Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, January 11th.

There are no changes recommended for any of our Portfolios.

With only six trading days under our belts for the year it’s almost irrelevant to try and make heads or tails of the market. That said, 2023 is off to a good start. All but four Vanguard funds are showing gains. The exceptions are Health Care (VGHCX), Health Care ETF (VHT), Market Neutral (VMNFX) and Commodity Strategies (VCMDX) with losses ranging from 0.6% to 3.0%. I wouldn’t read too much into that.

And I wouldn’t read too much into the winners. Leading the way in 2023 are emerging market stocks and Baillie Gifford-run international funds. Adviser Select International Growth (VAIGX) tops the charts with a gain 9.4% through Tuesday. International Growth (VWIGX) isn’t far behind, up 7.2%. Emerging Markets Select Stock (VMMSX) lands in between the two with a gain of 7.7%.

As I said, it’s only six days.

Mixed Data

The economic data released this past week provided something for everyone. For the bulls out there, the unemployment rate ticked lower to 3.5%. Additionally, wage inflation cooled, giving the Federal Reserve (Fed) some cover to come off the monetary brakes a bit when they next meet at the end of January.

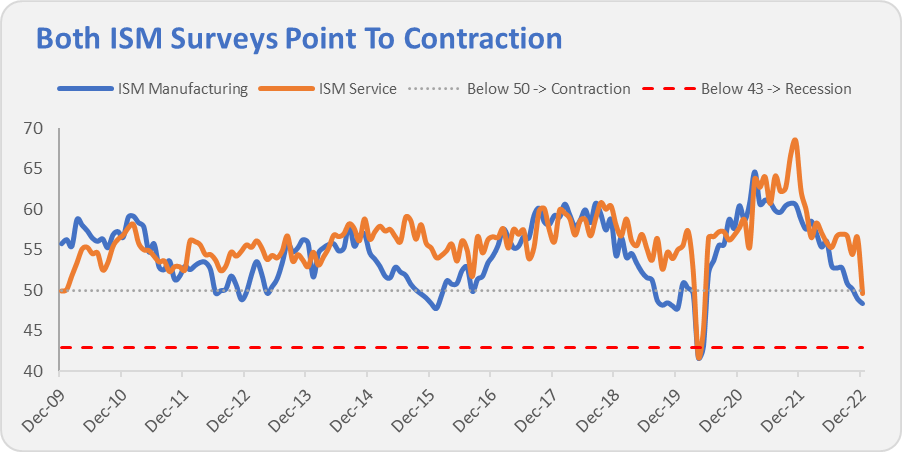

For the bears out there, we got yet another data point indicating that the economy is slowing down. The ISM Services survey fell below 50 for the first time since the 2008-2009 Great Recession (outside of two months around the initial pandemic shutdown). Anything below 50 suggests the economy is contracting. The index still has a way to go to reach “recession” levels, but with both ISM surveys (manufacturing and service) now coming in below 50, well, as I said, that’s another warning flag of an economic slowdown that might lead to recession.

This matches up with what I wrote in my 2023 outlook: With unemployment low, and hence consumers able to spend, it’s possible we’ll muddle through and avoid a recession. But the data pointing to a potential recession is piling up.

When Statements Mislead

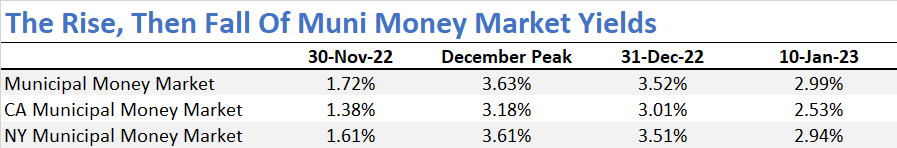

If you own one of Vanguard’s three municipal money market funds, beware when reviewing your year-end statement. The yield you see printed there is going to look attractive, but it’s already overstating what you’ll earn moving forward.

In December, I warned Premium Members that the spike in money market yields would prove fleeting. When I published that piece on December 23, Municipal Money Market (VMSXX) reported a 7-day yield of 3.63%—which turned out to be the peak. (Sometimes it is better to be lucky than good!)

That tax-exempt money market’s yield held at that 3.63% level for a few days and then began falling. It’s down to 2.99% (as of Tuesday, January 10). That’s still above the 1.72% level the fund was yielding at the start of December, so there is probably more room for the yield to continue dropping.

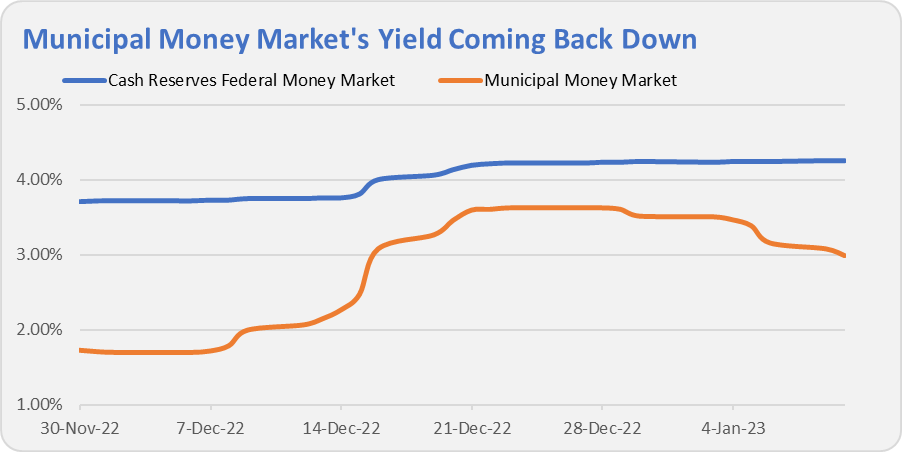

To be clear, this short-term spike in yields is a municipal money market phenomenon. As you can see in the chart below, Cash Reserve Federal Money Market’s (VMRXX) yield has been much steadier—it’s actually climbed slightly over the past week or so, while the tax-exempt fund’s yield has started coming back down.

50/50 > 60/40?

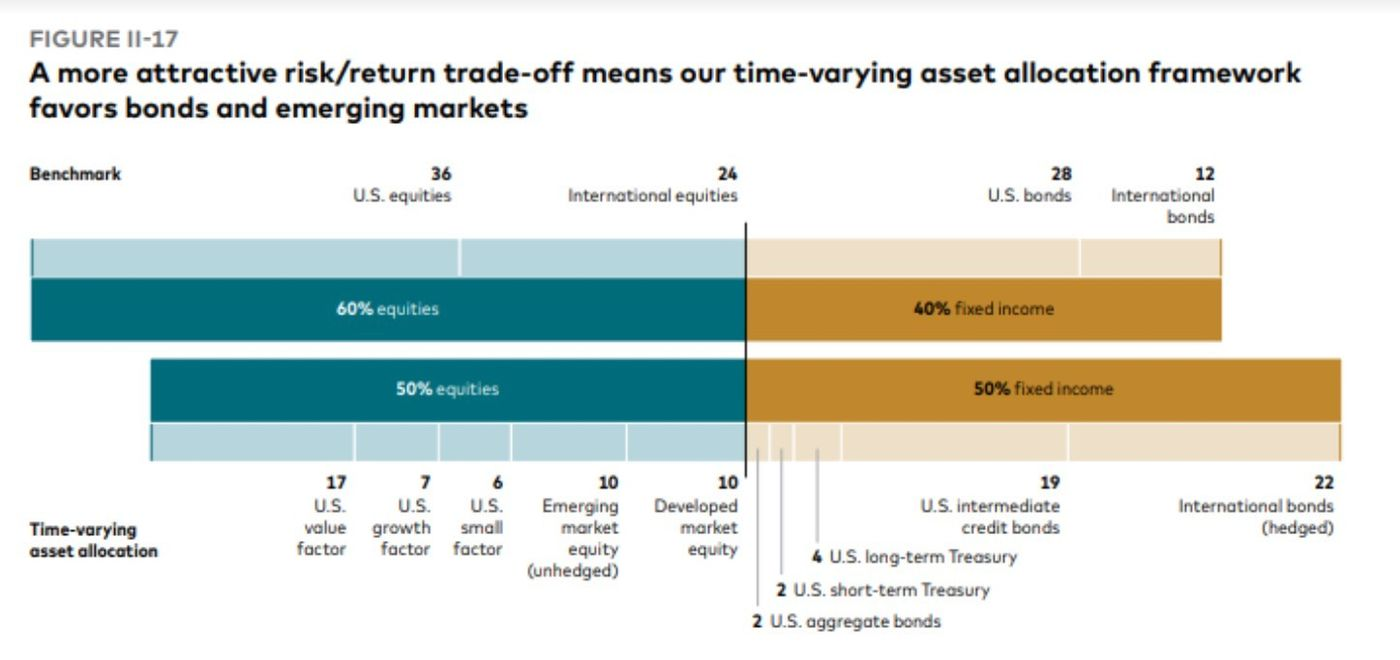

For many investors, 2022 suggested that the classic balanced portfolio—60% stocks and 40% bonds—is broken. I’ve taken the other side of that argument, see here. Vanguard’s Roger Aliaga-Diaz, head of portfolio construction, agrees that investors shouldn’t count out the 60/40 portfolio. However, he takes things a step further, using a “time-varying asset allocation framework” that spits out a fairly complex portfolio that is 50% stocks and 50% bonds as the “best” option.

Compared to the “benchmark” 60/40 this is a complicated portfolio that slices and dices the market into factors. On the stock side, Vanguard recommends, among other things, having 17% (or a third of your equity portfolio) in U.S. value factor (for example, U.S. Value Factor ETF (VFVA)). You should have another 7% in “U.S. growth factor” … though, I’ve never seen a growth factor fund or ETF. They also recommend putting 10% of the portfolio (which is 20% of the stock sleeve) in emerging markets. That’s a lot.

Turning to the bond side, Vanguard recommends some tiny allocations to Treasurys and “U.S. aggregate bonds” (think, Total Bond Market Index (VBTLX)). Why bother with just a 2% allocation to Total Bond Market Index? A bigger issue though: They suggest having 22% of your portfolio (or nearly half the bond allocation) in international bonds.

Put their recommendations together and Vanguard would have you invest 40% of your portfolio in foreign stocks and bonds. That could very well prove to be a smart call, but that’s not the point. How many investors are actually going to follow and stick with that advice? A “time-varying asset allocation framework” sounds fancy, but Vanguard needs to remember that investors don’t live in a spreadsheet—they live in the real world.

Is this really a portfolio anyone could actual stomach owning?

Speaking of investing in the real world, our Portfolios are off to a solid start to the year. International Growth and the PRIMECAP-run funds have offset Health Care ETF’s slow start. Through Tuesday, the Aggressive Portfolio is up 3.2%, the Growth ETF Portfolio has gained 2.1%, the Growth Portfolio has returned 2.7%, the Moderate Portfolio is up 2.2% and finally the Conservative Portfolio has advanced 1.8%.

This compares to a 2.3% return for Total Stock Market Index (VTSAX), a 4.6% gain for Total International Stock Index (VTIAX), and a 1.9% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSVNX), is up 3.0% for the year and its most conservative, LifeStrategy Income (VASIX), is up 2.0% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is also up 2.0%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.