Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, May 10.

There are no changes recommended for any of our Portfolios.

Playing Chicken

President Biden hosted meetings with House Speaker Kevin McCarthy and other congressional leaders yesterday. The topic of conversation? Raising the debt ceiling. The Treasury Department estimates it will be unable to pay all of its bills as soon as June 1 if the debt limit isn’t raised.

Politicians on both sides of the aisle say that a default is not an option, but, well, political sausage making is always messy. Time is short but my expectation is that a deal will be reached, and the U.S. government will not default.

Premium Members can find a deeper look at the debt ceiling and what it means for our portfolios here.

If you’re not already a Premium Member, and want to read my take on the situation, you can start a free 30-day trial by clicking the button below:

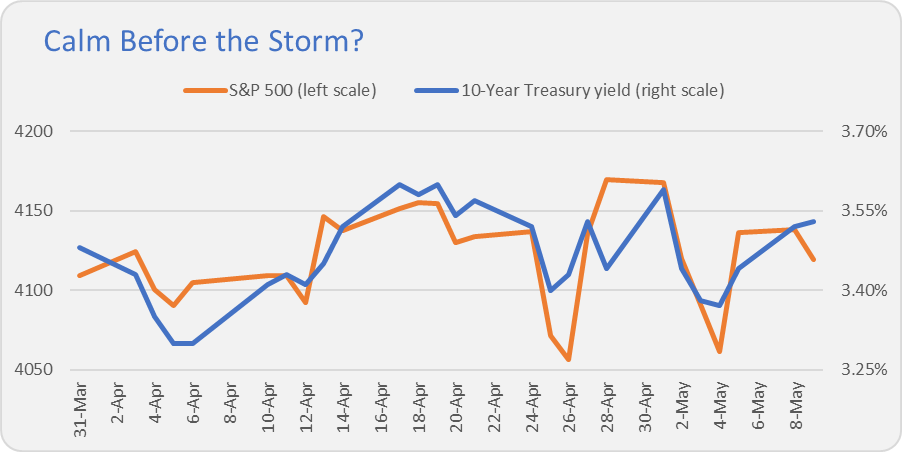

The markets, surprisingly, haven’t been roiled by the uncertainty. From the end of March through Tuesday night, the S&P 500 index has traded in a narrow 3% range—from a low of 4055 to a high of 4169. Over that period, the 10-Year Treasury yield has also been fairly stable—trading between 3.30% and 3.60%.

It could just be the calm before the storm. But—despite what you read in the headlines—the collective wisdom of the markets is not in a panic over a potential U.S. government default.

Inflation Check-In

Inflation held steady in April. According to the Bureau of Labor Statistics (BLS), consumer prices increased 0.4% in April, which means over the past year the Consumer Price Index (CPI) is up 4.9%—just a tick lower than March’s annual inflation rate of 5.0%.

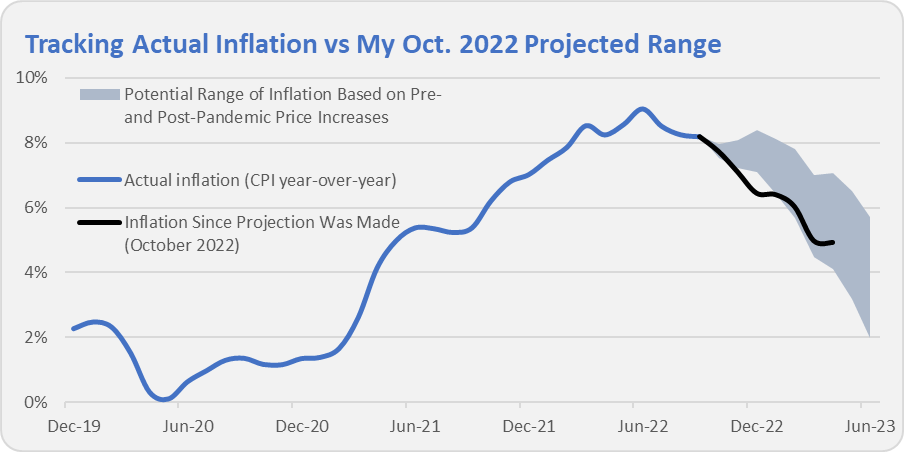

For several months now, I’ve been comparing reported inflation against the range I forecast back in October—below is the latest update. My base case assumption was for inflation to slow but to stay above pre-pandemic levels. So far, so good. Inflation at 4.9% is toward the lower end of my projections for April.

Unless something dramatic happens (say, the U.S. government defaults), we can be pretty confident that the annual inflation figure will drop over the next two months. Why am I confident in making that prediction? Simple math.

CPI increased 0.9% in May 2022 and another 1.2% in June 2022, and those numbers are going to roll off the annual calculation. So, unless prices increase 1% or so this month and next, then the annual inflation figure is destined to drop.

With CPI up 2.4% since the end of June 2022, I expect inflation will clock in between the current 4.9% annual rate and that 2.4% since-June number.

No. I won’t be trading my portfolio based on that two-month outlook. The point of this exercise was to try and set some reasonable expectations on inflation at a time when investors were worried about runaway price increases.

Down to the Wire

You might remember that last December Vanguard’s ability to buy utility stocks was threatened. Vanguard, due to its size, was forced to ask for a waiver from the Federal Energy Regulatory Commission (FERC) to own more than 10% of a utility’s voting shares. To do that, Vanguard had to pledge that it will be a passive investor.

Well, last December a coalition of attorney generals argued that because Vanguard was involved in emissions-reduction campaigns through its membership in groups like the Net Zero Asset Managers (NZAM) alliance, the firm had “abandoned its status as a passive investor in public utilities and adopted a motive consistent with managing the utility."

As I told you at the time, Vanguard caved to the pressure and exited the NZAM alliance. My take then (and now), is that Vanguard saw this as a credible threat to its ability to buy enough utility shares to run its index funds properly. The powers that be at Vanguard were willing to get egg on their faces by backing out of the NZAM rather than run that risk.

I thought Vanguard pulling out of the NZAM alliance would be the end of the story—at least from this regulatory perspective. (Of course, there are groups on the “other side” of the issue that are, let’s just say, disappointed in Vanguard.) But, the complaint against Vanguard was not withdrawn and May 9 was the deadline for FERC to extend Vanguard’s waiver.

It went down to the wire, but ultimately FERC granted Vanguard a three-year authorization to continue buying U.S. utility stocks.

Putting aside the climate and ESG question, this ruling is a good thing for the typical Vanguard investor. Pretend you’re a long-time shareholder of Total Stock Market Index (VTSAX) sitting on a large unrealized gain. (The fund is up nearly 200% over the past decade, for example.) If Vanguard can’t buy utility stocks, you suddenly have to decide whether to sell the fund—realizing a large gain and tax bill in the process—to move to another index fund that isn’t restricted from buying utilities or to hold the fund and accept some tracking error from the index.

For most investors, the answer is probably to stand pat … but weighing tracking error against taxes isn’t really something the average investor is well versed in.

The ESG debate isn’t going away, and Vanguard will continue to face pressure from both sides, but at least millions of investors didn’t have to wake up today and answer the question: Do I stick with Vanguard even though they can’t buy utility shares?

The Bond Tide Turned Years Ago

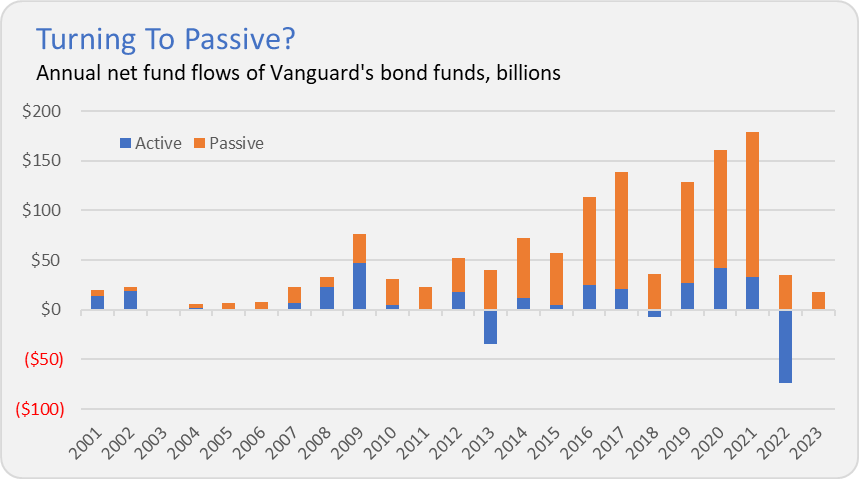

A recent Bloomberg article featuring Josh Barrickman—who manages pretty much all of Vanguard’s bond index funds, including Total Bond Market Index (VBTLX)—highlighted that investors pulled a record amount of money out of actively managed bond funds in 2022.

I agree with the premise of the article: For many bond investors, 2022 was akin to 2008 for equity investors—the final strike against active managers. After 2008, many investors said, “if my active manager isn’t going to protect me, I might as well go to an index fund and keep costs low.” Or at least, that’s what was said about stock managers; active bond managers were spared that conclusion … until 2022.

Looking at Vanguard’s stable of bond funds (and excluding the money market funds), investors pulled nearly $75 billion out of the active funds while adding $35 billion to the passive funds (index and ETFs) last year. As you can see in the chart below, that’s easily the largest net outflow for Vanguard’s active bond funds over the past two decades or so.

But the move toward passive has been taking place for years now. In four of the last six calendar years, investors put over $100 billion into Vanguard’s bond index funds. Last year was actually an off year for inflows to Vanguard’s index funds.

I still think we’ll look back at 2022 as the defining year in the active versus passive debate among bond investors, but the tide had turned in favor of index funds years ago.

Tracking Activity

I promise you; I can’t wait to write an article celebrating how Vanguard has stepped up its tech game and is delivering top-notch customer service … but today is not that day.

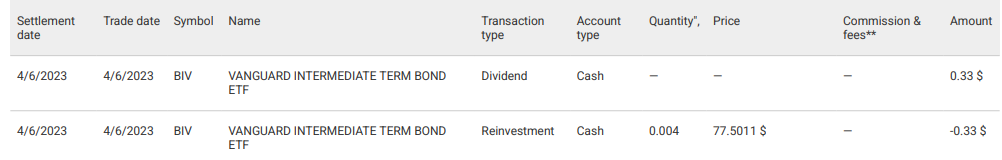

The latest complaint I’m hearing is around Vanguard’s transaction reports. The default export option is now a PDF which simply isn’t user-friendly if you’re trying to manipulate the data or interact with another tool (e.g. home finance software, Quicken). And while a PDF should allow Vanguard some level of quality control on the output, they’ve got some work to do on that—the dollar signs don’t look to be in the right place.

And when I clicked through to the “download center,” which at least gives me options to download information for Quicken or as a spreadsheet, well, I kept getting an error:

At this time, we’re unable to download Vanguard account data. We’re sorry for the inconvenience.

That was yesterday. Today, the download center seems to be functioning again.

Our Portfolios

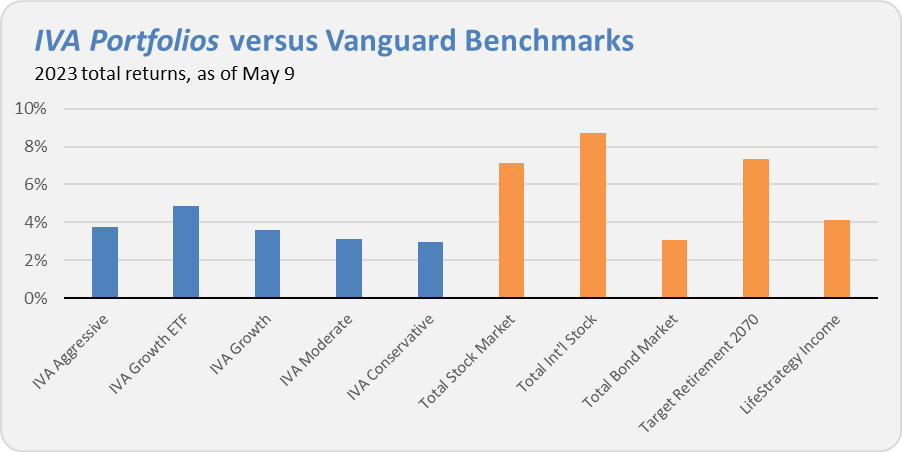

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 3.8%, the Growth ETF Portfolio is up 4.9%, the Growth Portfolio has gained 3.6%, the Moderate Portfolio has returned 3.1% and finally the Conservative Portfolio is up 3.0%.

This compares to a 7.1% gain for Total Stock Market Index (VTSAX), an 8.7% return for Total International Stock Index (VTIAX), and a 3.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070(VSNVX), is up 7.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.1% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.