Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, August 2.

There are no changes recommended for any of our Portfolios.

How do you explain 500 Index (VFIAX) gaining 20% in the year's first seven months? The economy and earnings are holding up better than expected.

Coming into the year, the consensus was that the U.S. economy would slip into a recession.

Well, the first estimate for Q2 indicates that the economy (measured by GDP) increased by 0.6% after inflation. Based on that number, the economy grew 1.1% after inflation—or over $220 billion—in the year's first six months.

Even if the minutes don’t reflect it, Fed Chair Jerome Powell and his policymaker colleagues at the Federal Reserve must be exchanging high fives. If you had told them back in June 2022 that over the next 12 months, they would double the fed funds rate, inflation would fall from 9% to 3%, unemployment would remain at 3.6% and the economy would expand by 2.6%, well, I think they would take that in a heartbeat!

The economy is undoubtedly faring better than projected. And it’s not just the economy that is exceeding our expectations.

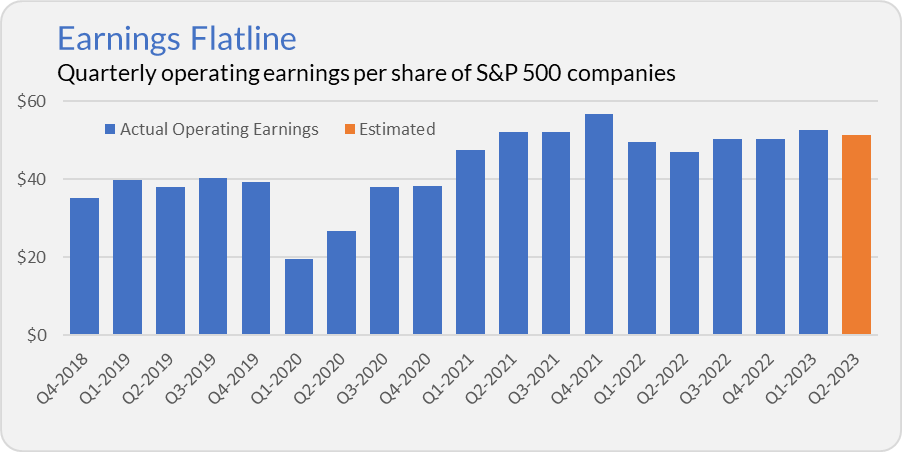

Yes, company earnings could improve—since peaking in 2021, operating earnings have flatlined around $50 per share, according to S&P Global. However, when everyone expects a recession, earnings holding their level is better than a decline!

Or consider the big fears that kept investors up at night this year: Many were convinced that the U.S. government would default. Others warned that Silicon Valley Bank and Signature Bank were just the first financial sector dominoes to fall—that we’d see industry-wide bank failures. Neither of those came to pass.

It’s not whether the data is “good” or “bad” that matters to traders and investors. It’s whether things are getting “better” or “worse.” This year is playing out much better than most investors anticipated, and so is the stock market.

Dividends Matter

As Dan pointed out to me yesterday, the Dow Jones Industrial Average hit a record high when you count dividends. Given its concentration and price-weighted construction, the Dow is a funky index (to use a technical term). Frankly, I wish the media would stop quoting it so ubiquitously.

Look at some broader (and investable) measures of the U.S. stock market, and “the market” isn’t setting new highs yet: 500 Index is 2.2% from a new record, and Total Stock Market Index (VTSAX) is 4.0% below its January 3, 2022 high. Again, I’m looking at total return figures, including dividends.

However, most people don’t own just the Dow, the S&P, or even Total Stock Market Index. If you own a globally diversified portfolio with some bonds in the mix, your portfolio has more work to do to recover from the recent bear market.

For example, Lifestrategy Moderate Growth (VSMGX), which invests 60% of its assets in stocks and 40% in bonds, is still 7.6% below its record high.

While indexes notching new highs make good headlines, most investors shouldn’t be benchmarking their portfolio against those all-stock barometers.

Two Out of Three

Last night, Fitch Ratings downgraded U.S. debt one notch from AAA to AA+.

Fitch is one of the three big credit rating agencies, alongside S&P and Moody’s. While S&P downgraded U.S. bonds to AA over a decade ago, Moody’s still gives the U.S. the highest possible rating (AAA).

Fitch downgrading the U.S. doesn’t tell us anything new. We already know that the U.S. has issued a lot of bonds in the past decade. And the recurring debt ceiling debate and brinksmanship have eroded confidence in our willingness to repay our debts.

U.S. Treasuries remain the safe haven asset of choice until proven otherwise. Fitch’s downgrade of U.S. debt to AA+ doesn’t change that.

The Tried-and-True

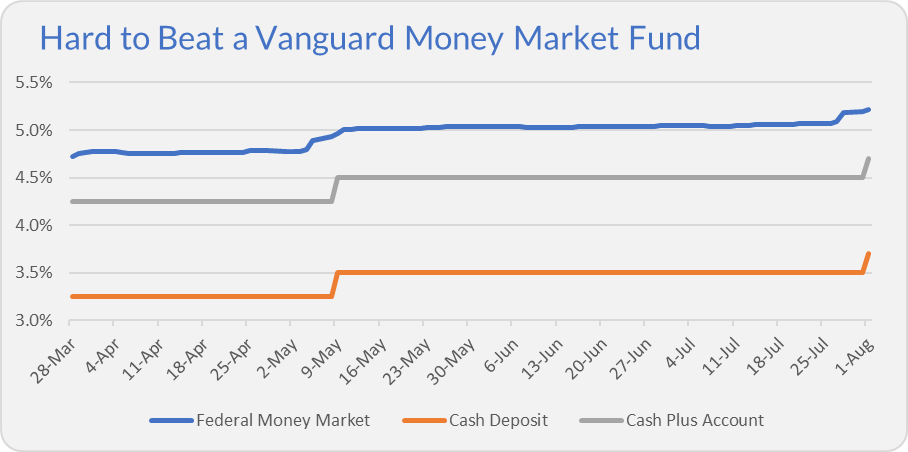

Speaking of safe assets, I’ve been watching Vanguard’s alternative cash programs, Cash Deposit and Cash Plus Account. These two programs are in test mode and are not open to all Vanguard investors. I covered them in detail here.

Unlike money market funds, the yields on these cash programs do not change daily—or at least Vanguard does not update them regularly. Vanguard revised the yields on their website today—Cash Deposit now pays 3.70%, while Cash Plus Account yields 4.70%. Both yields increased by 0.20% from their previous May 9 “as-of date.”

Yes, the programs went nearly three months without changing yields!

I still can’t explain why there is a 1% difference in yield between the two options—and Vanguard hasn’t provided a satisfying explanation. But, the two new cash options consistently yield less than Vanguard’s tried-and-true money market funds. For example, as of last night, Federal Money Market (VMFXX) yields 5.22%.

Not So Fast

In May, Vanguard announced a manager change at Growth & Income (VQNPX). My Quick Take on the original announcement is available to Premium members here.

In short, Vanguard is replacing its in-house quantitative managers with a team of Wellington analysts. The transition was supposed to be effective tomorrow (August 3), but Vanguard has asked for more time. In an SEC filing, Vanguard pushed the effective date back to August 28.

It’s unclear if the delay is coming from Vanguard or Wellington, but eventually, the analysts at Wellington will call the shots.

Hong Steps Down

After 15 years, Wellington’s Michael Hong has stepped away from High-Yield Corporate (VWEHX). I shared my Quick Take on his departure with Premium members on Monday. The short story is that while I find it odd that Vanguard and Wellington didn’t provide advance notice of this transition, the fund remains in good hands.

The only thing to add from my initial reaction is that Hong is not retiring. He will continue to manage other high-yield strategies for Wellington and will be a resource for his successor, Elizabeth Shortsleeve.

This is akin to the handoff between Don Kilbride and Peter Fisher at Dividend Growth (VDIGX). The difference is that Wellington and Vanguard told us nearly a year in advance that Kilbride is stepping away from the fund, while we got no such early warning at the junk bond fund.

Our Portfolios

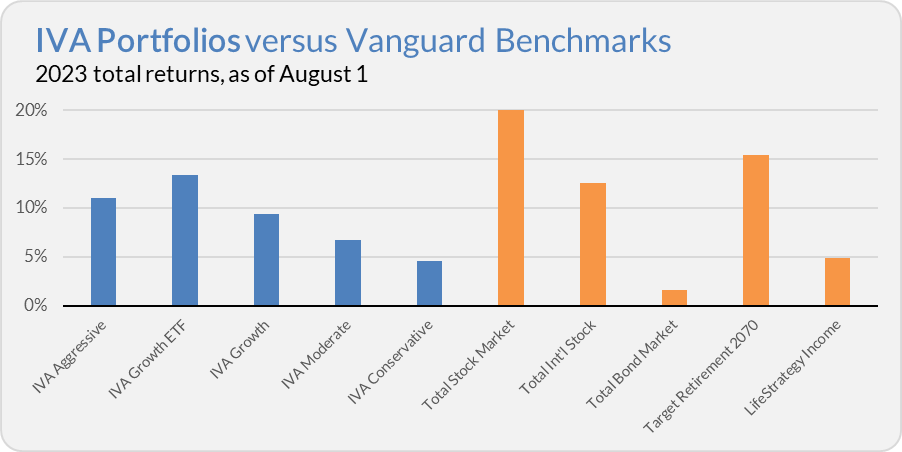

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 11.0%, the Growth ETF Portfolio is up 13.4%, the Growth Portfolio is up 9.4%, the Moderate Portfolio is up 6.8% and the Conservative Portfolio is up 4.6%.

This compares to a 20.0% return for Total Stock Market Index (VTSAX), a 12.5% gain for Total International Stock Index (VTIAX), and a 1.7% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.9% for the year.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Not a Premium Member yet? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.