Correction note: Long-Term Tax-Exempt Bond ETF and New York Tax-Exempt Bond ETF have not begun trading (yet). The text has been updated to make this clear.

Hello, and welcome to the IVA Weekly Brief for Wednesday, May 21.

There are no changes recommended for any of our Portfolios.

As America’s credit rating slips and its debt load grows, investors are surprisingly upbeat.

Moody’s—one of the “big three” credit rating agencies tasked with assessing a borrower’s reliability and likelihood of repaying their debts—lowered its rating of U.S. debt one notch from AAA (the highest level) to Aa1 this week. The move reflects worries about America’s growing debt load. At the same time, a “big beautiful” budget bill is advancing through Congress. The legislation promises tax cuts and some spending reductions, but, in the end, will add trillions more to the national debt.

Moody’s decision isn’t exactly breaking news; its peers sounded the alarm years ago, with S&P cutting its U.S. debt rating in 2011 and Fitch following suit in 2023. As for the budget bill, well, traders seem happy to focus on the “pro-growth” narrative tied to this side of President Trump’s agenda.

500 Index (VFIAX) is up 6.8% so far in May and now needs to gain just 3.1% to reclaim its February 19 high. SmallCap Index (VSMAX) is doing even better—up 7.9% in May—though it still sits 10.0% below its November 2024 peak. U.S. stocks are beating foreign stocks, though Total International Stock Index (VTIAX) is up a respectable 4.5% this month.

Market narratives can change quickly. Right now, the prevailing story is that tax cuts will fuel economic growth, and tariffs are just a minor speed bump. However, the flip side of lower taxes is a growing deficit, and the full tariff impact is still unfolding.

I can’t tell you when the story will change or what the next one will be. No one can. What I can tell you is that I’ve been beating the diversification drum all year—and I’m not about to stop now. In a market that shrugs off credit downgrades and cheers deficit spending, diversification remains your best defense against shifting stories and surprise turns.

Muni Bond ETFs Arriving

ETF investors looking for tax-free income will soon have two new Vanguard funds to consider: Long-Term Tax-Exempt Bond ETF (VTEL) and New York Tax-Exempt Bond ETF (MUNY). I say "soon" because Vanguard updated its paperwork with the SEC on Tuesday to launch the ETFs, but they have not begun trading. I expect them to go live in the next few days.

As I noted in March when Vanguard first announced these funds, the fund giant has been on a two-year mission to expand its municipal bond ETF lineup. The lastest ETFs are practical additions to the roster.

The new ETFs are index funds with expense ratios of 0.09%—a competitive fee by industry standards. However, they don’t offer a cost advantage over Vanguard’s existing options. Most shareholders of Vanguard’s legacy actively managed funds—Long-Term Tax-Exempt and New York Long-Term Tax-Exempt—own the Admiral shares, which also charge 0.09% in expenses (albeit with a $50,000 minimum investment).

Active Management at No Cost?

| Fund | Shareclass | Active or Index | Ticker | Expenses | Assets (millions) |

| Long-Term Tax-Exempt | Investor | Active | VWLTX | 0.17% | $707 |

| Long-Term Tax-Exempt | Admiral | Active | VWLUX | 0.09% | $16,182 |

| Long-Term Tax-Exempt Bond ETF | ETF | Index | VTEL | 0.09% | — |

| New-York Long-Term Tax-Exempt | Investor | Active | VNYTX | 0.14% | $503 |

| New-York Long-Term Tax-Exempt | Admiral | Active | VNYUX | 0.09% | $4,564 |

| New York Tax-Exempt Bond ETF | ETF | Index | MUNY | 0.09% | — |

So, if you are willing to own a mutual fund (over an ETF), you can get Vanguard’s active management for free! That’s a good deal in my book.

Vanguard’s product development team isn’t finished yet. While I doubt they’ll roll out additional state-specific municipal bond ETFs (the demand is limited), there are still two glaring gaps in the lineup: ETF versions of (or alternatives to) Ultra-Short-Term Tax-Exempt (VWSTX) and High-Yield Tax-Exempt (VWAHX).

Stay tuned.

Not So Fast

When Target Retirement shareholders received outsized capital gain distributions in 2020, I didn’t think I’d still be writing about it in 2025. But, well, here we are.

As a quick reminder, Vanguard botched its attempt to lower fees on its Target Retirement funds in 2020. As a result, shareholders were unnecessarily handed large tax bills. Vanguard has been paying the price ever since.

In 2022, Vanguard paid $6.25 million in a deal with Massachusetts regulators. In November 2024, Vanguard agreed to a $40 million settlement with Target Retirement shareholders who sued the company. And in January, Vanguard agreed to a $106.4 million settlement with the SEC.

That’s $152 million, if you’re counting.

However, a judge rejected the proposed $40 million settlement in the class action lawsuit this week. Approving it would actually leave Target Retirement shareholders $13 million worse off!

Here’s the breakdown:

We have two settlements in play—the class action lawsuit and a separate settlement with the SEC. The $40 million class action deal, announced in November, had only received preliminary court approval. Crucially, a third of that amount—about $13 million—would have gone to the attorneys’ fees.

Meanwhile, in the SEC settlement, Vanguard agreed to pay $135 million to compensate harmed investors. However, if the class action settlement were approved, Vanguard could reduce its SEC payment by that same $40 million.

(If you’re wondering about the disconnect between $135 million and $106.4 million, you start with $135 million in remedies for investors, subtract $40 million for the class action suit, another $2.6 million for individual claims, and then add back a $13.5 million civil fine.)

In other words, Vanguard is paying $135 million either way. But if the class action deal goes through, $13 million of that ends up with the lawyers. If it’s rejected, the full amount goes into the SEC’s “Fair Fund” for shareholders.

That’s why the judge concluded that “the proposed settlement provides no value to the class” and rejected it.

The case continues.

For investors, the damage of Vanguard's well-intentioned but poorly executed move to cut fees on its Target Retirement funds has been done. These settlements represent an effort to correct that mistake and hold Vanguard accountable. Moving forward, it’s a reminder that even a trusted firm like Vanguard doesn’t always get it right—and shareholders can’t afford to unthinkingly assume it will.

Our Portfolios

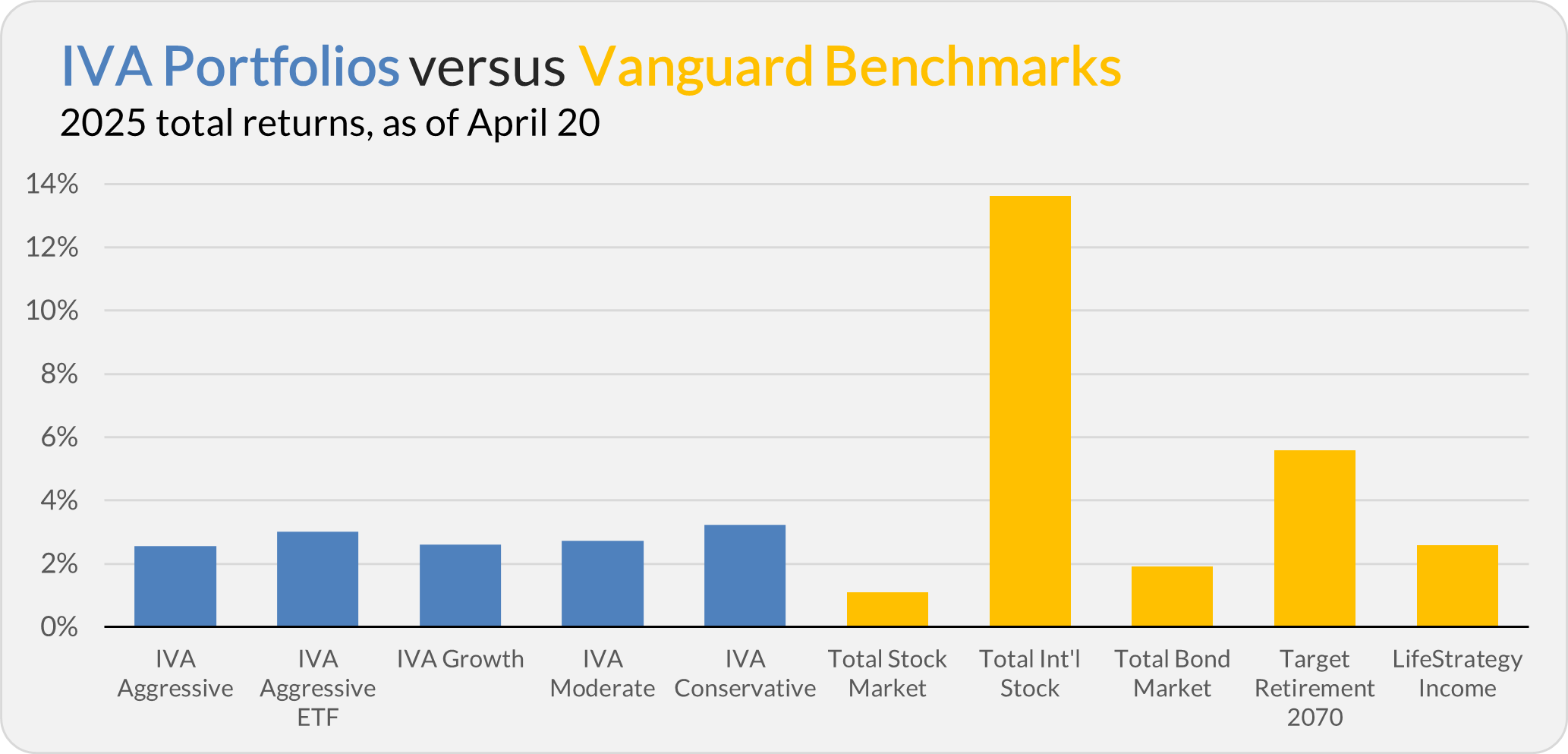

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 2.6%, the Aggressive ETF Portfolio is up 3.0%, the Growth Portfolio is up 2.6%, the Moderate Portfolio is up 2.7% and the Conservative Portfolio is up 3.2%.

This compares to a 1.1% gain for Total Stock Market Index (VTSAX), a 13.6% return for Total International Stock Index (VTIAX), and a 1.9% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 5.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.6%.

IVA Research

Yesterday, I answered IVA reader questions about being a tax-aware investor in a low tax bracket and the state of the municipal bond market.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.