Hello, and welcome to the IVA Weekly Brief for Wednesday, April 30.

There are no changes recommended for any of our Portfolios.

Back to the Starting Line

Do you think you can predict the stock market?

Imagine it’s April 1 and you’re asked to predict where the stock market will be in one month. Tomorrow is “Liberation Day”—President Trump is set to reveal his sweeping new tariff plan.

You also have a crystal ball and, looking to April’s end, you see this tariff landscape: The U.S. is charging a flat 10% tariff on (virtually) all imports and is negotiating trade “deals” with dozens of countries, though none have been announced. Even steeper tariffs hang in the balance. Some exceptions have been granted. Other sector-specific levies are in the works. And relations with China are in flames as the nations are locked in a full-blown trade war with tariffs above 100% on both sides.

So, with all this insight, where do you think the stock market will go compared to the end of March? And the bond market?

Any economist or market strategist would tell you the stock and bond markets would be in ruins. Heck, a week ago, the media was banging out headlines that the Dow was heading for its worst April since the Depression.

Of course, seeing into the future isn’t all it’s cracked up to be.

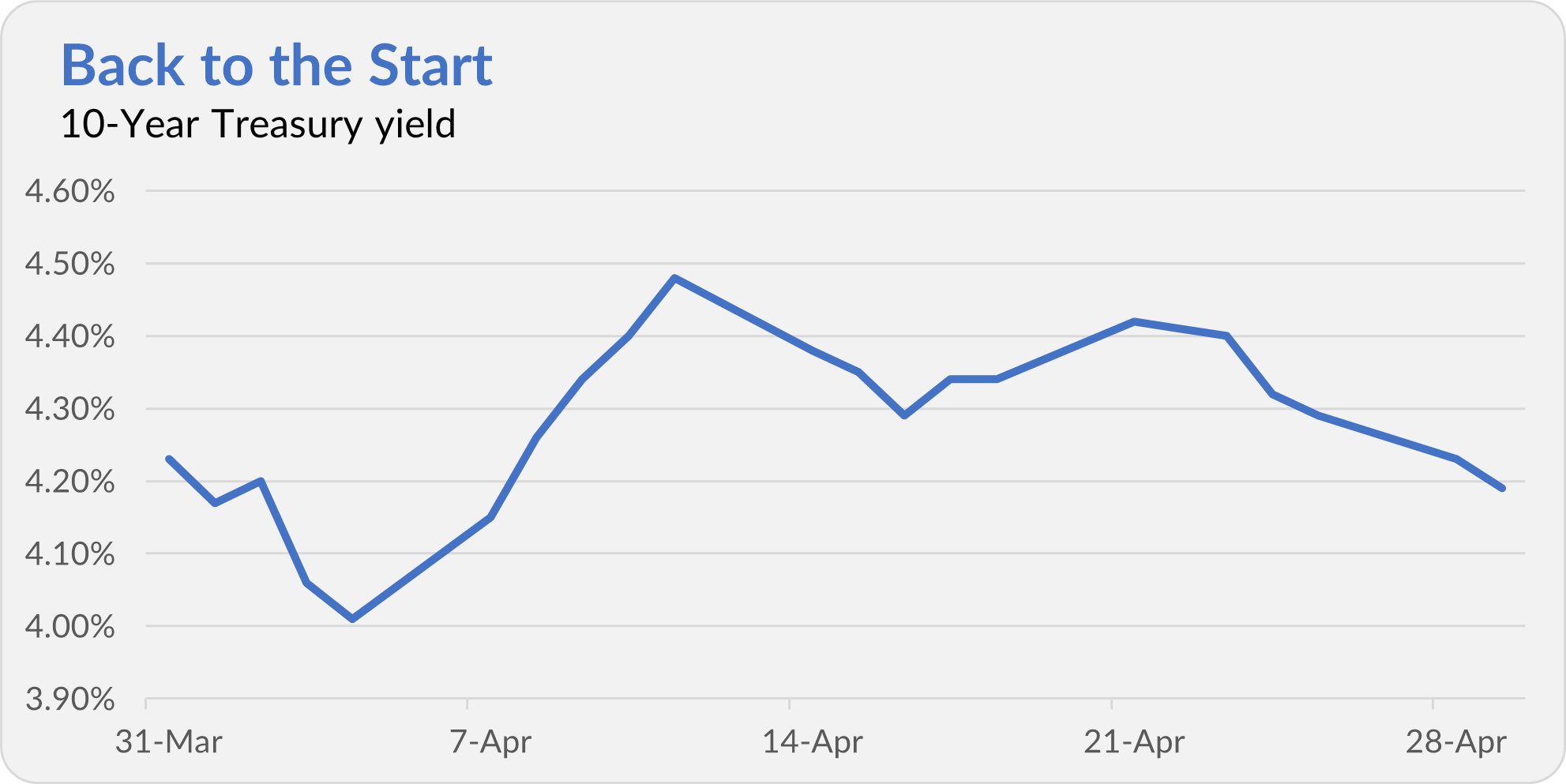

The S&P 500 index closed at 5,560.83 last night—just 0.9% below its March 31 level of 5,611.85. And the 10-year Treasury yield? At 4.19%, it’s only four basis points (or 0.04%) below where it stood on March 31 (4.23%).

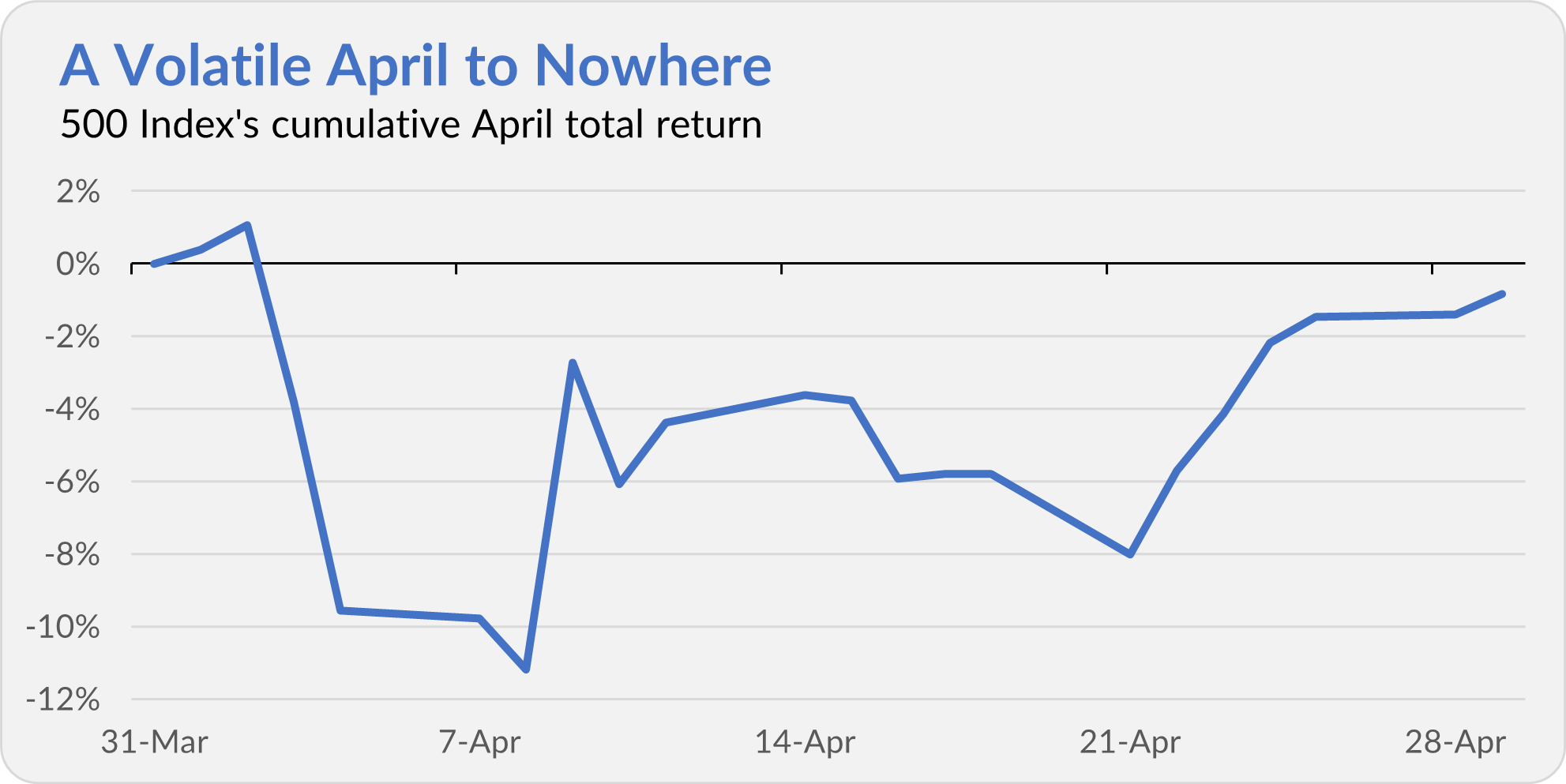

Of course, as the following charts show, those monthly numbers mask a lot of intra-month volatility. For example, 500 Index (VFIAX) fell 12.1% in four trading days following the initial tariff announcement. The flagship index fund then notched its third-best day ever, jumping 9.5% on April 9 as so-called “reciprocal” tariffs were paused for 90 days.

Treasury bonds initially rallied (bond prices rose and yields fell) following the tariff news. However, prices then fell and yields rose as traders began to second-guess the Treasury bonds’ safe-haven status. The yield on the 10-year Treasury returned to its starting level in the final weeks of April.

One lesson from all of this is that second-guessing the markets is challenging.

Another lesson is to avoid getting caught up in the daily noise masquerading as financial news. Said another way, if you’re a long-term investor, checking your portfolio’s value every day or week can be counterproductive.

That said, if you lost sleep over your portfolio as stocks tumbled in the first week of April, well, you have an opportunity to reposition your portfolio as if it were April 1 and the tariff news hadn’t broken.

Okay. That’s a slight exaggeration, as not everything in the markets is precisely where it was a month ago. For example, Energy ETF (VDE) is down 11.3% in April and Value Index (VVIAX) is off 3.8%.

But you get the point: Broadly speaking, the markets have reset while we sit in tariff purgatory—waiting to see what comes next, if any trade deals are struck, if those “reciprocal” tariffs go into effect, if the economy trips over the tariff hurdles already put in place.

If you’ve got a prediction for where the markets go next, write it down. And wait. Let’s see how close you come to reality.

Zero fees?

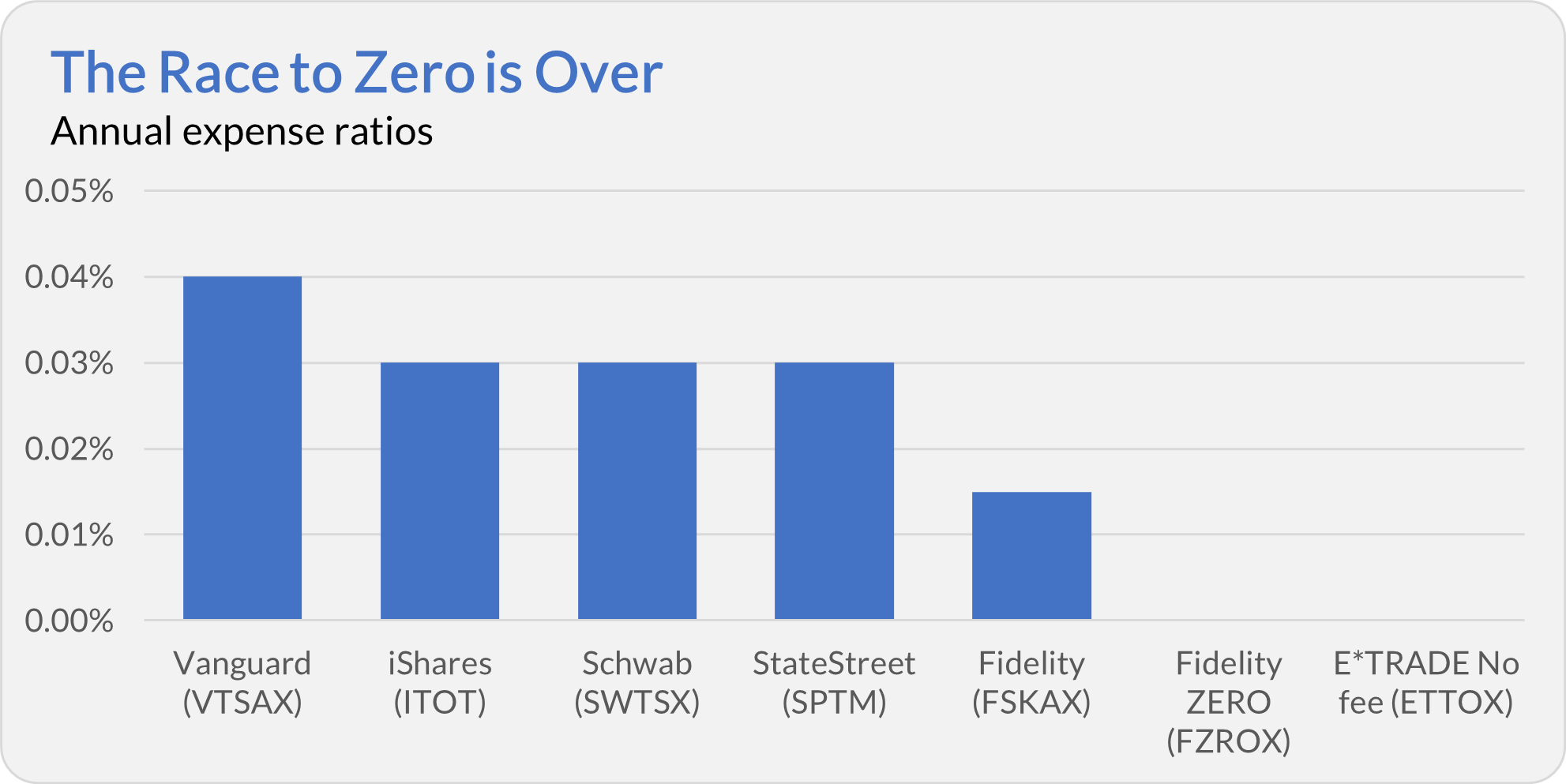

E*TRADE has joined Fidelity in offering “no-fee” index funds. Cue the confetti … or not.

You must have an account at either platform to buy these zero-expense-ratio index funds. You can’t, for example, buy a Fidelity ZERO index fund in your Vanguard account—you need an account at Fidelity. The same goes for E*TRADE’s new no-fee index funds.

No-fee funds sound enticing, but they haven’t reshaped the investment landscape. Take Fidelity’s ZERO Total Market Index fund (FZROX), for instance. Launched in 2018, it has gathered about $25 billion in assets. Not bad, but hardly a game-changer.

For context, Total Stock Market Index’s assets clock in at over $1.5 trillion. However, that’s counting all share classes—investor, ETF and institutional. Even if we narrow it down, the Admiral share class (VTSAX) alone holds over $380 billion—more than 15 times the size of the Fidelity ZERO fund.

Why haven’t zero-fee funds taken off and taken over? Because index fund costs were already near rock-bottom (thanks to Vanguard) before “zero” came along.

Consider that the total market index funds (and ETFs) from Vanguard, iShares, Schwab, StateStreet (SPDR), and Fidelity (which has zero-fee and non-zero-fee index funds) charge between 0.015% and 0.04% in expenses. Vanguard is the most expensive among this lot!

If you’re an index investor with an account at Fidelity or E*TRADE, sure, why not use the zero-expense-ratio index funds? But you’re not going to move your account to Fidelity or E*TRADE to save a few pennies a year. You also aren’t switching funds if there's a tax cost to the trade.

The bottom line: The race to zero has been run, and investors have Jack Bogle and Vanguard to thank.

Our Portfolios

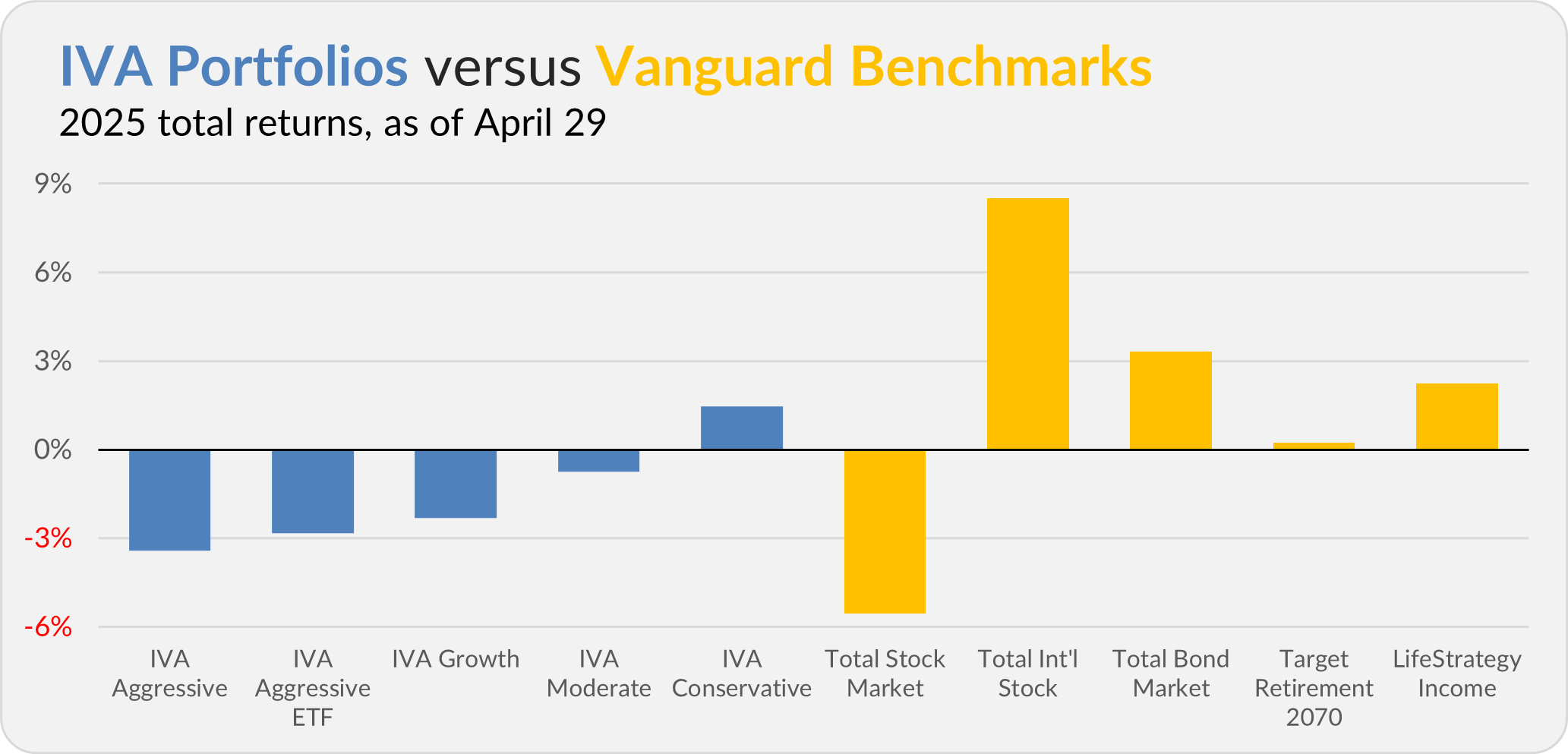

Our Portfolios are showing mixed returns for the year through Tuesday. The Aggressive Portfolio is down 3.4%, the Aggressive ETF Portfolio is off 2.8%, the Growth Portfolio is down 2.3%, the Moderate Portfolio is down 0.8% and the Conservative Portfolio is up 1.5%.

This compares to a 5.5% decline for Total Stock Market Index (VTSAX), an 8.5% gain for Total International Stock Index (VTIAX), and a 3.3% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 0.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.2%.

IVA Research

Yesterday, I launched a three-part series on tax-efficient investing and after-tax returns—see here. I’ll keep providing timely market updates, but no matter how noisy things get, focusing on what you can control (like taxes) is key to long-term investing success.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.