Hello, and welcome to the IVA Weekly Brief for Wednesday, September 24.

There are no changes recommended for any of our Portfolios.

Small stocks are back … sort of.

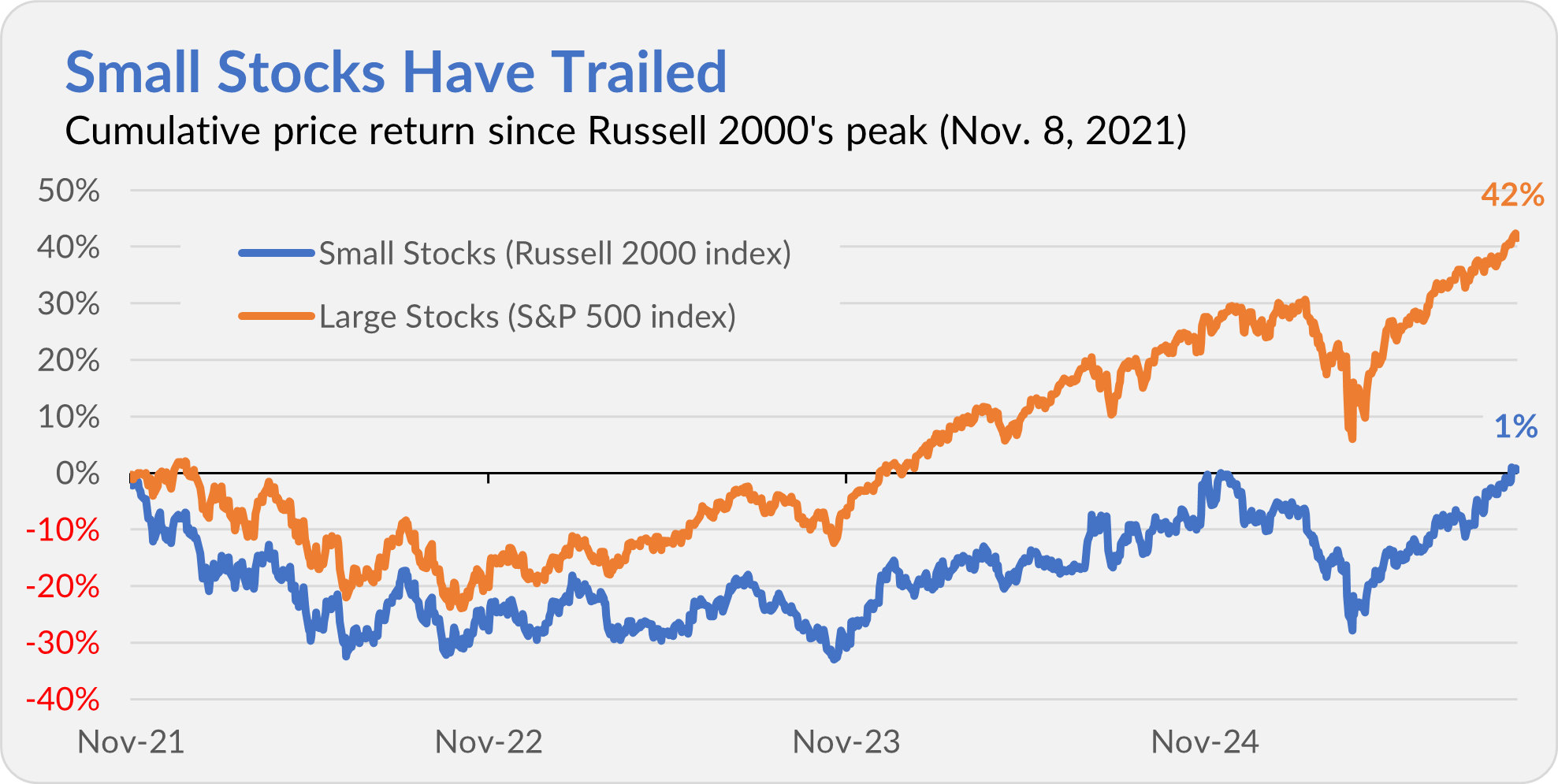

On Thursday, the Russell 2000 index—a widely cited benchmark of smaller-company stocks—set a record high for the first time since … wait for it … November 8, 2021; nearly four years ago.

It’s been a bumpy ride getting here. At its worst, the Russell 2000 index sat 33% below that 2021 high in October 2023. The index nearly clawed its way back in late 2024, only to slip back into bear market territory just four months ago. From that April 2025 low, small stocks have rallied 40%, finally bringing the index back above its 2021 high watermark.

While small stocks were languishing, large stocks didn’t fall as far, recovered more quickly and haven’t looked back. The S&P 500 index recovered its 2022 bear market losses by late 2023 and is now 42% higher, having hit 28 all-time highs this year alone.

A few caveats: First, the returns I’ve cited are price only—they don’t include dividends. Second, the Russell 2000 index isn’t the only yardstick for small stocks. The S&P Small Cap 600 index, which uses strict profitability screens to choose its component companies, reached a new high in late 2024; however, it has been trading below that record this year.

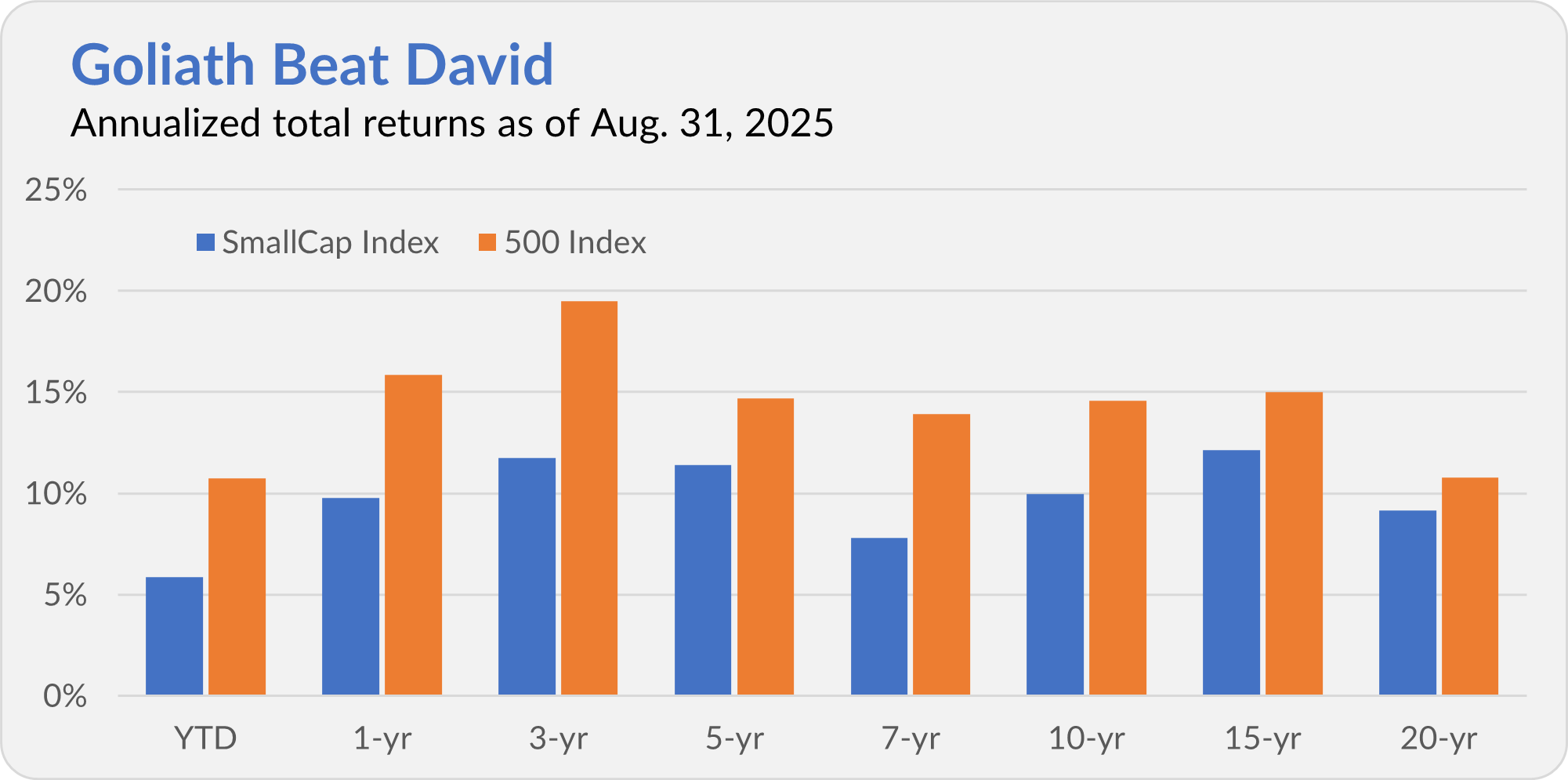

Still, the broader point holds: Large stocks have dominated. Over the past three years, 500 Index (VFIAX) has outperformed SmallCap Index (VSMAX) by roughly 8% a year. And it’s not just a recent thing—500 Index is ahead over the past one, three, five, seven, ten, 15 and even 20 years.

Academics will tell you that small stocks outperform large stocks in the long run. Maybe so—though I think the data supporting this claim can at times be a bit tortured. Either way, for the past two decades—which counts as a “long run” in most investors’ books—large stocks have been the clear winners.

I’m not going to argue that small stocks will or should outperform just because of their size. At the same time, I wouldn’t count them out.

Today’s market giants may look invincible, but leadership rotates—and no one rings a bell to announce it. Staying diversified means you’ll benefit if large stocks keep winning, but you’ll also be ready when that rotation comes.

One Cash Yield Down

As expected, Federal Reserve (Fed) policymakers lowered the fed funds target interest rate by 0.25% to a range of 4.00%–4.25%. And, as I discussed last week, the one place you can count on Fed moves to show up quickly is cash yields. In fact, I stuck my neck out with a few predictions:

- Federal Money Market (VMFXX): Yield slides from 4.19% (today) to roughly 3.95%.

- Cash Plus Account: Yield goes from 3.65% to 3.40%

- Cash Deposit: Yield drops from 2.25% to 2.00%

So far, so good.

Federal Money Market’s yield has started to slide—4.10% as of Tuesday (9/23). I expect it will settle around 3.95% by mid-October.

Cash Plus Account’s yield is holding steady at 3.65%, but history suggests it will tick lower in the next week or two.

Cash Deposit’s yield dropped to 2.10% on Friday (9/19). I expected 2.00%, but given it had already been cut by 0.50% this year, the full quarter-point (or 0.25%) wasn’t guaranteed. Still, I got the direction and timing right—I’ll take it.

For the ETF crowd: The yield on 0-3 Month Treasury Bill ETF (VBIL)—Vanguard’s cash-like ETF—has dropped from 4.21% at the start of September to 4.17%. It should roughly track Federal Money Market’s yield.

I’ll keep you posted on how these yields move in the weeks ahead. The bottom line? Even if Federal Money Market’s yield settles near 3.95%, it’s still paying investors well to sit tight. Bonds need to offer more than a rounding-error advantage before I’ll swap stable cash for volatile bonds.

Our Portfolios

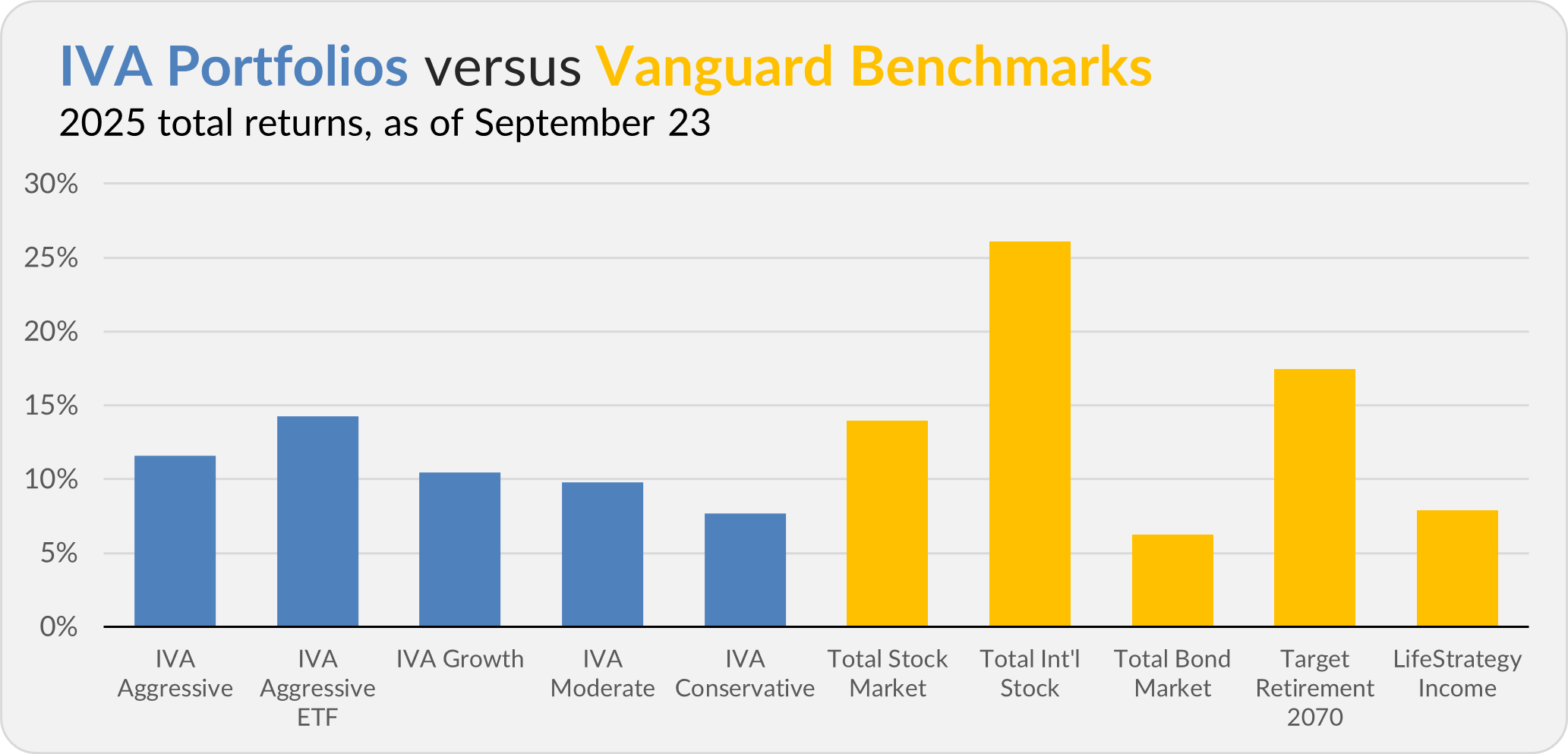

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 11.6%, the Aggressive ETF Portfolio is up 14.3%, the Growth Portfolio is up 10.5%, the Moderate Portfolio is up 9.8% and the Conservative Portfolio is up 7.7%.

This compares to a 14.0% gain for Total Stock Market Index (VTSAX), a 26.1% return for Total International Stock Index (VTIAX), and a 6.2% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 17.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 7.9%.

IVA Research

Yesterday, I showed Premium Members which Vanguard-employed portfolio managers are eating their own cooking—investing alongside shareholders in the funds they run—and which are not.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.