Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, August 9.

There are no changes recommended for any of our Portfolios.

Scheduling note: As I’ll be stepping away from the desk for a few days of late-summer R&R, there won’t be a Weekly Brief next week. However, Premium Members should keep an eye out for another of my IVA Research Articles. (I may take a vacation, but I never sleep when it comes to helping you make the most of your Vanguard investments.)

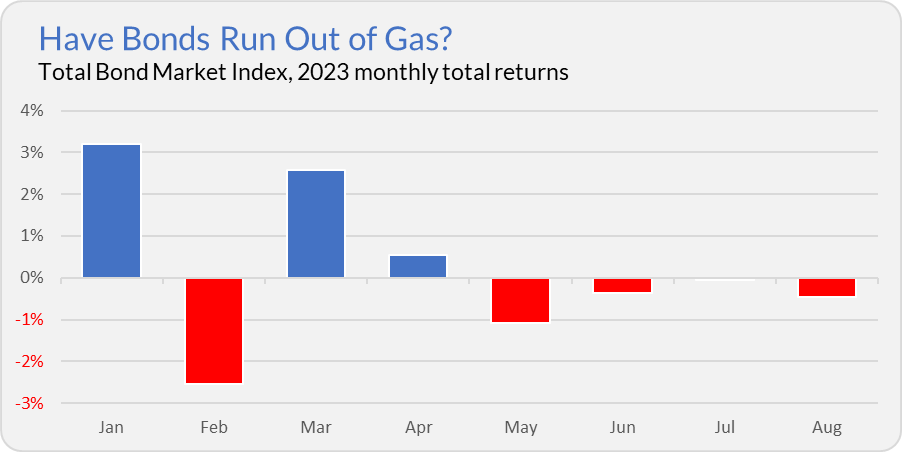

For all the talk about whether the stock market is in a new bull market (or not), the bond market has been stuck in a funk these past few months after a promising start to the year. Total Bond Market Index (VBTLX) gained 3.2% in the first quarter and another 0.6% in April. But the broad bond index fund has lost money for three consecutive months and is off another 0.5% in August, bringing its year-to-date return through Tuesday night to just 1.7%.

Even as the Federal Reserve’s interest-rate hiking program is nearing an end, the bond market isn’t bouncing back anywhere nearly as quickly as the stock market. While frustrating, I don’t think that’s cause for concern. The road to recovery for bonds (and bond funds) was always going to be long. As I have written, you have to Give Bonds Time to recover.

Remember, there is a positive to the short-term pain bond investors are enduring—higher yields. For example, Total Bond Market Index’s (VBTLX) yield is up from 4.00% at the end of April to 4.47%. With time that higher level of income will accrue to shareholders’ bottom lines.

Another Shift Ends

Many of Vanguard’s biggest and most popular index funds have been run for years by the duo of William Coleman and Donald Butler. But that era is coming to a close. By year-end, both will have stepped away from managing funds. Coleman moved to a new role within Vanguard back in February. Butler just announced his retirement.

While Butler will continue to help manage the funds he’s assigned to until December 21, Vanguard has already named his replacements. That’s good practice.

The table below provides specifics on who is stepping in for Butler on each fund:

| Fund | Butler's Replacement |

| 500 Index | Aaron Choi & Nick Birkett |

| S&P 500 Growth ETF | Kenny Narzikul |

| S&P 500 Value ETF | Kenny Narzikul |

| Tax-Managed SmallCap | Kenny Narzikul |

| MidCap Index | Aaron Choi |

| MidCap Growth Index | Aaron Choi |

| MidCap Value Index | Aaron Choi |

| S&P SmallCap 600 ETF | Nick Birkett |

| S&P SmallCap 600 Growth ETF | Nick Birkett |

| S&P SmallCap 600 Value ETF | Nick Birkett |

| Extended Market Index | Nick Birkett |

| Source: Vanguard and the IVA. | |

Shareholders of these funds (and ETFs) shouldn’t be overly concerned about Butler’s departure. A manager’s departure from an index fund isn’t the same as when a stock picker walks away from an active fund. Plus, Vanguard has as much experience as any firm in managing index funds—and managing index fund manager transitions.

Still, Vanguard could do a much better job communicating these changes. Yes, Vanguard updates the prospectuses—as required—but how many shareholders read those? By not broadcasting the manager changes more broadly, Vanguard is telling us that it’s not the individual managing your stock index fund that matters.

Reasonable people can agree with Vanguard on that. But I think knowing who manages your fund is essential because the buck doesn’t stop with a machine; it stops with the individual in charge. And there are many bucks at stake here.

For example, I like to know if managers are invested alongside shareholders—even in index funds. Of the managers replacing Butler, only Aaron Choi is invested—he has between $100,000 and $500,000 in 500 Index (VFIAX).

That’s not a great look, in my view. The only rationale I can think of is that all these managers are invested in funds they don’t have a hand in, such as Total Stock Market Index (VTSAX). We’ll never know because Vanguard never tells us. Again, they must think the manager is irrelevant to the fund and its shareholders.

Our Portfolios

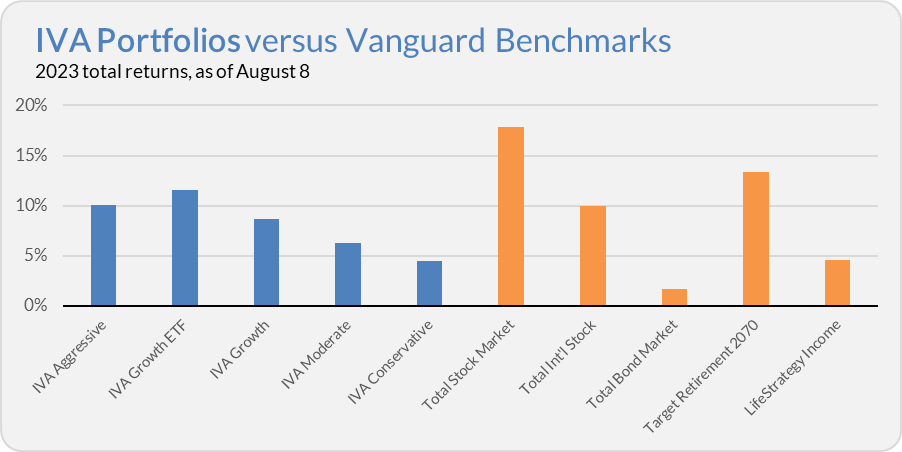

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 10.1%, the Growth ETF Portfolio is up 11.6%, the Growth Portfolio is up 8.7%, the Moderate Portfolio is up 6.3% and the Conservative Portfolio is up 4.5%.

This compares to a 17.8% gain for Total Stock Market Index (VTSAX), a 10.0% return for Total International Stock Index (VTIAX), and a 1.7% advance for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 13.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.6% for the year.

Dividend Growth (VDIGX) and Health Care ETF (VHT), with gains of 3.4% and 0.4%, respectively, have been the primary culprits for our relative underperformance this year. Both funds are holding up better than the market in August—though it’s only been six trading days.

Also, U.S. Value Factor ETF (VFVA) has gotten off to a good start in our Portfolios. The factor ETF is only down 0.5% in August, while Total Stock Market Index has declined 2.1%. It’s very (very) early days, but that’s a step in the right direction.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Not a Premium Member yet? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.