Hello, and welcome to the IVA Weekly Brief for Wednesday, January 14.

There are no changes recommended for any of our Portfolios.

I warned you last week that the noise out of Washington wasn’t going away. If anything, it got louder.

This week, the President’s proposals aimed at “lowering costs” dominated the headlines. They included:

- Banning institutional investors (think private equity firms) from buying single-family homes

- Directing Fannie Mae and Freddie Mac to buy $200 billion of mortgage-backed bonds

- Capping credit card interest rates at 10%

- Questioning stock buybacks

- Controlling the Venezuelan oil industry

On top of that, President Trump took aim—via social media—at big tech companies over data centers and electricity costs.

Aside from the directive involving Fannie Mae and Freddie Mac, most of these ideas are just that: proposals. Whether they become policy is an open question.

But arguably the most consequential development was something the President said he didn’t know about: The Department of Justice subpoenaed the Federal Reserve and threatened criminal charges. Fed Chair Jerome Powell pushed back in a video statement, framing the investigation as an attempt to pressure the Fed into lower interest rates.

That’s the news. What does this mean for us as investors?

First, and it bears repeating: The noise is going to be loud this year. Don’t let it knock you off a sound, long-term investment plan.

Case in point—despite the headlines, stocks of all sizes hit record highs on Tuesday. In the U.S., the S&P 500, S&P Mid Cap 400 and S&P Small Cap 600 indexes all set new marks. So did local stock markets in the U.K., Germany, Japan, Korea and Mexico.

Second, politicizing the Fed is not a great idea—to use a technical term. It may result in lower interest rates in the short run, but history suggests the bill may come due later in the form of higher inflation and higher interest rates.

That helps explain why the yield on the 10-Year Treasury is higher today (4.18%) than it was when Fed policymakers first cut interest rates on September 17 (4.06%).

Remember: The Federal Reserve only “controls” short-term interest rates. Longer-term interest rates are set by the market and are driven by growth and inflation expectations. And right now, investors and traders are worried that lower interest rates today will lead to even higher interest rates tomorrow.

Notably, the yield on the 10-year Treasury has barely moved since news of the subpoena broke. That tells me that traders were already pricing in some degree of political pressure on the Fed.

Here's the bottom line: As I’ve been saying for a year, the President and his administration are charting a markedly different course than their predecessors. That creates uncertainty—and a wider range of possible outcomes.

Rather than betting on any single scenario, I want to own a diversified, resilient portfolio that can navigate whatever comes our way.

With that, let’s turn to the news out of Vanguard.

Leadership Musical Chairs

One year ago, Vanguard spun out its Advice & Wealth Management business from the broader Personal Investor division and tapped Fidelity veteran Joanna Rotenberg to lead the new unit. Now, Matt Benchner—who led the Personal Investor division for the past five years—has exited the firm, and Rotenberg is overseeing both divisions.

That’s a bit of a head-scratcher. Why go through the disruption of separating the businesses, only to bring them under the same director a year later?

I can speculate all day long about the motivations for the change, but the real question—what does this mean for investors?—is equally hard to pin down. We’ve heard very little from Rotenberg in her first year running the Advice & Wealth division. (I expect that to change in 2026.) At the very least, this tells us that Rotenberg isn’t going to upend the apple cart on day one.

Still, she must be doing something right behind the scenes if Vanguard is expanding her remit.

While the leadership shuffle raises questions, it’s far from the only change at Vanguard investors should be paying attention to. Here are three Vanguard developments that Premium Members have already seen—but are worth revisiting:

The Split is Complete

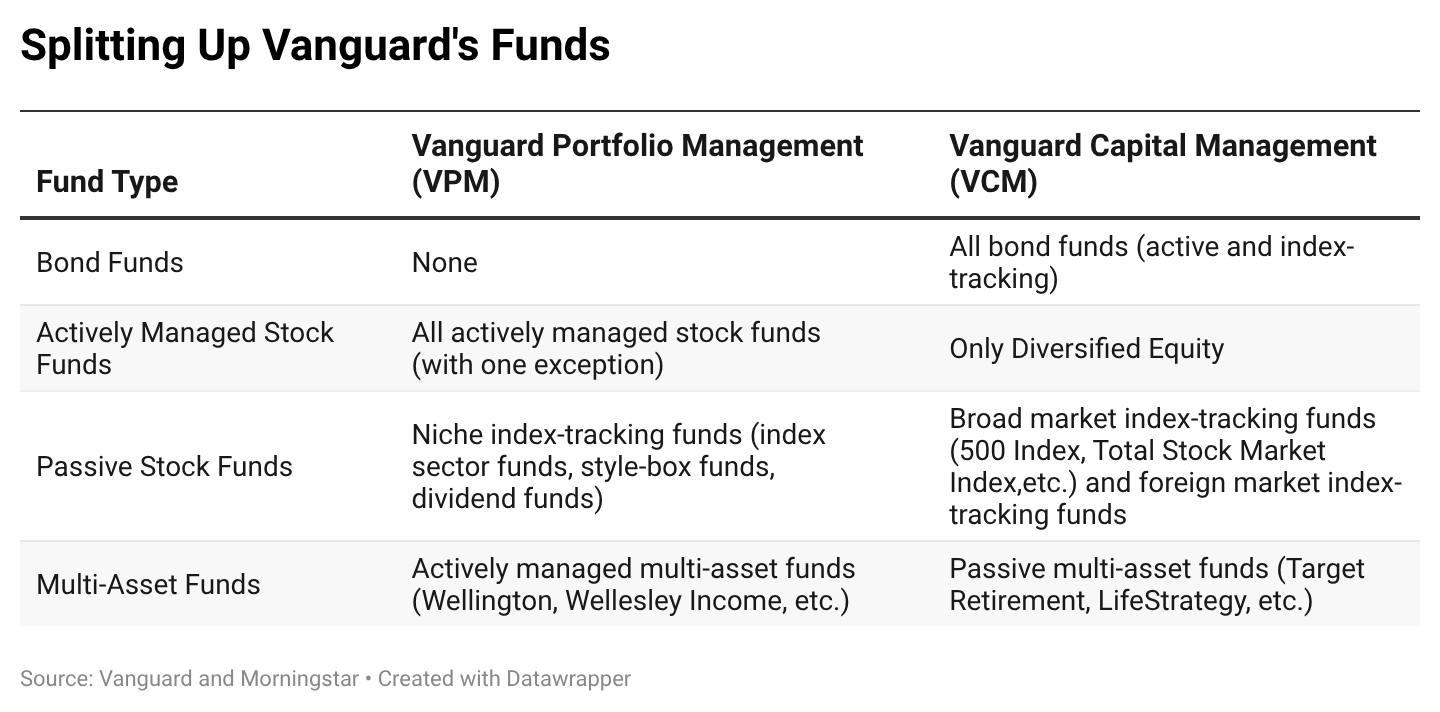

It’s official: On Monday, Vanguard completed its internal reorganization, splitting its investment operations into two units—Vanguard Capital Management (VCM) and Vanguard Portfolio Management (VPM).

Given Vanguard first unveiled this shift in June (see here and here), here’s a quick refresher on the new structure:

- Vanguard Portfolio Management oversees actively managed funds and niche stock index funds.

- Vanguard Capital Management runs the bond funds, broad index funds and index-based balanced funds—including the Target Retirement and LifeStrategy funds.

The table below summarizes how the funds are now divided between the two units.

To be clear, the reorganization does not change how Vanguard’s bond funds or its actively managed stock and balanced funds are run. What is new is the creation of two separate stock index teams inside Vanguard.

These teams now operate independently, even working out of different buildings.

The key question is whether Vanguard can maintain two world-class stock indexing teams without letting costs rise or performance slip.

If any firm can pull this off, it’s Vanguard. But make no mistake: This is a meaningful operational challenge, not a box-checking exercise.

The bottom line for fund shareholders is simple: Stay the course. This isn't a reason to panic or jump ship. But it is worth watching closely—and I will.

Vanguard’s First Promotional Cash Yield

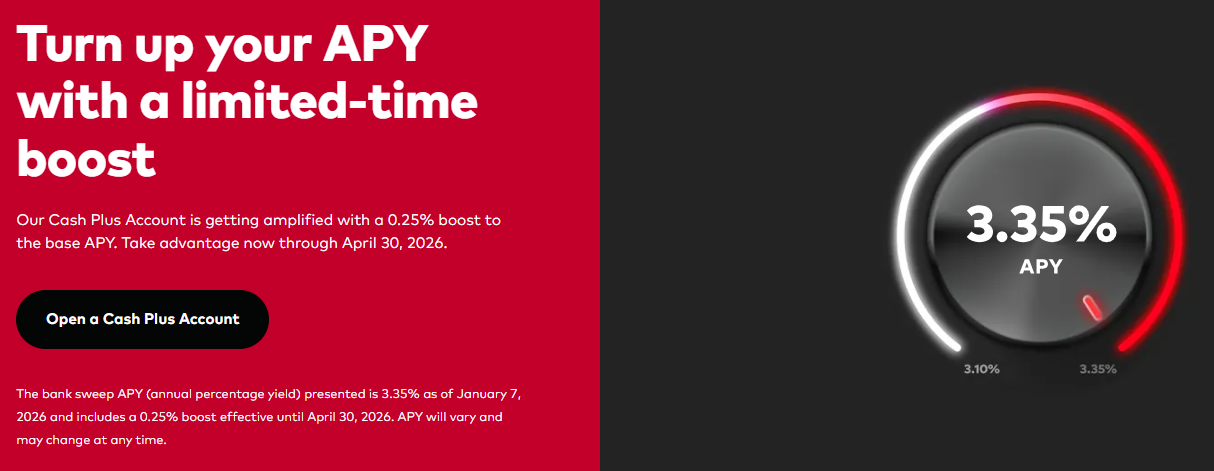

Last week, Vanguard introduced a “limited-time boost” to Cash Plus Account’s yield. Instead of earning 3.10%, Cash Plus now pays 3.35%—an extra 0.25%—through April 30, 2026.

The 3.35% yield itself isn’t the “news.” It’s still below Federal Money Market’s (VMFXX) 3.64% yield, and it does nothing to address Cash Plus’s other shortcomings—like the lack of an ATM card.

The real news is that Vanguard is offering a teaser rate at all. That’s something it simply hasn’t done before.

This move underscores just how competitive the cash-account landscape has become. More importantly, it signals a meaningful shift in Vanguard’s posture. For years, the firm has relied on its reputation and inertia rather than promotional tactics. This rate bump—temporary as it may be—suggests a newfound willingness to play offense.

The yield boost will expire. The strategic shift behind it likely won’t.

New Year, Same Issues

Finally, Vanguard’s technology and service woes followed the firm straight into 2026.

On December 31, 2025, many Vanguard clients—myself included—received an “outdated tax planning email” welcoming us to… 2021. Yes. 2021.

About 10 hours later, Vanguard sent an apology.

Look, mistakes happen. As the calendar turns, confusing 2025 with 2026 is a forgivable slip. But this wasn’t a minor typo. It appears Vanguard sent an old email wholesale, complete with outdated branding.

That raises a more troubling question: Who is reviewing these communications before they go out? Vanguard’s technology may be misfiring, but the human backstop isn’t catching the errors either.

It’s long past time for Vanguard to get its technology and service issues under control. Until then, take this as a reminder to double-check your tax documents when they arrive. As always, no one cares more about your money than you do—not even Vanguard.

Our Portfolios

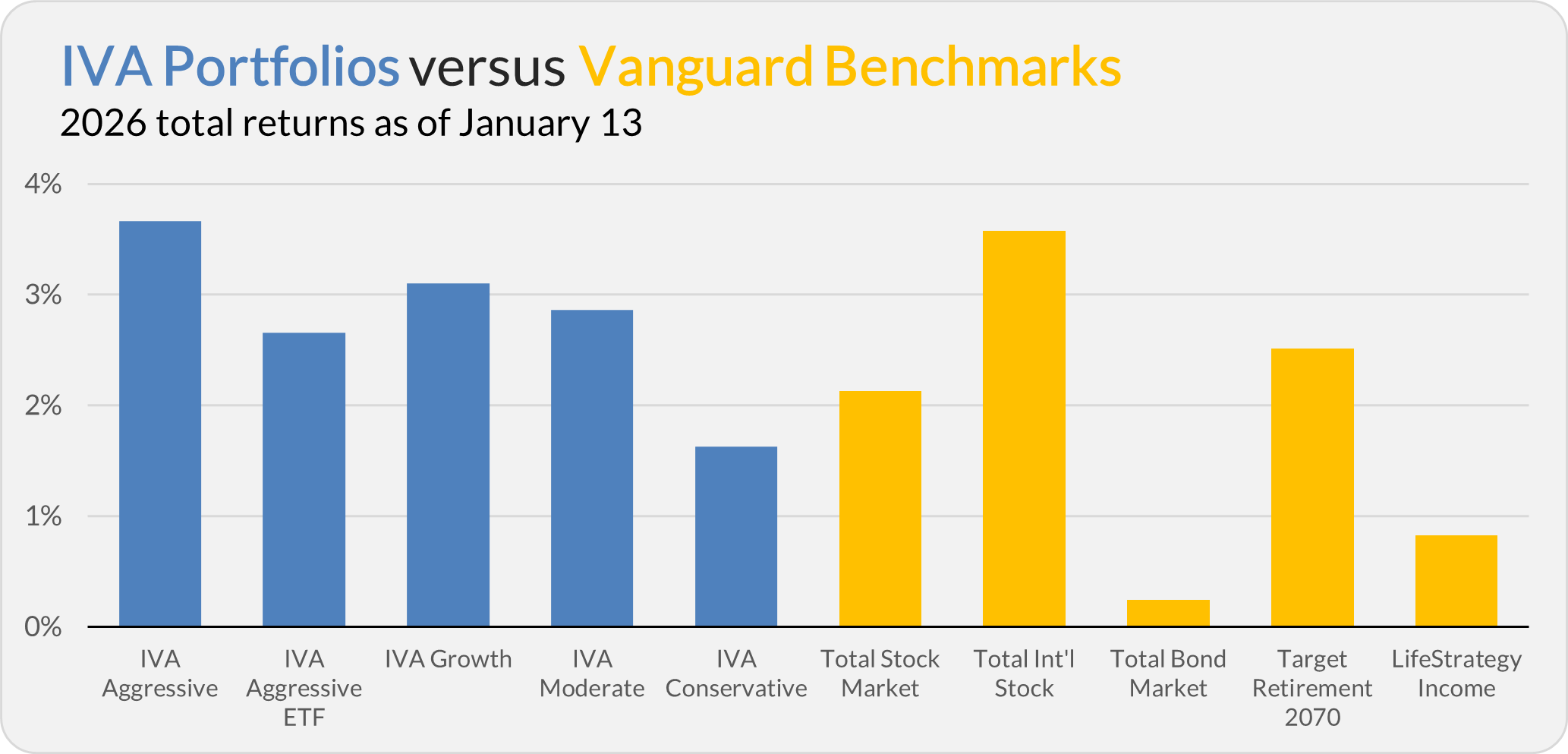

Our Portfolios are off to a decent start this year. The Aggressive Portfolio is up 3.7%, the Aggressive ETF Portfolio is up 2.7%, the Growth Portfolio is up 3.1%, the Moderate Portfolio is up 2.9% and the Conservative Portfolio is up 1.6%.

This compares to a 2.1% gain for Total Stock Market Index (VTSAX), a 3.6% return for Total International Stock Index (VTIAX), and a 0.2% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 2.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.8%.

IVA Research

Since my last Weekly Brief, I shared three articles with Premium Members:

- A deep dive into Vanguard’s 2026 Outlook and what it means for investors.

- A Quick Take on Cash Plus Account’s temporary yield boost—here.

- A Quick Take on Vanguard’s split into two investment units—here.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.