Hello, and welcome to the IVA Weekly Brief for Wednesday, October 1.

There are no changes recommended for any of our Portfolios.

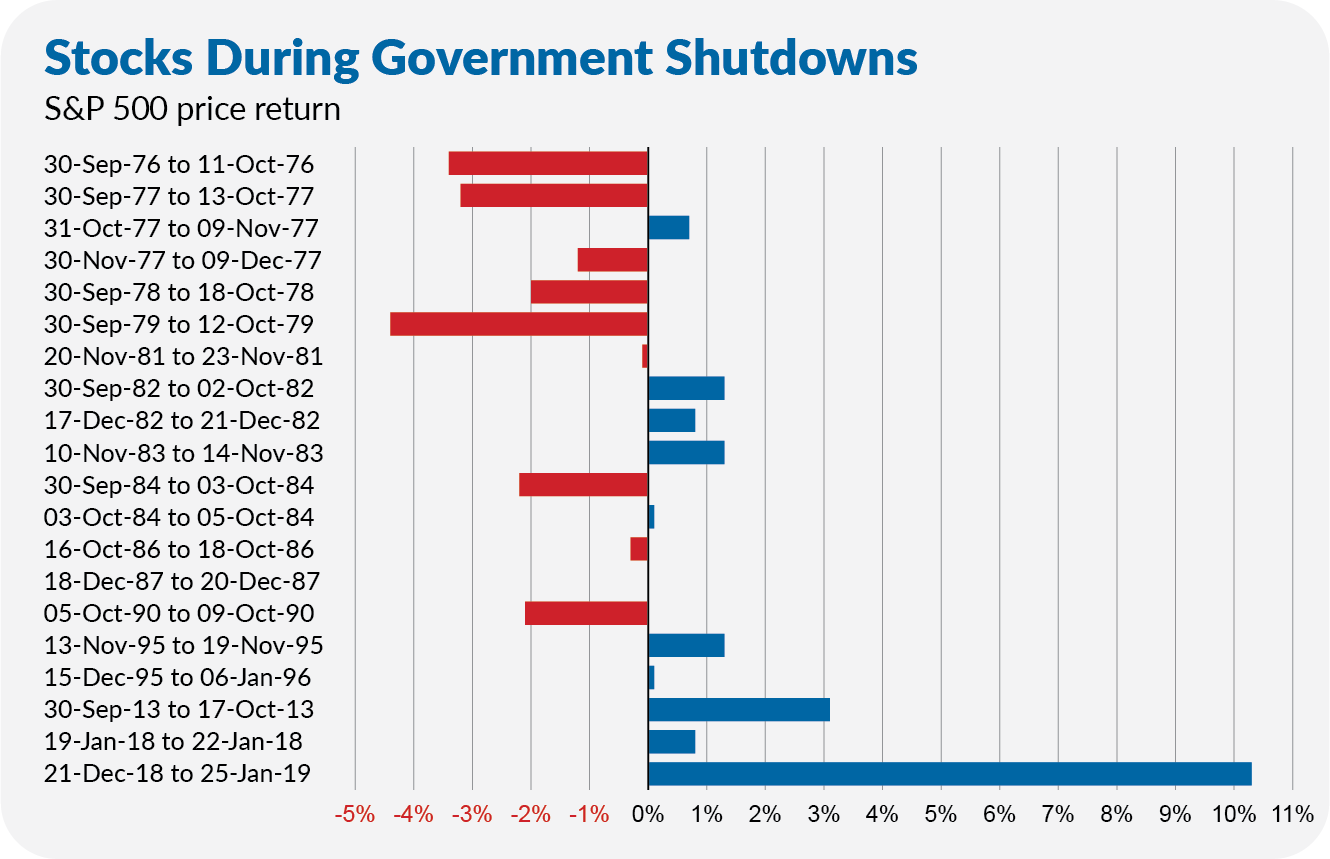

Lawmakers failed to reach a budget agreement, leading to another government shutdown. History suggests that markets usually take these episodes in stride—sometimes stocks dip, sometimes they rise, but they’ve never cratered.

In other words: stay disciplined, not distracted.

Meanwhile, Vanguard has been making news:

- In a recent “expert insight”, Vanguard laid the analytical groundwork for adding private assets to its Target Retirement funds. I remain skeptical that opaque, illiquid and expensive funds are the solution for long-term investors. My mentor’s personal experience backs up my assessment.

- Rumors are swirling that Vanguard may allow cryptocurrency ETFs on its brokerage platform. Don’t expect a Vanguard-branded bitcoin ETF, but you may soon be able to trade competitors’ offerings. That’s a win for access—but the bigger question remains: How much crypto do you really need?

- Morningstar is acquiring CRSP, the index provider behind Vanguard’s core U.S. stock funds. While this deal doesn’t change much for shareholders, it raises questions about fees, ratings and potential conflicts.

- And finally, as announced in July, Nafis Smith now manages Vanguard’s default settlement fund, Federal Money Market (VMFXX), as John Lanius has retired.

I cover all of these topics in greater depth—along with a full review of the quarter—in this month’s Monthly Recap. You can read it here. (Premium Members will also find my closer look at the IVA Portfolios behind the paywall.)

Our Portfolios

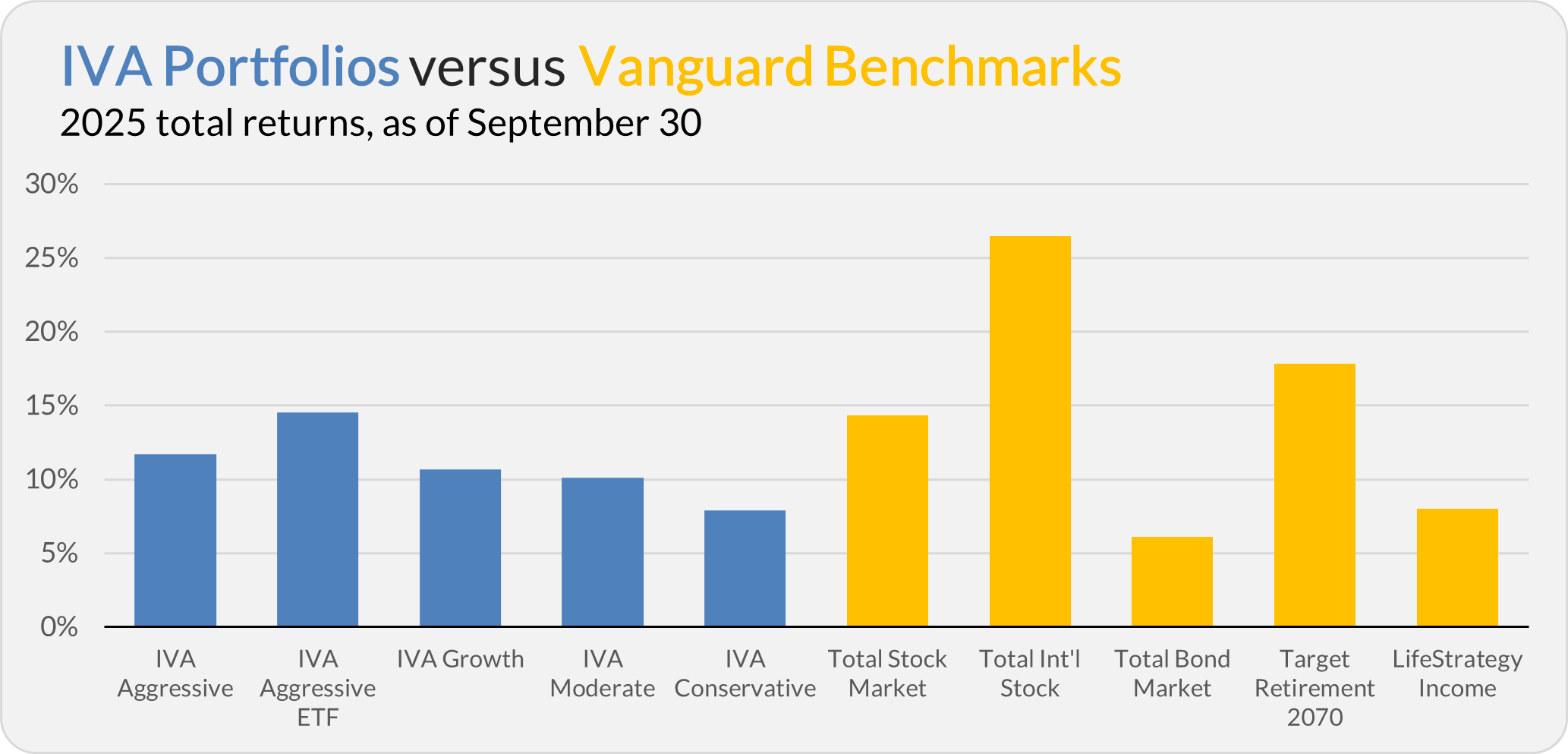

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 11.7%, the Aggressive ETF Portfolio is up 14.5%, the Growth Portfolio is up 10.7%, the Moderate Portfolio is up 10.1% and the Conservative Portfolio is up 7.9%.

This compares to a 14.3% gain for Total Stock Market Index (VTSAX), a 26.5% return for Total International Stock Index (VTIAX), and a 6.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 17.8% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 8.0%.

IVA Research

Yesterday, I showed Premium Members which trustees—those tasked with overseeing Vanguard’s funds on our behalf—are eating their own cooking by investing alongside shareholders … and which are not.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.