Hello, and welcome to the IVA Weekly Brief for Wednesday, June 11.

There are no changes recommended for any of our Portfolios.

So far, the economy is muddling through the noise and uncertainty surrounding the tariffs.

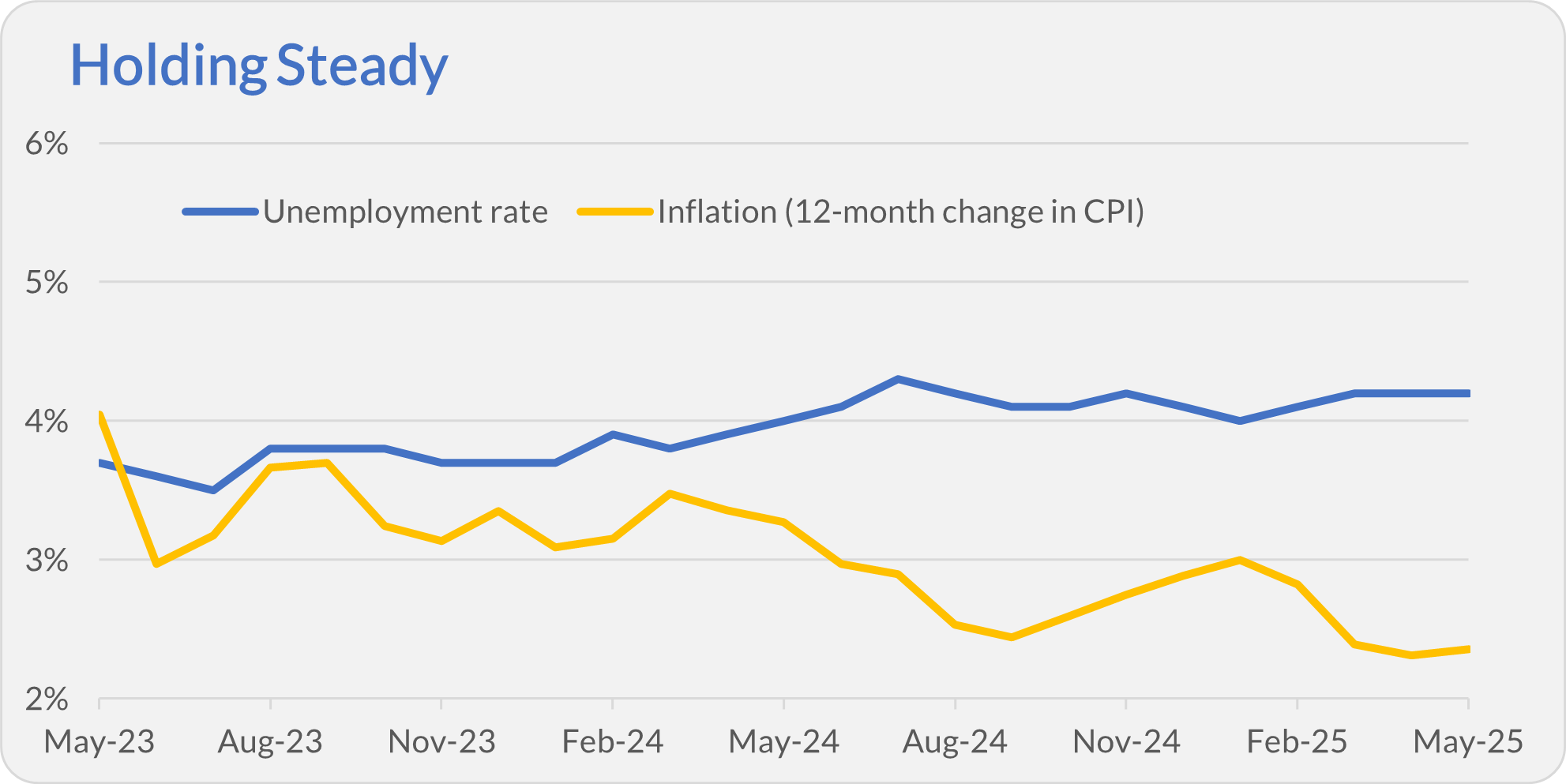

In May, the unemployment rate remained steady at 4.2%, marking a full year within a tight range of 4.0% to 4.2%. Meanwhile, consumer prices rose 0.1% during the month, leaving the annual inflation rate (measured by the Consumer Price Index or CPI) at 2.4%—pretty much where it’s been for the past three months.

To be clear, steady unemployment and inflation in May do not signal an all-clear. The effects of all the tariff back-and-forth will take some time to be reflected in the data. And don’t forget—we’re just a month away from the expiration of the 90-day pause on the Liberation Day “reciprocal” tariffs. With only one “deal” in place, frankly, I’m not sure even the White House knows what comes next.

I’ve been beating this drum for a while—fortunately, it’ll never get worn out—but it’s still true: When the road ahead is foggy, diversification is an investor’s best friend.

The ETFs Keep Coming

Vanguard ETF investors now have another actively managed bond ETF at their disposal, as Multi-Sector Income ETF (VGMS) began trading today.

While technically a distinct vehicle from the Multi-Sector Income mutual fund, the new ETF is effectively a clone. It’s run by the same trio—Michael Chang, Arvid Narayanan and Danial Shaykevich—and targets the same recently updated blended benchmark.

The ETF charges a 0.30% expense ratio, identical to the Admiral share class (VMSAX) of the mutual fund and 0.15% cheaper than the Investor shares (VMSIX). That makes the ETF a more cost-effective choice for smaller investors who don’t meet the $50,000 minimum for the Admiral share class.

Still, I’m not rushing to buy the new ETF. As I’ve said, junk bonds simply aren’t offering enough additional yield to justify the risk right now.

What’s more interesting is what this ETF signals. As I told Premium Members when Vanguard first filed for this fund, it could be a stepping stone. A high-yield bond ETF and an ETF version of Emerging Markets Bond (VEMBX) could be next. I wouldn’t be surprised to see both hit the market before long.

What’s My Balance?

When I logged into my Vanguard account on Friday evening, I was met with an error message: Vanguard was “temporarily unable to display [my] total balance.”

Not exactly what you want to see from the firm holding your life savings.

The system error was resolved over the weekend, and everything looked fine on Monday morning. Still, it serves as a reminder that Vanguard’s tech transformation is a work in progress.

Our Portfolios

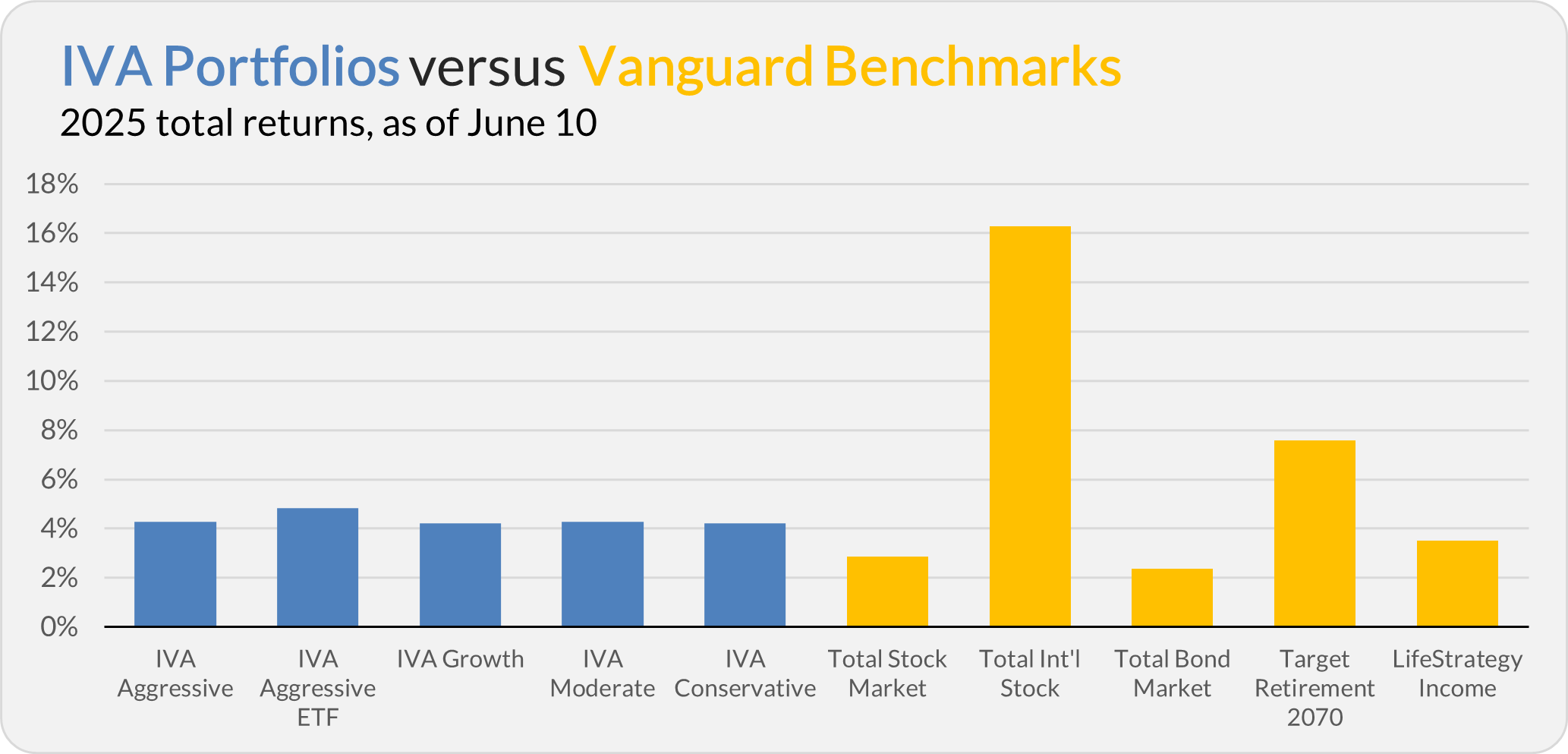

As I said at the top, diversification has been an investor’s best friend in 2025. Our Portfolios are all outpacing U.S. stocks this year through Tuesday. The Aggressive Portfolio is up 4.3%, the Aggressive ETF Portfolio is up 4.8%, the Growth Portfolio is up 4.2%, the Moderate Portfolio is up 4.3% and the Conservative Portfolio is up 4.2%.

This compares to a 2.8% gain for Total Stock Market Index (VTSAX), a 16.3% return for Total International Stock Index (VTIAX), and a 2.4% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 7.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.5%.

IVA Research

Yesterday, in Life-Cycle Funds: Simple, Not One-Size-Fits-All, I shared my analysis of Vanguard’s Target Retirement and LifeStrategy funds with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.