Hello, and welcome to the IVA Weekly Brief for Wednesday, July 30.

There are no changes recommended for any of our Portfolios.

Scheduling note: I’m visiting family next week, so there won’t be an IVA Weekly Brief. But Premium Members will get an IVA Research piece exploring how the average Vanguard investor is positioned—and what returns they’ve actually earned.

And if any big Vanguard news breaks, I’ll be sure to share a Quick Take. Vacation or not, I’ve got your back.

You’ve got to hand it to the Trump Administration: After a rocky start, they’ve managed to implement significantly higher tariffs without triggering a sustained trade war, recession or bear market—yet.

Still, here are a few reasons (or unanswered questions) why it may be early for a victory lap:

- Will one-sided handshake agreements—like those with Japan and Europe—evolve into lasting, detailed trade deals? So far, all that analysts and economists have seen are headlines—no specifics.

- Talks continue with the one nation that retaliated—China—as well as with our neighbors, Mexico and Canada.

- Will companies keep footing the tariff bill, or start passing those costs on to consumers via higher prices?

- Can these tariffs withstand legal challenges? (Remember, one trade court already ruled the sweeping reciprocal tariffs were illegal. That decision has been appealed.)

As I’ve said, the tariff story is far from over. Nonetheless, the collective wisdom of the stock and bond markets says that as long as a tit-for-tat trade war doesn’t spiral out of control—which becomes less likely with each handshake—then rising U.S. tariffs (from around 2% to 15%–20%) are… fine (to use a technical term).

Case in point: The S&P 500 index (counting dividends) has made 19 record highs this year and is up 9.1%. The index has logged seven new highs in the past nine trading days alone. Meanwhile, the 10-year Treasury bond’s yield is holding around 4.34%—in line with its year-to-date average (4.41%). In other words, the bond market isn’t particularly stressed.

The market consensus isn’t infallible. But if you’re betting against it, say, sitting on the sidelines, ask yourself: What do you know that the millions of investors and traders don’t?

This is where investment discipline comes in. As trade dynamics shifted this year, I made a few adjustments to the IVA Portfolios—see here and here. But I never lost sight of the bigger picture. The Portfolios remained disciplined, diversified and, most importantly, invested.

Remember, time in the market, not market-timing, is an investment maxim we can all get behind.

Are Bonds the New Stocks?

Speaking of betting against the crowd, one of Vanguard’s top voices is rethinking the classic 60% stock/40% bond portfolio—big time!

In a recent interview with Fortune, Greg Davis—Vanguard’s president and chief investment officer—raised more than a few eyebrows with his portfolio recommendation for the next decade: “60% fixed income, 20% international equities, and—gulp—just 20% in U.S. stocks.”

That’s a sharp departure from the standard 60/40 portfolio. And an even split between U.S. and foreign stocks is even broader than Vanguard’s already hefty allocation to overseas markets in its LifeStrategy and Target Retirement funds.

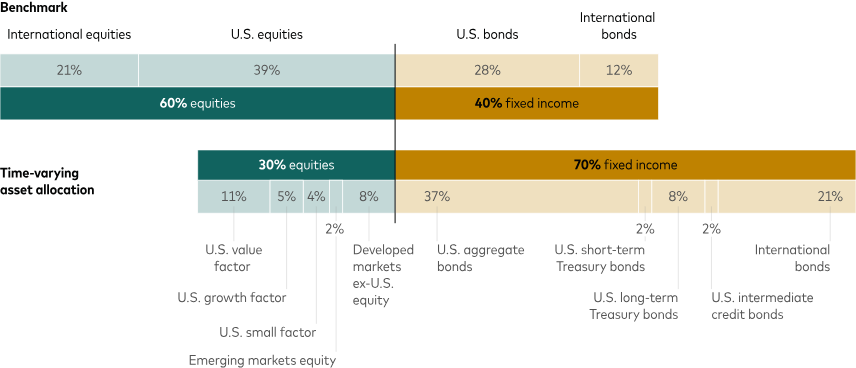

But Davis isn’t the only one sounding the conservative horn at Vanguard. The firm’s time-varying asset allocation (TVAA), essentially a computer-driven allocation model, goes even further—suggesting a 30/70 stock/bond mix. To be clear, as far as I can tell, the TVAA is only an academic exercise—none of Vanguard’s mutual funds follow it.

In short, Vanguard sees bonds matching stocks with less risk. If that’s your view, then yes, you should own bonds over stocks.

Before you head for the bunker, remember that Vanguard—and many other strategists—have been forecasting below-average U.S. stock returns for at least a decade.

For example, at the end of 2015, Vanguard projected global stocks would return 6% to 8% annually. But over the decade ending June 30, Total World Stock Index (VTWAX) delivered a 10% annual return. Oh, and Vanguard also expected U.S. stocks to lag foreign markets, but domestic stocks actually outperformed international shares by more than seven percentage points per year—12.5% to 5.1%!

So, maybe don’t overhaul your portfolio based on Vanguard’s forecasts.

Cash Corner: Some Yields Don’t Add Up

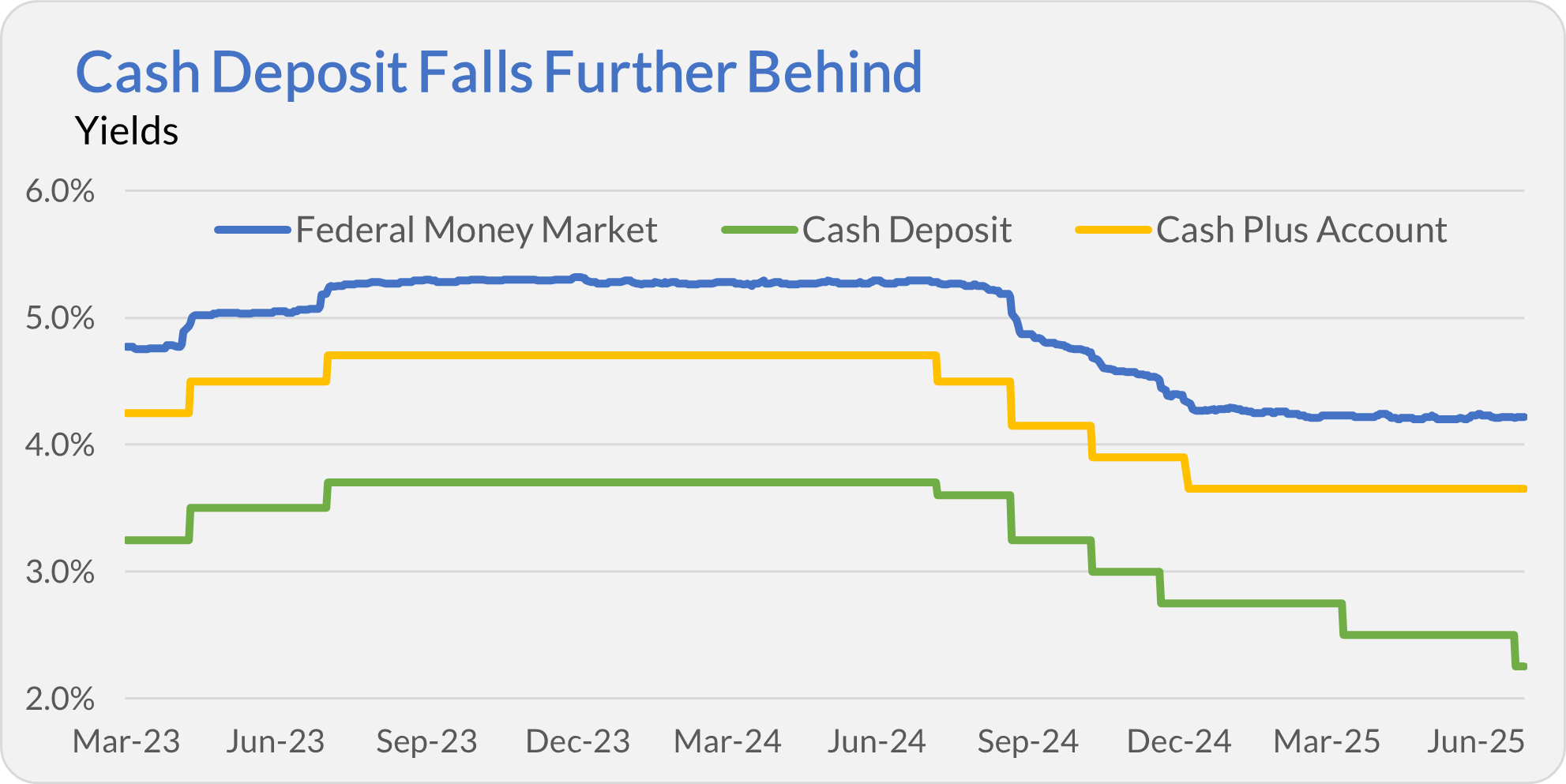

One of Vanguard’s newer cash options—Cash Deposit—just can’t seem to keep pace. On Thursday, its yield dropped from 2.50% to 2.25%, putting it well behind its in-house rivals.

Cash Deposit is available as a settlement fund in your Vanguard accounts. But with Federal Money Market (VMFXX) yielding 4.22%, it’s tough to justify using Cash Deposit. Why settle for 2% less?

I also compare Cash Deposit to Cash Plus Account, as both are bank sweep programs offering daily liquidity. Cash Deposit has always yielded less, but at least the two moved more or less in tandem. That pattern broke this year. Cash Deposit’s yield has dropped twice while Cash Plus has held steady, widening the gap with no clear explanation.

Premium Members can read a full breakdown of Vanguard’s cash options here. The bottom line is that it’s hard to beat Vanguard’s tried-and-true money markets.

Cash Corner: Manager Departure

Speaking of Vanguard’s cash options, John C. Lanius—who manages Federal Money Market, Money Market Annuity and the internal Market Liquidity Fund—will retire on September 24, 2025. The news comes as a surprise—Lanius is only in his mid-50s.

That said, Vanguard isn’t leaving anything to chance. Nafis Smith, who heads Vanguard’s taxable money market team and manages Treasury Money Market (VUSXX) and Cash Reserves Federal Money Market (VMRXX), will take over. This should be a smooth transition.

Our Portfolios

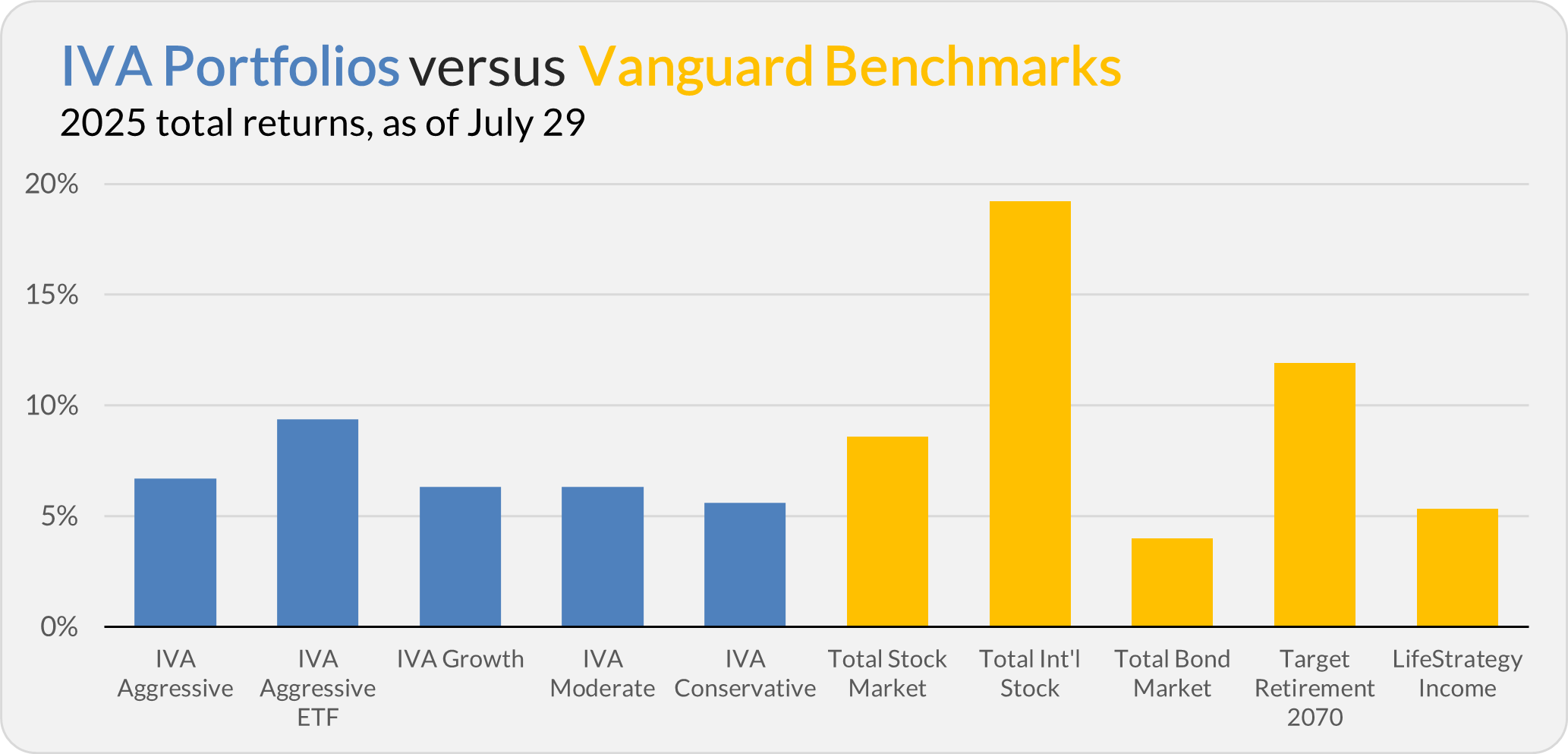

Our Portfolios are showing decent returns for the year through Tuesday. The Aggressive Portfolio is up 6.7%, the Aggressive ETF Portfolio is up 9.4%, the Growth and Moderate Portfolios are up 6.3% and the Conservative Portfolio is up 5.6%.

This compares to an 8.6% gain for Total Stock Market Index (VTSAX), a 19.2% return for Total International Stock Index (VTIAX), and a 4.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 11.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.3%.

IVA Research

Yesterday, I wrapped up a three-part series on sector investing at Vanguard.

- Part 1: I took a long-term investor’s view of Vanguard’s sector index funds (and ETFs).

- Part 2: I looked at the same lineup through a trader’s lens.

- Part 3: I analyzed Vanguard’s actively managed sector funds—Health Care (VGHCX) and Energy (VGENX).

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.