Hello, and welcome to the IVA Weekly Brief for Wednesday, December 31.

There are no changes recommended for any of our Portfolios.

Bessent Barometer

With the government shutdown behind us, official economic data is once again flowing. And the latest readings paint a familiar but mixed and confusing picture.

In December, we learned that:

- The unemployment rate rose from 4.4% in September to 4.6% in November

- The inflation rate eased from 3.0% to 2.7% over the same period

- Gross Domestic Product (GDP) grew 1.1% in the third quarter (a 4.3% annual pace)

In short, the labor market is softening, inflation remains above policymakers’ comfort zone, and economic growth continues.

But to get a more complete view of where the economy stands as we head into the new year, I want to revisit what I’ll call the “Bessent Barometer.”

On May 4, Treasury Secretary Scott Bessent laid out an expansive and decidedly optimistic economic forecast in The Wall Street Journal. As he put it:

The American people should expect to hear the [economy’s] engine humming during the second half of 2025. With all pistons moving, we’ll see more jobs, more manufacturing, more growth, a more robust national defense, higher wages, lower taxes, less-burdensome regulation, cheaper energy, less national debt and less dependence on China—all while maintaining a strong dollar.

When Bessent made that call, I took a snapshot of the indicators behind his list of “mores” and “lesses.” The table below compares where those metrics stood in early May with the most recent data available as of Friday, December 26.

Not every promise lends itself to a clean data series. National defense and regulatory burden, for example, are difficult to measure consistently, so I’ve set those aside. But for the rest, there are trackable numbers—and I’ve done my best to hold the forecast accountable.

Here’s what the data say so far:

- More growth? Yes. GDP growth has accelerated.

- Higher wages? Yes. Salaries are up.

- Less dependence on China? Also, yes.

But the scorecard isn’t all green.

Manufacturing activity is down. Energy prices are essentially flat. The national debt is higher, not lower. And while total employment has increased, the unemployment rate has risen as well—making the “more jobs” claim a mixed bag at best. The dollar, meanwhile, has fallen since the start of the year.

Given how sweeping Bessent’s forecast was, it’s no surprise that some calls landed and others missed.

I’ll give him credit for this: His bullish outlook came at a time when many economists were warning that tariffs could tip the economy into recession. And yes, the economy has proven more resilient than many expected.

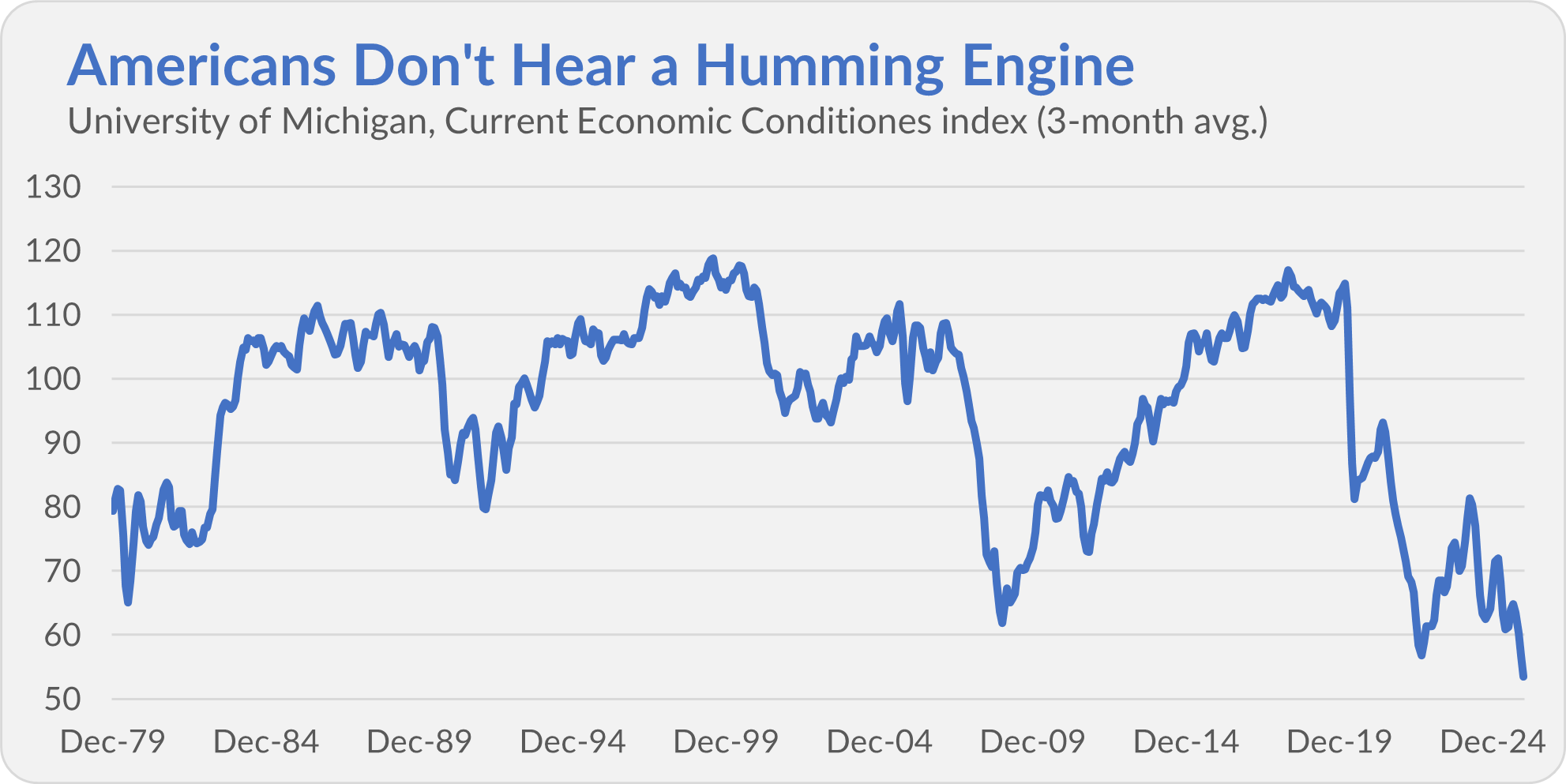

That said, even if the engine is technically “humming,” I’m not convinced most Americans hear it.

According to the University of Michigan’s consumer survey, sentiment around current economic conditions remains deeply pessimistic. For many households, the economy doesn’t feel like it’s working.

The bottom line? The economy hasn’t been perfect—but it has shown resilience and enters 2026 with positive momentum.

All of that said, the economy isn’t the stock market.

So, let’s turn our attention there.

Gains For All

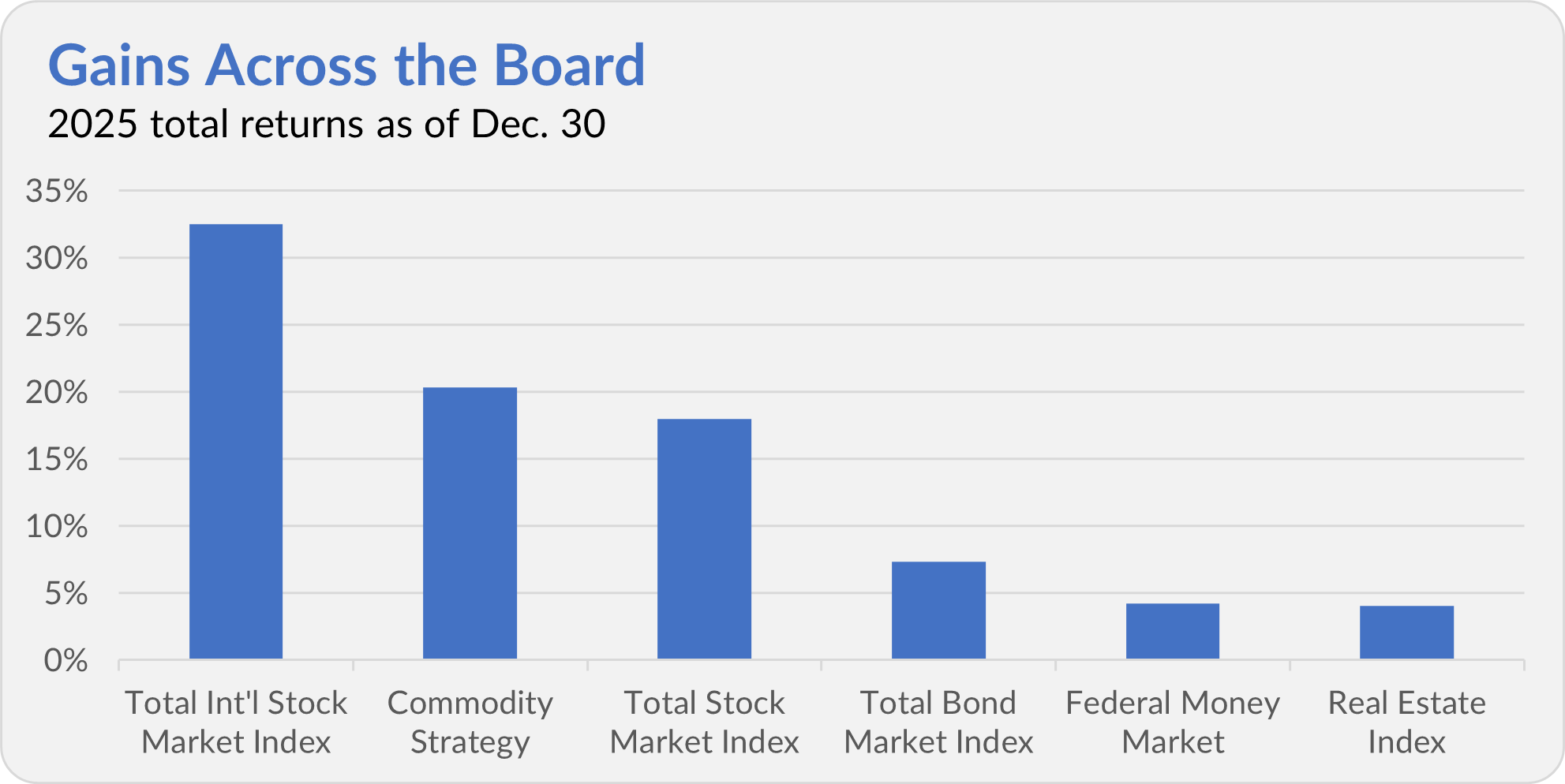

I’ll share my full 2025 market review with Premium Members on Friday. But the short version is this: It’s been another profitable year for disciplined investors who stayed invested despite all the noise, of which there was quite a lot.

Every major asset class—stocks, bonds, real estate and cash—gained in 2025. In fact, as we head into the year’s final trading day, every Vanguard fund is showing a positive return. That’s a rare outcome—and a welcome one.

Of course, it didn’t always feel so calm.

In March and April, the President’s sweeping tariff announcement sent traders scrambling. At its low point, 500 Index (VFIAX) came within a hair of bear-market territory—a decline of 20% or more—before the now-familiar AI narrative helped propel the flagship index to fresh highs.

With a gain of 18.7% so far this year, 500 Index may end 2025 with its third consecutive year of 20%-plus returns.

As I explained a few weeks ago, it’s been an exceptionally strong three-year run for U.S. stocks. I don’t expect above-average returns to persist indefinitely. But that doesn’t mean investors should shy away from the market—or try to outsmart it.

I shared my full thoughts on the year ahead with Premium Members yesterday (see here). The bottom line: Patience, diversification and discipline once again did the heavy lifting in 2025—and those principles matter just as much heading into the next chapter.

Another 403(b) Fee Increase

Repeat after me: Fees don’t only go down at Vanguard.

For the second time in just 12 months, Vanguard is hiking the flat, per-participant recordkeeping fee on its 403(b) accounts—this time by another $20.

The first increase, from $60 to $80, took effect on April 1, 2025. Now, according to an email an IVA reader shared with me, Vanguard will raise that fee again—from $80 to $100—effective February 2, 2026.

That’s a 67% increase in recordkeeping fees in less than a year.

Vanguard says the latest increase is needed to “maintain the service levels you deserve” while it “ramp[s] up delivery of digital enhancements that are being developed based on direct feedback from retirement plan investors like you.”

In short, the higher fees today are meant to pay for better technology and service tomorrow. But let’s put the $40 jump in fee in context. The table below shows what it means as a percentage of assets for different account sizes.

Flat fees always hit smaller investors hardest. If you’re just starting out—or struggling to save at all—this increase isn’t trivial. It’s a meaningful drag on returns.

And it highlights a familiar tension at Vanguard: Delivering service that meets expectations while still living up to its low-cost reputation.

Another ex-Fidelity Hire

Around this time last year, Vanguard hired Joanna Rotenberg from Fidelity to lead its Advice and Wealth Management division. We haven’t heard much from Rotenberg since, though I suspect we will next year.

Now, Vanguard has added another former Fidelity employee to its leadership ranks. Kathryn Condon has joined the firm as global chief marketing officer.

Condon’s arrival is the latest sign of Vanguard’s growing willingness to look outside its own walls when filling senior roles. CEO Salim Ramji, of course, is the clearest example of that shift and may be the catalyst for this executive refresh.

Hiring outsiders can inject fresh thinking and help push an organization forward—or in a new direction. The challenge for Vanguard is a familiar one: Embracing change without losing the culture and investor-first ethos that made the firm what it is.

Our Portfolios

Our Portfolios are showing double-digit returns for the year through Tuesday. The Aggressive Portfolio is up 16.3%, the Aggressive ETF Portfolio is up 17.8%, the Growth Portfolio is up 15.2%, the Moderate Portfolio is up 15.3% and the Conservative Portfolio is up 11.0%.

This compares to an 18.0% gain for Total Stock Market Index (VTSAX), a 32.5% return for Total International Stock Index (VTIAX), and a 7.4% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 22.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 9.7%.

IVA Research

Since my last Weekly Brief, I shared three articles:

- A Quick Take on the PRIMECAP Odyssey’s exposure to artificial intelligence.

- An update on the Hot Hands strategy.

- My 2026 Outlook: Investing Beyond the AI Hype.

Premium Members can also expect to receive four articles—a Hot Hands trade alert, a month-by-month review of the year, a complete 2025 market review and the regular monthly recap—from me on Friday.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Appendix. Data sources for the Bessent Barometer table:

Civilian workforce, total employed: Civilian Labor Force Level (CLF16OV) | FRED | St. Louis Fed

Unemployment rate: Unemployment Rate (UNRATE) | FRED | St. Louis Fed

ISM Manufacturing PMI: US ISM Manufacturing PMI Monthly Trends: ISM Manufacturing Report On Business | YCharts

Industrial Production Manufacturing Index: Industrial Production: Manufacturing (SIC) (IPMANSICS) | FRED | St. Louis Fed

Manufacturers’ New Orders: Manufacturers' New Orders: Durable Goods (DGORDER) | FRED | St. Louis Fed

Real GDP: Real Gross Domestic Product (GDPC1) | FRED | St. Louis Fed

Average hourly earnings: Average Hourly Earnings of All Employees, Total Private (CES0500000003) | FRED | St. Louis Fed

Wages and salaries: Compensation of Employees, Received: Wage and Salary Disbursements (A576RC1) | FRED | St. Louis Fed

WTI crude oil: CL1 - Koyfin

National debt: Understanding the National Debt | U.S. Treasury Fiscal Data

Total debt as % of GDP: Federal Debt: Total Public Debt as Percent of Gross Domestic Product (GFDEGDQ188S) | FRED | St. Louis Fed

U.S. Imports of Goods From China: U.S. Imports of Goods by Customs Basis from China (IMPCH) | FRED | St. Louis Fed

ICE US Dollar index: ICE US Dollar Index Performance & Stats

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.