8Hello, and welcome to the IVA Weekly Brief for Wednesday, October 8.

There are no changes recommended for any of our Portfolios.

As I showed you last week, history tells us that government shutdowns are not a good reason to sit on the market’s sidelines. So far, history is proving right again.

Since the shutdown began through Tuesday’s close, 500 Index (VFIAX) has gained 0.4%. Smaller stocks and foreign shares have done even better, with SmallCap Index (VSMAX) up 0.6% and Total International Stock Index (VTIAX) up 0.9%.

The lesson is familiar but worth repeating: Trading the headlines isn’t a profitable strategy. No, I don’t know when or how the shutdown will be resolved. But staying disciplined and diversified remains the surest path to long-term success.

Vanguard’s First ex-China Fund

The third time was the charm.

After two delays, Vanguard finally launched Emerging Markets ex-China ETF (VEXC) last week.

Premium Members can read more here, but here’s the short story: The new ETF charges the same rock-bottom 0.07% expense ratio as its older sibling, Emerging Markets ETF (VWO). So, Vanguard investors don’t have to weigh costs when deciding between emerging markets with or without China.

That’s no small choice. China makes up around 35% of Emerging Markets ETF’s portfolio, so this isn’t a minor tweak.

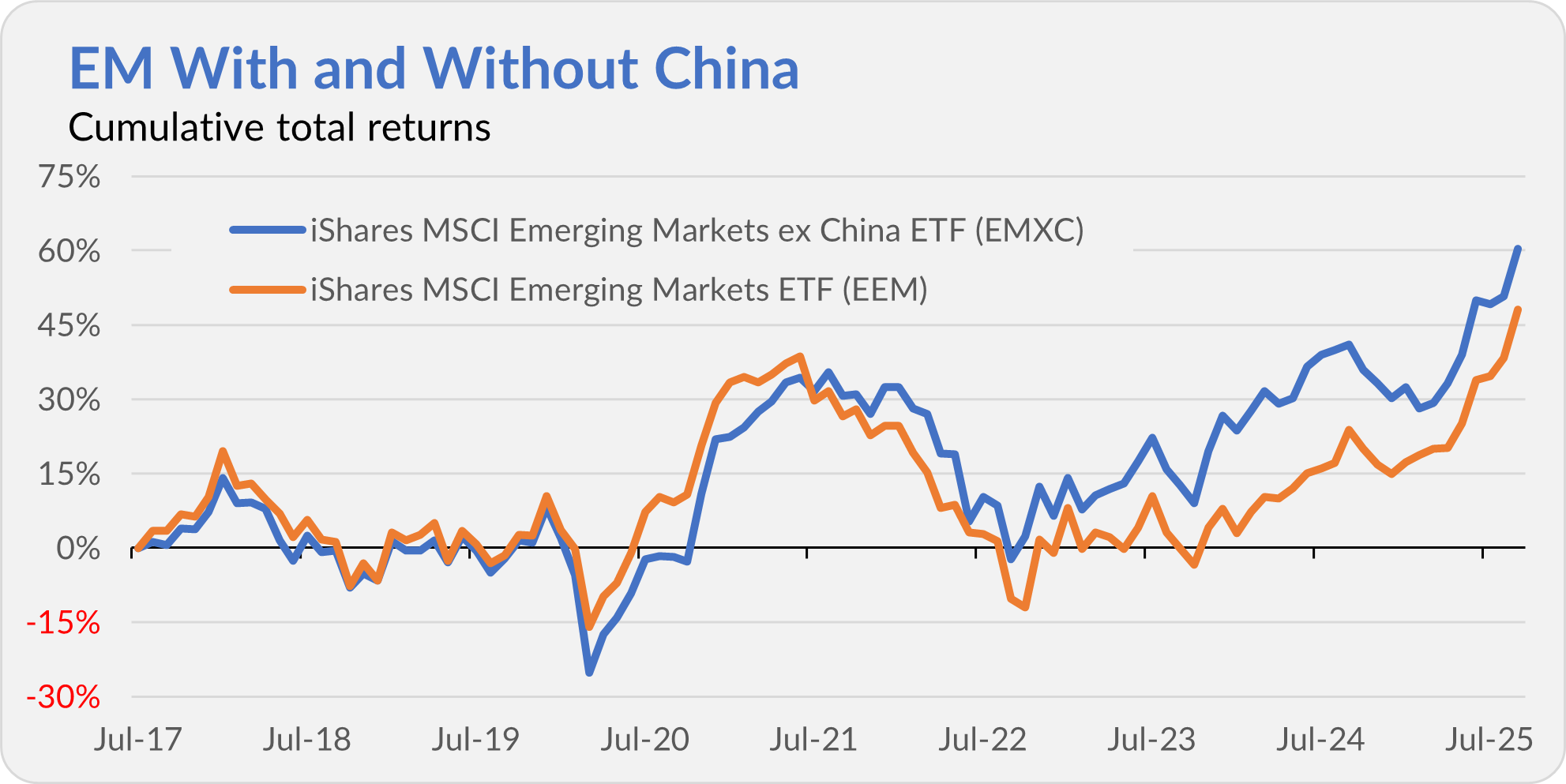

Still, over the past decade, it hasn’t been a make-or-break decision. Since iShares launched Emerging Markets ex-China ETF (EMXC) in 2017, the ex-China ETF has gained 60%, while the broader Emerging Markets ETF (EEM) is up 48%—a roughly 1% per year advantage for skipping China.

As the chart below shows, though, iShares’s two emerging markets ETFs have largely moved in tandem. The investor experience has been similar, suggesting that while leaving China out can tilt results, it hasn’t rewritten the playbook.

Cash Yield Check In

Before Federal Reserve (Fed) policymakers voted to lower the fed funds target rate by a quarter-point (0.25%) to 4.00%–4.25% on September 17, I told you that cash yields would move lower.

Well, they have. On Friday, Cash Plus Account’s yield dropped from 3.65% to 3.50%. Based on my experience, I had expected a 0.25% decline—not 0.15%. But there’s little transparency in how Vanguard sets this yield, so I’m not surprised I was off by a little bit. Either way, I was directionally correct—and Vanguard may trim its yield by another 0.10% in the weeks ahead.

To keep myself honest, the table below shows the yields on Vanguard’s cash products as of September 16 (before the Fed acted), my original predictions and where those yields stand as of Tuesday:

I haven’t hit the bullseye, but I’m definitely on target.

Also, the yield on 0-3 Month Treasury Bill ETF (VBIL)—Vanguard’s cash-like ETF—is now 4.11%. Again, it should roughly track Federal Money Market’s (VMFXX) yield.

Check Your Accounts

Over the weekend, The New York Times ran a cautionary tale of an investor who logged into his wife’s Vanguard account only to find that half of her Roth IRA had vanished. You can read the story here.

Coincidentally—or maybe not so coincidentally—I spoke with an IVA reader on Monday who had a remarkably similar experience. Here’s his story:

In late August, everything in this reader’s two Vanguard accounts—a brokerage account and a rollover IRA—looked perfectly normal. But when he rechecked a week later, his IRA’s balance had dropped to zero.

At first, he assumed it was a temporary glitch. When the problem persisted, he called Vanguard. He reached the transfer-of-assets group and filed a complaint.

It turns out the Automated Customer Account Transfer Service (ACATS)—the system that handles money movements between brokerage firms—had received a “transfer out” request on September 3.

The problem? The request wasn’t his.

Vanguard hadn’t sent him any notice or confirmation. He was lucky to catch it when he did. Days later, he received a welcome letter (in the mail) from a brokerage firm he had never worked with, congratulating him on his new IRA and noting that all future correspondence would be by email—only the email listed wasn’t his.

Thankfully, the transfer was halted and his assets returned on September 28. But Vanguard never explained what went wrong.

Unsurprisingly, this IVA reader is now in the process of moving his money off Vanguard’s platform.

So, what can you do to protect yourself?

First, check your accounts regularly—not to scrutinize performance, but to confirm that your balances look right. And save account statements periodically. They provide a record if something goes missing.

Second, practice good cybersecurity hygiene: use strong, unique passwords; enable two-factor authentication; and never click on suspicious links.

Third, turn on every account alert available. It may be annoying to get text messages and emails about every minor transaction, but I’d rather be mildly irritated than blindsided.

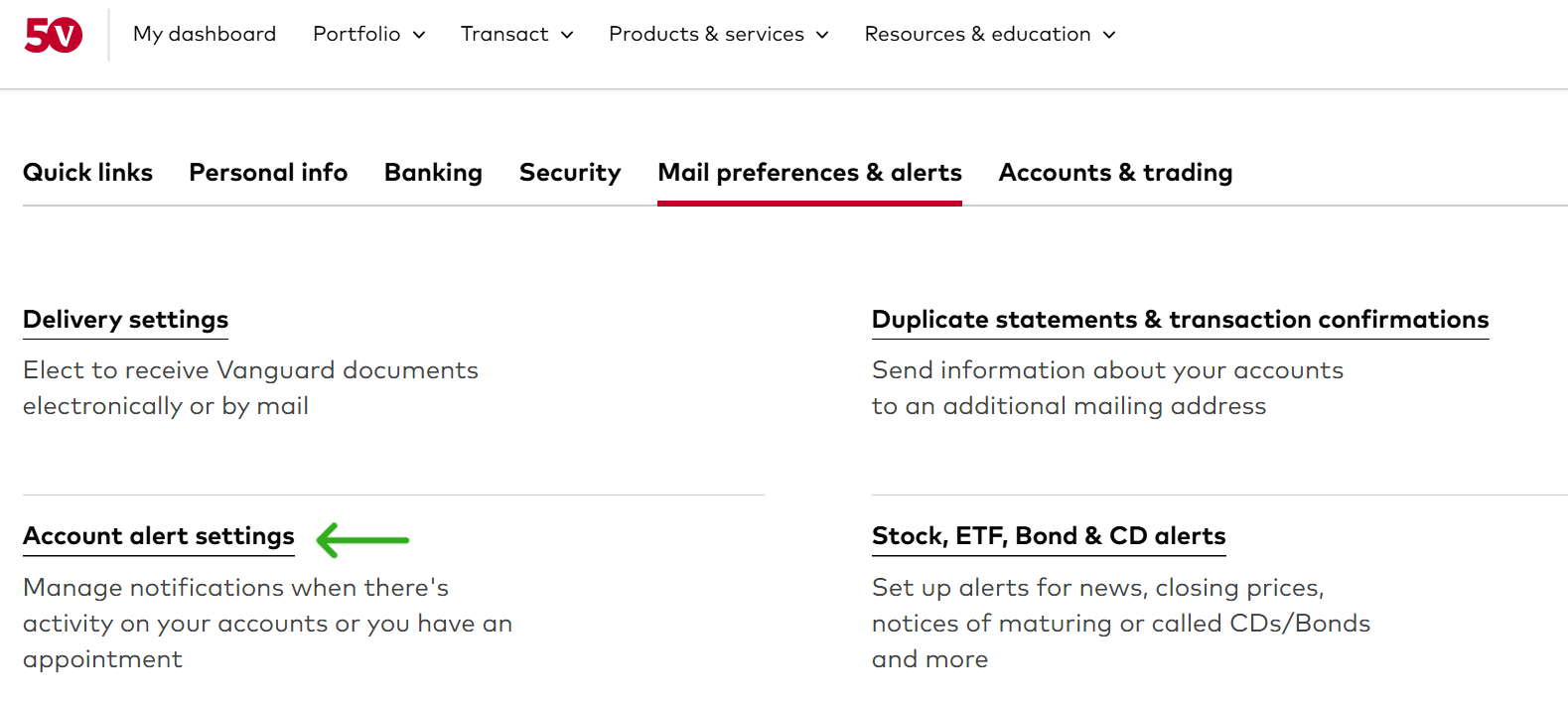

You can manage the alerts you receive by logging into your Vanguard account and clicking on your profile. You’ll then want to navigate to the “Mail preferences & alerts” section. Then go to the “Account alert settings” (the green arrow in the screenshot below).

That said, this shouldn’t fall entirely on our shoulders. Vanguard could do more.

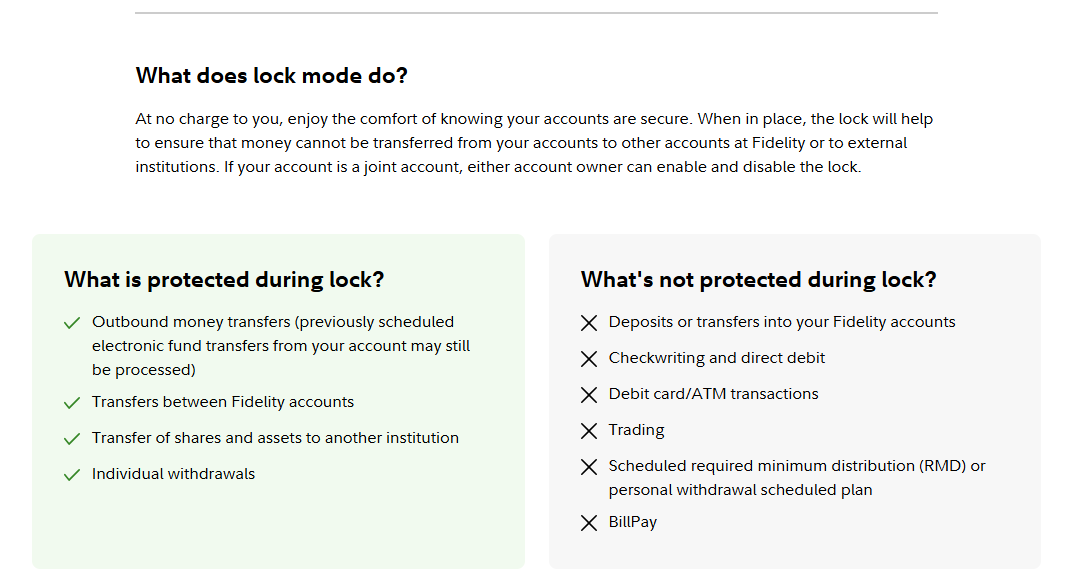

For instance, Fidelity offers a “Money Transfer Lock” feature. It allows you to toggle a security lock on individual accounts to block “major” withdrawals, while still permitting regular activity, such as bill payments, check writing and scheduled RMDs. It’s a smart balance between security and convenience.

Vanguard doesn’t have anything comparable—or at least, not that I could find.

When I called Vanguard on Monday, a representative informed me that I could lock my account—no withdrawals would be allowed, although I could still trade—for 10 days. However, for a longer-term lock, I need to mail a letter to Vanguard. Yes, mail.

Here’s what the letter must include:

- Your account number

- The account registration name

- A clear statement of your request

- Any additional details

- A handwritten (wet) signature and date

Mail it to:

Vanguard Group

P.O. Box 982901

El Paso, TX 79998

It wasn’t clear whether I’d have to send in another letter to remove the hold or if that could be done over the phone. It sounded like this wasn’t a request they got very often.

I realize that there’s always a tradeoff between security and convenience. Maybe requiring a letter in the mail is technically safer. But it’s also so inconvenient that almost no one will do it—assuming they even know it’s an option in the first place.

Fidelity’s system isn’t perfect either. Someone with full access to your login could unlock your account—but at least you’d get an immediate text and email alert.

As I often remind you, no one cares about your money more than you do. So, keep a close eye on it.

But Vanguard should care, too. It’s time to give shareholder-owners the same kind of protection competitors already offer—a simple, effective transfer lock.

Our Portfolios

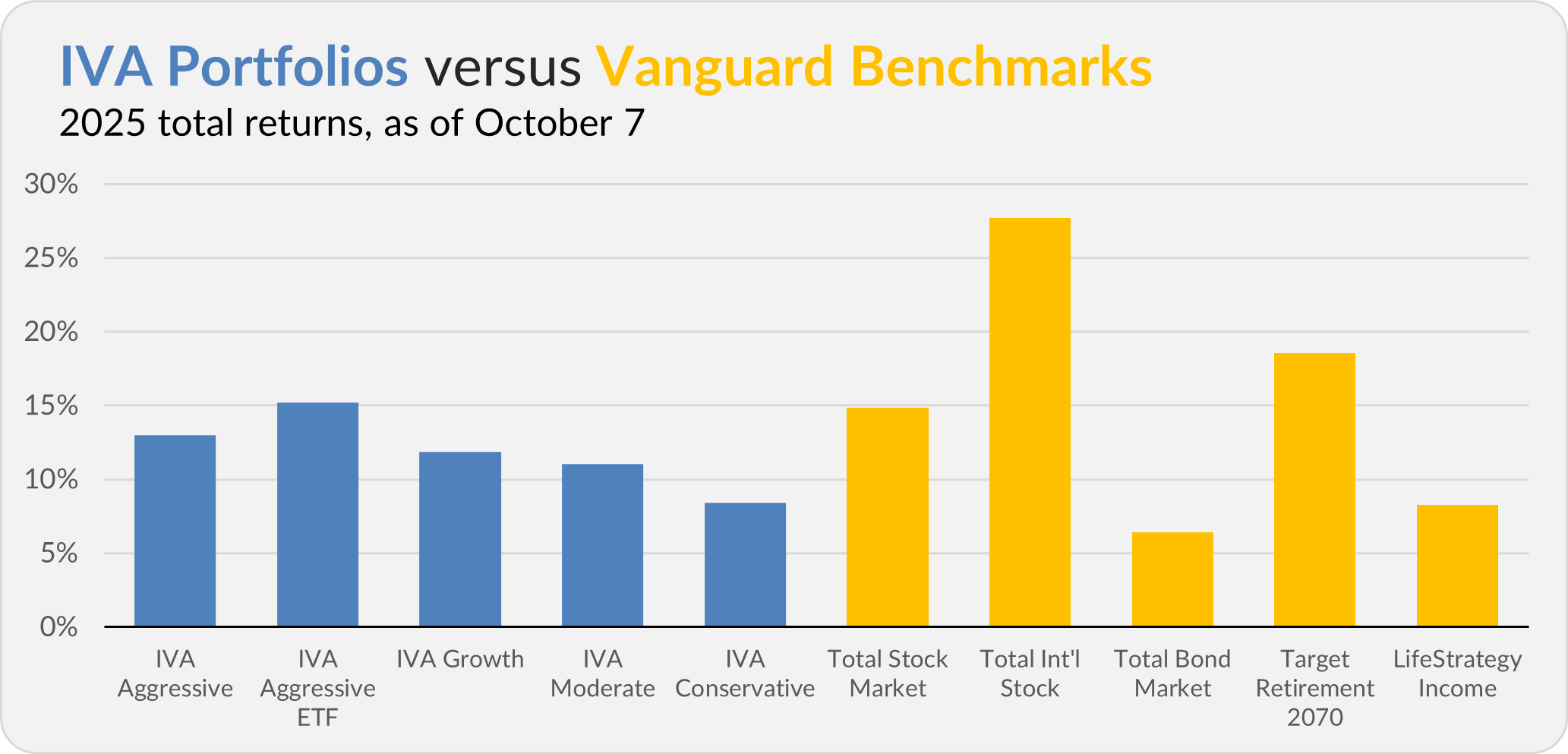

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 13.0%, the Aggressive ETF Portfolio is up 15.2%, the Growth Portfolio is up 11.9%, the Moderate Portfolio is up 11.0% and the Conservative Portfolio is up 8.4%.

This compares to a 14.8% return for Total Stock Market Index (VTSAX), a 27.7% gain for Total International Stock Index (VTIAX), and a 6.4% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 18.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 8.3%.

IVA Research

Yesterday, Premium Members received my exclusive interview with Peter Fisher, portfolio manager of Dividend Growth (VDIGX), and Tim Casaletto, the newest addition to Fisher’s team.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.