Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, December 28th.

There are no changes recommended for any of our Portfolios.

Yesterday, I shared my outlook for 2023 with Premium Members. In the next few days and weeks, I’ll be reviewing 2022 in depth and grading my outlook from a year ago. I know, I may have gotten that order backwards, but, well, I was eager to share my outlook. Plus, when it comes to investing, while it is helpful to know how we got to where we are, what matters more is how we position our portfolios for the road ahead.

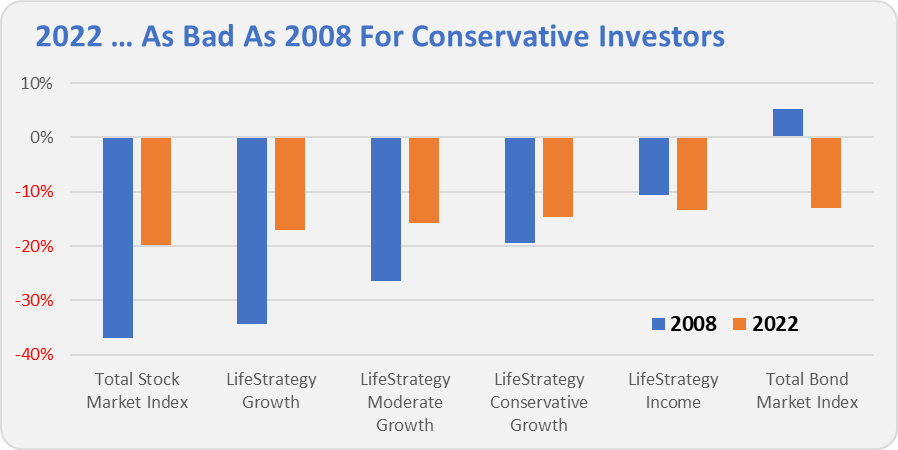

That said, as I’m pulling together my review of the last 12 months what jumps out to me is just how difficult a year it has been—particularly for the more conservative investors amongst us. Many investors look back at 2008—when Total Stock Market Index (VTSAX) fell 37%—as the worst year in the market in their investment careers. Well, for those who thought they were keeping risk as low as possible with large holdings in bonds, they saw their portfolios take a major whacking in 2022.

In the chart below, I’ve plotted the 2008 and 2022 (as of Dec. 27) returns for Total Stock Market Index and Total Bond Market Index (VBTLX) alongside the returns of Vanguard’s four LifeStrategy funds. As you move from left to right on the chart you move down in stock exposure.

Looking at the most conservative of the four options, you can see LifeStrategy Income’s (VASIX) 13.4% 2022 decline is steeper than its 10.5% drop in 2008. Yes, there are a few days left in the year, so maybe the fund can rally to come back from behind, but that won’t change the story.

Stocks falling 20% or so in a calendar year isn’t fun, but it’s also something most investors expect and are prepared for. But bonds falling 13%? That’s an unexpected game-changer.

I know that many critics will blame the Federal Reserve’s (Fed) interest rate hikes as the reason bonds took a dive, but the real culprit is inflation. Rising prices are the enemy of a fixed income investor, so when inflation goes from muted to the highest level in three-to-four decades, we shouldn’t be surprised that fixed income securities follow suit with their worst performance over the same period.

As I explained in the outlook, the return prospects for bonds have dramatically improved from a year ago—Total Bond Market Index’s yield has more than doubled from under 2% at the start of the year to over 4% today. Though I know many conservative investors are frustrated by what they see in the rearview mirror (as reported on their monthly account statements), the view through the windshield looks better. Much better. Stay the course.

Our Portfolios are going to end the year in the red. But the Aggressive Portfolio is ahead of the broad stock market by three-to-four percentage points. I’ll take that—especially in a down year.

International Growth (VWIGX) has been a drag on our returns, down 31.0% on the year through Tuesday. However, offsetting that has been solid performance from Don Kilbride at Dividend Growth (VDIGX) and our continued overweight to Health Care ETF (VHT), with returns of -4.7% and -6.0%, respectively.

Additionally, five of the six PRIMECAP Management-run funds (three at Vanguard, three through the Odyssey funds) also outperformed the broad market this year. The recently reopened PRIMECAP Odyssey Aggressive Growth (POAGX) was the outlier. (I’m not worried by that and see it as an opportunity to buy into the fund at lower prices.)

On the bond side, I’ll say, “mea culpa.” I could’ve done more to protect us given my bold prediction coming into 2022 that bonds would notch back-to-back down years for the first time in decades. But I wasn’t willing to simply abandon the asset class. I’ll take credit, though for avoiding long maturity bonds.

As of Tuesday night, Long-Term Bond Index (VBLAX) was down 26.9% on the year. Comparatively, holding Short-Term Investment-Grade (VFSTX) which is only off 5.8%, feels like a big win. Of course, Intermediate-Term Investment-Grade’s (VFICX) 13.7% decline isn’t anything to celebrate.

Wrap it all together and here is where our Portfolios stand for the year through Tuesday. The Aggressive Portfolio is down 15.4%, the Growth ETF Portfolio is off 18.5%, the Growth Portfolio is down 14.0% and finally the Moderate Portfolio has declined 10.7%. This compares to a 19.8% decline for Total Stock Market Index (VTSAX), a 15.8% drop for Total International Stock Index (VTIAX), and a 13.0% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065 (VLXVX), is down 17.4% for the year and its most conservative, LifeStrategy Income(VASIX), is down 13.4% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation(VPGDX) is down 9.0%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future and a very happy new year!