Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, September 20.

There are no changes recommended for any of our Portfolios.

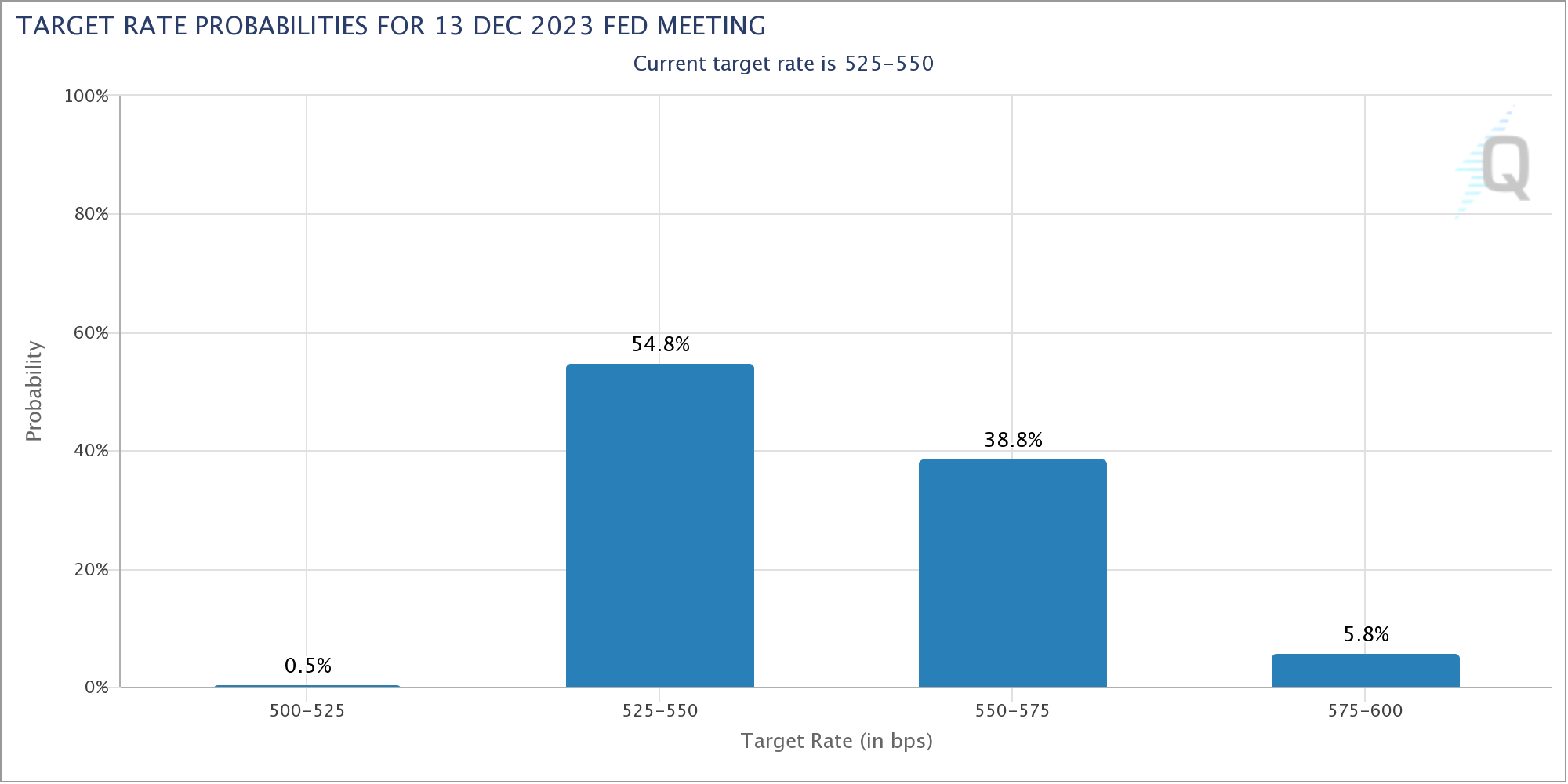

Jerome Powell and his Federal Reserve (Fed) colleagues held the line after their two-day meeting today. While they did not raise or lower interest rates—the fed funds rate target is still 5.25%-5.50%—policymakers signaled that one more increase could be in the cards before the end of the year.

According to the CME FedWatch Tool—which summarizes the probability of changes to the fed funds rate based on the prices of interest-rate futures—traders agree/disagree. At the time of writing (after the Fed’s announcement), traders are predicting a 55% chance that the fed funds rate will be unchanged between now and the end of the year and a 45% probability that the Fed will raise interest rates.

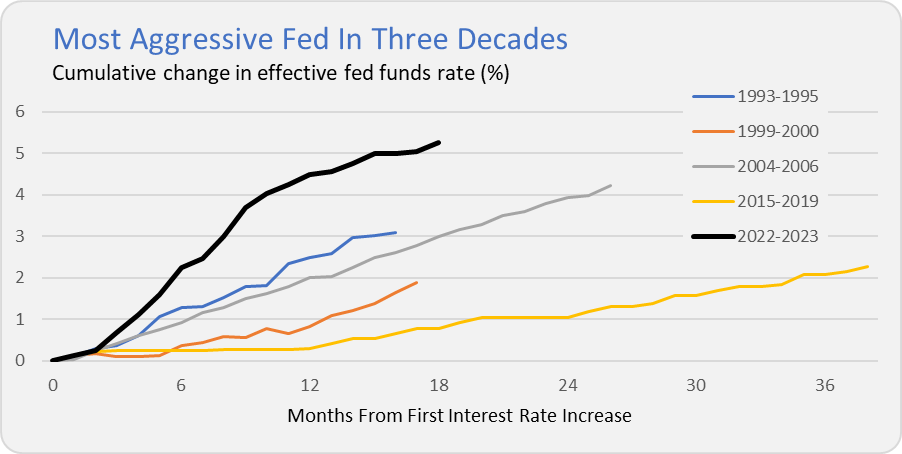

I don’t have any inside information regarding future Fed actions—nor does anyone else. Given how quickly and dramatically the Fed has acted over the past 18 months—hiking their policy rate from 0.00%-0.25% all the way to 5.25%-5.50% in 11 separate moves.

To put that into perspective, the chart below compares the Federal Reserve’s (Fed) current action to the past four interest rate hiking cycles. In short, the Fed hasn’t moved this quickly nor by this much in over three decades.

As Fed policy has a delayed impact on the economy, it makes sense to pause and see what happens—getting more information is more valuable than acting.

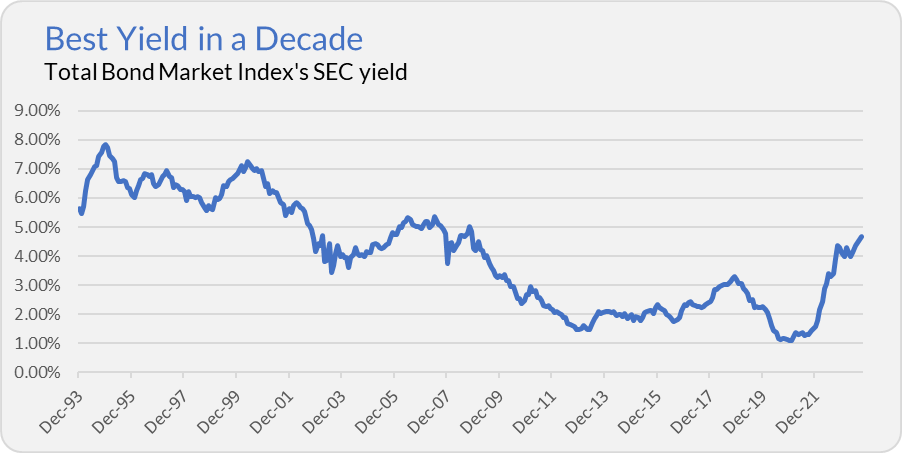

One more interest rate hike doesn’t have me worried. As I’ve been saying for some time now, while it’s been a frustrating three years for bond investors, the outlook for bonds hasn’t looked this good in over a decade. Total Bond Market Index (VBTLX) took a big price hit when its yield went from 1.1% to 4.7%.

But that move is behind us. All we can do is position our portfolios for the road ahead. And I’ll take high-quality bonds yielding nearly 5% over high-quality bonds yielding 1% any day of the week.

Remember, a bond fund’s current yield is a strong predictor of the total return you’ll earn over the period synonymous with the fund’s average maturity. Intermediate-Term Investment-Grade (VFICX) for instance, currently yields 5.45% and has an average maturity of 7.5 years. So, one can reasonably expect that over the next 7.5 years the fund will return around 5.5% annually.

Will College Grads Cause a Recession?

Against the odds, the economy is arguably making a soft landing—inflation has moderated, but we haven’t tipped into a recession. Still, many people, both on and off Wall Street, are making predictions about what will push us into a recession.

The latest worry is that the resumption of student loan repayments will be the straw that breaks the economic camel’s back. I’m skeptical.

Moody’s Analytics estimates that student loan repayments will suck $70 billion annually out of the economy. That’s a big number. But gross domestic product (GDP) is a much bigger number—$26.8 trillion—or $26,800 billion. That’s the nominal size of the economy—adjust for inflation, and GDP is $20.3 trillion. I’m unsure if Moody’s number is adjusted for inflation.

Either way, if Moody’s forecast is correct, we’re talking about a roughly 0.3% hit to GDP. That’s not nothing. But it also isn’t enough to push us into a recession.

Distribution Season

As a reminder, Vanguard’s mutual fund and ETFs are in the process of paying out quarterly distributions. Premium Members can find the full schedule here—scroll to the bottom of the page. Several popular funds—like Balanced Index (VBIAX), Total Stock Market Index (VTSAX) and SmallCap Index (VSMAX)—are “going ex-dividend” today (meaning owners will reinvest based on today’s closing price).

Our Portfolios

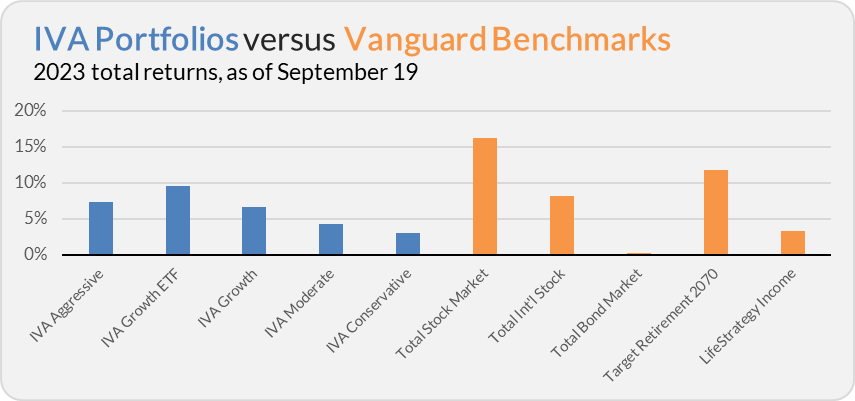

Our Portfolios are showing decent absolute but lagging returns for the year through Tuesday. The Aggressive Portfolio is up 7.3%, the Growth ETF Portfolio is up 9.6%, the Growth Portfolio is up 6.6%, the Moderate Portfolio is up 4.3% and the Conservative Portfolio is up 3.1%.

This compares to a 16.2% gain for Total Stock Market Index (VTSAX), an 8.2% return for Total International Stock Index (VTIAX), and a 0.3% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 11.8% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.3%.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.