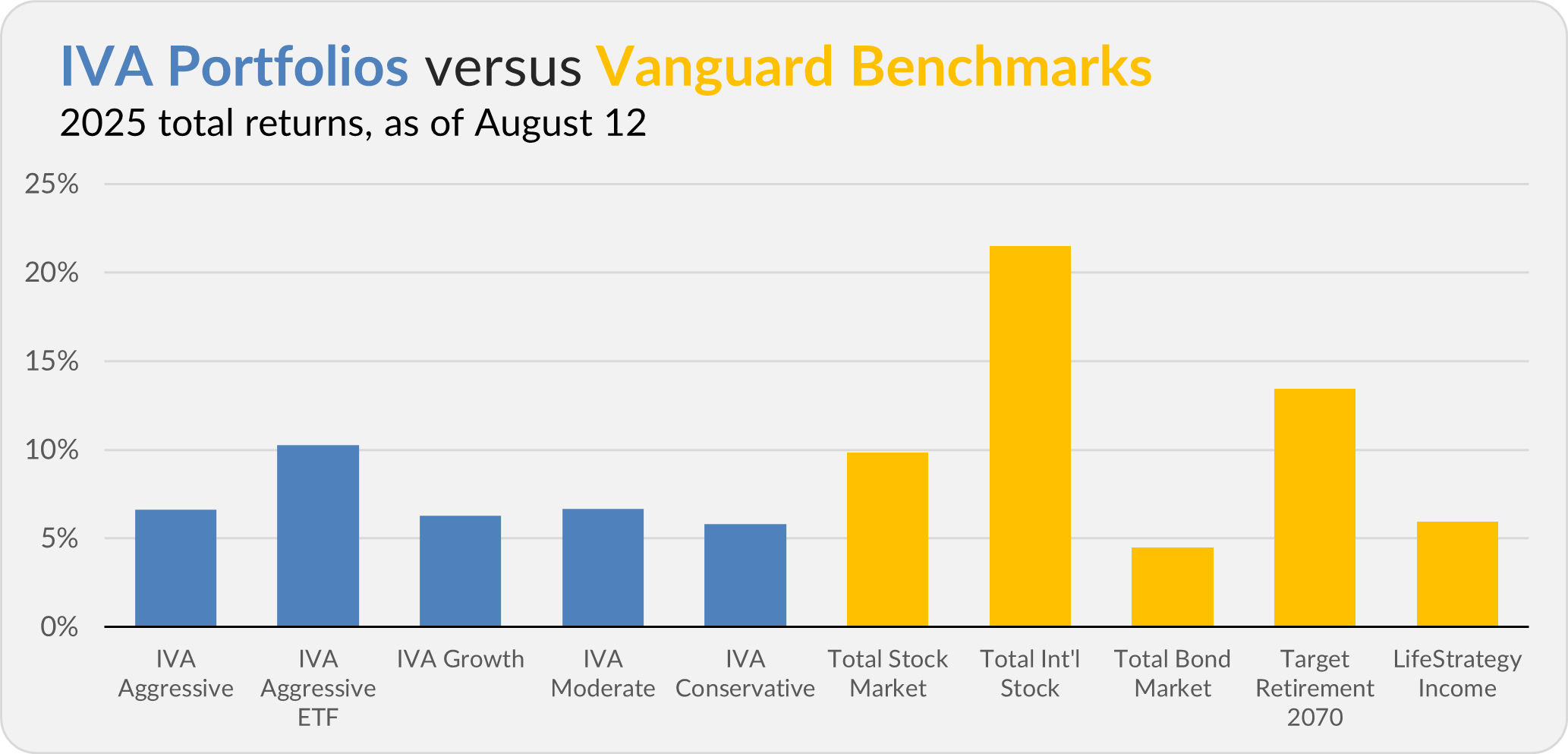

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 6.6%, the Aggressive ETF Portfolio is up 10.2%, the Growth Portfolio is up 6.3%, the Moderate Portfolio is up 6.7% and the Conservative Portfolio is up 5.8%.

This compares to a 9.8% gain for Total Stock Market Index (VTSAX), a 21.5% return for Total International Stock Index (VTIAX), and a 4.5% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 13.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.9%.

IVA Research

Yesterday, in Hedge the Noise: Currency Risk and Bond Funds, I explained why foreign bond funds should hedge the currency risk. Next week, I’ll try to answer the question of whether foreign stock funds should hedge currency exposure back to the dollar.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.