Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, October 25.

There are no changes recommended for any of our Portfolios.

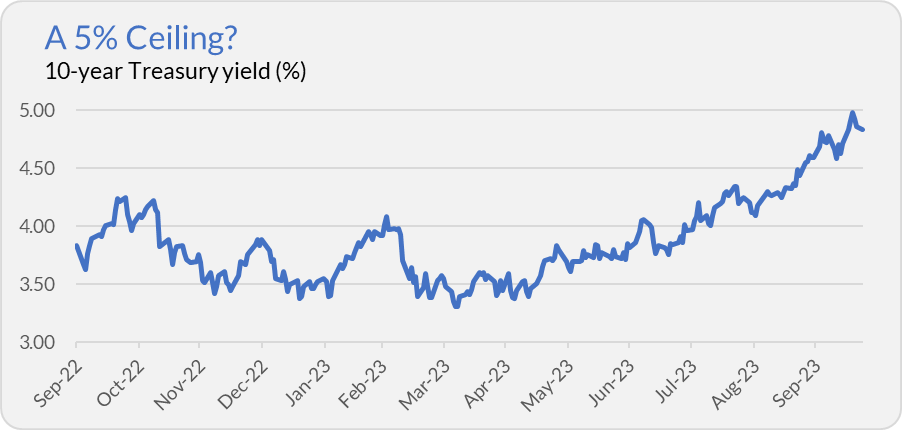

On Monday, the 10-year Treasury briefly traded above 5% for the first time since July 2007. Blink, and you missed it, as the benchmark bond’s yield ended the day at 4.86%. (As I write this, the 10-year Treasury is yielding 4.90%.)

Below is an update to a chart I shared with you at the start of the month.

Since the end of March, bond yields have been on a one-way street higher. The yield on the 10-year Treasury has risen about 1.5% over the past nearly seven months—from 3.5% to 5%. Falling bond prices go hand-in-hand with rising bond yields. Since the end of March, Total Bond Market Index (VBTLX) has dropped 4.0%, and Long-Term Treasury Index (VLGSX) has declined 14.0%.

I was recently talking to a subscriber who was considering bailing out of GNMA (VFIIX) in favor of Federal Money Market (VMFXX). Given the rough two-to-three years bonds have had, and that you can earn a safe 5% on the money market fund, I get the temptation.

If you are contemplating a similar move, I’d suggest you give my Balancing Trade-Offs article a read. While I compare Short-Term Treasury (VFITX) and Long-Term Treasury (VUSTX) in the article, the takeaway is the same. If you are moving from intermediate-term bonds to a money market fund, you are choosing price stability over income stability.

Granted, today, you can earn a decent income while having a stable price, but that can change. I can’t make the decision (bonds or cash) for you, but I can try to help you understand the trade-offs involved.

Also, remember that it doesn’t have to be an all-or-nothing proposition. In my Portfolios, I own both an intermediate-term and a short-term bond fund. Would I have been better off with just Short-Term Investment-Grade (VFSTX) or, better yet, Federal Money Market? Yes, of course. But that’s a big bet on one specific outcome. I prefer to own a portfolio that can do reasonably well in multiple scenarios.

Had I been smart enough to own cash instead of bonds for the past two years, I’d be inclined to start shifting back toward bonds. Of course, interest rates could keep going higher, but yields have moved a long way in a relatively short time.

Simple > Complex

I’ve said it before, and I’ll say it again: Complexity doesn’t automatically lead to better investment results.

College endowments are renowned for embracing complexity and illiquidity in pursuit of market-beating returns, often loading up on private equity and venture capital funds. This approach—now called the “endowment model”—was popularized by Yale’s David Swensen.

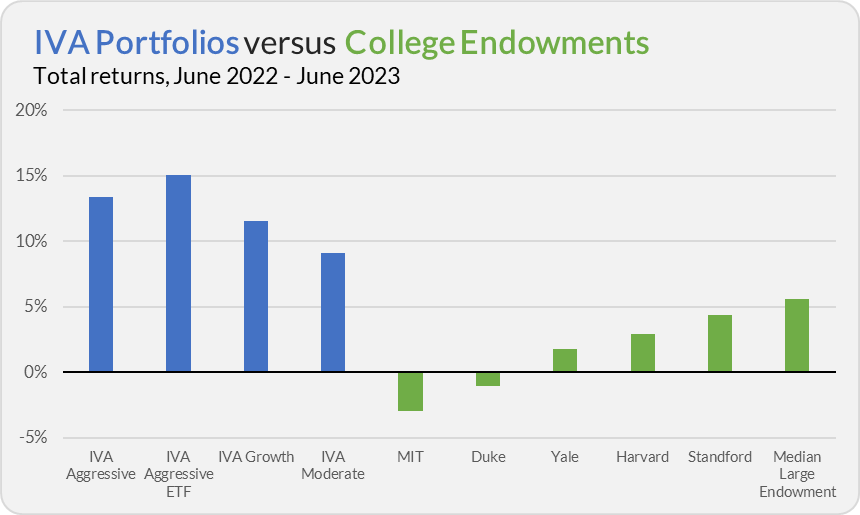

But private investments are not silver bullets that will automatically improve your returns. In fact, according to The Wall Street Journal, the biggest and “best” endowments struggled last year—or rather, from June 2022 through June 2023. (College endowments report results on a fiscal year that ends in June.)

The likes of Harvard, Yale, MIT and Standford returned between -2.9% and 4.4%. But it wasn’t just the “name-brand” endowments that struggled—the average large endowment with over $1 billion in assets only gained 5.6%.

For some context, Total Stock Market Index (VTSAX) gained 18.9% in the 12 months ending in June 2023. However, it’s not entirely fair to compare the endowment portfolios to an all-U.S. stock portfolio. For more reasonable comparison points, consider LifeStrategy Growth (VASGX) and LifeStrategy Moderate Growth (VSMGX), which returned 12.7% and 9.3%, respectively.

The name-brand endowments also trailed my Portfolios, which returned between 9.1% and 15.0% over that same period. (Note that the Conservative Portfolio was only launched in October 2022.)

It was those complex, expensive and illiquid private investments that led to the endowments' poor recent results. The Wall Street Journal article says that the venture capital funds performed particularly poorly.

Of course, it’s just one year. In another year, I’m confident the endowment managers will look smart for loading up on private investments. But the private funds won’t work every year, and there’s no guarantee they’ll work over time. Keeping your portfolio simple can be highly effective.

Our Portfolios

Of course, our Portfolios won’t outperform every year either—no strategy does.

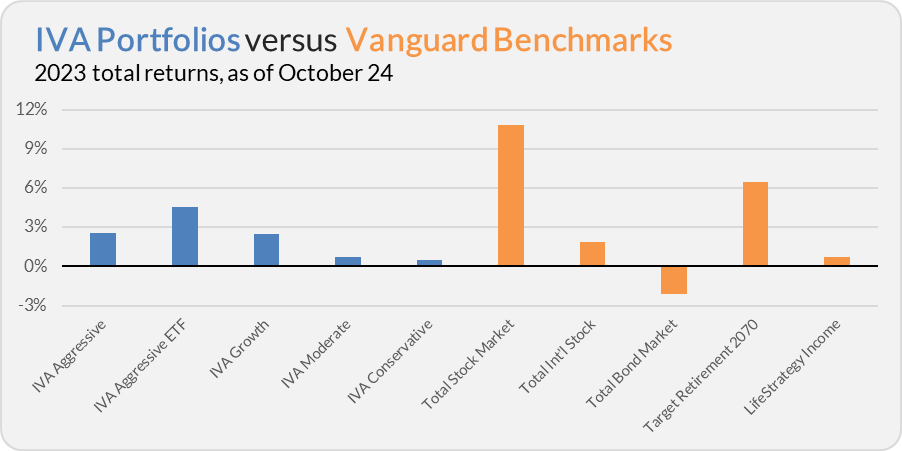

Our Portfolios are holding on to positive returns for the year through Tuesday. The Aggressive Portfolio is up 2.5%, the Aggressive ETF Portfolio is up 4.5%, the Growth Portfolio is up 2.4%, the Moderate Portfolio is up 0.7% and the Conservative Portfolio is up 0.5%.

This compares to a 10.8% gain for Total Stock Market Index (VTSAX), a 1.9% return for Total International Stock Index (VTIAX), and a 2.1% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.4% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.7%.

Capital Opportunity (VHCOX) has been the best-performing fund in our Portfolios, with a 12.6% gain. However, our other U.S. stock funds have been out of sync with the broad market. Dividend Growth (VDIGX) and Health Care ETF (VHT) were standout performers in 2022 but are both in the red this year.

While the broad market, measured by Total Stock Market Index, is up double digits this year, the largest companies have driven the gains. Consider that while MegaCap ETF (MGC) is up 15.5% this year, MidCap Index (VIMAX) is down 0.3% and SmallCap Index (VSMAX) has declined 0.8%.

I can point to many other examples, but the short story is that diversification has let investors down this year. Don’t give up. It will pay off in time.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.