Hello, and welcome to the IVA Weekly Brief for Wednesday, September 17.

There are no changes recommended for any of our Portfolios.

Let’s set aside all the drama surrounding the Federal Reserve (Fed) for a moment. While politics and personalities may grab headlines, what matters today is the near-term outlook for monetary policy and how the Fed responds to signs of stubbornly high inflation and falling employment.

At the conclusion of today’s meeting, most on Wall Street think policymakers will trim the benchmark fed funds rate by a quarter-point (0.25%)—taking the target range down to 4.00%–4.25%. There’s a slim chance they move faster and cut by half a point (0.50%), but that would be a surprise.

Inflation has hovered around 3% for months—still above the Fed’s 2% target, but it’s not accelerating. Hiring, on the other hand, has slowed meaningfully.

In other words, if policymakers don't bow to political pressure but instead react to the data in front of them, a small interest rate cut is the most likely path to take.

What does this mean for investors?

The link between Fed moves and market performance is less direct than many assume. A rate cut doesn’t guarantee higher stock or bond prices. The most consistent impact of Fed policy on our money shows up in cash yields, which, as the chart below shows, tend to move in lockstep with the fed funds rate.

If Fed officials lower the fed funds rate by 0.25%, here’s what I expect from Vanguard’s cash options:

- Federal Money Market (VMFXX): Yield slides from 4.19% (today) to roughly 3.95%.

- Cash Plus Account: Yield goes from 3.65% to 3.40%

- Cash Deposit: Yield drops from 2.25% to 2.00%

Federal Money Market’s yield tends to lag the Fed by a month or so—meaning its yield will remain higher longer—but I expect Cash Plus and Cash Deposit to adjust more quickly.

The wrinkle is that Cash Deposit’s yield has already fallen this year—from 2.75% to 2.25%—despite no Fed action. I’d still bet on its yield dropping again, but the way Vanguard sets this yield is a bit of a black box.

As for the bond market, while many investors mistakenly think the Fed controls interest rates of all shapes and sizes, the fact is that long-maturity bond yields respond more to the economic environment (and particularly inflation) than to Fed policy.

Even if Federal Money Market’s yield settles near 3.95%, I still see value there. That’s only 0.20% below Total Bond Market Index’s (VBTLX) 4.16% yield, with the added benefit of price stability. In today’s environment, that’s not a bad trade-off.

Getting Active

Last week, Vanguard announced that after two decades of playing manager musical chairs, it has stopped the music yet again and turned MidCap Growth (VMGRX) back into a focused fund, with a single sub-adviser at the helm.

Or it will in mid-November, when Frontier Capital and Wellington Management are shown the door, and Tremblant Capital takes the helm.

Premium Members can read more about this fund’s makeover here. The bottom line is that MidCap Growth is going from a sleepy index mimic to a genuinely active, aggressive mid-sized stock growth fund—something Vanguard’s lineup hasn’t had since Capital Opportunity (VHCOX) outgrew that role.

In other words, MidCap Growth is getting a whole lot more interesting.

Vanguard Delays Emerging Markets, …

After two false starts, Vanguard’s Emerging Markets ex-China ETF is still idling on the runway.

Vanguard first filed to launch the ETF in May, with an expected debut 75 days later in mid-August. The appeal was obvious: a rock-bottom 0.07% expense ratio—matching its sibling Emerging Markets ETF (VWO) and undercutting iShares’ incumbent ex-China option (EMXC), which charges 0.25% (and has around $13 billion in assets). At that price, Vanguard looked poised to grab market share.

But the launch hasn’t gone according to plan. Vanguard delayed once on August 12, and again on September 9, without explanation. The new launch target is September 29.

Will the fund actually arrive this time? Maybe. Given Vanguard’s track record on this rollout, I won’t be surprised by another delay.

Vanguard has walked away from new products before, even after filing plans with the SEC—its shelving of municipal bond index funds in the 2010s comes to mind. But given investor demand and the chance to swipe market share from iShares, I expect Vanguard will get this one off the ground sooner or later.

… Moves Forward with Junk Bonds, …

Vanguard’s first junk bond ETF—High-Yield Active ETF (VGHY)—hit the market today.

Premium Members received a Quick Take earlier this morning. The very short story is that while the fund’s launch is long overdue, it may still be coming at the wrong time. Why? Because investors simply aren’t being compensated adequately for the risks they’re taking in the junk bond market.

… And Plans Core-Plus Bonds.

Salim Ramji wasn’t kidding when he said he wanted to expand Vanguard’s fixed income ETF lineup.

The fund giant has launched 10 bond ETFs this calendar year (counting High-Yield Active ETF). Number 11—Core-Plus Bond Index ETF—is due out in December.

Premium Members can read more here, but the new ETF is essentially Total Bond Market ETF (BND) with an extra kick—about 10% in junk bonds. The index-tracking ETF will compete head-to-head with the similarly named, but actively managed, Core-Plus Bond (VCPIX) and Core-Plus Bond ETF (VPLS).

My money would be on the active bond funds to win the man-versus-machine race Vanguard is setting into motion.

Speaking of which, in a recent interview with Jeff Sommer of The New York Times, Vanguard’s top economist, Joe Davis, took a shot at predicting the next 10 years in the economy and markets. But what really caught my eye was Davis’s admission that he favors active management in his personal retirement account. Who knew? (A tip of my hat to Jeff for an excellent piece written in plain English and packed full of commonsense advice.)

Our Portfolios

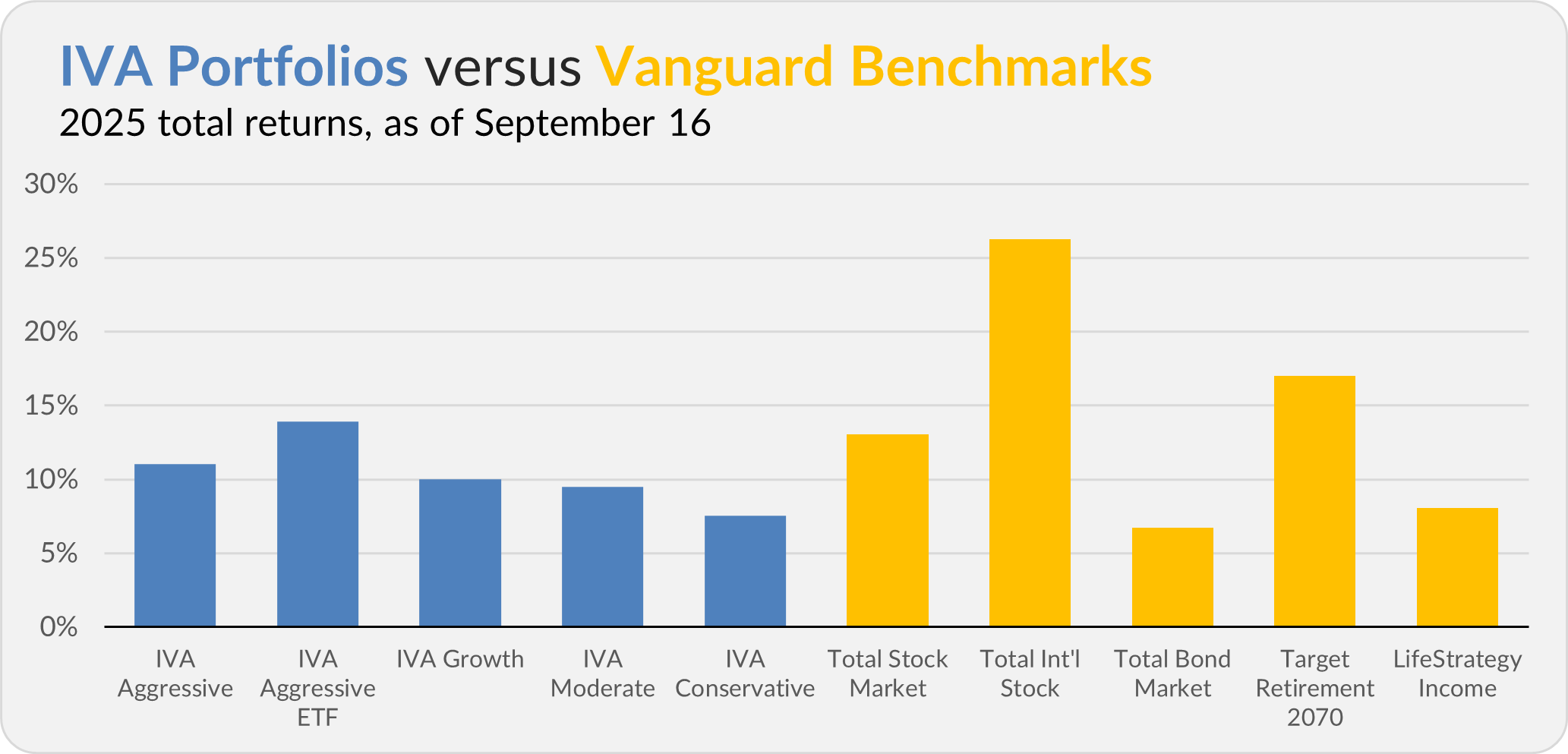

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 11.0%, the Aggressive ETF Portfolio is up 13.9%, the Growth Portfolio is up 10.0%, the Moderate Portfolio is up 9.5% and the Conservative Portfolio is up 7.5%.

This compares to a 13.1% gain for Total Stock Market Index (VTSAX), a 26.2% return for Total International Stock Index (VTIAX), and a 6.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 17.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 8.0%.

IVA Research

Yesterday, I shared my analysis of Global Capital Cycles (VGPMX) with Premium Members. The fund has evolved into a credible global stock fund, but I still have reservations.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.