Hello, and welcome to the IVA Weekly Brief for Wednesday, June 18.

There are no changes recommended for any of our Portfolios.

Here’s the latest reminder that markets don’t always move the way the headlines suggest they should.

Despite Israel and Iran firing missiles at each other for the past week, the only Vanguard fund showing clear signs of this conflict is Energy ETF (VDE), which is up 9.1% this month. That’s what you’d expect as oil prices typically rise with growing tensions in the Middle East.

But beyond that, there’s little evidence of market worry. The S&P 500 index is within 3% of its all-time high. 500 Index (VFIAX), SmallCap Index and Total International Stock Index (VTIAX) are all up between 0.9% and 1.3% so far this month. On the bond side, well, there’s not much to read into as everything from High-Yield Corporate (VWEHX) to Long-Term Treasury ETF (VGLT) is in the green in June.

The message is clear: don’t trade your portfolio on headlines. Now, let’s turn to the news out of Vanguard.

Dual Mutual Fund–ETF Share Classes, Again

Two weeks ago, I shared my take on the dual mutual fund–ETF share class structure with Premium Members. At the time, Vanguard hadn’t yet filed for “exemptive relief”—the SEC’s permission—to offer ETF share classes of its actively managed mutual funds. That’s changed.

Vanguard has joined the growing list of fund companies seeking regulatory approval to add ETF shares to their legacy active mutual funds. Yes, Vanguard already runs this dual share class structure for its index funds. The new frontier is bringing ETF shares to actively managed mutual funds.

As I mentioned to Premium Members in a Quick Take last week, I understand the appeal, but the structure has trade-offs that investors shouldn’t ignore. Premium Members can read on for my take on the risks, potential rewards, and what to watch here.

Lazard Out, Altrinsic In

With one manager out and another in, not much changes at International Value (VTRIX).

After nearly two decades, Vanguard has removed Lazard Asset Management from International Value’s portfolio and replaced it with Altrinsic Global Advisors—a newcomer to the Vanguard lineup.

The fund’s two other sub-advisers, ARGA Investment Management and Sprucegrove Investment Management, remain in place. The three firms will now manage equal portions of the portfolio.

In a recent Quick Take for Premium Members, I took a closer look at International Value and compared the recent results of the fund’s sub-advisors, including Altrinsic. The short story is that Lazard is out, despite delivering reasonable results of late. That said, shareholders shouldn’t expect dramatic change as Altrinsic’s performance has been in line with Lazard’s returns.

This sub-advisor swap is more evolution than revolution.

McCarragher Retires

Speaking of fund evolution … Kathleen McCarragher, a veteran manager at Jennison Associates and co-manager of the firm’s sleeve of U.S. Growth (VWUSX), plans to retire in a year. Her longtime co-manager, Blair Boyer, will remain at the helm.

It wouldn’t be surprising to see Jennison name a new co-manager as McCarragher steps down. If I had to place a bet, it would be on Owuaka Koney—a growth portfolio manager on the team who’s already succeeding McCarragher on several other Jennison-managed mutual funds.

McCarragher's tenure with Vanguard has spanned two funds: Growth Equity and U.S. Growth. She entered Vanguard’s lineup in January, when she took charge of half of Growth Equity’s portfolio. When Growth Equity was merged into U.S. Growth in 2014, McCarragher’s role shrank to overseeing just 7% of the combined fund’s assets. (Growth Equity was a much smaller fund than U.S. Growth.) That stake grew to about 30% in 2019 and has held steady since.

To assess how investors who partnered with McCarragher fared over the years, I created a hypothetical “McCarragher Growth” fund by linking the returns of Growth Equity and U.S. Growth.

On both an absolute and relative basis, shareholders of the “McCarragher Growth” strategy performed well. From January 2009 through May 2025, it returned 16.1% per year—a cumulative gain of 1,044%. That’s a solid result, and better than Total Stock Market Index’s (VTSAX) 14.8% annual gain (849% total).

Don’t pop the champagne quite yet. You would have done slightly better with Growth Index (VIGAX), which compounded at a 17.0% annual pace for a total return of 1,208%.

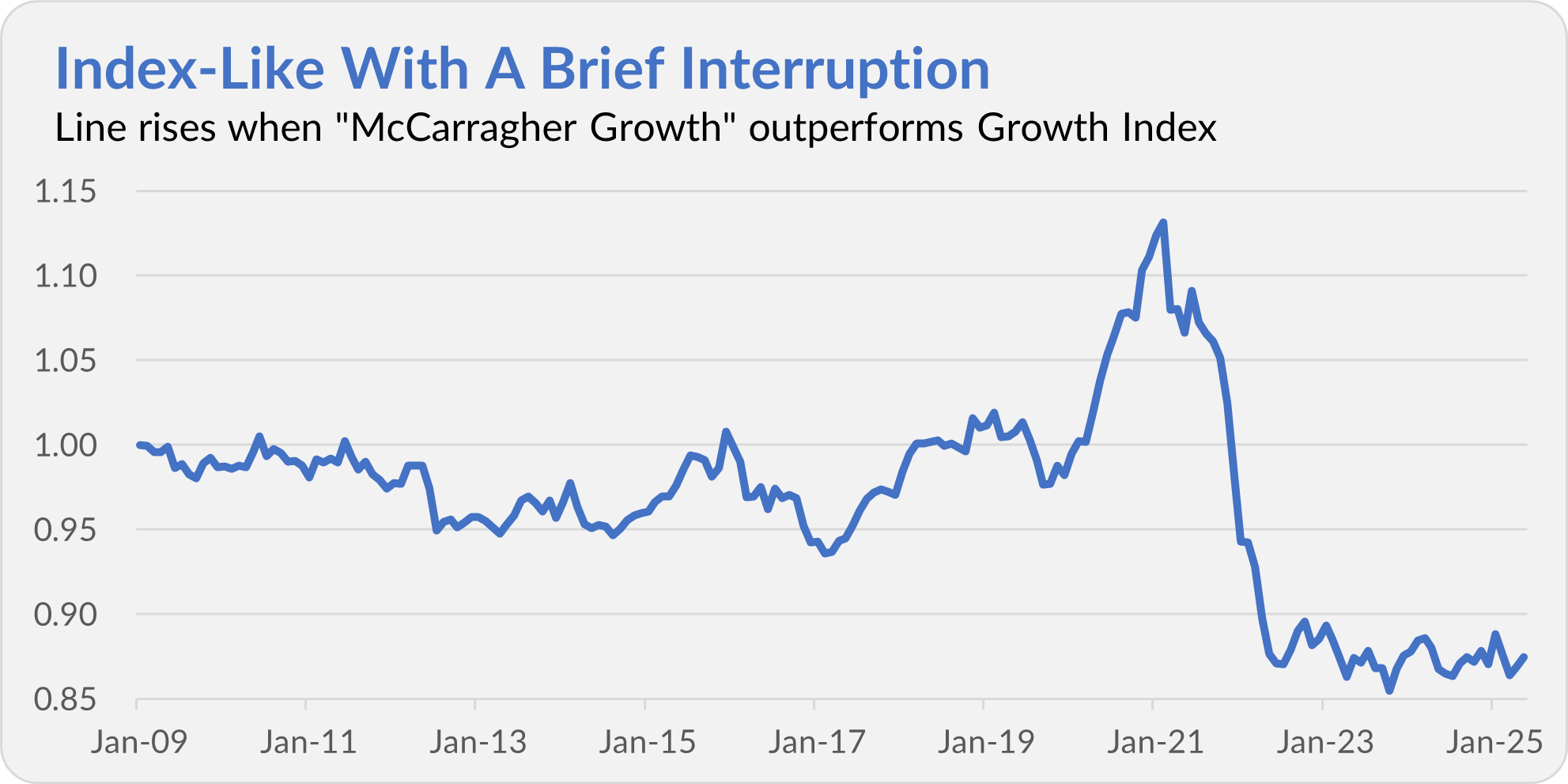

The chart below tracks the relative performance of “McCarragher Growth” versus Growth Index. The line rises when “McCarragher Growth” outperforms.

For most of the period, both growth strategies—one active, one passive—delivered similar returns. The exception occurred in the two years following the COVID market shock, when the active fund initially surged ahead but then fell behind. (The Baillie Gifford managers drove those relative swings.)

Of course, this isn’t really a McCarragher Growth fund; U.S. Growth is (and Growth Equity was) a multi-manager fund. McCarragher and her colleagues didn’t fully own the track record I’ve analyzed; they only contributed to it.

That’s part of the appeal of the multi-manager structure: shareholders don’t need to worry about the departure of any single manager, including McCarragher. The trade-off? You often wind up earning index-like returns while paying higher fees.

Our Portfolios

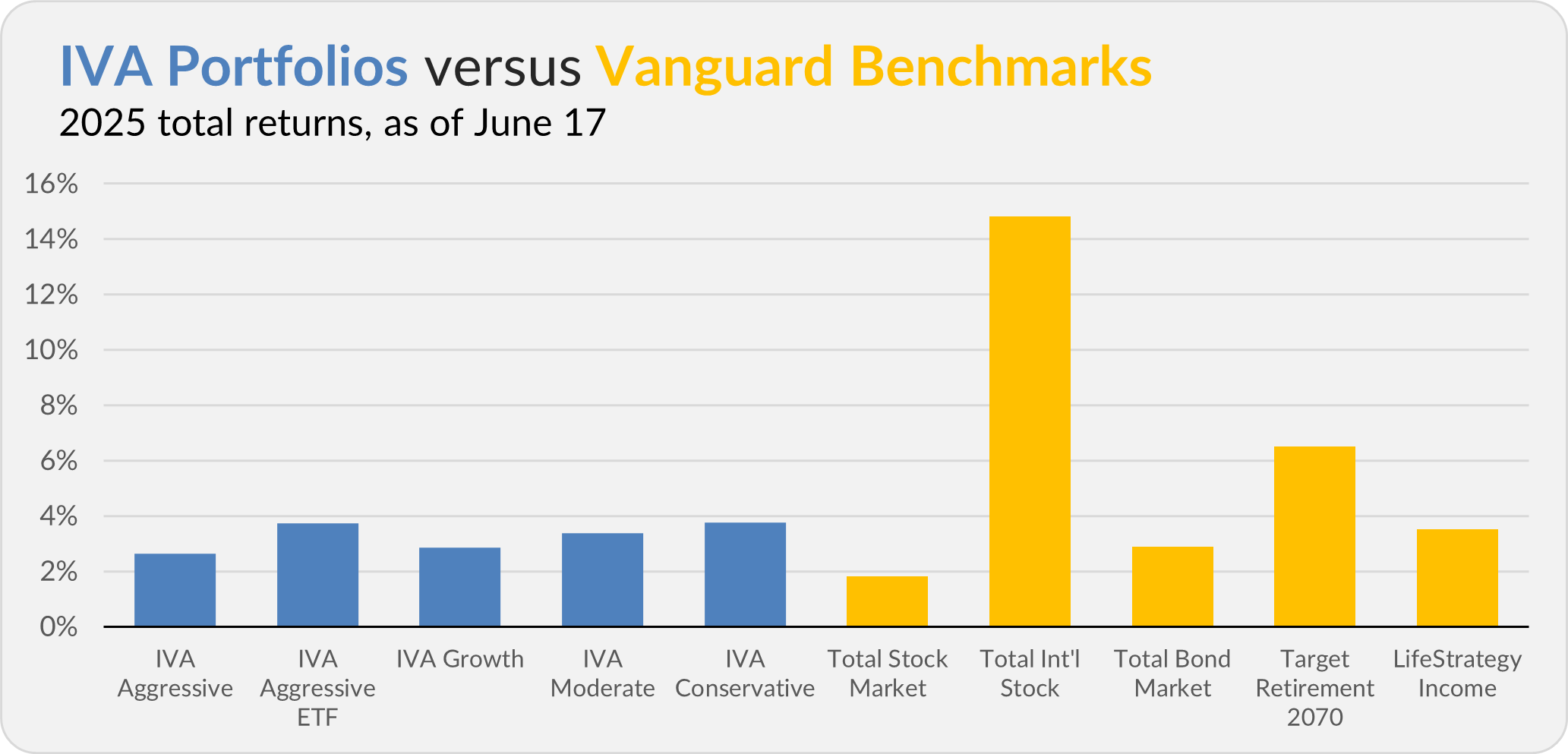

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 2.7%, the Aggressive ETF Portfolio is up 3.7%, the Growth Portfolio is up 2.9%, the Moderate Portfolio is up 3.4% and the Conservative Portfolio is up 3.8%.

This compares to a 1.8% return for Total Stock Market Index (VTSAX), a 14.8% gain for Total International Stock Index (VTIAX), and a 2.9% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.5%.

IVA Research

Last week, I shared my Quick Take on Vanguard joining the ranks of fund companies seeking permission to add ETF share classes to actively managed mutual funds.

On Monday, I analyzed Vanguard’s decision to replace Lazard with Altrinsic as a sub-adviser on International Value.

And yesterday, I took a thoughtful walk through market history, examining how traders and long-term investors reacted to defining geopolitical events.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.