Hello, and welcome to the IVA Weekly Brief for Wednesday, October 29.

There are no changes recommended for any of our Portfolios.

Every week feels momentous while we’re living through it—and this one is no different.

Investors are facing earnings reports from tech giants, a Federal Reserve rate decision and a potential trade “deal” with China. Traders are optimistic about each. On Monday, not only did the S&P 500 Index, the Dow Jones Industrial Average and the Nasdaq Composite hit record highs, but markets in the U.K., Japan, South Korea and Brazil followed suit.

Of course, any of the aforementioned positives could just as easily disappoint. And even if they don’t, by week’s end, we may look back to see another case of traders buying the rumor and selling the news.

Most importantly for investors, rather than traders, you shouldn’t upend your portfolio based on whether the Fed cuts interest rates or if the President returns from his trip with an outline of a trade agreement—or not.

Rather than trying to second-guess how markets will react to these news items, market highs present an opportunity to step back and review your portfolio:

- Are your holdings aligned with your goals and your comfort with risk?

- Do you know what you own and why you own it?

If the answers reveal that your portfolio needs adjusting—say stocks have grown into a larger share than you’re comfortable with—that’s a good reason to act. It’s far better to make trades because your goals—not the headlines— dictate them.

When Double the Exposure Means Double the Trouble

Speaking of risk and restraint, with Halloween fast approaching, let me share a cautionary tale for investors: Beware leveraged ETFs—particularly the single-stock kind.

No. Vanguard isn’t launching leveraged ETFs, but traders (and investors) have flocked to single-stock leverage ETFs in this bull market. Jack Pitcher of The Wall Street Journal recently highlighted the risks of leveraged ETFs, and he’s right to sound the alarm.

Leveraged ETFs are designed to deliver two or three times the daily return of a particular stock or index—up or down. Some even aim for the inverse, meaning they rise when the security they’re tracking falls.

Let me be clear. Leveraged ETFs are trading tools. They are not meant to be bought and held.

Pitcher used an ETF following the company Strategy (ticker: MSTR)—a software firm that’s loaded up on bitcoin—as an example. Let’s follow his lead.

The chart below compares Strategy stock’s performance this year to two leveraged ETFs tied to the stock: Defiance Daily 2X Long MSTR ETF (MSTX) and Defiance Daily 2X Short MSTR ETF (SMST).

On Friday, Strategy’s stock closed at $289.08 per share—almost exactly its 2025 starting value of $289.62. Technically, the stock is flat for the year, but it has been on a wild ride—rallying nearly 90% in the summer but suffering two separate 35% drops along the way.

And those leveraged ETFs? The 2x long ETF is down 54% this year, and the 2x short ETF is down 80%. Ouch!

The stock is flat, but the leveraged funds—whether betting on the stock rising or falling—are down a LOT. How does that happen?

The short answer is that you need ever-larger gains to recover from bigger losses.

If a stock falls 10% one day, from say $100 to $90, it needs a 11.1% gain to get back to $100. But a 2x long ETF falls 20% in that same scenario—from $100 to $80—and would need a 25% gain to recover.

So, even if the stock rebounds 11.1% the next day, the 2x long ETF—up 22%—only climbs back to $97.78—it’s still underwater.

This dangerous use of leverage is why Vanguard bars these products from its brokerage platform.

Unless you are a day trader—or think you have an edge in forecasting very, very short-term moves—you shouldn’t go anywhere near leveraged ETFs—the single-stock variety or otherwise. Leverage promises excitement, not success—and excitement is rarely a good investment strategy.

And if you can’t resist the temptation to dabble? Well, all the best of luck to you—just don’t risk more than you’re willing to lose.

Our Portfolios

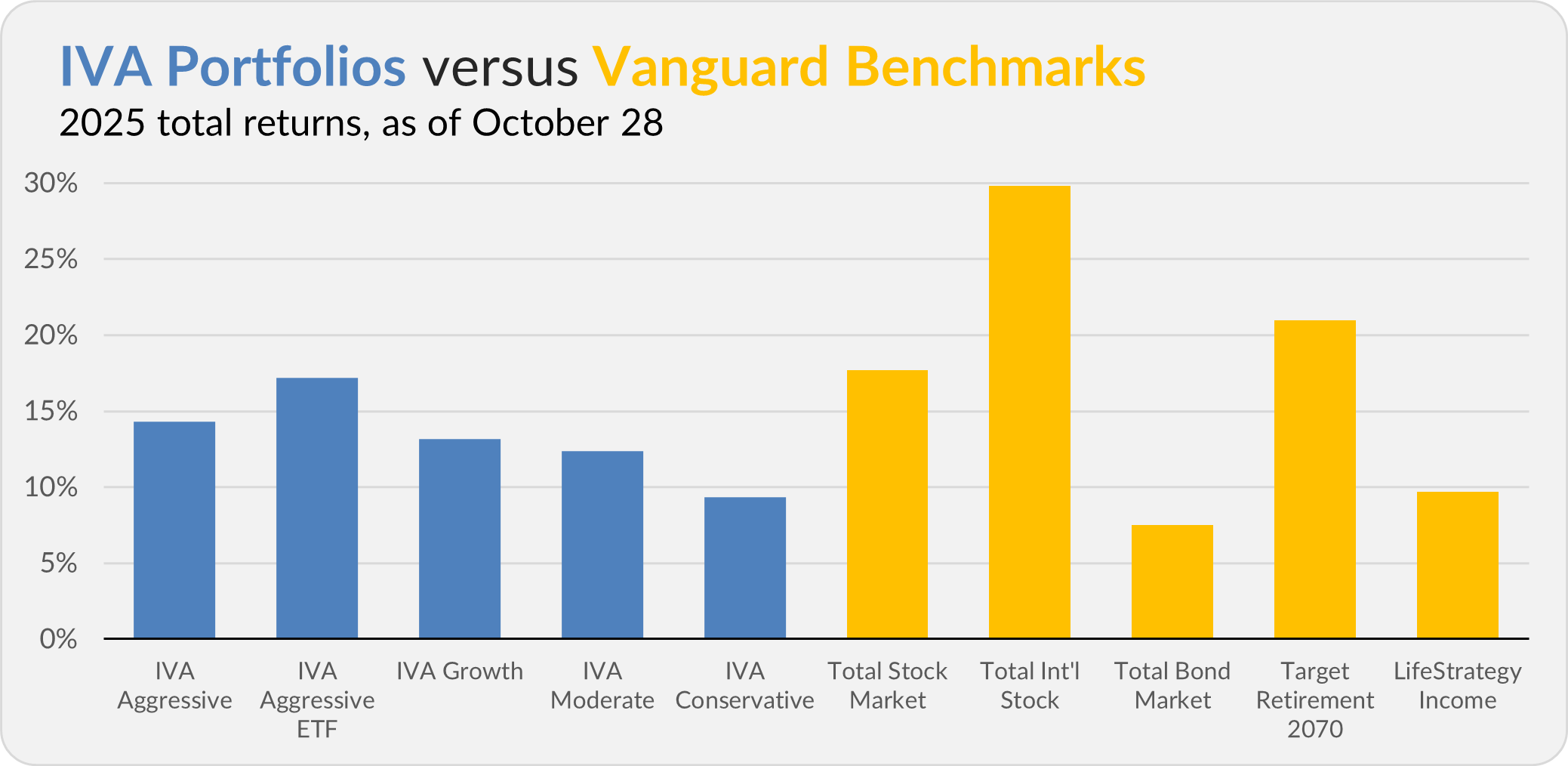

Our Portfolios are showing solid returns for the year through Tuesday. The Aggressive Portfolio is up 14.3%, the Aggressive ETF Portfolio is up 17.2%, the Growth Portfolio is up 13.1%, the Moderate Portfolio is up 12.4% and the Conservative Portfolio is up 9.4%.

This compares to a 17.7% return for Total Stock Market Index (VTSAX), a 29.8% gain for Total International Stock Index (VTIAX), and a 7.5% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 21.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 9.7%.

IVA Research

Yesterday, I showed Premium Members why they should analyze total returns, not price returns, when evaluating their investments. I also explained that ETFs and index funds don’t eliminate taxes, but they do give you more control over the timing of your tax bill. See here.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.