Hello, and welcome to the IVA Weekly Brief for Wednesday, February 11.

🚨🚨Last week, I recommended trades in two of the five IVA Portfolios. You can review the trades and my reasoning behind them here. 🚨🚨

Dow 1,000,000?!

On Friday, the Dow Jones Industrial Average (Dow) closed above 50,000 for the first time. Cue the confetti? Not so fast.

If big round numbers get your pulse racing, let me raise the stakes: How about the Dow at one million? I’ve got a decent shot at seeing that in my lifetime.

The Dow first crossed 1,000 in November 1972. It took 53 years of compounding at a 7.6% annual rate to reach 50,000. If that same pace continues, the Dow will hit 1,000,000 in another 41 years. I’ll turn 83 in 2067.

Prefer a longer lens? Since the start of 1900, the Dow has grown at a more modest 5.4% annual rate. At that pace, I’ll need to hang on until I’m 100—58 years from now—to see the million mark.

The point isn’t to predict whether the Dow gets there faster or slower. It’s to remember that big round numbers feel dramatic but don’t actually change much. They’re just mile markers along a very long road.

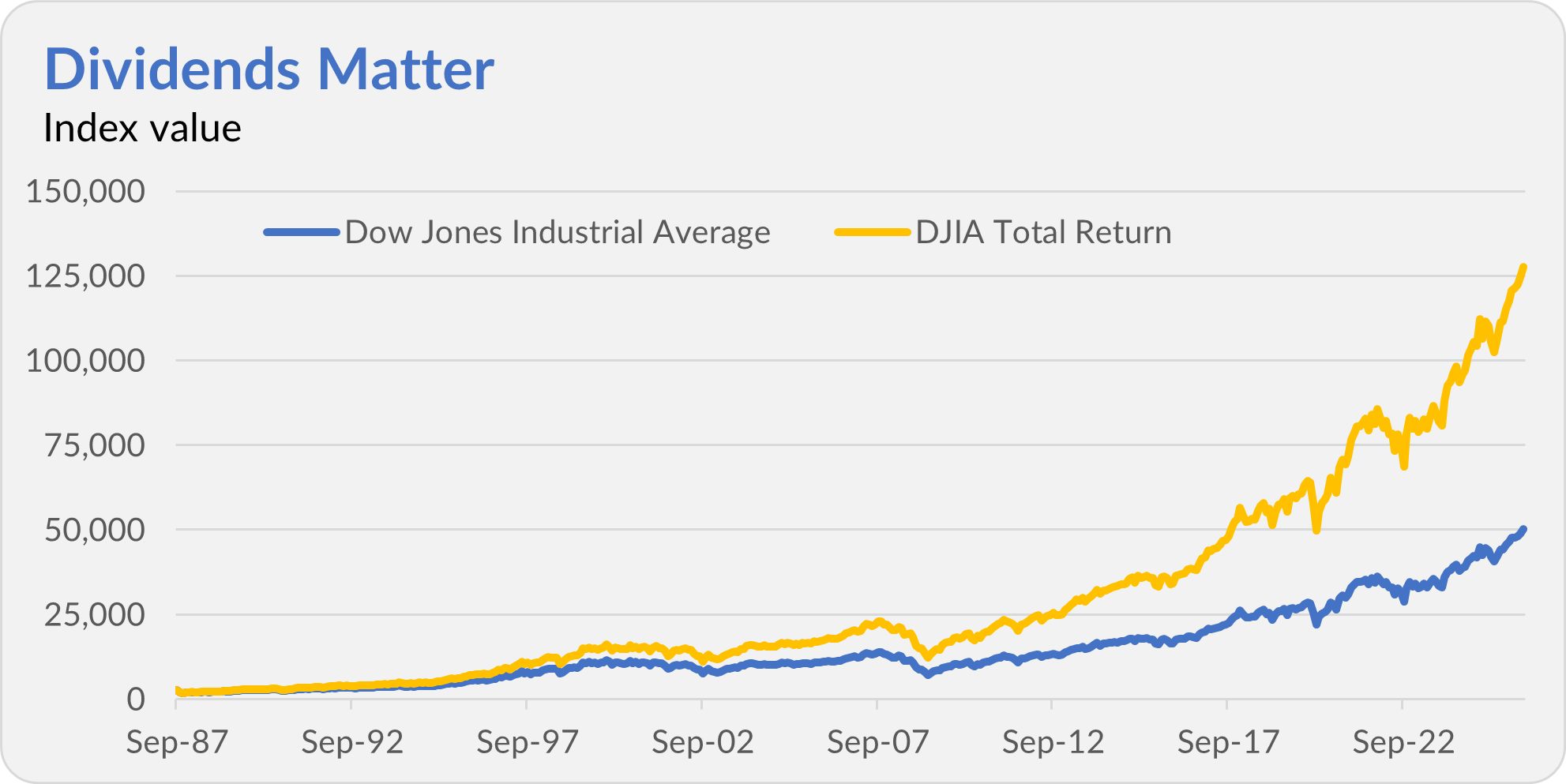

And there’s another wrinkle: Those headline Dow figures don’t include dividends. Add dividends back in, and the Dow effectively blew past 50,000 years ago—in 2017. The Dow’s total return index is already north of 125,000.

You might notice that the chart above starts in 1987—that’s when my total return data begins. But what if we counted dividends all the way back to 1900?

Over the past 40 years, dividends have added 2.7% per year to the Dow’s returns. If the Dow had compounded at 8.1% annually for the last 126 years (5.4% price return plus 2.7% from dividends), then today’s Dow wouldn’t be flirting with 50,00.

It would be—drumroll—over 1,200,000.

I know. That was a lot of numbers. And yes, I had some fun with the maths.

Here’s the point: Big round numbers like 50,000 make for catchy headlines. But the real story is compounding—and the patience required to let it do its work.

ETFs Delayed

A few days before Thanksgiving 2025, Vanguard filed with the SEC to launch ten target-maturity corporate bond ETFs—one for each year between 2027 and 2036.

I talked about them before, but a quick refresher: Each will hold a basket of investment-grade corporate bonds that all mature in the target year. On December 15 of that year, the fund will close and return the proceeds to shareholders. In the meantime, investors will collect monthly interest payments.

In short, they’re a lot like buying an individual bond—only with built-in diversification and convenience.

Based on Vanguard’s initial SEC filing, these Target Maturity Corporate Bond ETFs were expected to launch on February 7. That didn’t happen. Last week, Vanguard filed updated paperwork pushing the launch date up to March 6.

Like bonds, these funds should be useful tools if you’re building a “ladder”—staggering maturities across multiple years—or trying to match a specific future liability, like tuition payments or a down payment. But they’re not likely to replace a traditional bond fund as a core holding.

Either way, we’ll have to wait another month.

Two new trustees. One old question.

This morning, Vanguard announced that David Hunt and Ken Jacobs have been elected to the firm’s board of directors and as trustees of each Vanguard fund, effective February 24.

Both are conventional, high-profile additions. Hunt most recently served as president and CEO of Prudential Global Investment Management (PGIM). Jacobs led Lazard for 14 years and remains its senior chairman—so yes, he’s effectively doing double duty.

There’s no question that both men bring deep industry experience. On paper, they are qualified.

But here’s the question that matters for Vanguard investors: Will they invest alongside the shareholders they are well paid to represent?

That’s not a throwaway line. Trustee ownership is one of the clearest signals of alignment between a fund board and its shareholders. Every year, I dig into the data to see how much Vanguard’s trustees actually invest in the funds they oversee. (You can also find the data here.) The results have been a mixed bag. Some trustees have meaningful skin in the game. Others… not so much.

In fact, when Barbara Venneman joined the board in 2025, she did so without owning a single Vanguard fund.

Unfortunately, Vanguard does not publish trustee ownership in one clean, consolidated report. The disclosures trickle out over time, buried in filings that are anything but investor-friendly.

As always, I’ll do the heavy lifting—tracking the filings and reporting back once the data becomes available.

Experience is important. But ownership matters, too.

Our Portfolios

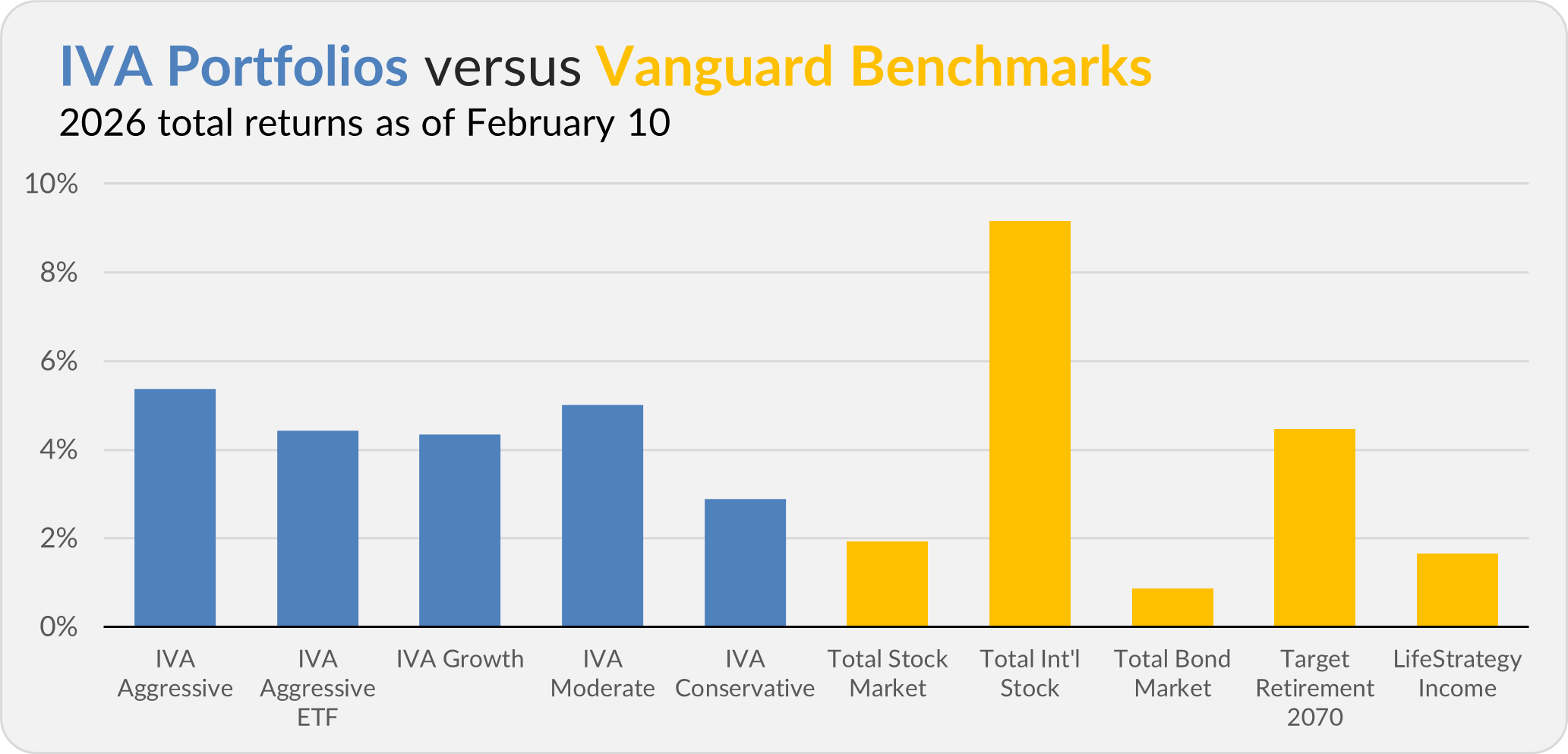

Our Portfolios are showing solid returns for the year through Tuesday. The Aggressive Portfolio is up 5.4%, the Aggressive ETF Portfolio is up 4.4%, the Growth Portfolio is up 4.3%, the Moderate Portfolio is up 5.0% and the Conservative Portfolio is up 2.9%.

This compares to a 1.9% gain for Total Stock Market Index (VTSAX), a 9.2% return for Total International Stock Index (VTIAX), and a 0.9% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 4.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.6%.

IVA Research

Yesterday, I shared a deep dive with Premium Members on whether gold—and commodities more broadly—belong in a diversified portfolio.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.