Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, August 30.

There are no changes recommended for any of our Portfolios.

Is bitcoin finally going to go mainstream? And will Vanguard have a dog in this fight?

Why I’m talking about bitcoin? Well, the granddaddy of cryptocurrencies was all over the financial media yesterday. The backstory is that several asset managers, including Fidelity and iShares, have requested permission to launch “spot” bitcoin ETFs. While you can currently buy an ETF that trades bitcoin futures, the SEC has said N-O to companies seeking to offer an ETF that will hold bitcoin directly.

Yesterday, the U.S. Court of Appeals ruled in favor of Grayscale—an asset manager fighting with the SEC for permission to convert its Grayscale Bitcoin Trust (GBTC) into an ETF.

Despite some headlines, this doesn’t automatically mean a bitcoin ETF is coming to a market near you soon. The SEC has 45 days to appeal the decision. If they lose the appeal, the SEC must reconsider Grayscale's ETF application. The SEC could still reject it—though they’ll need to come up with a better reason for saying no.

Nonetheless, the pressure is ramping up for the SEC to approve a bitcoin ETF. While a spot bitcoin ETF (one that trades in bitcoin directly rather than in the more regulated bitcoin futures markets) gets lots of media attention, I’m not sure how much it changes the landscape.

On the one hand, a spot bitcoin ETF would make bitcoin, rather than bitcoin futures, more accessible to more people.

On the other hand, if you care about holding bitcoin on your own, in your own “wallet,” then an ETF isn’t for you. And if you want to “play” (or trade) bitcoin because you think its price will go up, well, as I said, you can buy a bitcoin futures ETF that will do just that.

Plus, it’s worth asking if making bitcoin more accessible to more people is actually a “good thing.” In my view, bitcoin is a speculation, not an investment. I can as easily envision a time when bitcoin is worth $100,000 as one where it’s completely worthless. Proceed accordingly.

If you are tempted by bitcoin, Vanguard won’t be able to help you … at least no time soon. While Fidelity was an early adopter—the firm’s president, Abigail Johnson, reportedly had a bitcoin mining machine in her office a decade ago—and iShares recently put their hat in the ring, Vanguard hasn’t moved to launch a bitcoin (or cryptocurrency) fund like its biggest competitors.

Yes, Vanguard uses the blockchain technology behind cryptocurrencies for managing its index funds. But, from an investment standpoint, they view crypto as a speculative asset that doesn’t belong in long-term portfolios.

Vanguard is more than happy to be late to the bitcoin party … if they show up at all.

Market Calm

That’s what’s happening in the crypto sphere. Let’s turn to the markets you and I care the most about.

The final report on Q2 Gross Domestic Product (GDP) is in. GDP rose at a slower pace (2.1%) in the third quarter than initially estimated (2.4%). I’m not bothered by the slight downward revision—growth is growth. Plus, consumer spending was strong and corporate profit margins widened.

Also, the Fed’s preferred measure of inflation (the personal consumption expenditures price index excluding food and energy or core PCE) increased about 4% from June 2022 to June 2023. (We’ll get the July PCE number tomorrow.)

In other words, the economy is growing, and inflation is trending down—that’s good. Maybe that’s why, despite all of the headline angst this year (for example, remember the debt ceiling debate?), the markets have been relatively calm.

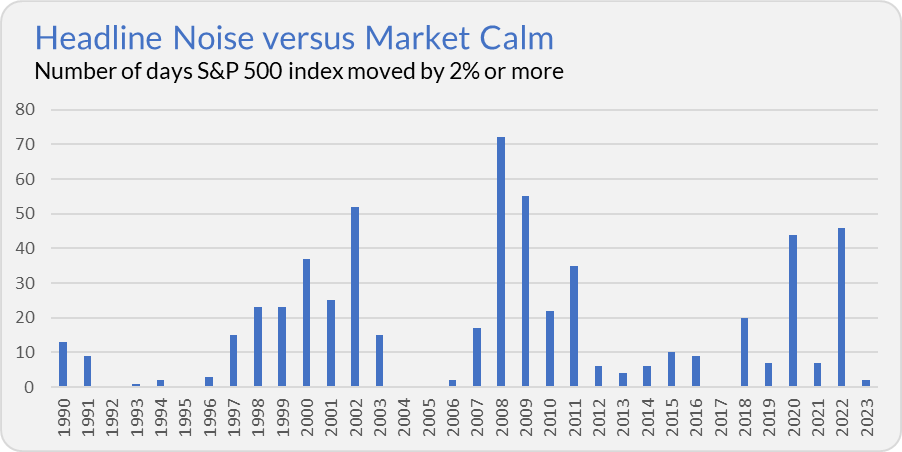

There are seemingly countless ways to measure market volatility. One metric I like to track is the number of days when the S&P 500 index rose or fell by 2% or more. The chart below plots the number of “2%-plus days” for the S&P 500 index each calendar year since 1990.

So far, we’ve only had two 2%-plus days. In a typical year, the S&P 500 index moves by 2% or more on 17 trading days. However, as you can see in the chart above, most years aren’t typical—either we get a lot of 2%-plus days or very few.

Periods of calm (low volatility) can persist, but eventually, they are all followed by bouts of upheaval (high volatility). If good times are followed by bad, what’s an investor to do?

Timing the market is a fool’s errand. Sitting in cash feels good in the short term but only guarantees you’ll miss out on compounding in the long run.

The sensible answer is to hold a diversified portfolio that you can stick with through calm and bumpy markets. It won’t be the “perfect” portfolio for any market environment, but it also won’t be the “perfectly wrong” portfolio either!

Too much or too little?

Speaking of 2%, Vanguard supported just 2% of shareholder proposals related to climate and social issues—down from 12% the previous year.

Vanguard says the drop is due to two main factors: First, a change in SEC rules led to more proposals being put forward for a vote. Second, companies have improved their disclosure of environmental and social issues. As a result, most proposals were either already being satisfied or went too far—Vanguard typically votes in favor of more disclosure but against proposals that “encroach upon company strategy and operations.”

Vanguard’s stance is that they have not changed their approach to proxy voting despite pressure from the left and the right. BlackRock also supported a smaller percentage of shareholder proposals this past year. (Their explanation for the drop is essentially the same as Vanguard’s.)

Supporting just 2% of shareholder proposals sure sounds low. But whether these asset manager giants are doing too much or too little with their voting power is an open debate.

You can read Vanguard’s latest “stewardship” report here—the climate and social proxy voting section is on pages 3 and 4.

Handoff Complete

It was May when Vanguard first announced that a team of Wellington analysts would replace its in-house quantitative managers at Growth & Income (VQNPX). The transition was initially scheduled for August 3, but, as I told you at the start of the month, Vanguard delayed the change by three weeks.

Well, the handoff is now complete. Mary Pryshlak, Wellington’s Head of Investment Research, is officially the portfolio manager overseeing a third of Growth & Income’s assets. But it's Wellington’s industry analysts who will be picking the stocks. This is the same setup in place on the quarter Emerging Markets Select Stock (VMMSX) that Wellington is responsible for—Pryshlak is the named manager, but the analysts are calling the shots.

This change doesn’t make Growth & Income materially better or worse. With three managers in the mix and hundreds of stocks in the portfolio, the most likely outcome is that Growth & Income roughly matches the market over time.

Our Portfolios

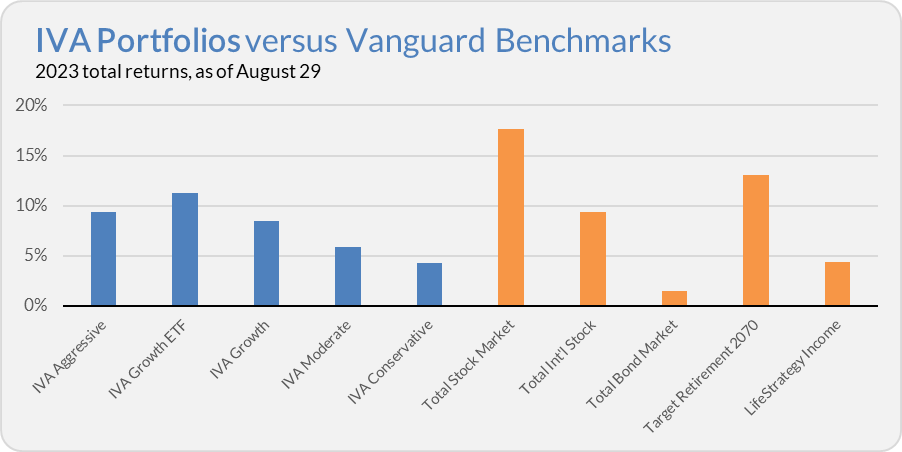

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 9.4%, the Growth ETF Portfolio is up 11.2%, the Growth Portfolio is up 8.5%, the Moderate Portfolio is up 5.9% and the Conservative Portfolio is up 4.3%.

This compares to a 17.6% gain for Total Stock Market Index (VTSAX), a 9.3% return for Total International Stock Index (VTIAX), and a 1.5% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 13.0%, and its most conservative, LifeStrategy Income (VASIX), is up 4.4%.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Not a Premium Member yet? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.