Hello, and welcome to the IVA Weekly Brief for Wednesday, July 23.

There are no changes recommended for any of our Portfolios.

What a difference three months make.

In April, talk of “reciprocal tariffs” and the President’s musings about firing Federal Reserve Chief Jerome Powell had traders on edge and markets teetering. At its worst, 500 Index (VFIAX) was 19% below its February high—just shy of a bear market.

Today, most of those same tariffs are scheduled to kick in next week, Powell’s job is (still) not secure and yet … 500 Index has spent the month climbing to new highs.

Same headlines. Different responses.

Tariffs and the Fed’s independence are serious issues—don’t get me wrong—but markets aren’t reacting to them the way they did three months ago. Why? Possibly because corporate earnings are doing the heavy lifting. According to Factset, more companies are beating analysts’ forecasts than usual, and the quarter is shaping up better than many feared.

Factset now pegs earnings growth at 5.6% year-over-year—not a blockbuster number, but solid. Importantly, it’s an improvement from the recession calls we heard just a few months ago. And as I’ve said before, the market doesn’t move strictly on good or bad news; it moves on whether things are getting better or worse.

Could both earnings and the economy stumble in the quarters ahead? Absolutely. But for now, the story is one of resilience—not collapse.

The Tables Turned

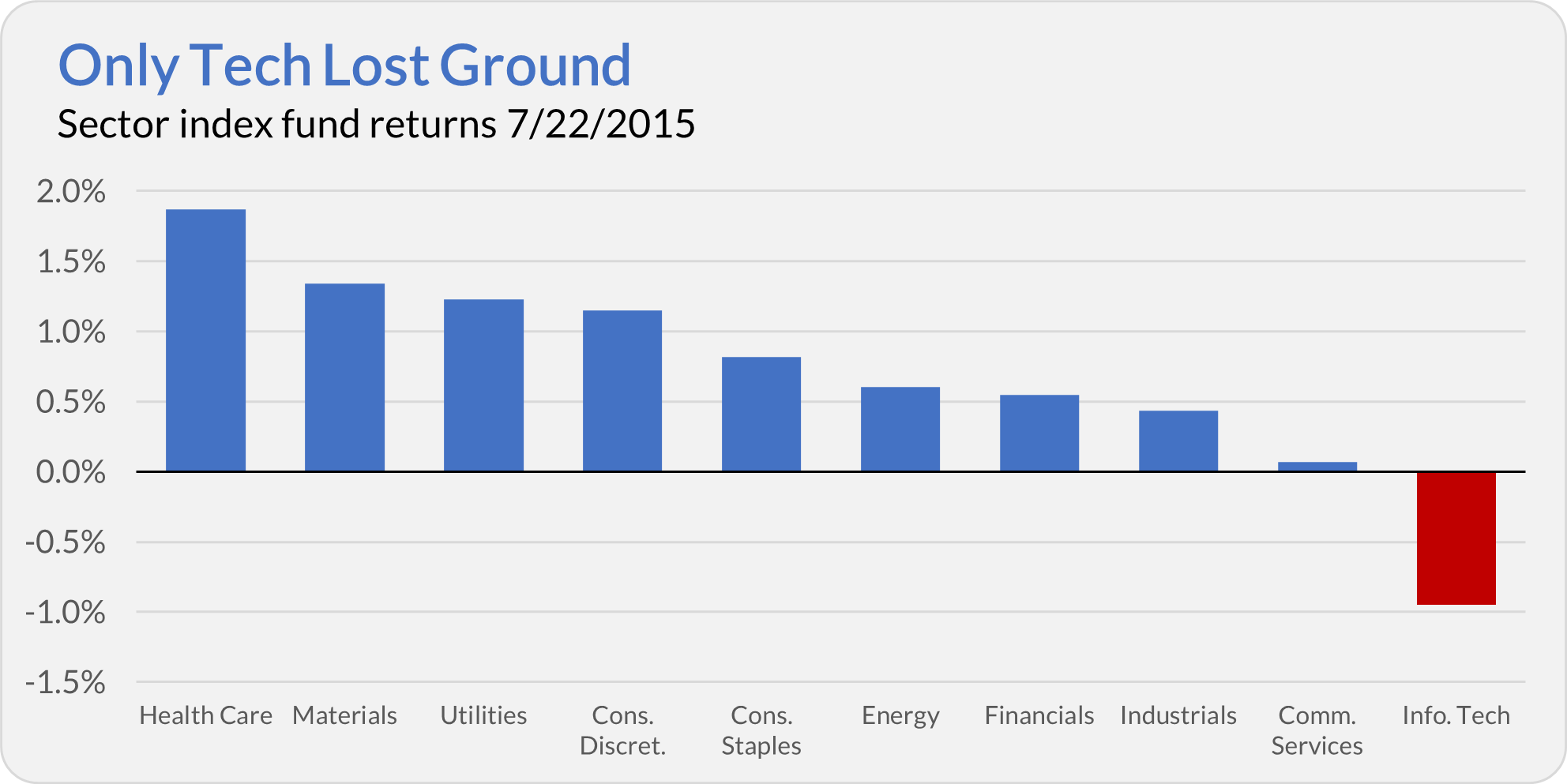

In last week’s Brief, I pointed out that Information Technology Index (VITAX and VGT) was the only sector fund to gain on Tuesday, July 17. Well, yesterday the tables turned—tech was the only sector in the red, falling 1.0%.

As I said last week, one day doesn’t make a trend.

But if there’s a message in these two trading days, it's that the tech sector has become disconnected from the rest of the market. Loading up on tech stocks has worked for years—but yesterday’s trading is a good reminder that diversification still pays.

Is Vanguard Finally Betting on Bitcoin?

Not quite. Despite what a recent Bloomberg headline—and a slew of other articles—might have you believe, Vanguard hasn’t gone “big on crypto.”

Over the past week, I've seen stories accusing Vanguard of hypocrisy: The fund giant won’t offer a bitcoin ETF and has blocked all cryptocurrency ETFs from its brokerage platform, yet it’s reportedly the largest shareholder in Strategy—a software company that's become a stand-in for bitcoin thanks to its massive crypto holdings.

Let’s clear this up.

Vanguard’s stake in Strategy isn’t an endorsement of cryptocurrencies. It’s just a function of index investing. Strategy is included in the indexes that Vanguard tracks—whether that’s from S&P, Russell or CRSP. And when you run an index fund, you buy what the index tells you to buy—no more, no less.

That’s how indexing works. It’s not about judging the merits of any one company. It’s about owning the whole haystack—even if a few of the straws make you sneeze.

Vanguard’s Cost Basis Change: One More Thing

One (hopefully final) update on Vanguard’s move to change its default cost-basis settings.

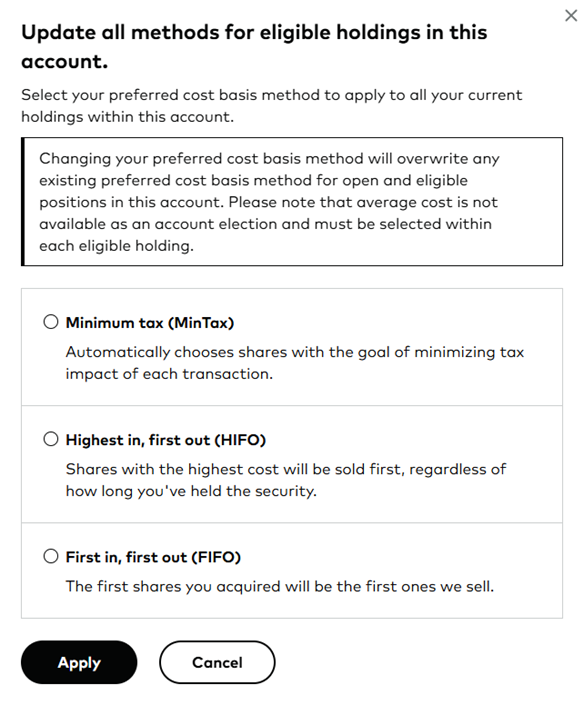

As I’ve explained here and here, Vanguard is removing Specific Identification (SpecID) as a default method for accounting for sales through brokerage accounts. Going forward, you’ll need to choose one of three options as your default:

- First in, First Out (FIFO): Sells your oldest shares first, based on purchase date.

- Highest in, First Out (HIFO): Sells your most expensive shares first to minimize capital gains.

- MinTax: Uses a tax-sensitive waterfall to sell shares with the lowest tax rate

If you don’t make a selection, Vanguard will default you to FIFO.

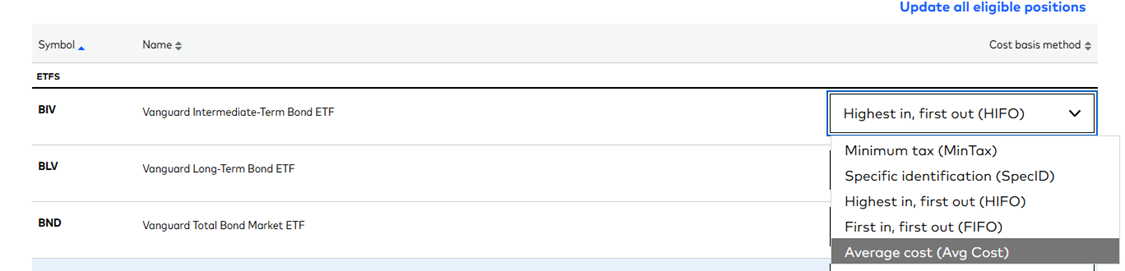

But what about average cost—the method that assigns the same (average) cost to all your shares?

In my account, I was able to select average cost for individual positions.

However, when I tried to make a global change using the “Update all eligible positions” link, average cost wasn’t on the menu.

So, I asked Vanguard for clarification. Here’s what they told me:

Average cost remains an available cost basis method for eligible positions. However, due to IRS rules, it’s not available for all products and positions. For example, certain securities like stocks require dividends to be reinvested to qualify.

Because of these specific eligibility requirements, average cost isn’t included in the global “update all positions” option. Clients can still select average cost for each eligible position individually when the criteria are met, and the option will appear accordingly. [Emphasis added]

So, the bottom line is this:

Yes, average cost is still available—but only if you select it manually for each eligible position. You can’t apply it globally.

As for me, I’m sticking with HIFO as my default and will continue using SpecID when placing trades.

Our Portfolios

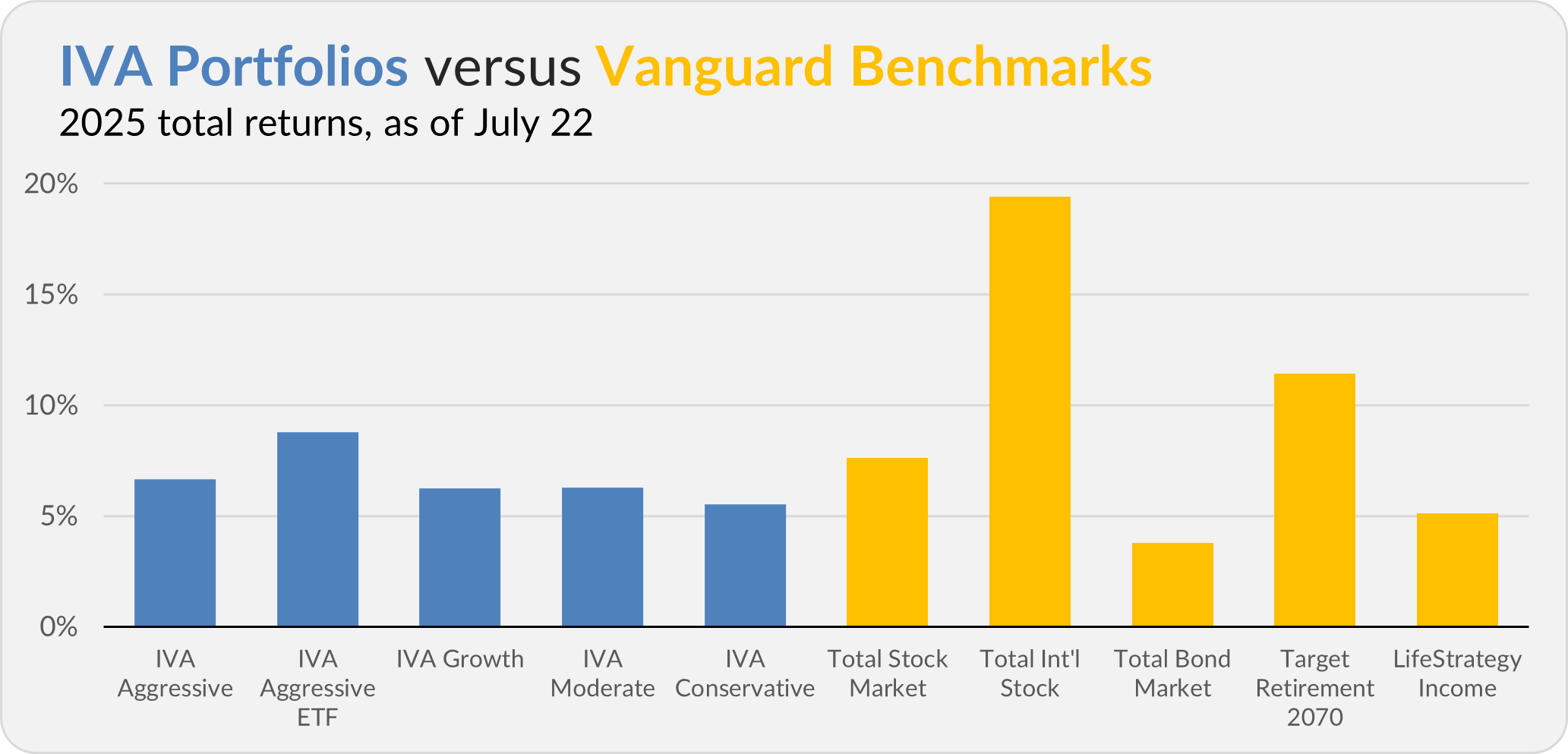

Our Portfolios are showing decent absolute returns for the year through Tuesday. The Aggressive Portfolio is up 6.7%, the Aggressive ETF Portfolio is up 8.8%, the Growth Portfolio is up 6.2%, the Moderate Portfolio is up 6.3% and the Conservative Portfolio is up 5.5%.

This compares to a 7.6% gain for Total Stock Market Index (VTSAX), a 19.4% return for Total International Stock Index (VTIAX), and a 3.8% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 11.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.1%.

IVA Research

Last week, I took a long-term investor’s view of Vanguard’s sector index funds (and ETFs). Yesterday, I switched gears and looked at the same lineup through a trader’s lens. Next week, I’ll wrap up this series with a look at Vanguard’s actively managed sector funds—Health Care (VGHCX) and Energy (VGENX).

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.