Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, May 24.

There are no changes recommended for any of our Portfolios.

Down to the Wire

President Biden and House Speaker McCarthy continue to meet and discuss the debt ceiling with little to show for their efforts. As long as they are talking, a deal can be reached to avoid a default. But, geez, they are taking this down to the wire. It looks as though the bond and stock markets are finally beginning to react—negatively.

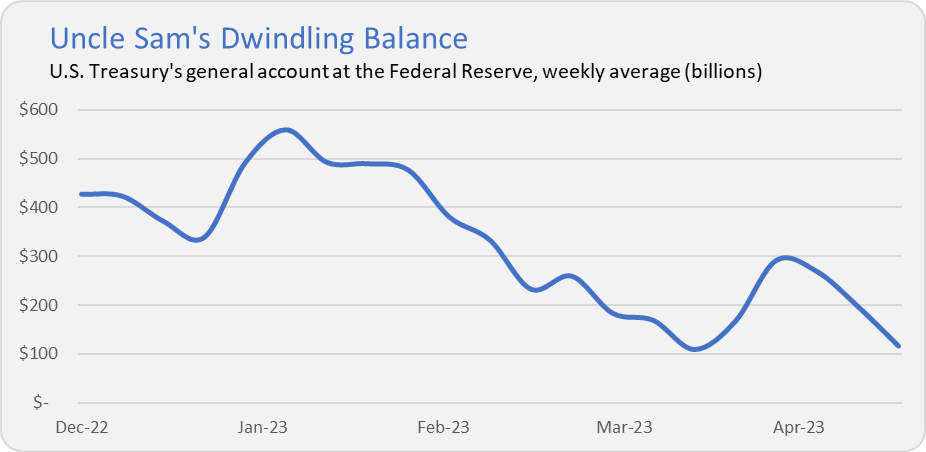

The chart below shows the running balance in the U.S. government’s checking account—technically, it’s the balance of the Treasury’s general account at the Federal Reserve (Fed). This is the U.S. Treasury’s primary operating account. Fed by tax receipts, nearly all government disbursements are paid from here. And if this balance runs out, someone isn’t going to get paid on time.

Heading for the exits

As I noted a couple of weeks ago in Ceiling the Debt? and dug deeper into for Premium Members in Fleeting Flight to Safety, so far, traders haven’t been overly worried about the U.S. defaulting on its obligation. I called it the calm before the storm. Well, the first drops of rain may have arrived.

- The Dow Industrial Average has declined three days in a row (and is on course to make it four).

- The S&P 500 index dropped 1.1% on Tuesday and is off another 0.8% so far today.

- The VIX index, a measure of market volatility that is commonly called the fear gauge, has jumped 25% or so in the last few trading days.

- The yield on the 1-month T-Bill has risen from 4.49% at the start of the month to 5.67%.

Traders aren’t rushing for the exit en masse, but some are showing themselves out.

Sound Familiar?

Time in the market, not market timing. You’ve heard us at The Independent Vanguard Adviser say it countless times before … and now it appears that even Vanguard’s got the message! (Though I wonder why they say “often better” as if to say sometimes market timing works. Talk about hedging.)

Anyway, we got there first. Thanks for the nod, Vanguard.

Our Portfolios

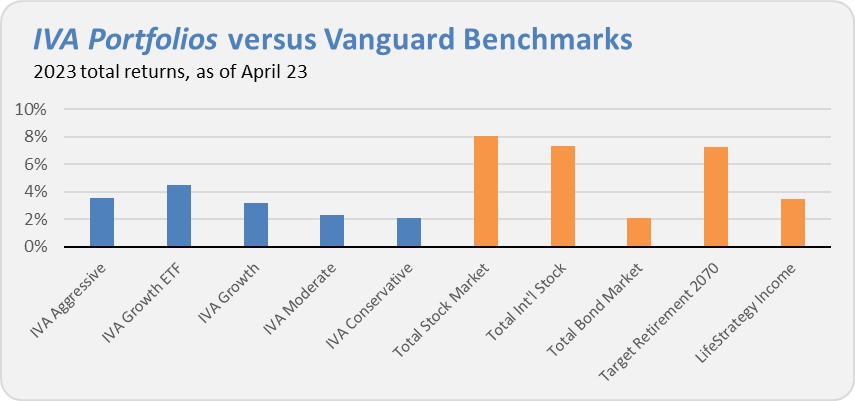

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 3.5%, the Growth ETF Portfolio is up 4.5%, the Growth Portfolio is up 3.2%, the Moderate Portfolio is up 2.3% and finally the Conservative Portfolio is up 2.1%.

This compares to an 8.0% gain for Total Stock Market Index (VTSAX), a 7.3% return for Total International Stock Index (VTIAX), and a 2.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 7.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.5% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.