Hello, and welcome to the IVA Weekly Brief for Wednesday, December 17.

There are no changes recommended for any of our Portfolios.

That doesn’t mean there haven’t been changes at Vanguard. Yields are falling, new ETFs are coming, managers have been hired and fired and, well, we’re going into the new year with lots to watch.

Holiday Publishing Schedule

With the holidays upon us, I’m making a few tweaks to the publishing calendar. Here’s what to expect over the next couple of weeks:

Next week (12/22–12/26)

Premium Members will receive an IVA Research article on the Hot Hands strategy on Tuesday, December 23. I’ll be skipping the free Weekly Brief that week.

The following week (12/29–1/2):

Premium Members can expect my annual Outlook article on Tuesday, December 30. I’ll also publish a Weekly Brief on Wednesday, December 31.

Then, on Friday, January 2, Premium Members will receive four pieces—including a look back at the year that was and the annual Hot Hands Trade Alert.

I’ll return to the regular Tuesday–Wednesday publishing rhythm the week of January 5.

As always, if there’s pressing Vanguard or market news, I’ll do my best to weigh in promptly—holiday or not.

If you want access to the full slate of research and trade alerts, click the button below to upgrade:

Happy Holidays!

Jeff

Some Yields Rise, Others Fall

Last week, despite a lack of fresh, official economic data, Federal Reserve policymakers lowered the target range for the fed funds rate by 0.25% to 3.50%–3.75%. As I’ve told you repeatedly, the only consistent impact Fed policy has on our money shows up in money market and cash yields. By contrast, longer-term bond yields are driven mainly by inflation and inflation expectations.

Recent experience bears this out. Since the end of August, policymakers have lowered short-term interest rates three times. And yet, as you can see in the chart below, the 10-year Treasury’s yield is actually higher today (4.15%) than it was when the Fed first moved (4.06%).

So, what does the latest Fed action mean for cash yields?

Well, Cash Plus Account’s yield has already ticked lower from 3.25% to 3.10% and Cash Deposit’s yield has slid from 1.85% to 1.75%.

Federal Money Market’s (VMFXX) yield typically sits a little below the lower bound of the Fed’s fed funds target range, but it doesn’t drop overnight. It’ll probably take a month or two for the money market fund’s yield to settle around 3.45%.

0-3 Month Treasury Bill ETF’s (VBIL) yield should roughly track Federal Money Market’s.

As I showed Premium Members in November, Municipal Money Market’s (VMSXX) yield has been far less predictable—zigging and zagging instead of gliding down. Heck, it’s been three months since the Fed’s first interest rate cut and Municipal Money Market’s yield is higher today (2.90%) than it was before (2.61%).

Municipal Money Market’s yield won’t defy gravity forever. The fed funds rate still acts as an anchor for tax-free cash yields—it just doesn’t tug quite as tightly. Which is why I don’t make a specific forecast for the muni fund’s yield.

Looking Overseas for Growth and Value

Tilting a portfolio toward growth or value stocks using index funds and ETFs is nothing new for Vanguard investors. Vanguard introduced Growth Index (VIGAX) and Value Index (VVIAX) more than three decades ago, giving investors a simple, low-cost way to express those preferences in the U.S. markets.

Overseas, the story has been different. If you wanted to lean toward growth or value in foreign markets at Vanguard, your choices were limited and imprecise, using actively managed funds like International Growth (VWIGX) and International Value (VTRIX). What’s been missing is a straightforward, index-based way to make the same growth-versus-value bet.

As Premium Members learned yesterday, it only took about 30 years, but Vanguard is finally filling that gap, having filed to launch two new ETFs: Developed Markets ex-U.S. Growth Index ETF and Developed Markets ex-U.S. Value Index ETF. Both are expected to debut in March.

Premium members can read more analysis—including a look at how growth and value stocks have performed overseas—here.

Windsor II: Lazard Out, Oakmark In

After two decades, Vanguard has completely cut ties with Lazard Asset Management. In June, Lazard was relieved of its duties at International Value (VTRIX). And on Monday, the firm was removed as sub-adviser from Windsor II (VWNFX) and Diversified Value Annuity.

Taking Lazard’s place is a new name for Vanguard investors: Harris Associates’ Oakmark, which appears on Vanguard’s site as “Harris | Oakmark.”

While new to Vanguard, Harris | Oakmark is hardly new to value investing. Bill Nygren—one of three managers now named to Windsor II—has run Harris’s flagship Oakmark fund (OAKMX) for more than 25 years. He’s joined by Robert Bierig and Michael Nocolas on Windsor II. This trio co-manages Oakmark and Oakmark U.S. Large Cap ETF (OAKM), giving us a sense of how they will operate here.

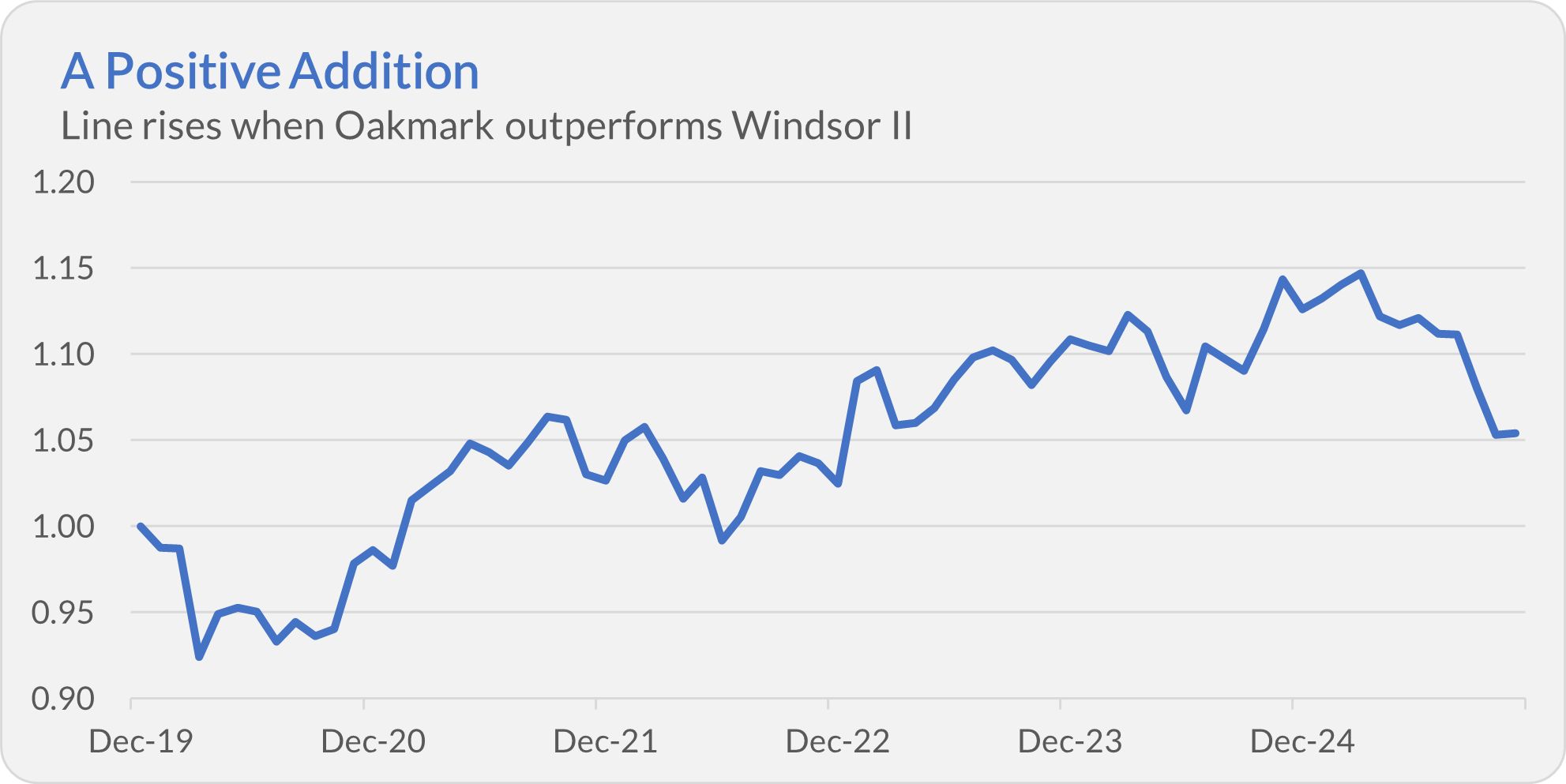

On paper, this looks like an upgrade. Since March 2000, when Nygren took the reins at Oakmark (the fund), it has outperformed Windsor II, 10.7% versus 9.0% per year—an almost 2% advantage.

Windsor II has long had a revolving door of sub-advisers. The previous four-manager structure—Lazard, Aristotle Capital Management, Sanders Capital and Hotchkis & Wiley Capital Management—was put in place at the end of 2019. Since then, Oakmark has also come out ahead, compounding at 14.1% per year versus Windsor II’s 13.1%.

While I don’t own the fund today, I’ve invested alongside Nygren (and the Oakmark fund) in the past and have a high regard for his flexible, value-driven approach. But Windsor II’s multi-manager structure remains a sticking point. With so many chefs in the kitchen, it’s hard to know how much impact any one team can have.

Following the change, Windsor II’s assets are now split evenly between Harris | Oakmark, Aristotle, Sanders and Hotchkis & Wiley.

At Diversified Value Annuity, Vanguard also dropped Lazard, bringing in Harris | Oakmark and Aristotle. That leaves three sub-advisers—Harris | Oakmark, Aristotle and Hotchkis & Wiley—each with an equal slice of the annuity’s portfolio.

A Nygren-led fund with Vanguard pricing would certainly get my attention. (Oakmark charges 0.89% per year while Windsor II’s expense ratio is just 0.34%.) But layered sub-adviser structures tend to dilute conviction—and that continues to limit Windsor II’s appeal.

More Distributions to Come for MidCap Growth?

In September, when Vanguard announced that it was handing MidCap Growth (VMGRX) to a single sub-adviser—Tremblant Capital—I said that the fund was “getting a whole lot more interesting.” It was shifting from “a sleepy index mimic to a genuinely active, aggressive mid-sized stock growth fund.”

With MidCap Growth’s transition to Tremblant Capital completed in mid-November, several IVA readers have asked for an update on the fund. Is it a buy?

My answer: Not yet—especially in taxable accounts.

First, it’s simply too early. We haven’t even seen the fund’s holdings under Tremblant’s full control. I’m not going to slap a buy rating on any strategy or fund without knowing what’s in the portfolio!

Second, the tax picture is messy—and could get messier.

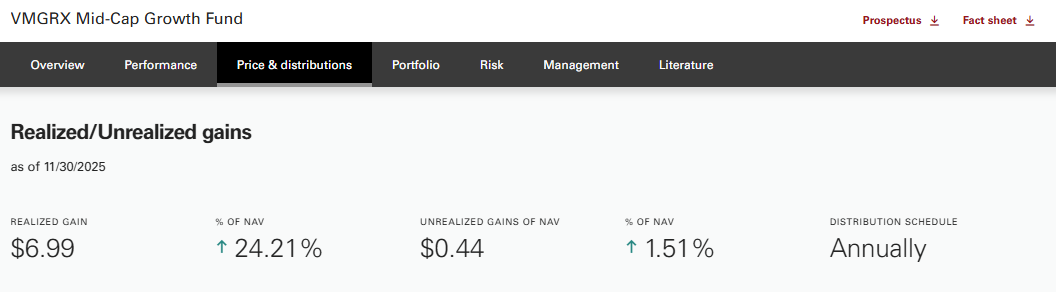

The fund is paying a $4.35 per-share capital gains distribution (the ex-dividend date is today). But Vanguard reported the fund had $6.99 per share in realized capital gains at the end of November. That leaves $2.64 per share potentially still in the pipeline—possibly as a special distribution in March.

The bottom line: There’s no need to rush. That’s doubly true for taxable investors. You don’t want to buy a distribution.

I’m intrigued by a new-look MidCap Growth. So much so, that I’ve taken a (very) small “test” position in Tremblant Global ETF (TOGA)—the ETF run by the same team now calling the shots at MidCap Growth. But before I do anything meaningful with MidCap Growth, I want to see the holdings, understand the true degree of the change and get to know the managers.

🎁 Gift the IVA

Looking for a smart, last-minute gift? Share The Independent Vanguard Adviser.

Give a one-year (or recurring) subscription—just click below to get started:

Our Portfolios

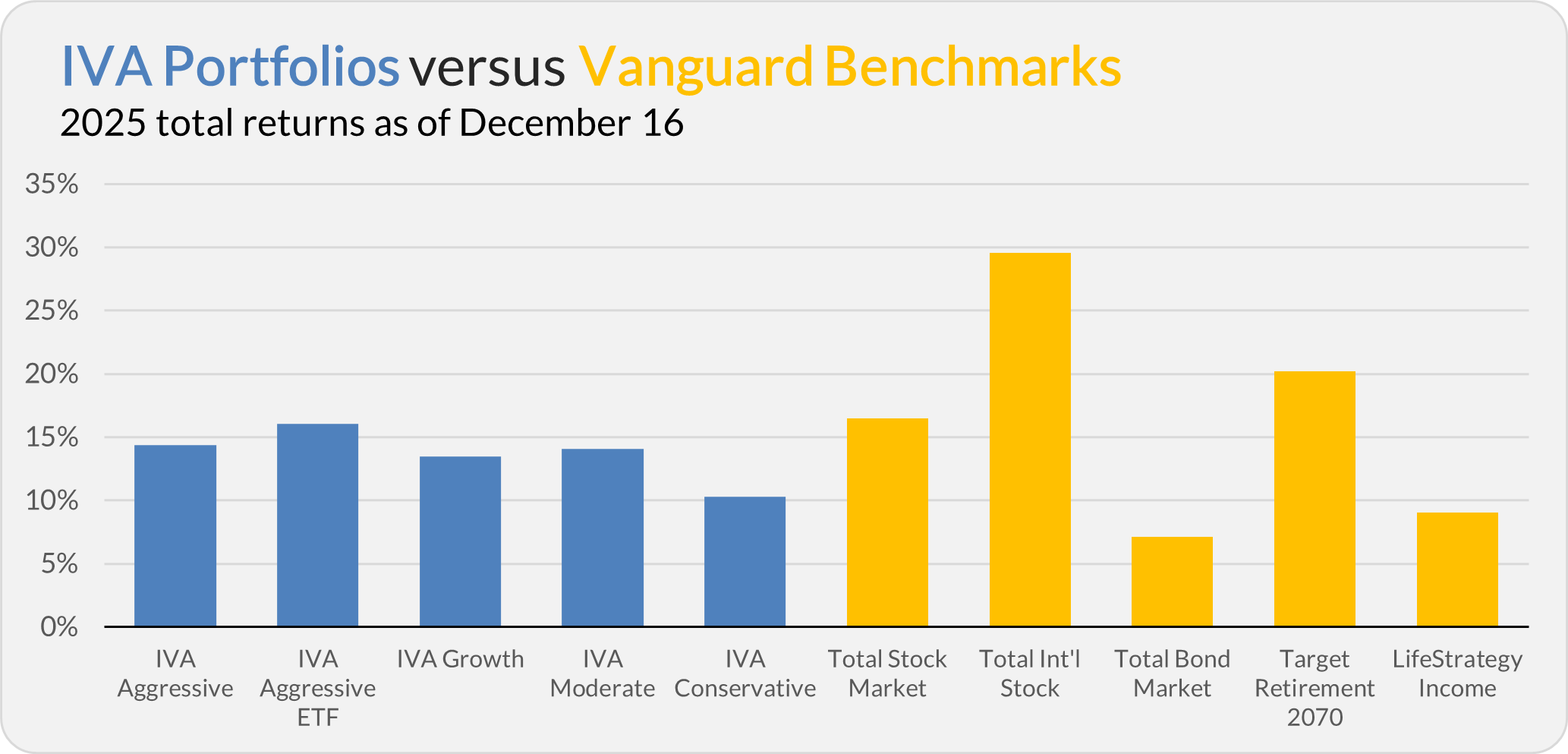

Our Portfolios are showing double-digit returns for the year through Tuesday. The Aggressive Portfolio is up 14.3%, the Aggressive ETF Portfolio is up 16.1%, the Growth Portfolio is up 13.5%, the Moderate Portfolio is up 14.1% and the Conservative Portfolio is up 10.3%.

This compares to a 16.5% gain for Total Stock Market Index (VTSAX), a 29.6% return for Total International Stock Index (VTIAX), and a 7.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 20.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 9.0%.

IVA Research

Yesterday, I shared my annual review of the IVA Portfolios with Premium Members. Plus a Quick Take on the Vanguard’s move to launch growth and value versions of Developed Markets ETF.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.

Vanguard and The Vanguard Group are service marks of The Vanguard Group, Inc. Tiny Jumbos, LLC is not affiliated in any way with The Vanguard Group and receives no compensation from The Vanguard Group, Inc.

While the information provided is sourced from sources believed to be reliable, its accuracy and completeness cannot be guaranteed. Additionally, the publication is not responsible for the future investment performance of any securities or strategies discussed. This newsletter is intended for general informational purposes only and does not constitute personalized investment advice for any subscriber or specific portfolio. Subscribers are encouraged to review the full disclaimer here.