Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, January 25th.

There are no changes recommended for any of our Portfolios.

Big tech companies are no longer untouchable. The Department of Justice is suing Google (known as Alphabet on Wall Street), alleging the search giant abuses monopoly power when it comes to online and mobile advertising. The lawsuit seeks to force Google to unwind past acquisitions and to divest its ad exchange (which links up websites and advertisers).

I don’t know how successful the DOJ will be. Ads are where Google makes big bucks though, so a drawn-out court case is guaranteed. But it’s not just Google—Facebook (now Meta Platforms), Apple and Microsoft all also face regulatory pressures. And it’s not just happening at home as these tech giants are also battling the European Union

Of course, it’s not easy to invest off this type of “macro news.” Google’s stock fell 2% … and it’s down some 35% from its November 2021 high. How much bad news is priced in? Hard to say. Plus, none of this regulatory pressure has stopped growth stocks from getting off to a nice start to the year. Through Tuesday, Growth Index (VIGAX) is up 8.1% while Value Index (VVIAX) is up just 1.7%.

Trading this kind of news is hard. The more relevant news will be fourth-quarter earnings and many of the big tech companies will be reporting over the next week or so. Of course, earnings aren’t necessarily any easier to trade around either.

For example, Microsoft’s stock initial rose when it reported earnings yesterday. However, the company suggested that its cloud business wouldn’t grow quite as fast in the next few quarters—we’re talking about 30% growth instead of 35% growth, so still strong—and the stock sold off after-hours. Today it’s down 3% or so I as write this.

Why talk big tech? Because they make up a huge percentage of the assets in funds like Growth Index, 500 Index (VFIAX) and Total Stock Market Index (VTSAX). According to The Wall Street Journal, the five largest stocks in the S&P 500, Apple, Microsoft, Alphabet, Amazon and non-tech Berkshire Hathaway are 18.9% of the index’s market capitalization, and that’s after their tumultuous tumbles in 2022.

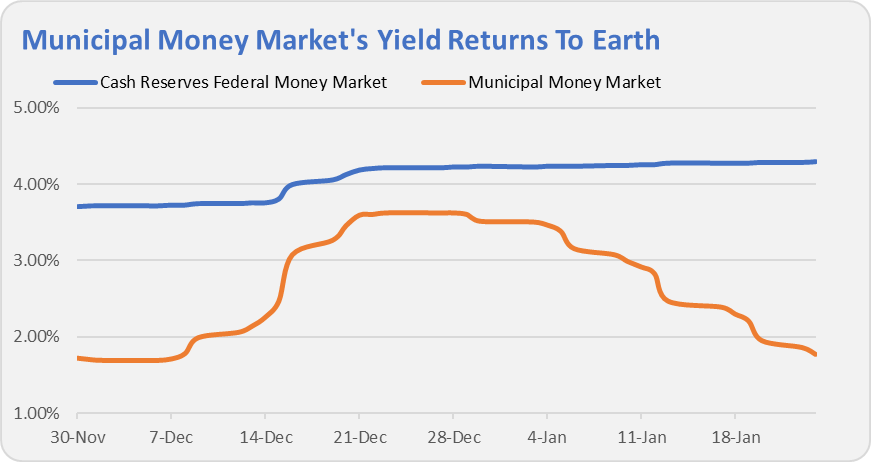

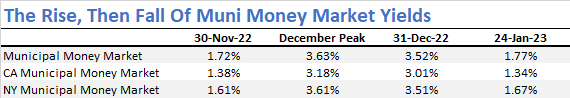

Money Market Yields Come Full Circle

In December, I told you to be wary of the abnormally high yields on Vanguard’s municipal money market funds. I warned they would not last. Two weeks ago, I showed you that they were on the decline. And now, well, we can wrap the story up, as those money market yields have returned to their November levels.

Unexpected Income

Unexpectedly, Multi-Sector Income Bond (VMSIX and VMSAX) is paying an income distribution today. Why today and not the final business day of the month as is typical? I couldn’t tell you.

It doesn’t “really” matter as the fund isn’t open to investors. The only assets in the fund are the $25 million that Vanguard seeded the fund with back in October 2021. As with all bond funds, Multi-Sector Income has had a tough run. That said, its 10.6% decline in 2022 was better than Total Bond Market Index (VBTLX), Core Bond (VCORX) and Core-Plus Bond (VCPIX) which fell 13.2%, 13.3% and 12.7%, respectively.

As with many of this month’s reversals of fortune, Multi-Sector Income is off to a decent start to the year. Maybe Vanguard should stop operating the fund in the shadows and open it to investors?

Our Portfolios

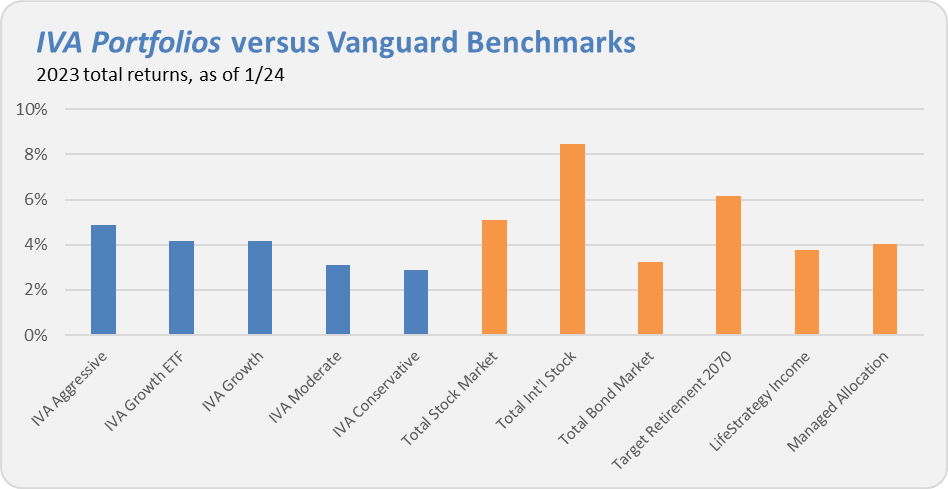

Our Portfolios are showing reasonable returns for the year through Tuesday. The Aggressive Portfolio is up 4.9%, the Growth ETF and Growth Portfolios have returned 4.2%, the Moderate Portfolio is up 3.1% and finally the Conservative Portfolio is up 2.9%. This compares to a 5.1% return for Total Stock Market Index (VTSAX), an 8.5% gain for Total International Stock Index (VTIAX), and a 3.2% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.1% for the year and its most conservative, LifeStrategy Income (VASIX), is up 3.8% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is up 4.0%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.