Hello, and welcome to the IVA Weekly Brief for Wednesday, September 3.

There are no changes recommended for any of our Portfolios.

August was a profitable month across the board—stocks, bonds, cash, commodities and real estate all gained ground. Heck, only three of Vanguard’s funds finished in the red—Utilities ETF (VPU), MidCap Growth Index (VMGMX) and Extended Duration Treasury ETF (EDV). Not a bad showing.

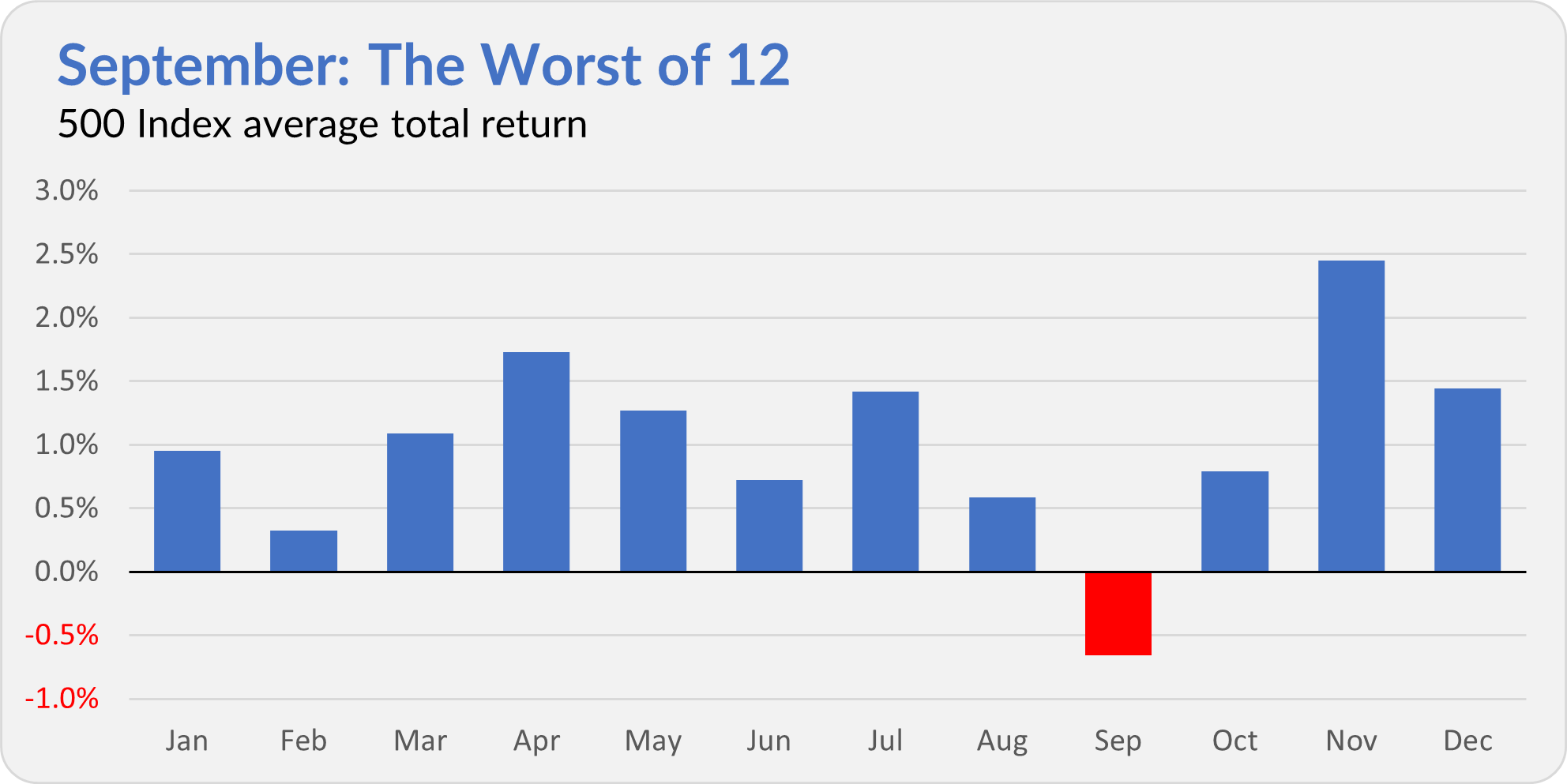

But history tells us not to get too comfortable. While October gets the bad press thanks to 1987 and 2008, September has delivered the weakest returns on average.

Over the past 49 Septembers, 500 Index (VFIAX) has averaged a 0.7% loss. The flagship index fund gained ground 25 times—basically a coin flip.

To be clear, this is trivia, not strategy. I would never recommend adjusting your portfolio based on a calendar quirk. Still, with September off to a poor start (500 Index fell 0.7% yesterday) and the media hungry for drama, be wary of bold claims to avoid the market in September.

Another Own Goal

As I told Premium Members in yesterday’s Monthly Recap, Vanguard was hit with a $19.5 million civil penalty by the SEC. The reason? Vanguard failed to disclose that its advisors had a financial incentive to enroll clients into its Personal Advisor Services (PAS) program.

That $19.5 million will go into a “Fair Fund.” If you enrolled in PAS between August 2020 and December 2023, you’ll get a slice of the proceeds—your payout will be based on the advisory fees you paid during that period. (You can read the official order here.)

Bigger picture: This is an own goal—and more than a little ironic. Vanguard built its reputation railing against hidden fees and conflicts of interest.

Now, Vanguard’s reputation as the investors’ champion is largely intact, but that goodwill isn’t limitless. My prescription for Salim Ramji and co.? Transparency. A dose of candor would go a long way toward shoring up Vanguard’s brand and protecting its most valuable asset—trust.

The Rules Are Still Being Written

At month’s end, an appeals court weighed in on tariffs—and the administration didn’t like the verdict. The court upheld an earlier ruling from the Court of International Trade, finding that most of this year’s tariffs were an overreach and therefore illegal.

In short, the universal 10% tariff and the so-called “reciprocal” tariffs have been struck down—at least for now. But they won’t vanish overnight. They’ll stay in place until October while the case almost certainly makes its way to the Supreme Court.

I’ll leave the fine points of trade law to the scholars, but here’s what matters for investors: The rules of trade are (still) being rewritten. That creates uncertainty, but two things are clear to me:

First, tariffs aren’t going back to 2024’s 2.4% rate anytime soon. For the next few years, they’ll be higher—probably the highest since the 1970s.

Second, contrary to the President’s claims, this ruling will not “literally destroy” America.

What’s an investor to do?

The rules of trade may be in flux, yet the rules of investing haven’t changed: Stay patient, stay diversified and spend time in the market.

Our Portfolios

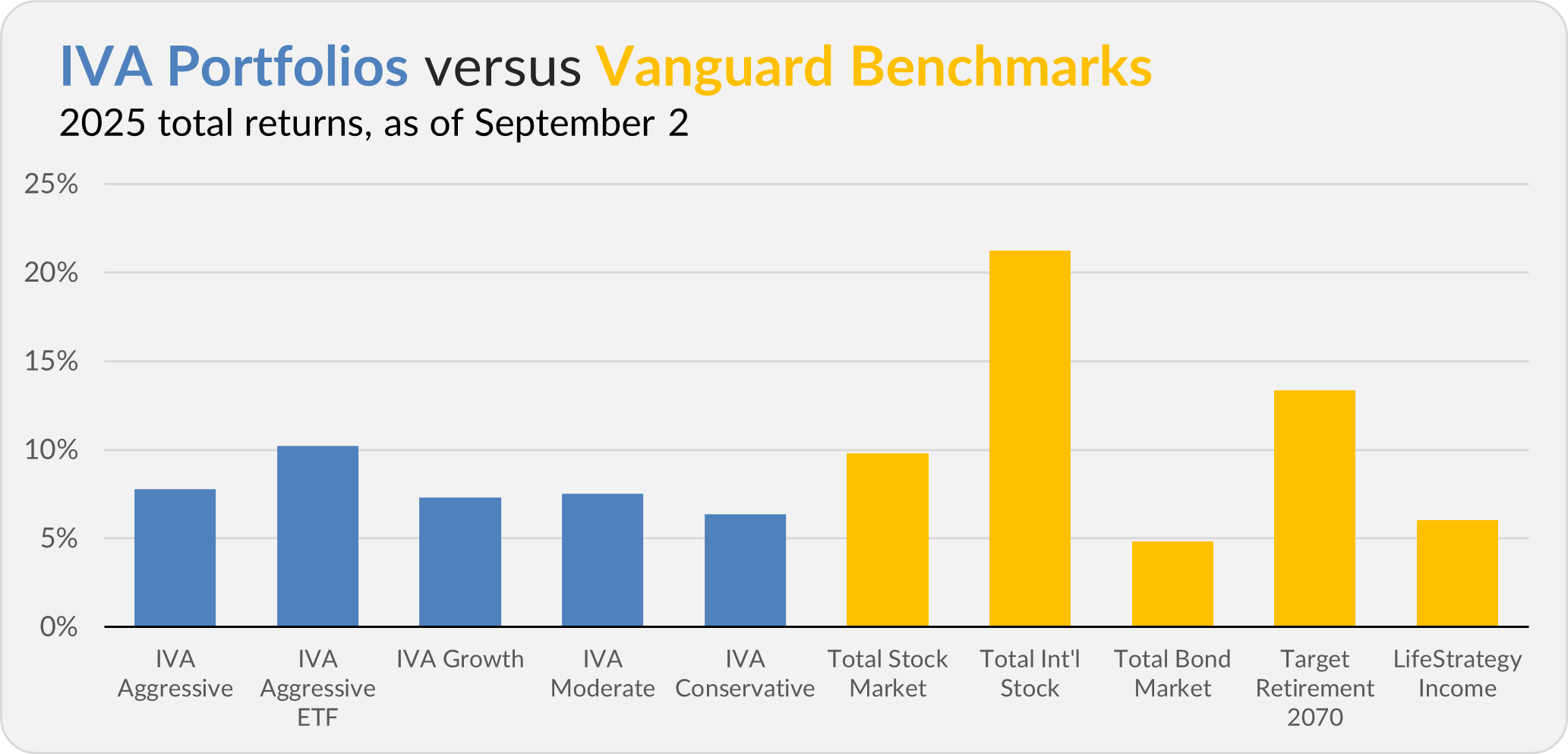

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 7.8%, the Aggressive ETF Portfolio is up 10.2%, the Growth Portfolio is up 7.3%, the Moderate Portfolio is up 7.5% and the Conservative Portfolio is up 6.4%.

This compares to a 9.8% gain for Total Stock Market Index (VTSAX), a 21.3% return for Total International Stock Index (VTIAX), and a 4.8% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 13.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 6.0%.

IVA Research

In yesterday’s Monthly Recap, I shared a deeper analysis of the Portfolios and reviewed last year’s trade with Premium Members.

Tomorrow, Premium Members will receive a piece analyzing Vanguard’s foreign stock index fund lineup.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.