Hello, and welcome to the IVA Weekly Brief for Wednesday, May 28.

There are no changes recommended for any of our Portfolios.

Not five months into 2025 it seems the investment lesson of the year is to avoid reacting to the news.

On Friday, President Trump threatened 50% tariffs on European Union (EU) imports starting June 1. Not surprisingly, 500 Index (VFIAX) fell 0.7% on the day.

However, over the weekend, the June 1 deadline was extended to July 9. As you’d expect, stocks rebounded on the news when markets reopened after the Memorial Day holiday, with 500 Index gaining 2.1% on Tuesday.

If the President’s July 9 date rings a bell, it’s because that Wednesday marks the expiration of the 90-day pause on his “Liberation Day” reciprocal tariffs. So, despite the flurry of on-again, off-again threats and Wall Street’s sometimes manic trading, little has changed: European goods still face the threat of a higher tariff—now 50%, instead of 20%—if a deal is not reached within the next six weeks.

No Alarm Bells

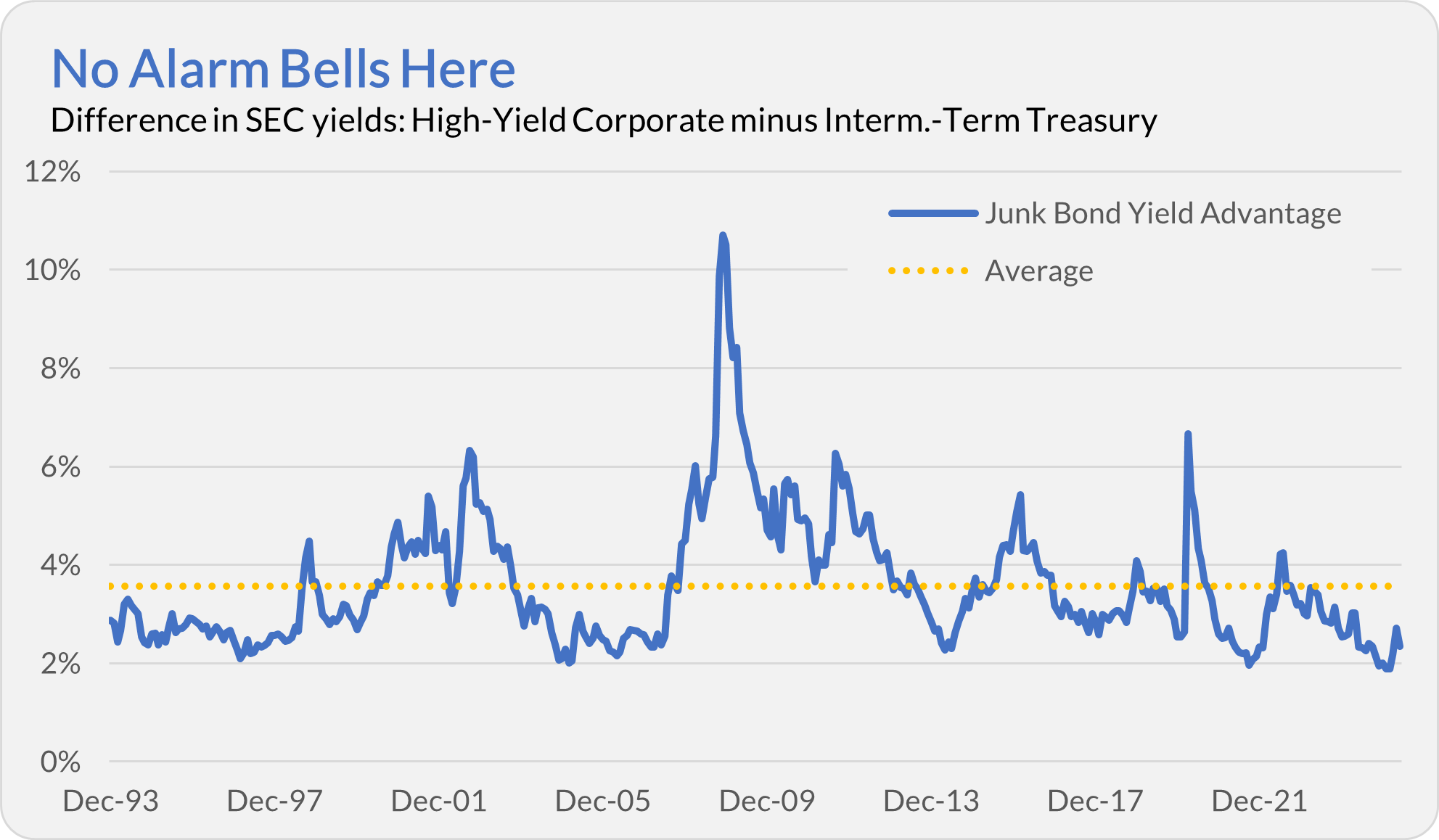

This is a good time to check in on one of my favorite measures of investors’ risk appetite: the high-yield bond market.

Bonds with below-investment-grade ratings (also known as junk bonds) tend to be more sensitive to economic conditions than to changes in interest rates. Why? Because companies with low credit ratings may skate by during periods of economic growth, but are most at risk of defaulting when the economy stumbles.

Junk bonds tend to offer higher yields than high-quality bonds—investors want to be compensated for taking on greater risk. But the amount of extra income, or “spread,” that investors demand to hold junk bonds isn’t constant. When times are good (the economy is growing), investors become more confident and accept lower spreads (less additional income). By contrast, during recessions or periods of uncertainty, investors demand much higher yields to justify junk bonds’ added risks.

One way to gauge how worried bond traders are about the economy, and the prospects for more financially fragile companies, is to track the difference in yield between High-Yield Corporate (VWEHX) and Intermediate-Term Treasury (VFITX). Currently, High-Yield Corporate yields 2.33% more than the Treasury fund—6.29% to 3.96%.

To put that 2.33% spread into context, it’s about in the middle of the range of 1.89% to 2.72% we’ve seen this year. It’s also well below the long-term average of 3.56%.

The junk bond market—at least as viewed through this Vanguard lens—shows little concern about a recession on the horizon. Investors are still demanding very little in extra yield to hold junk bonds. And even at the peak of the tariff turmoil, spreads remained well below average, never approaching distressed levels.

I tend to take a contrarian view of the high-yield bond market. When spreads are wide—meaning you are being paid generously for the risk you’re taking—I’m interested in buying. But when there’s little extra income on offer, I’m content to wait patiently.

Today is a day for patience, not bold moves. And if the junk bond market is right, the risk of recession remains low.

Our Portfolios

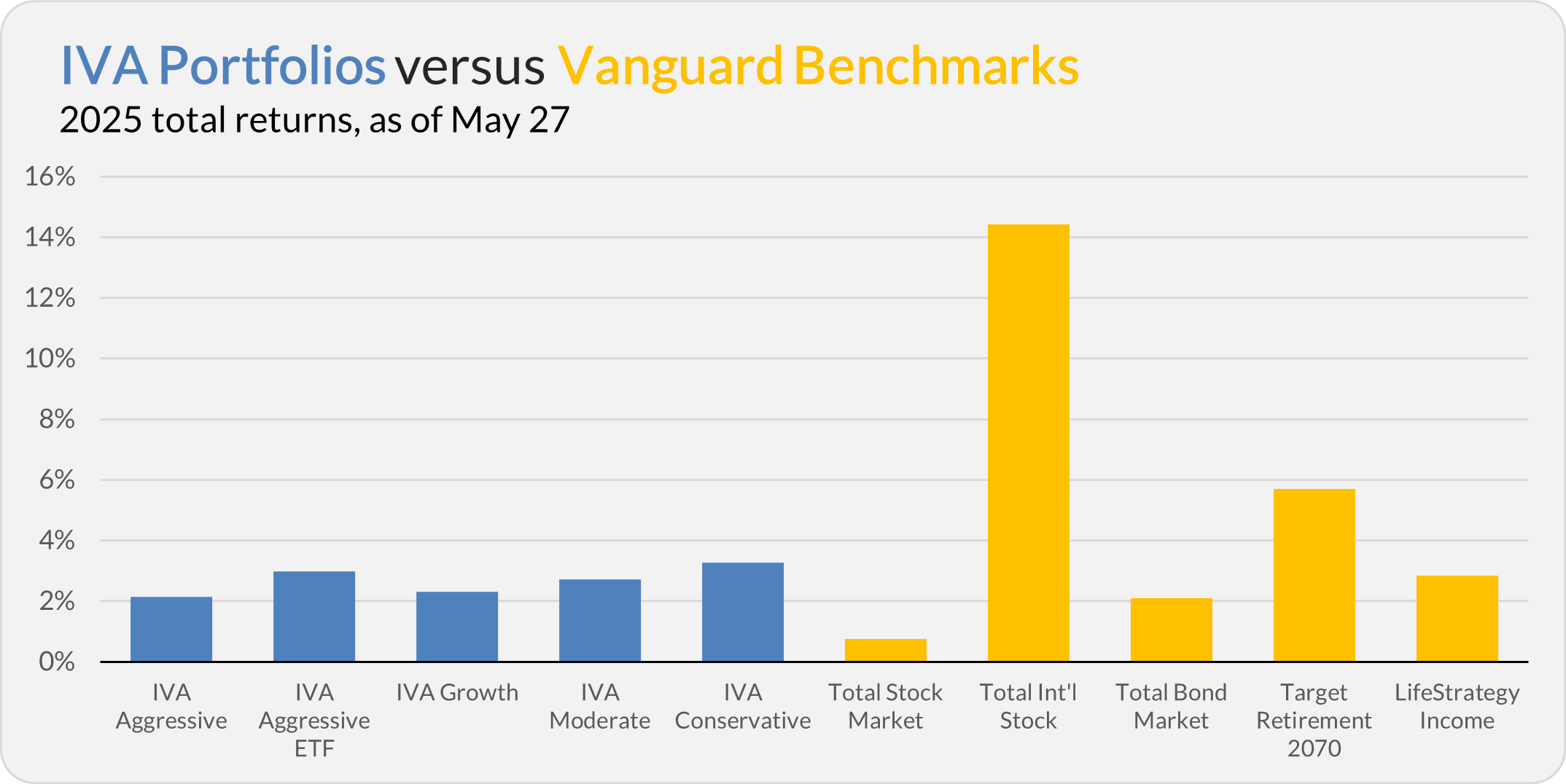

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 2.1%, the Aggressive ETF Portfolio is up 3.0%, the Growth Portfolio is up 2.3%, the Moderate Portfolio is up 2.7% and the Conservative Portfolio is up 3.3%.

This compares to a 0.8% gain for Total Stock Market Index (VTSAX), a 14.4% return for Total International Stock Index (VTIAX), and a 2.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 5.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.8%.

IVA Research

Yesterday, in Do You Really Need “Private” Investments?, I shared my analysis on private (or alternative) investments with Premium Members.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.