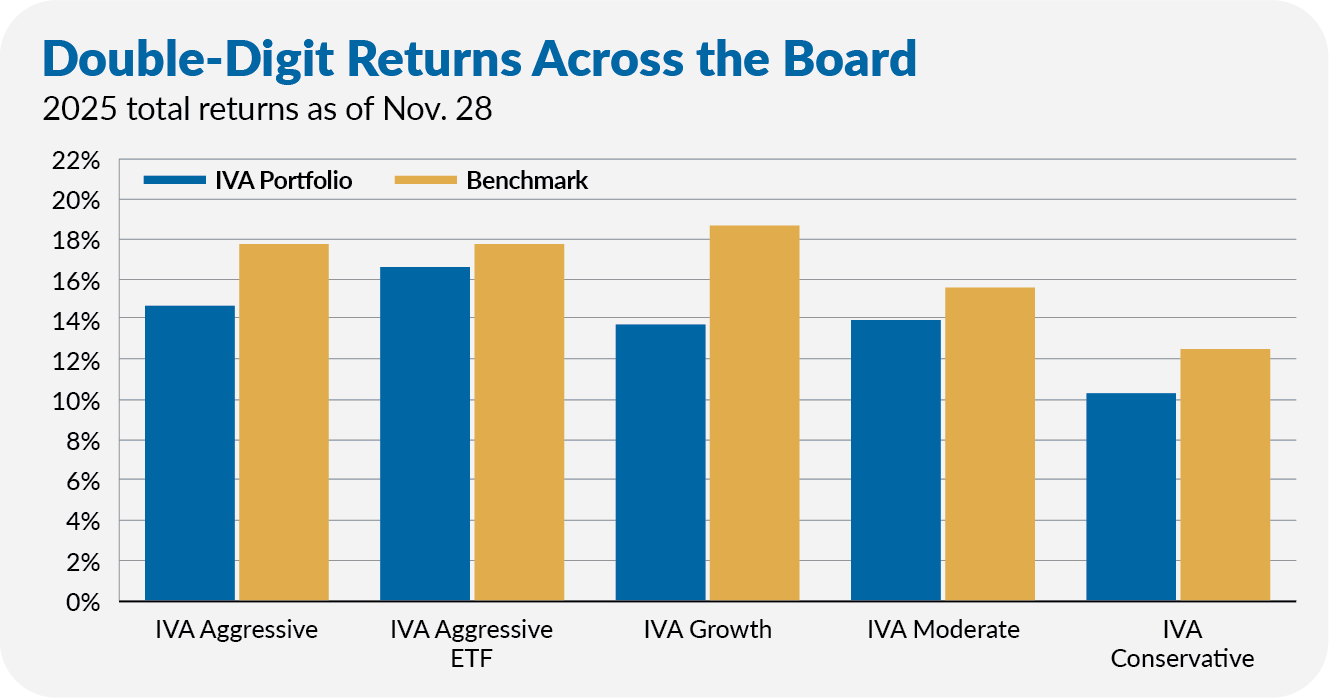

Executive Summary: All five IVA Portfolios posted double-digit gains in 2025, though none beat their benchmarks. I explain why, examine the key portfolio decisions behind the results and outline how the Portfolios are positioned heading into 2026.

2025 was a two-step in the right direction.

All five IVA Portfolios delivered double-digit gains through November, helped by strong showings from the PRIMECAP-run funds and a long-awaited rebound in foreign stocks.

But diversification cut both ways. Dividend growers lagged, out-of-favor areas stayed out of favor, and a safety-first bond stance meant leaving some gains on the table. The result: solid absolute returns that ran slightly behind their index benchmarks.

That doesn’t shake my conviction in my fund picks or portfolio strategies. My own money sits in the funds I recommend—my plate is piled high with my own cooking.

So, as I do every year, I’m going to take a clear-eyed dive into the IVA Portfolios—I’ll walk you through what worked, what didn’t, and how we’re positioned for 2026.

Note: All of the performance stats in this article are through the end of November 2025. Also, I will compare my Portfolios against 500 Index, since the S&P 500 remains the go-to benchmark for most investors. The story wouldn’t change much if I used, say, Total Stock Market Index (VTSAX), as that fund is still dominated by the same stocks that drive the S&P 500.

Setting the Stage: 2025’s Results

Regular readers of the Monthly Recap will recognize the chart below, which compares each IVA Portfolio to an appropriate benchmark:

- Aggressive and Aggressive ETF versus 500 Index

- Growth Portfolio versus LifeStrategy Growth (VASGX)

- Moderate Portfolio versus LifeStrategy Moderate Growth (VSMGX)

- Conservative Portfolio versus LifeStrategy Conservative Growth (VSCGX).

Yes—the scoreboard shows all five Portfolios trailing their Vanguard bogeys. No—I’m not happy with that, but I’m also not losing sleep over it.

The IVA Portfolios are intentionally more diversified and more resilient than their index-only counterparts. That approach didn’t pay off in 2025, but diversification never works every year—it works over time.

Performance in Perspective

One year is noise. The long run is signal.

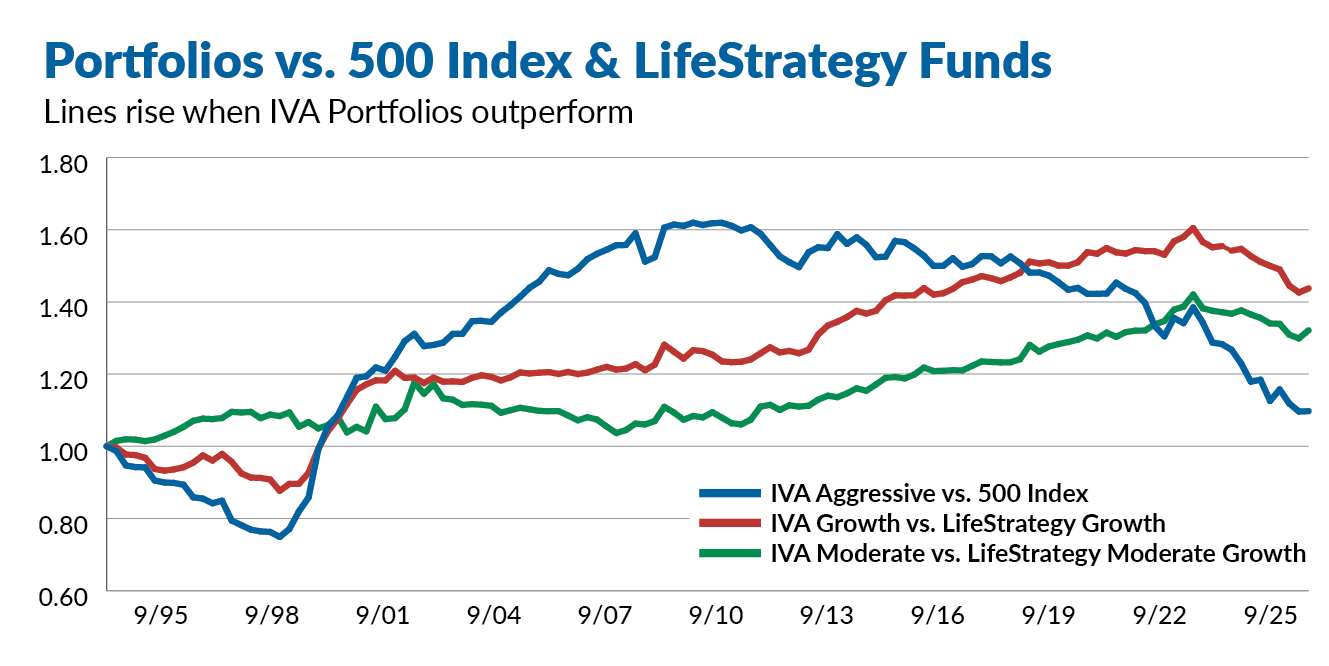

To put 2025 in context, the following chart compares the longest-running IVA Portfolios against those same benchmarks since the LifeStrategy funds launched in 1994.

This longer-term comparison shows that the Aggressive Portfolio lagged during the 1990s but pulled ahead in the 2000s. The past dozen years have been tougher—explained in large part by one simple dynamic: foreign stocks have badly trailed U.S. stocks, and the Aggressive Portfolio has historically held more overseas exposure.

The Growth and Moderate Portfolios tell the opposite story. Over the past decade-plus, they’ve often outperformed their LifeStrategy benchmarks—helped by holding less in foreign stocks than the LifeStrategy funds.

To get a fair, apples-to-apples comparison, I built custom benchmarks that better reflect how the Portfolios were actually invested—mixing U.S. stocks, foreign stocks, and bonds in proportions that match each IVA Portfolio’s long-term profile.

- IVA Aggressive: 85% 500 Index, 15% Total International Stock Index

- IVA Growth: 72% 500 Index, 13% Total International Stock Index, 15% Total Bond Market Index

- IVA Moderate: 51% 500 Index, 9% Total International stock Index, 40% Total Bond Market Index

Adjusting for the U.S.–foreign stock gap paints a clearer picture. The Aggressive Portfolio held its own through most of the 2010s, though it has struggled over the past few years.

For the Growth and Moderate Portfolios, the adjustment reduces their earlier outperformance. But the takeaway remains the same:

The IVA Portfolios win where it matters: not every time, but over time.

With that foundation laid, let’s turn to the philosophy behind how I build the Portfolios.

Be Selective, Diversified and Disciplined

My strategy is simple: Partner with Vanguard's best managers and funds, stay invested and diversify smarter.

While Vanguard is famous for its index funds, the firm deserves credit for giving individual investors access to institutional-quality active managers at exceptionally low costs. Partnering with the best Vanguard has to offer often means investing alongside an active manager.

But that doesn’t mean every active Vanguard fund earns a spot in the Portfolios. It also doesn’t mean a manager’s place in the Portfolios is safe forever—far from it. I’m selective, not dogmatic. If I can’t identify an active manager who clears a very high bar, or if I think a manager has lost their edge, I’m perfectly happy to hold an index fund (or ETF).

Sometimes the most disciplined decision is simply to stick with an index fund.

The fund you pick matters, but so does your behavior. Are you trading in and out? Or are you spending time in the market?

Simply put: The best way to compound wealth is to stay invested, spending time in the market, not trying to time the market. My goal is to build diversified portfolios you—and I—can hold through the market’s ups, downs and sideways stretches without flinching.

Spending time in the market doesn’t mean I never make changes. Patience isn’t passivity. In fact, I was more active this past year than usual, with three trades that: