Hello, and welcome to the IVA Weekly Brief for Wednesday, January 28.

There are no changes recommended for any of our Portfolios.

Gold crossed above $5,000 per ounce for the first time. Since the end of 2024, gold is up 97.0%, while 500 Index (VFIAX) has gained 20.2%. Foreign stocks, as measured by Total International Stock Index (VTIAX), are up 41.9% over that stretch.

Those are solid returns from stocks worldwide. For context, 500 Index has returned 14.1% on average over rolling 13-month periods since its 1976 inception. And, as of Tuesday’s close, both the U.S. and international stock index funds are at record highs.

These gains reflect a simple reality: Economies worldwide have continued to grow, companies are earning more than they were a year ago and investors expect profits to rise further in the year ahead.

Gold’s rally, however, reflects a different dynamic.

Historically, gold tends to perform best when uncertainty rises—and there has been no shortage of that lately, both globally and at home.

Yes, last week President Trump backed away from his tariff-fueled pressure campaign to seize Greenland, opting instead for a framework deal (details still to be determined). That’s a relief in the short run.

But this was just one episode in a long-running tale. With the President now leveling new tariff threats at Canada and South Korea, well, America’s allies are already adjusting to a United States they increasingly view as an unreliable partner. Over time, that likely means less trade with—and less investment in—the U.S. than would otherwise have occurred.

Uncertainty isn’t confined to foreign policy. At home, recent events in Minneapolis underscore a broader point: Markets (and traders) don’t operate in a vacuum. Confidence—in institutions, rules and processes—matters.

The U.S. economy has long benefited from a stable legal and institutional framework that has supported innovation, investment and long-term growth. That foundation is a key reason U.S. stocks have been among the best-performing assets in the world over the past century.

From an investment perspective, this isn’t about taking sides. It’s about recognizing that uncertainty—whatever its source—can influence investor behavior and asset prices.

When uncertainty rises, some investors look for a port in the storm. Historically, U.S. Treasurys have filled that role. But when the U.S. itself is perceived as part of the storm—and when investors like Ray Dalio, the founder of Bridgewater Associates (a giant hedge fund), are warning that the U.S. is a tinderbox and on the brink of a civil war or revolution—well, it’s not surprising that investors have turned to the original safe-haven: gold.

As I’ve said repeatedly, when uncertainty rises, my response is to lean into diversification. My goal is to hold a resilient portfolio—one still centered on owning productive assets like stocks, not shiny metals.

From time to time, the price of gold will boom. But it can also go bust. Timing gold’s ups and downs isn’t my edge. And when it comes to the long-term record, the race isn’t even close.

Over the past five decades:

- 500 Index has returned 23,357% (11.7% per year), including dividends.

- Gold’s price has increased 4,949% (8.3% per year).

Call me an optimist, but I’ll keep spending time in the market as long as the long-term forces supporting economic growth, innovation and productivity remain intact—that “We the People of the United States” are working toward living in a “more perfect Union.”

Our Portfolios

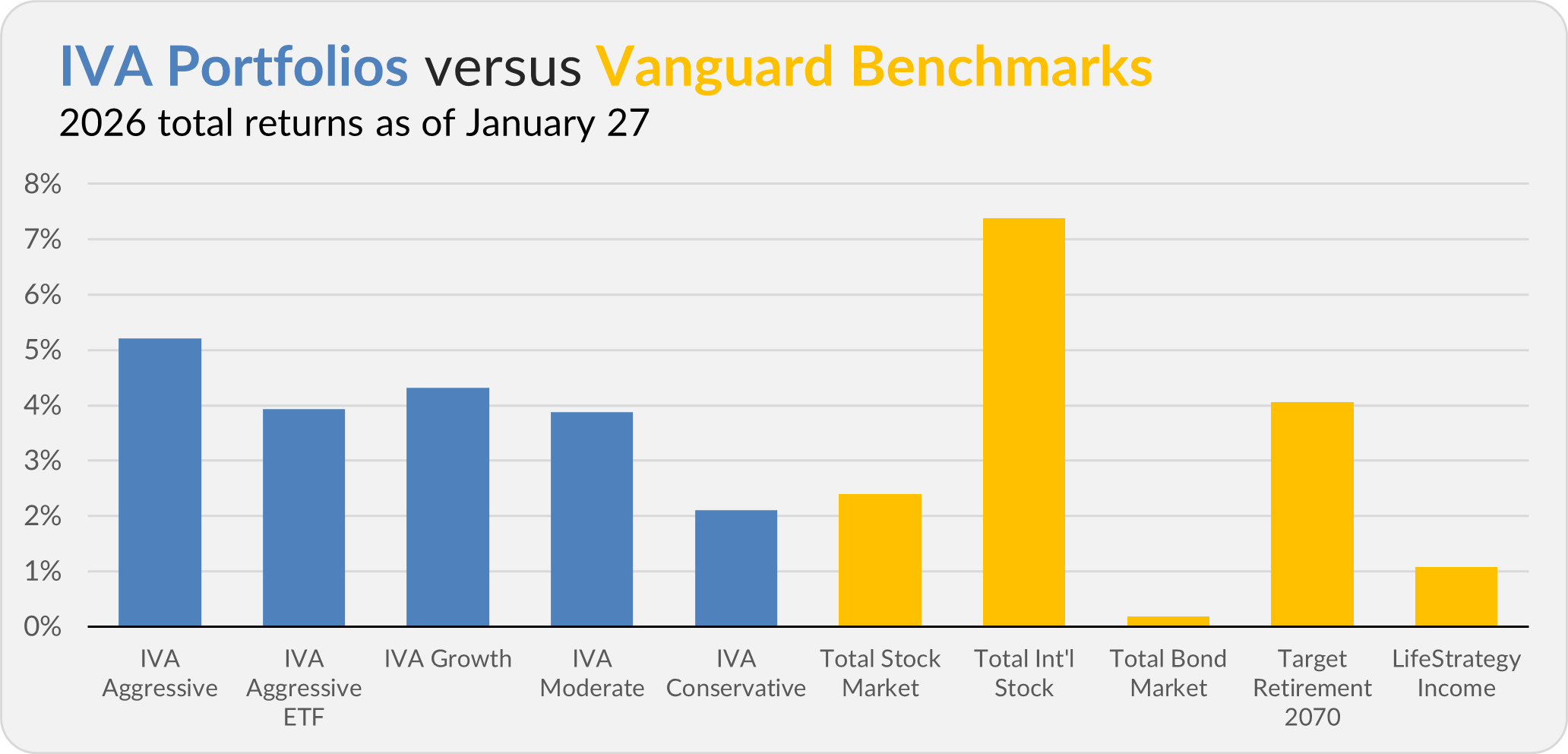

Our Portfolios are showing solid returns for the year through Tuesday. The Aggressive Portfolio is up 5.2%, the Aggressive ETF Portfolio is up 3.9%, the Growth Portfolio is up 4.3%, the Moderate Portfolio is up 3.9% and the Conservative Portfolio is up 2.1%

This compares to a 2.4% return for Total Stock Market Index (VTSAX), a 7.4% gain for Total International Stock Index (VTIAX), and a 0.2% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 4.1% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.1%

IVA Research

Yesterday, Premium Members received a deep dive into Vanguard’s Growth & Income index funds. Next week, I’ll turn the spotlight on the firm’s actively managed options.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.