Hello, and welcome to the IVA Weekly Brief for Wednesday, November 19.

There are no changes recommended for any of our Portfolios.

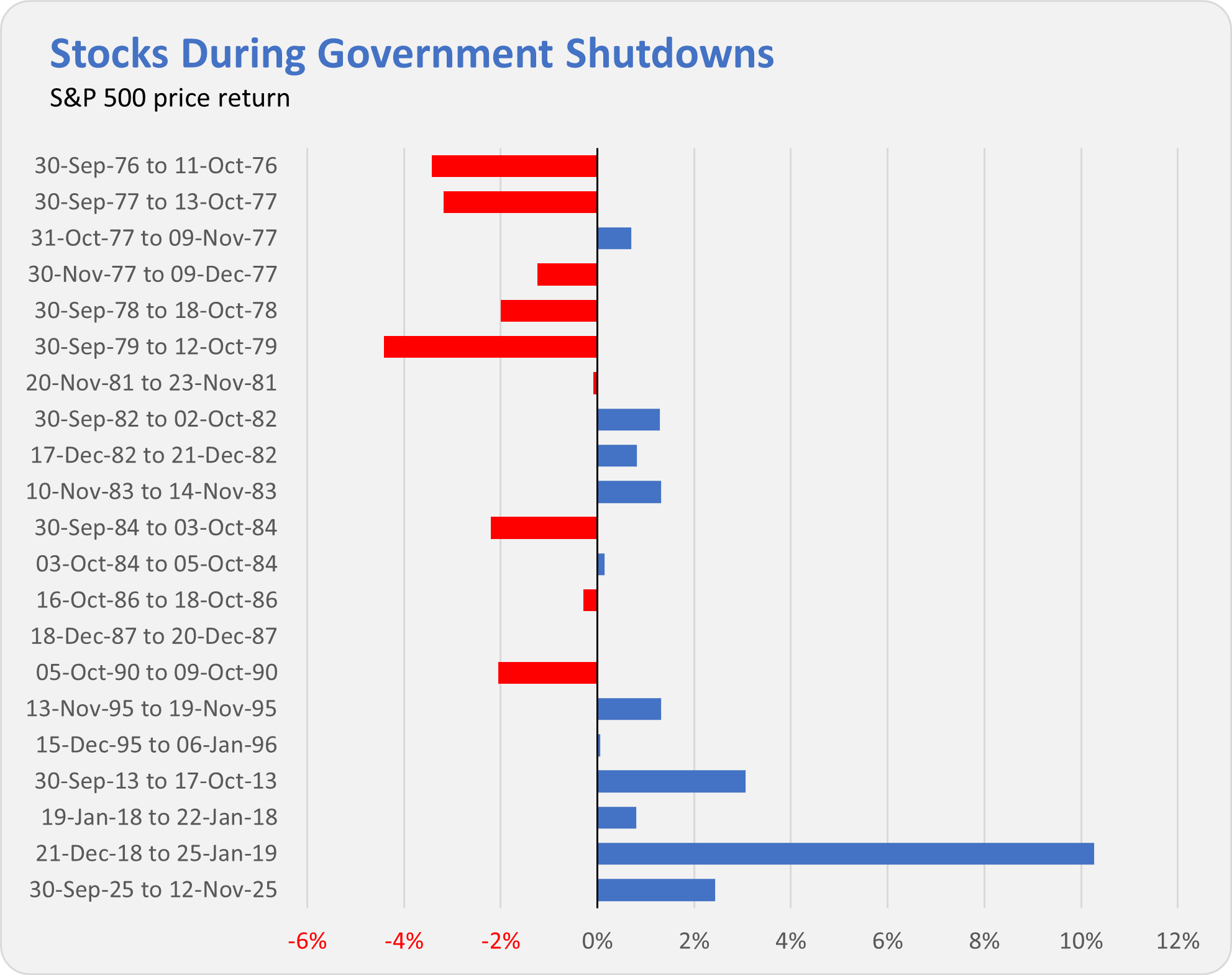

The longest government shutdown on record, lasting 43 days, is over. (Hooray!) When the government closed its doors on October 1, I told you to stay disciplined and invested. So, how did stocks fare over the past 43 days (31 trading days)?

The S&P 500 index gained 2.4%—its third-best return during a government shutdown. It’s also better than the index’s average 31-trading-day return of 1.0%.

Granted, the S&P 500 index is down 3.4% since the shutdown ended—meaning the market has erased all of its “shutdown gains.”

No, I’m not implying that government shutdowns are “good” for investors and the markets … or that the government reopening is “bad.” The point is that you shouldn’t let headlines or short-term noise drive your investment decisions.

Human Error Taints Active ETF Launch

Vanguard’s first actively managed ETFs—run by human stock pickers, not algorithms—began trading yesterday. The three ETFs were built in partnership with Wellington and even carry the sub-adviser’s name on the label:

- Vanguard Wellington Dividend Growth Active ETF (VDIG)

- Vanguard Wellington U.S. Growth Active ETF (VUSG)

- Vanguard Wellington U.S. Value Active ETF (VUSV)

Premium Members received my complete analysis yesterday, tackling the key question: Are these strategies worth owning?

Unfortunately, this debut isn’t just notable for Vanguard breaking ground in actively managed ETFs—it’s also another example of the firm stumbling over basic operational plumbing. Call it human error.

Here’s what happened.

Vanguard’s initial regulatory filings (on Thursday, Nov. 13) listed expense ratios between 0.13% to 0.17% for the new ETFs. The numbers caught my eye immediately; it looked like Vanguard was coming out swinging on fees—undercutting the competition by a mile. (Though I was skeptical and said so.) But no. Those ultra-low fees were, as Vanguard later admitted, the result of a “human error.”

(And yes, it’s fair to say that my reporting—here and here—is what flagged the mistake.)

The correct expense ratios are between 0.30% and 0.40%—still competitive, but not industry-shaking.

Look, everyone makes mistakes. But this episode is yet another reminder that Vanguard’s tech and operations still aren’t as buttoned-up as they should be. For a firm managing trillions, the margin for error should be a lot smaller.

I’ve heard from a number of IVA readers ask whether they can move from Dividend Growth (VDIGX) to the new Wellington Dividend Growth Active ETF (VDIG) without triggering taxes. So let me clear:

Switching from Dividend Growth to the new Dividend Growth Active ETF will be a taxable event.

You can move between, say, Total Stock Market Index (VTSAX) and Total Stock Market ETF (VTI) without realizing capital gains because those are simply different share classes of the same fund. But that structure does not exist here. The new active ETFs are separate funds, not ETF share classes of the legacy mutual funds.

The different matters. A sale of Dividend Growth in a taxable account is a sale—and it comes with tax consequences.

If you’re a longtime Dividend Growth shareholder, think twice about making a switch in a taxable account.

Cash Plus Yield Slips—Again

Last week, I walked you through Vanguard’s aggressive marketing push for its Cash Plus Account. Turns out the campaign had more mileage left in it. On Thursday, an IVA reader shared an email promoting the account—and its headline 3.50% yield—specifically for his trust.

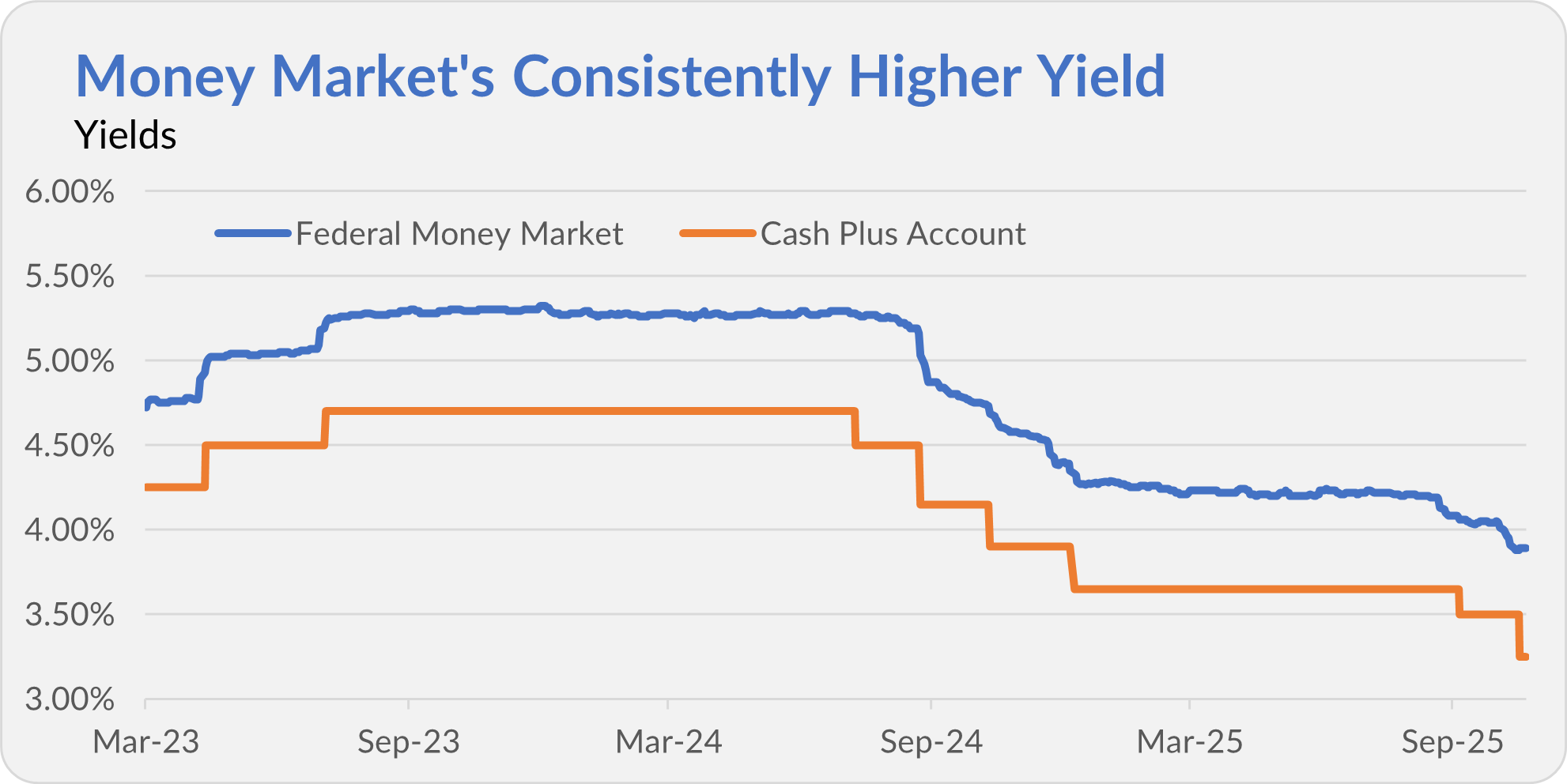

Then, right on cue, that 3.50% APY was history. As I predicted (here and here), Cash Plus Account’s yield slipped to 3.25% the very next day. If you signed up expecting a durable 3.50% yield, well, it didn’t last long. As the fine print warned, “The APY will vary and may change at any time.”

Let’s put this into perspective. Earning 3.25% is certainly better than parking cash in a bank’s checking account earning next to nothing. But it’s not the only “high-yield” cash option at Vanguard—and not the best paying one either. Federal Money Market (VMFXX) has consistently yielded about 0.60% more than Cash Plus.

Which leads to the obvious question: If you’re giving up 0.60% in yield, what exactly are you paying for?

That’s a question, I’ll answer for Premium Members in the weeks ahead.

🎁 Gift the IVA

Looking for a thoughtful holiday gift? Share The Independent Vanguard Adviser.

Give a one-year (or recurring) subscription—just click below to get started:

Our Portfolios

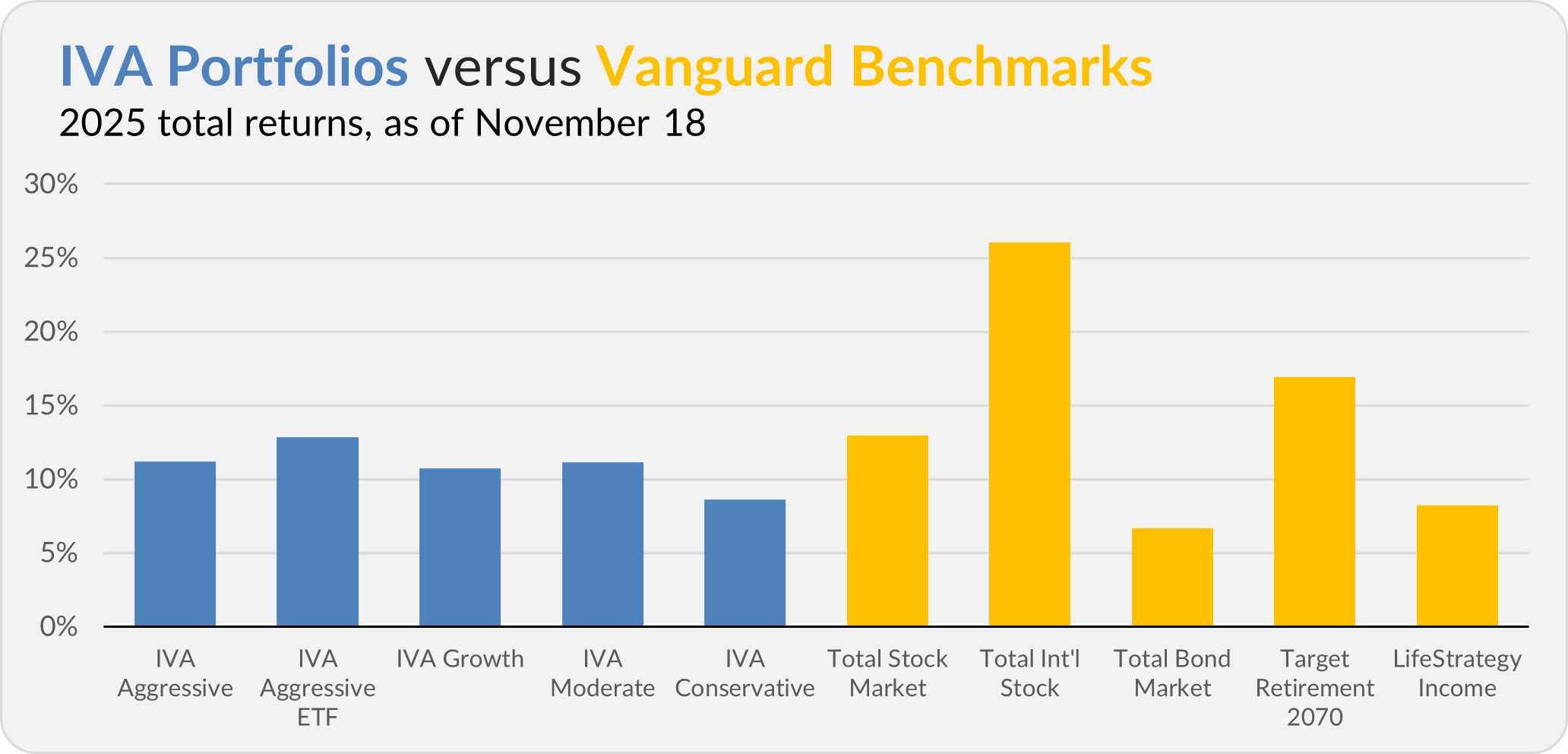

Four out of five of our Portfolios are showing double-digit returns for the year through Tuesday. The Aggressive Portfolio is up 11.2%, the Aggressive ETF Portfolio is up 12.8%, the Growth Portfolio is up 10.7%, the Moderate Portfolio is up 11.1% and the Conservative Portfolio is up 8.6%.

This compares to a 12.9% gain for Total Stock Market Index (VTSAX), a 26.0% return for Total International Stock Index (VTIAX), and a 6.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 16.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 8.2%.

IVA Research

Yesterday, I shared a deep dive into Vanguard’s new actively managed ETFs with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.