Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, February 14.

There are no changes recommended for any of our Portfolios.

S&P 5000?!

Well, that was short. January inflation came in hotter than expected, taking the wind from the market’s sails as traders cut back their expectations for the timing of the first Federal Reserve interest rate cut and, yes, sold stocks.

So much for records like Friday’s, when the S&P 500 index hit a big round number—5000.

Big whoop. How about the S&P 500 index at 100,000? I fully expect to see that in my lifetime.

Since its inception 67 years ago, the S&P 500 index has compounded 7.3% per year (not counting dividends). At a 7% annual pace, the index will hit 100,000 in 2069—45 years from now. I’ll be 85.

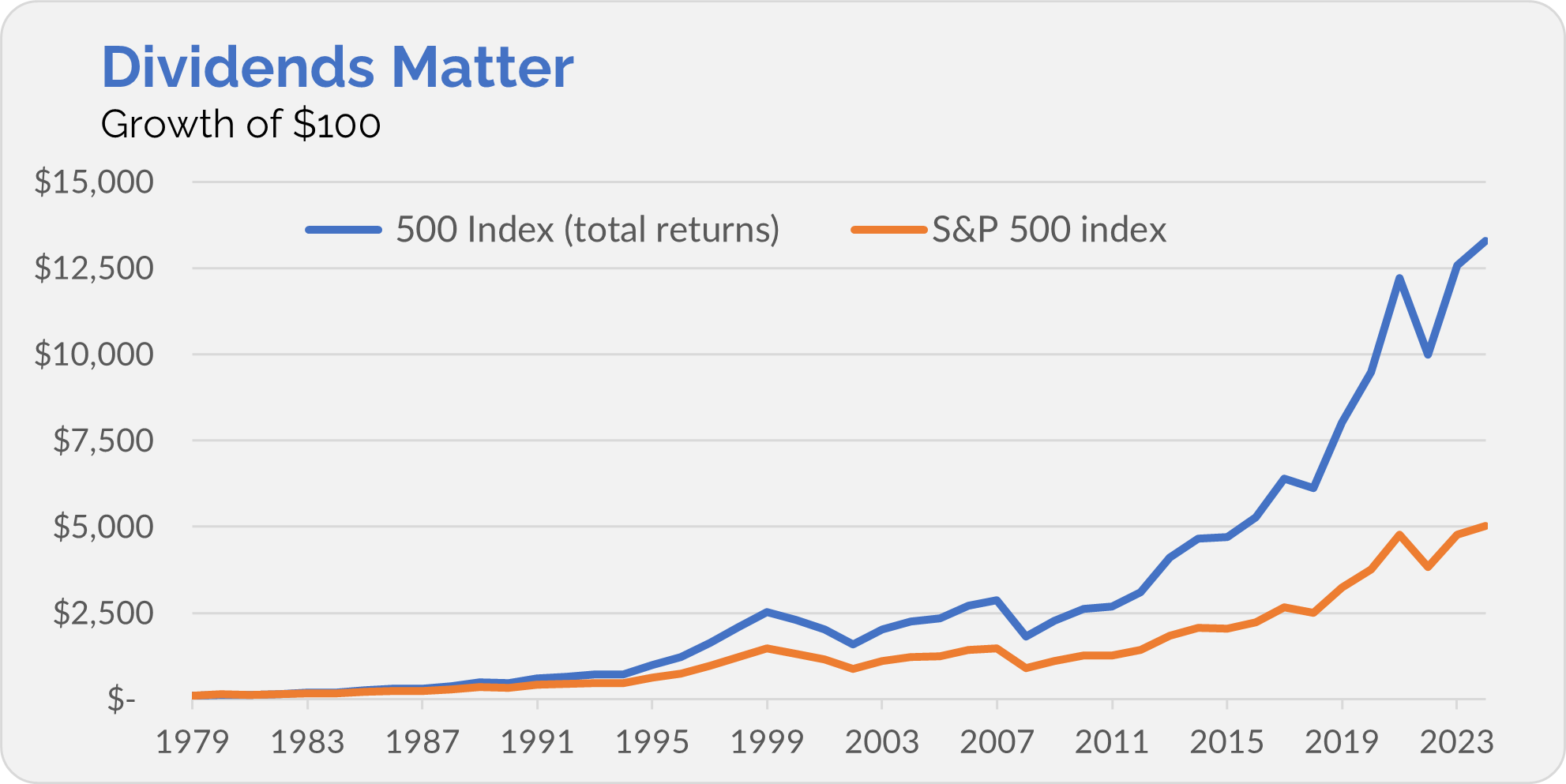

If that sounds preposterous, consider that 45 years ago (in 1979), the S&P 500 index was trading around 100. If you had told a 40-year-old in 1979 that the S&P 500 index would surpass 2000 in their lifetime—which it would reach after 45 years of 7% growth—they’d probably have laughed at you.

But here we are. Not 2000, but 5000! The S&P 500 index has compounded at a better than 9% annual rate over the last four and a half decades.

Do you think that after 45 years of better-than-average returns, we are in for a lackluster run in the stock market? Well, consider that if the S&P 500 index only compounds at a 5% annual rate, I’ll still see the index trade at 50,000 if I live to 90.

Big round numbers may feel good but are just steps on a long journey. Plus, the headline index numbers don’t include dividends. Add those back in, and the S&P blew past 5000 years ago.

Let’s put real dollars on it. 500 Index (VFINX) compounded at an 11.6% annual rate (including dividends and after fees) between the end of 1979 and the end of 2023. This means that a $100 investment in 500 Index made in 1979 turned into $5,000 in 2016. The position’s value was over $12,500 at the end of 2023.

The point is you shouldn’t get caught up in the headlines around big round numbers. Enjoy them, but look ahead to more gains because, well, that’s what stocks tend to do over time.

Fed on Hold

Not to be overly curmudgeonly, but the market’s obsession with when policymakers at the Federal Reserve (Fed) will cut interest rates is misguided and shortsighted.

As I mentioned, stocks sold off on Tuesday—500 Index fell 1.4%, and SmallCap Index (VSMAX) dropped 2.9%. The catalyst? Inflation clocked in at 3.1%, marginally ahead of the consensus expectation of 2.9%. The narrative was that with inflation still “hot,” policymakers at the Fed would delay cutting the fed funds rate.

According to the CME FedWatch Tool (which calculates, based on traders' actions, what they expect the fed funds rate to be in the months ahead), in January, 80% of traders thought policymakers would cut the fed funds rate in March. Today, nine out of ten traders expect the Fed will keep the fed funds rate at its current 5.25% to 5.50% target range in March. The consensus doesn’t expect policymakers to cut rates until June.

Whether the Fed cuts the fed funds rate in March (which is highly unlikely after the latest inflation reading) or June is irrelevant in the long run. Plus, we’re only talking about a tiny 0.25% tweak.

No U.S consumer or household is changing their day-to-day spending whether the Fed acts in June rather than March. Companies aren’t delaying investment projects until the Fed tweaks its policy either. In a few years, you’ll be hard-pressed even to remember if it was March or June. And it certainly doesn’t matter in the course of an investment lifetime.

The Votes Are In, Again

Vanguard’s second proxy voting pilot program, which I wrote you about in December, has begun.

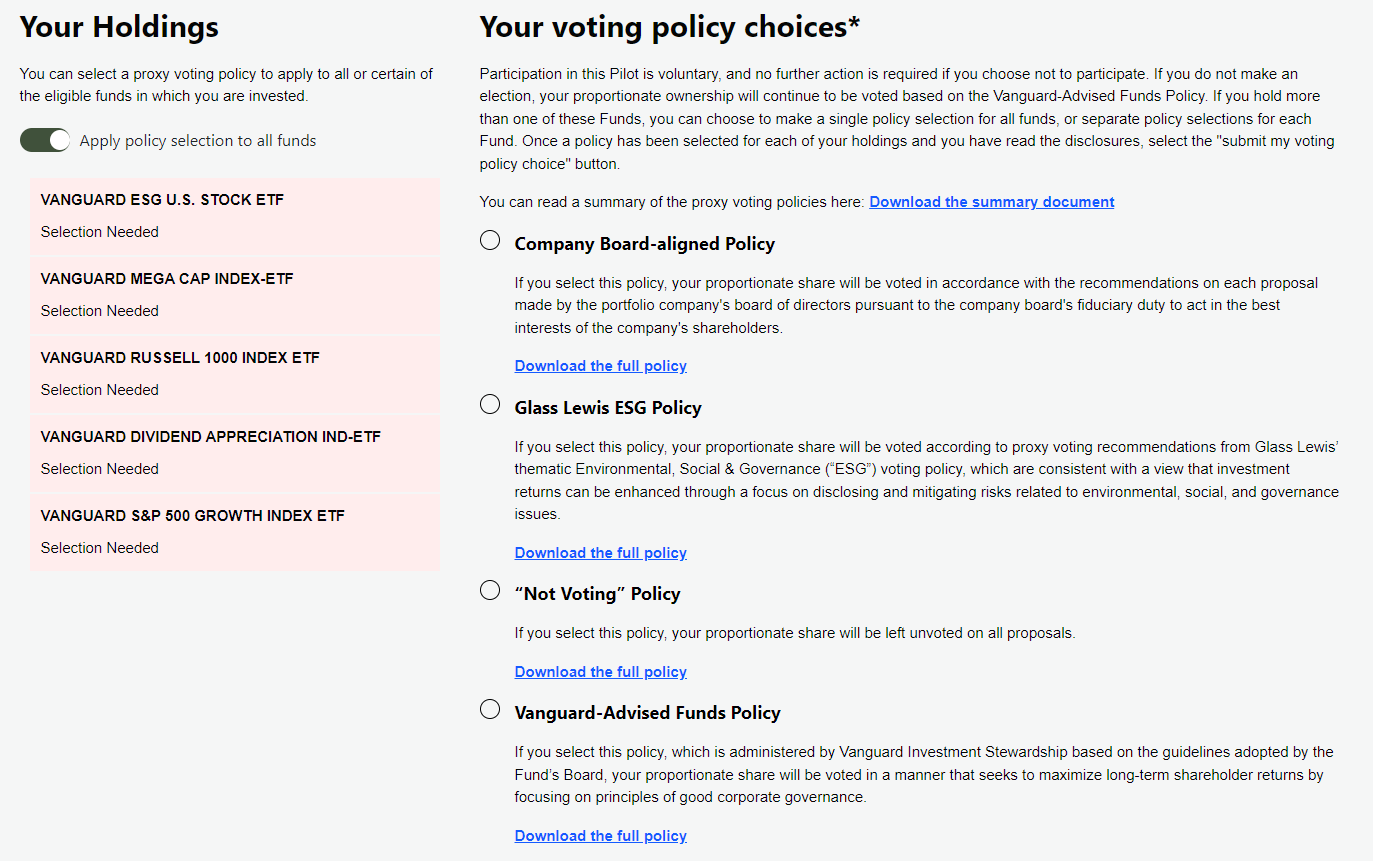

It’ll run from February 12 through June 30 and includes five funds: S&P 500 Growth ETF (VOOG), ESG U.S. Stock ETF (ESGV), Russell 1000 ETF (VONE), MegaCap ETF (MGC) and Dividend Appreciation ETF (VIG). If you own one (or more) of those five funds, you probably received an email from Vanguard to participate in the pilot program.

In a nutshell, the program lets you choose among four policies that determine how your votes will be cast at the annual shareholder meetings for the 30 largest companies in each fund. Premium Members can read more about the program here.

If you are interested in participating but don’t own any of those funds, you have until March 1 to buy shares. (To be clear, I don’t think that’s a good reason to buy any of these funds, but I want you to have all the information.)

Credit to Vanguard, it was super simple to participate in the pilot program.

The link in the email I received took me to a website with a clear explanation of the program and the four voting policies. (A screenshot is below.) I could select the voting policy I wanted on that page and apply it to all my holdings. (As a reminder, I own all of Vanguard’s ETFs!)

I believe it was five clicks in total, and I was done. Let’s applaud when Vanguard’s tech gets it right.

If you own one of these funds, by all means, participate in the pilot program and select the voting policy that makes sense to you. Just don’t expect it to move the needle on any issue.

Our Portfolios

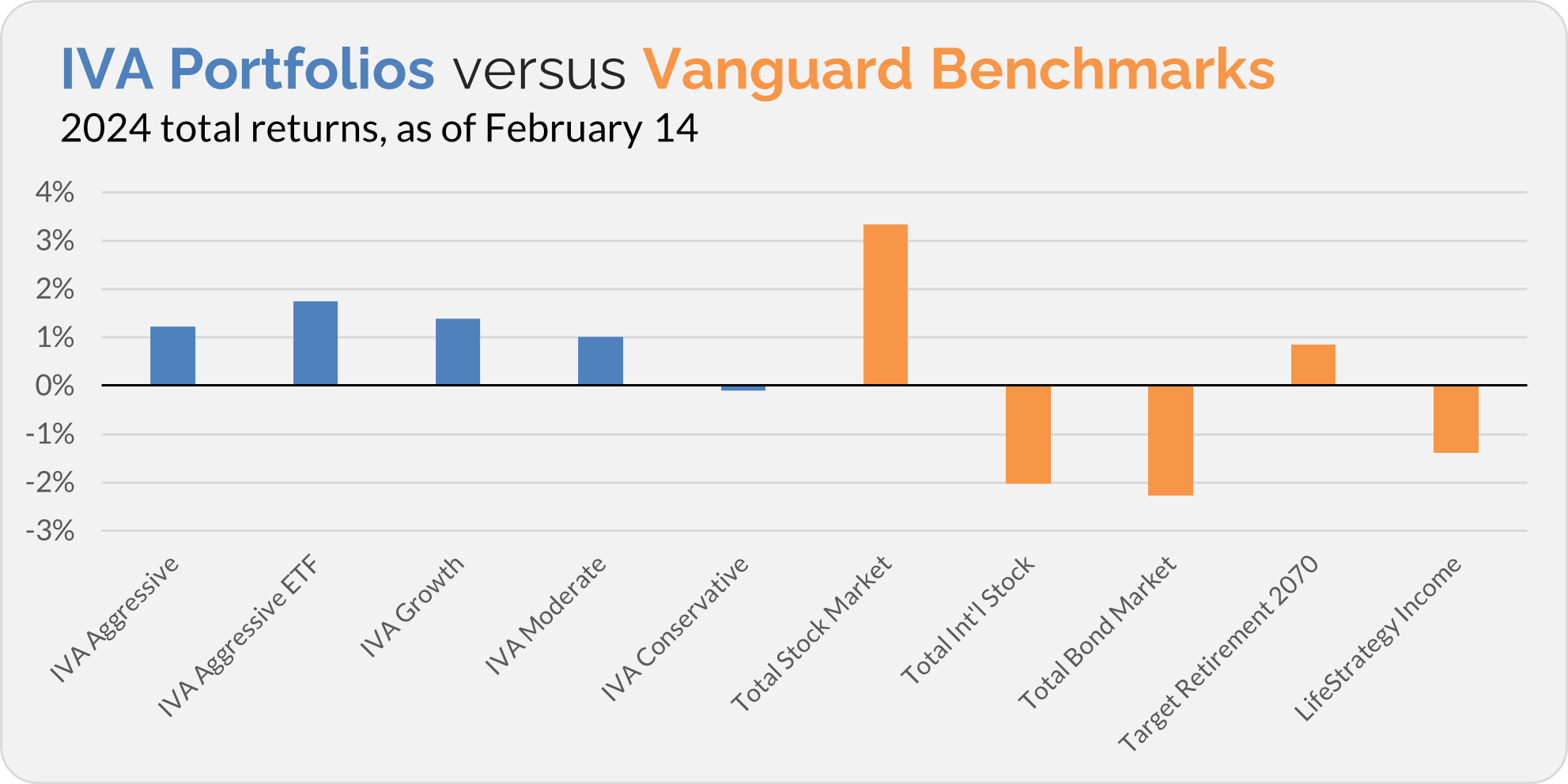

Our Portfolios are showing modest returns for the year through Tuesday. The Aggressive Portfolio is up 1.2%, the Aggressive ETF Portfolio is up 1.7%, the Growth Portfolio is up 1.4%, the Moderate Portfolio is up 1.0% and the Conservative Portfolio is down 0.1%.

This compares to a 3.3% return for Total Stock Market Index (VTSAX), a 2.0% decline for Total International Stock Index (VTIAX), and a 2.3% drop for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 0.8% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 1.4%.

IVA Research

Yesterday, in Van-guarding Your Cash, I kicked off a series of articles for Premium Members exploring Vanguard’s cash solutions. I hope you didn’t miss it.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.