I know, teenage retirement sounds ridiculous. Unless they’ve discovered the cure for cancer or founded the hottest internet gaming site known to man, your teen isn’t going to retire for a long, long time. In fact, I’d be surprised if your teen has even given retirement a split second of thought—as is appropriate.

That doesn’t mean that YOU can’t be thinking about your teen’s retirement.

While many of us talk about taking an early retirement, we rarely contemplate the idea of making an early retirement for someone else. In particular, how about making one (or at least starting one) for a young family member or friend—yes, even someone as young as a teenager?

Every year, I suggest opening an IRA for your teen or grand-teen. (I usually make this suggestion around tax season, but with summer jobs kicking into gear, now is a good time to mention it, so you can plan ahead.) And, yes, every year I hear from subscribers saying, in a nutshell, “Great idea. Never thought of that.”

And it is a great idea. Helping a young person prepare for retirement may not get you lots of high-fives or fist-bumps today. But trust me, the beneficiary of your forward thinking will thank you for years to come as they move into and through adulthood.

Housekeeping

A few quick notes before we get further into the topic:

Credit where it’s due: Dan’s been writing about this strategy since he funded IRAs for his teenage children (to much eyerolling). But now that his children are adults, they’re thankful.

Also, let me thank my parents for funding a Roth IRA on my behalf during my teenage years—I’m not sure where you got the idea from, but thank you! And though my toddler won’t be working anytime soon, I look forward to getting him off to an early start when the time comes.

Typically, this article (and the linked article on compounding which you’ll also receive via email) would be reserved for Premium Members, but I hope this is an idea you want to share with others—be it a parent of a teen or even someone who’s still a teen or young adult. So, I’m making them available to everyone.

Please, share it with anyone you think might find it useful.

How it works

It’s pretty simple. Once someone starts earning income, they are eligible to contribute to a retirement account. This means that even if that earner is a teenager working part-time or picking up a summer job, yes, they can start building a retirement nest egg.

A young person (anyone under 50, according to the IRS) can contribute earnings of as much as $6,500 to a Roth IRA. Make just $3,000 working this summer, and they can put $3,000 into an IRA. Earn $10,000 working part-time, year-round, and their contribution is capped at $6,500.

Do I really expect a teenager to save for retirement? No. Absolutely not.

I know that it would be nice if junior earners would take on this chore themselves, but how many teens do you know who read investment newsletters? And if they did, where would they get the money to stash in a Roth IRA? Most spend what they make, and then some. That’s one reason I believe the world invented parents (and uncles, aunts and grandparents).

Even if I don’t expect a teen to save for retirement, that doesn’t mean we “elders” can’t help them!

Let’s assume you can afford to match your teen’s summer earnings. Do it. Let them have their hard-earned money but open a Roth IRA in your child or grandchild’s name and add the money yourself. Remember, the child may earn $1,250, but with taxes taken out, they will not bring it all home. That doesn’t keep you from putting a full $1,250 into a Roth IRA for them. (Or, for that matter, for any teen you want to help out. They don’t have to be a family member.)

Maybe you can’t afford to add the full amount. Consider making a deal with your teen to match a portion of any earnings that they add to the Roth IRA as well. If the teen contributes $250, maybe you’ll contribute $500 or $1,000.

Roth over Traditional

I was intentional when I wrote “Roth IRA” in the paragraphs above, because I think they are a better choice for younger people than traditional IRAs.

Both traditional and Roth IRAs are powerful options that allow you to compound your earnings tax-free. But, of course, you have to have a long-term mindset. The money contributed is generally locked up until the IRA’s beneficiary is 59 ½ years old—unless they feel like paying a 10% fee on withdrawals.

There are some exceptions to that penalty—for instance, if the distributions will be used for a first-time home purchase (something today’s kid might appreciate down the road) or to help with a disability—but really you shouldn’t expect this money to be touched for years and years. Once clear of the age of 59½, that 10% penalty disappears.

But Roth IRAs have the clear advantage over traditional IRAs—though, again, your teen won’t understand why until they are well down the retirement road. The advantage is withdrawals:

A traditional IRA forces you to take distributions in retirement (for today's teens that means the age of 75), paying income taxes at your future, and possibly higher, tax rate. With a Roth IRA, once you hit retirement, there is no requirement on distributions—if you don’t feel like taking money out or don’t need it, you can leave it to continue growing tax-deferred. And if you do make withdrawals, they are entirely tax free.

Also, it’s worth noting that the owner of a Roth IRA can withdraw contributions at any time, tax- and penalty-free, after five years. Since taxes have already been paid on the contributions, they won’t be taxed again … it’s the earnings that would be taxed and subject to a penalty if an early (pre-59½) distribution is taken. I’d strongly discourage anyone from doing this—the ability to compound tax-free for years is so powerful.

The bottom line is that putting money in a Roth IRA where a teen can leave it to compound tax-free indefinitely and avoid paying taxes on withdrawals in retirement, well, that’s a gift they will come to greatly appreciate.

Spending Decades in the Market

The power of compounding is what really makes funding a teen’s Roth IRA such a smart investment.

The definition of compounding is “the act of generating earnings from previous earnings.” While I know you know what that means, it’s not intuitive and, frankly, it takes time to see (and feel) the impact of compounding.

The “classic” example of compounding is that the inventor of chess, for his reward, asked for a grain of rice for the first square of the board, two grains for the next, four for the next and so on. It sounds small and manageable at first, but by the 64th square, we’re talking about enough rice to cover the whole of India in a meter of rice.

But … well, we don’t operate in chess squares and rice in our day-to-day. So, in Compounding Takes Time, I walk through the merits of investing early and often by comparing four different investors. It is (in my humble opinion) a good article to share with a young person you are encouraging to start investing.

But let me show you the value of helping a teen get an early start on funding their retirement—even if you can only help a little for a limited amount of time.

Let’s say your teen starts their first summer job at age 15, and it’s one that they continue to hold through college (age 22). You are able to contribute $1,000 to their Roth IRA each year for those seven years—putting in a total of $7,000. However, that's the end of your contributions—another penny is never added to the account.

Would that be worth it? Absolutely.

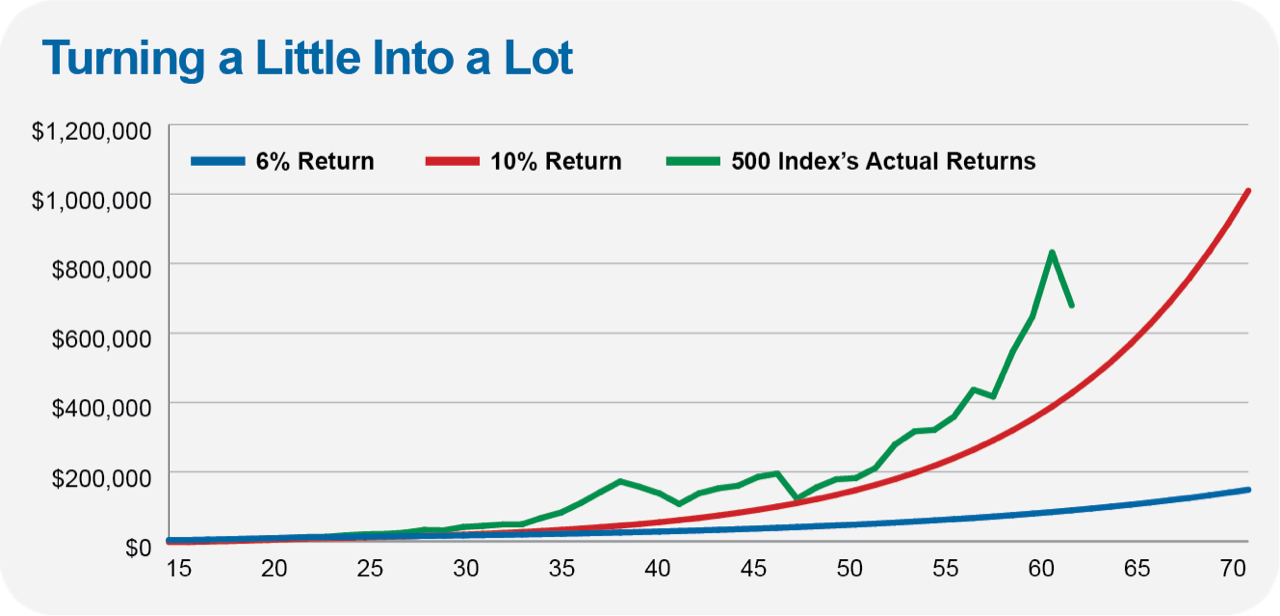

Consider the chart below, where I’ve plotted the growth of our teen’s portfolio over time assuming different rates of return. Even if your teen’s money goes on to only compound at a 6% annual rate, they’ll turn that $7,000 into over $80,000 by the time they turn 60 (and can start withdrawing it penalty-free).

If they leave the money untouched and it continues to grow 6% per year for another decade, they’ll have nearly $150,000 in the account on their 70th birthday. Not too shabby.

The results are even more compelling if your teen earns better returns. Stocks have historically compounded around 10% per year. Compound at 10% a year, and that $7,000 contribution becomes nearly $400,000 on your no-longer-a-teen’s 60th birthday. Give it another ten years, and we’re talking about a portfolio worth around a million dollars.

Of course, stocks don’t go up in a straight line, so in the chart above I included the actual results of an investment made in 500 Index (VFINX) starting with the index fund’s first full calendar year (1977). Again, only $1,000 was contributed in each of the first seven years.

We don’t have enough history to get to age 70 in this example, but as you can see, the actual returns of 500 Index are tracking above the smooth 10% annual return scenario. That’s no surprise, as 500 Index compounded at a 10.9% annual rate between 1977 and 2022.

So, even if you can’t contribute the full amount ($6,500), and even if you don’t know if your young adult will follow your lead, doing what you can today is absolutely worth it. As long as the money is left in the account and allowed to grow tax-free, compounding can turn a little into quite a lot if given decades to work.

What to Buy

When initially funding your teen’s Roth IRA, you may have to contend with the fact that most Vanguard mutual funds require a $3,000 investment to get in the door.

To bypass this investment hurdle, you can buy an ETF—the minimum amount you need is the price of one share. Since we’re talking about a young investor with years and years ahead of them, go with a stock ETF. You can’t go wrong picking S&P 500 ETF (VOO), Total Stock Market ETF (VTI), Total International Stock ETF (VXUS) or Total World Stock ETF (VT)—or mix and match as you see fit.

Amongst Vanguard’s mutual funds, your low-minimum ($1,000) options are STAR (VGSTX) or the Target Retirement funds. They are better than leaving the money in cash, but a big drawback of these options is that they invest a portion of the assets in bonds. Your teen’s retirement is decades away, so they shouldn’t hold bonds in this account.

If you have a favorite Vanguard fund and you have a personal representative at Vanguard, see if they'll waive the minimum for you. Obviously, you won't be making regular contributions to the IRA, since its deposits are contingent on the child's income stream, but if Vanguard's smart about it, your request will be seen as a way to grab a potential long-term client at an early age.

And, if you’re willing to open an account outside of Vanguard, go directly to one of the PRIMECAP Odyssey funds, where the IRA minimums are also just $1,000. You can find them at www.odysseyfunds.com. (POAGX, as long as it’s open, would be my pick.)

Also, if your teen is interested in the markets, this is a perfect place and time to let them call a few of the shots. Do they have a favorite brand? Maybe they want to buy some stock in the company.

Of course, as the account grows, you (or your teen) will want to consider a portfolio that isn’t constrained to “low-minimum” funds.

No Time Like the Present

It’s too bad more people don’t help the young get started early with their investment education, because the perfect time to learn about saving and investing is when your portfolio is small enough that your mistakes won’t kill you. Also, it’s a time when a new investor can begin to develop lifelong habits that will stand them in good stead as they pass into and through their working years.

Time is on a kid’s side, and by helping one start to build an IRA with earnings from summer and part-time jobs, you may be able to make a meaningful impression on him or her. Next March and April, you can tote up what Mr. or Ms. Gen Z earned in 2023 and fund that IRA account before the April deadline.

Helping to put your teenage or newly-employed child or grandchild on the road to a more comfortable retirement may truly be one of the best gifts you can make, and it will be one that keeps on giving year after year.