Hello, and welcome to the IVA Weekly Brief for Wednesday, November 5.

There are no changes recommended for any of our Portfolios.

All eyes have been on the stock market lately, where an artificial intelligence-fueled rally has 500 Index (VFIAX) on the cusp of posting its third-straight calendar-year gain of more than 20%. Through October, the flagship index was up 17.5%. And of course, the political noise (and action) out of Washington, D.C. has been hard to ignore.

But quietly, the bond market has been putting together a solid year of its own.

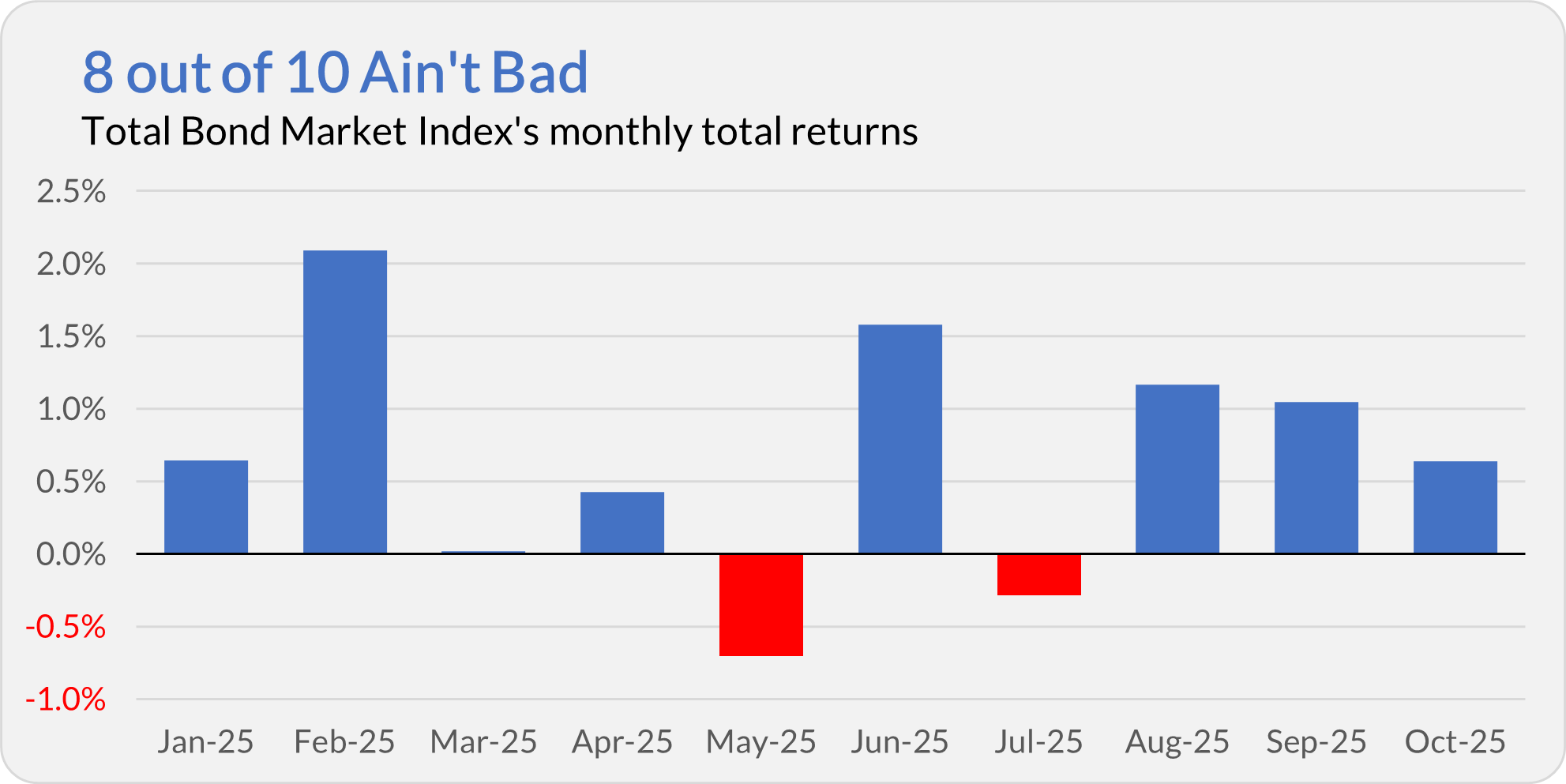

Consider Total Bond Market Index (VBTLX), which has delivered positive returns in eight out of ten months this year—up 6.8% through October.

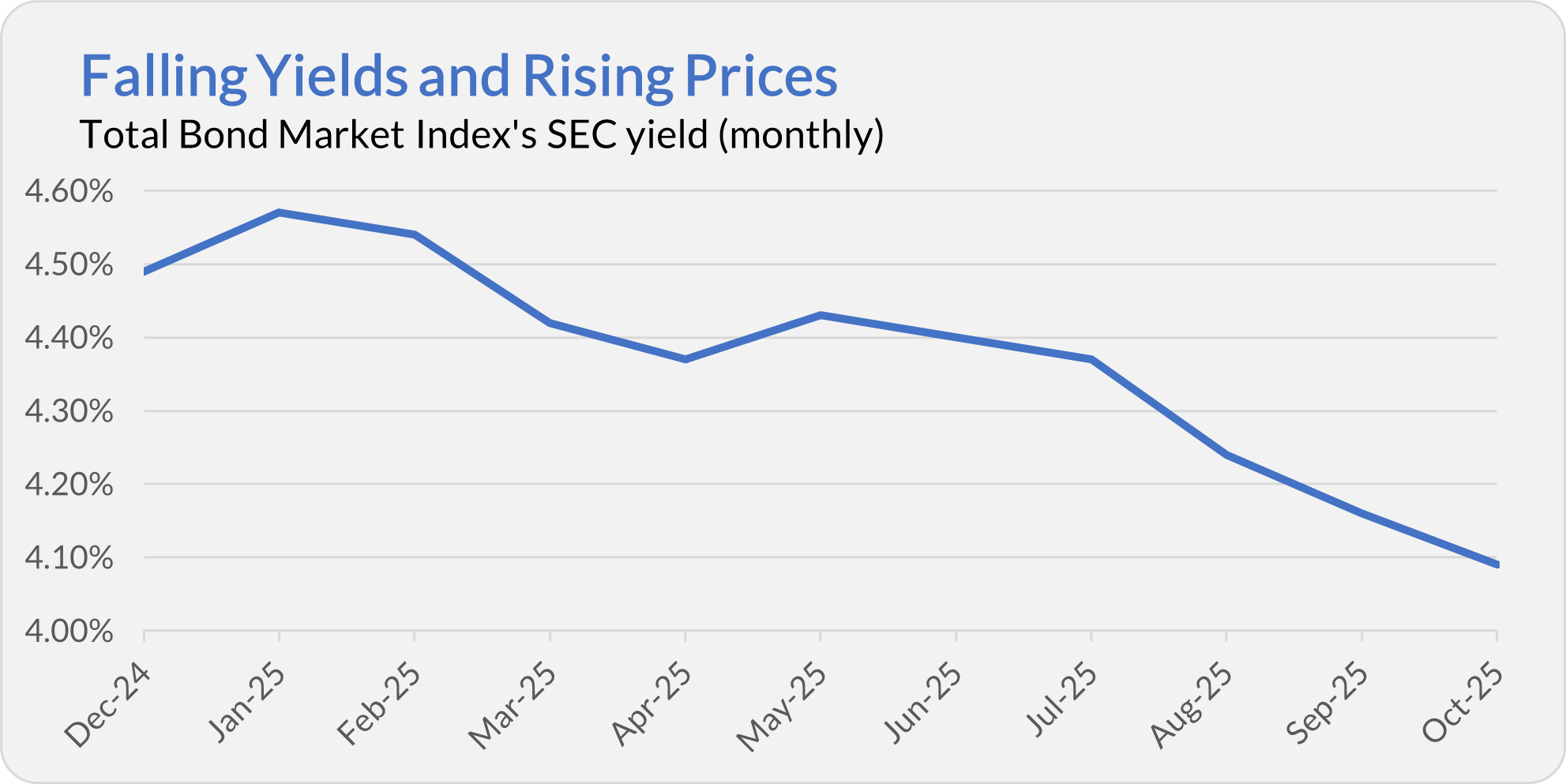

The fund started 2025 yielding 4.49%, setting the stage for decent returns. Its 6.8% year-to-date gain outpaces that starting yield because yields have since declined to 4.09%. Remember: when bond yields fall, bond prices rise.

And it’s not just Total Bond Market Index. All of Vanguard’s bond funds are in the black this year. The best of the bunch through October is Emerging Markets Bond (VEMBX), up 12.9%. Twenty other bond funds are also ahead of Total Bond Market Index—including High-Yield Corporate (VWEHX) and Long-Term Bond Index (VBLAX) with gains of 7.9% and 7.8%, respectively.

In short, whether you took default risk (via junk or emerging market bonds) or interest rate risk (via long-maturity bonds), 2025 has been a rewarding year to stretch for yield and returns.

That’s not what most investors expected. Coming into the year, bonds were an afterthought. Then in the Spring, recession and tariff-driven inflation worries dominated the conversation. But those fears faded as the economy muddled through, and bonds ticked along.

As the year wraps up, I’ll revisit my 2025 Outlook and see how my calls held up. One thing that I wrote at the time was, “Bonds will continue to deliver reasonable returns, but I’m leery of long-maturity and corporate bonds,” and “I’m taking a safety-first approach … [which] may leave some returns on the table.”

I was right that bonds could deliver reasonable returns, but early in leaning away from risk. I did note I might be leaving a bit on the table, and that’s exactly how it’s played out.

Even so, I still don’t think investors are being paid to take the risk that comes with long-maturity or junk bonds today. I believe my patience will be rewarded with a more compelling opportunity down the road.

What About Tax-Free Cash?

When the Federal Reserve cut interest rates in September and October, I went out on a limb and predicted exactly where yields on Vanguard’s cash options were headed—see here, here and here.

Notably missing from my predictions was any mention of Municipal Money Market (VMSXX).

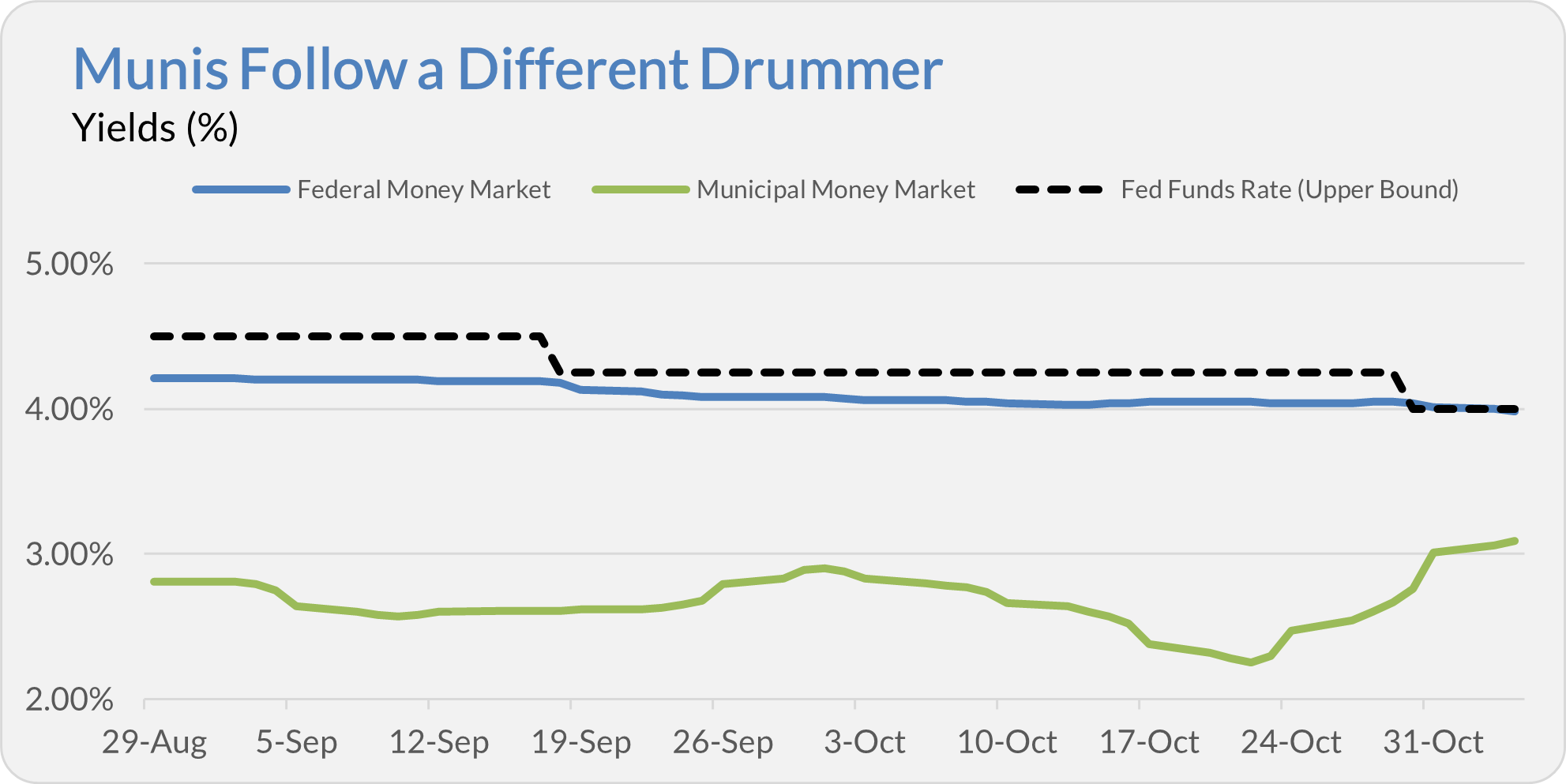

That omission wasn’t an oversight. Yes. I know many IVA readers own Municipal Money Market or its California and New York siblings—heck, I own the Big Apple-specific fund myself. The reason I didn’t make a prediction is that Municipal Money Market’s yield often marches to a different drummer.

The chart below shows that while Federal Money Market’s (VMFXX) yield has steadily drifted lower as the fed fund rates declined, Municipal Money Market’s yield has been less predictable—zigging and zagging instead of gliding down.

When Fed officials eased policy in September, Municipal Money Market’s yield stood at 2.61%. It then rose to 2.90%, fell to 2.25% in mid-October, and has since climbed to 3.09%. In other words, the cash fund’s yield is now higher than it was before the Fed cut interest rates twice.

Municipal Money Market’s yield won’t defy gravity forever. The fed funds rate still acts as an anchor for tax-free cash yields—it just doesn’t tug quite as tightly.

Correction Ahead?

According to Axios, Goldman Sachs CEO David Solomon recently warned that “it's likely there'll be a 10% to 20% drawdown in equity markets some time in the next 12 to 24 months.”

I’ll give Axios credit for putting that quote in context—but let me remind you that it isn’t much of a warning. Why? Because, as I explained before (see here and here), you should generally expect a correction—a decline of 10% to 20%—every year or two. A full-blown bear market (a drop of 20% or more) typically comes along every four to five years.

Here’s another way to look at it. The chart below plots 500 Index’s (VFIAX) worst calendar-year decline—the red dots—and its total return—the blue dots—for each year since 1984.

Even though 500 Index suffered an average intra-year drop of 13.8%, it still compounded at an annual rate of 11.6% over the past four decades—turning a $10,000 investment into roughly $1 million (a total return of 9,942%).

So, yes, I agree with Solomon: expect a correction between now and the end of 2027. But that’s not cause for alarm or reason to start tinkering with your portfolio.

Corrections are a feature of investing, not a flaw. They’re part of the price of admission for long-term compounding. If your portfolio was built with that in mind—as it should be—then there’s nothing to “correct” in your plan when the next market drop arrives.

Where’s the Data?

With the U.S. government shut down and key data agencies like the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA) suspending services (see here and here), several IVA readers have asked where to turn for timely economic updates.

One promising source of employment data is Revelio Labs’ Public Labor Statistics (RPLS—here), which draws on publicly available sources—think LinkedIn profiles or Worker Adjustment and Retraining Notices (WARN)—to model real-time labor market trends.

As Revelio notes, its data are best used “alongside” official BLS reports rather than as a substitute for them. Still, until the government is back online, RPLS offers a rare window into employment dynamics—one worth watching to see how closely it tracks the official numbers once they return.

Our Portfolios

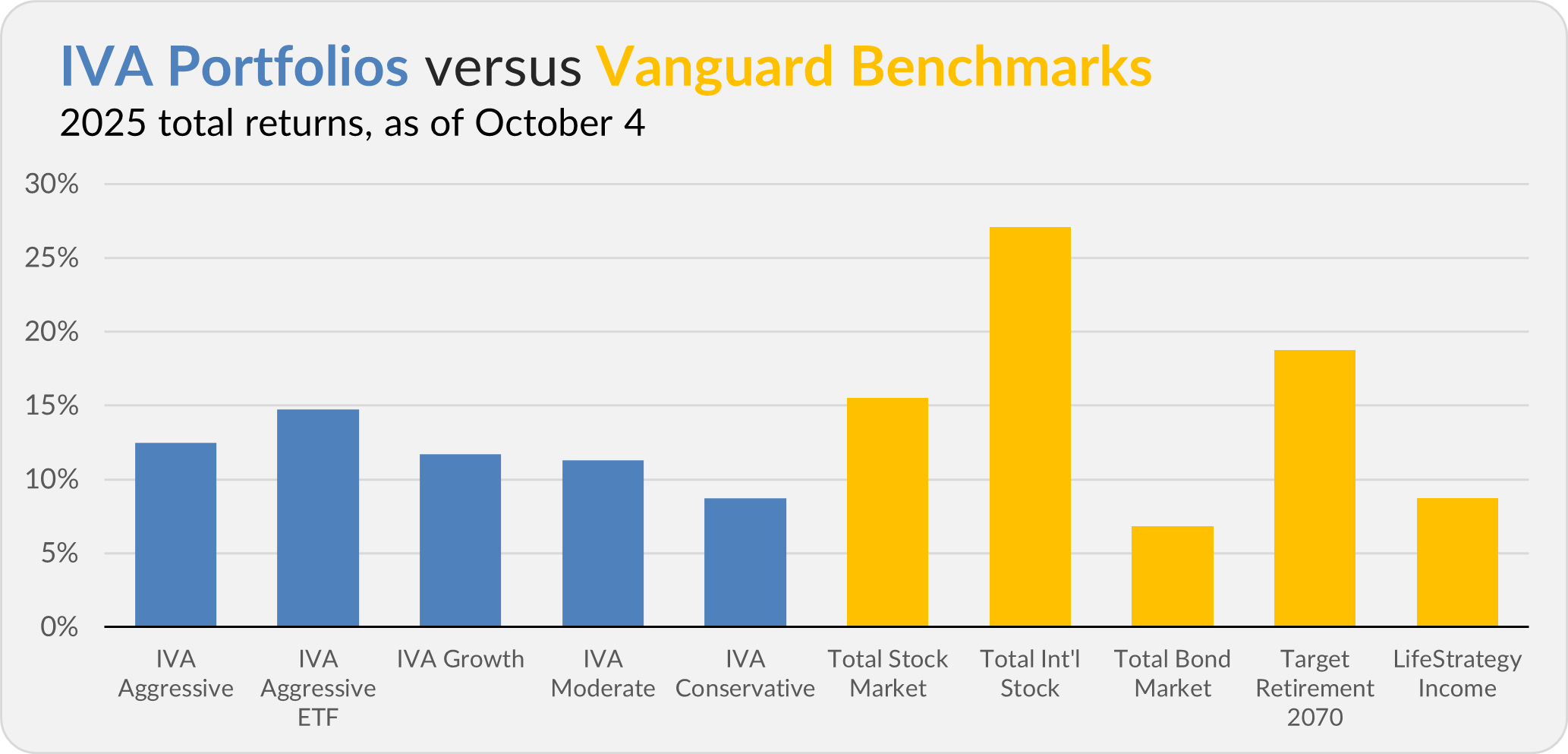

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 12.4%, the Aggressive ETF Portfolio is up 14.7%, the Growth Portfolio is up 11.7%, the Moderate Portfolio is up 11.3% and the Conservative Portfolio is up 8.7%.

This compares to a 15.5% return for Total Stock Market Index (VTSAX), a 27.1% gain for Total International Stock Index (VTIAX), and a 6.8% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 18.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 8.7%.

IVA Research

Yesterday, I told Premium Members my answer to the common question: Should you invest your lump sum today or average in over time? (I also discussed what to do with a stock that’s run far ahead.)

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.