Hello, and welcome to the IVA Weekly Brief for Wednesday, November 26.

There are no changes recommended for any of our Portfolios.

Here’s the question I’m hearing most today: Is the AI bubble bursting—or is this dip a buying opportunity?

The only honest answer to that question is, “I don’t know.” Anyone giving you a confident Yes or No is blowing smoke. And let’s set aside the bigger “Are we in a bubble?” debate—I’ll take that up in my annual Outlook. For now, let’s add some context and perspective.

One measure of tech performance is the Invesco QQQ ETF (QQQ), which tracks the tech-heavy Nasdaq-100 index. Over the past three years, the ETF is up 114%—roughly 29% per year. I think we can all agree that near-30% annual returns aren’t sustainable.

But don’t let the end-to-end number fool you. Earning those returns hasn’t been a smooth ride. Over those three years, QQQ has weathered one bear market (a 20% decline), three corrections (10%–20% drops), and four pullbacks (5%–10% declines), including the current slide (which reached a nadir of -8% before rallying the past three trading days).

So, the chatter about an “AI bubble” may be louder this time around, but that doesn’t guarantee today’s pullback is the beginning of the end. As usual, we’ll only know with hindsight—frustrating, but true.

In moments like this, the playbook doesn’t change: Diversification and discipline remain your best friends. The market’s narrative can shift overnight; your long-term plan shouldn’t.

Vanguard Targets Bonds

Vanguard’s product development team has been working overtime. The fund giant has already rolled out 14 ETFs this year—its most active calendar year since 2010—and it’s not slowing down. With 10 more ETFs already in the pipeline for early 2026, it’s a safe bet that Vanguard will surpass this year’s tally with an even bigger one next year.

Here are the 10 funds slated for a February 2026 launch:

- Target Maturity 2027 Corporate Bond ETF (VBCA)

- Target Maturity 2028 Corporate Bond ETF (VBCB)

- Target Maturity 2029 Corporate Bond ETF (VBCC)

- Target Maturity 2030 Corporate Bond ETF (VBCD)

- Target Maturity 2031 Corporate Bond ETF (VBCE)

- Target Maturity 2032 Corporate Bond ETF (VBCF)

- Target Maturity 2033 Corporate Bond ETF (VBCG)

- Target Maturity 2034 Corporate Bond ETF (VBCH)

- Target Maturity 2035 Corporate Bond ETF (VBCI)

- Target Maturity 2036 Corporate Bond ETF (VBCJ)

What exactly are Target Maturity funds, and what sets them apart?

Unlike traditional bond funds, where the managers constantly buy and sell bonds for their portfolios year after year, target-maturity funds have a finish line. Each one holds a diversified portfolio of bonds (in this case, investment-grade corporate bonds), and on December 15 of the target year, the fund liquidates and returns the proceeds to shareholders. Think of them as ETFs designed to “mature,” much like an individual bond.

And just to avoid confusion: these are not relatives of Vanguard’s Target Retirement funds. Yes, each Target Retirement fund eventually merges into Target Retirement Income (VTINX), but it keeps going indefinitely. Target Maturity funds shut down and return your money on a schedule.

Two very different tools, two very different purposes.

As I told Premium Members yesterday, these new ETFs could be useful if you’re building a bond ladder or matching specific future liabilities—college tuition in 2032, a home down payment in 2035, that sort of thing. If you don’t need that precision, your current diversified bond fund will continue to work just fine.

I’ll have more to say about the funds in the months ahead, but for now, consider these a niche tool—not a likely addition to the IVA Portfolios.

PRIMECAP Fine Print, Updated

Yesterday, I walked Premium Members through a deep dive into PRIMECAP Management and its funds. In case you missed it, Vanguard quietly updated the fee schedules and benchmarks for the PRIMECAP-run funds—and the changes are worth noting.

Here’s what you need to know:

First, PRIMECAP Management’s decades-old fee arrangement with Vanguard is gone.

For roughly 40 years, PRIMECAP was paid a simple, asset-based fee: a set percentage of each fund’s assets, billed quarterly. In the six months ending in March 2025—the most recent data available—Vanguard paid PRIMECAP Management nearly $113 million to run PRIMECAP (VPCMX), PRIMECAP Core (VPCCX) and Capital Opportunity (VHCOX). Annualized, that’s roughly $225 million in fees.

Big numbers, yes—but on a base of roughly $110 billion in assets, it works out to about 0.20%—a reasonable price for access to one of the industry’s most successful stock-picking teams.

From now on, though, PRIMECAP will be paid differently: a base fee plus or minus a performance adjustment. In English, PRIMECAP will earn more when it beats its benchmark and less when it lags it. (The same structure will also apply to Capital Growth Annuity.)

In the near term, the new fee structure trims expenses for the three mutual funds:

- PRIMECAP: down 0.02%–0.37% to 0.35%

- PRIMECAP Core: down 0.06%–0.43% to 0.37%

- Capital Opportunity: down 0.03%–0.43% to 0.40%

Modest reductions, yes, but still a win for shareholders—and really just a move that brings PRIMECAP’s arrangement in line with Vanguard’s standard model for sub-advisors.

Second, Vanguard also used this moment to revisit the benchmarks for the PRIMECAP-run funds. The table below shows the old and new bogeys.

I wouldn’t read too much into the benchmark changes. PRIMECAP Core is switching to a similar, but more recognizable bogey, while Capital Opportunity is moving from a mid-size stock index to a broader one that better matches how the portfolio has been positioned for years.

The bottom line for shareholders: The strategies stay the same—even if the fine print just got a tune-up.

Odyssey Distribution Estimates Rise

And while we’re talking about PRIMECAP-run funds, I have an update on capital gains distributions for the private-label Odyssey funds.

As a reminder, if you’re a shareholder of any of the three Vanguard funds on December 16—Capital Opportunity, PRIMECAP and PRIMECAP Core—you should expect payouts ranging from 8% and 14% of NAV. (You can find distribution estimates for all Vanguard funds here.)

If you own the Odyssey funds, brace for even larger distributions. The latest estimates (through October) are shown in the table below. And—frustratingly, but not surprisingly—each distribution has crept higher since the initial September 30 projections.

⚠️ NOTE: You’ll receive these distributions if you own the funds on December 12.

🎁 Give the Gift of The IVA

Help someone make the most of their Vanguard investments.

Our Portfolios

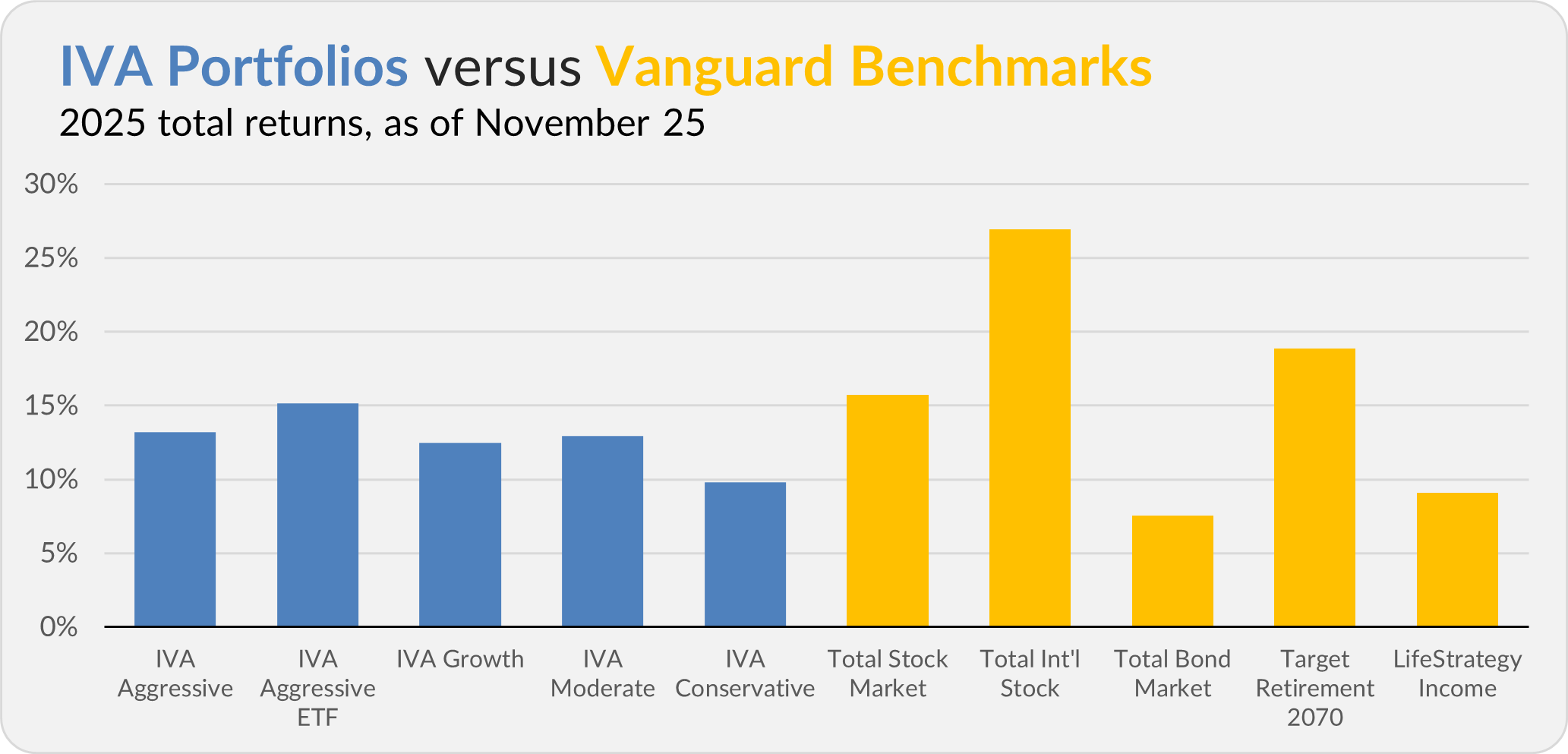

Our Portfolios are showing solid returns for the year through Tuesday. The Aggressive Portfolio is up 13.2%, the Aggressive ETF Portfolio is up 15.1%, the Growth Portfolio is up 12.5%, the Moderate Portfolio is up 12.9% and the Conservative Portfolio is up 9.8%.

This compares to a 15.7% return for Total Stock Market Index (VTSAX), a 26.9% gain for Total International Stock Index (VTIAX), and a 7.5% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 28.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 9.1%.

IVA Research

Yesterday, I put the PRIMECAP-run funds under the spotlight—see here.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future and a very happy Thanksgiving.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.