Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, October 4.

There are no changes recommended for any of our Portfolios.

After nine months on the job, Kevin McCarthy became the first House speaker to be removed from office. I wonder if he’s breathing a sigh of relief.

All joking aside, McCarthy had to navigate some challenging waters this year—particularly when extending the debt ceiling and funding the government. Unfortunately, we aren’t clear of the choppy waters yet.

McCarthy was ousted after engineering a temporary spending bill that averted a government shutdown. This means the clock is ticking on electing a new speaker and passing a full spending bill.

I try to keep politics out of this newsletter. I am not a political commentator; this isn’t a political newsletter. More importantly, mixing politics and your investment portfolio is rarely profitable. The noise out of Washington has been as loud as ever this year. Long-term investors are best served by turning down the volume.

How Much Higher?

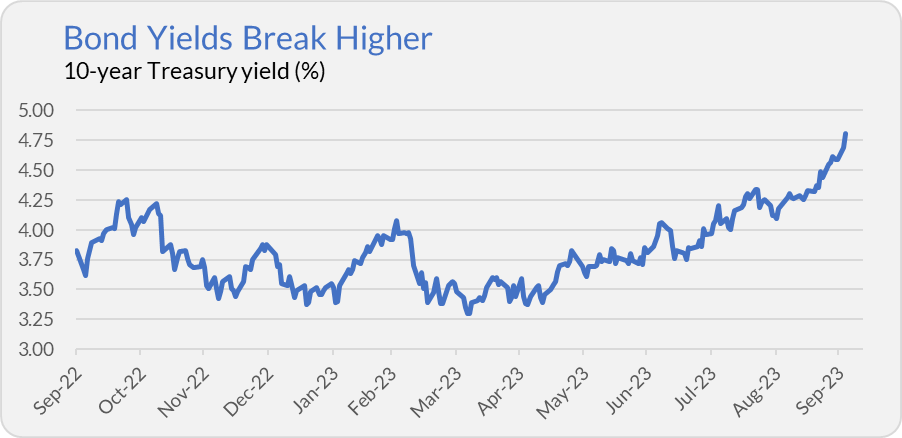

For the past year, the 10-year Treasury’s bond yield was reasonably stable—it traded between 3.25% and 4.25%. That changed in the middle of September. Now, the question is, how high will the benchmark bond’s yield go?

Frankly, I don’t have the answer. No one does—though plenty of people go on TV, speak confidently and give the impression that they know. They don’t, they’re guessing.

I’ve been saying that the time to sell bonds was two years ago when they yielded 1%-2%. You can say I’ve been “wrong” in suggesting investors stick with bonds. After all, as of Tuesday’s close, Cash Reserves Federal Money Market (VMRXX) was up 3.8% for the year, while Total Bond Market Index (VBTLX) was down 2.4%.

But I’ve never had an edge in forecasting short-term moves in interest rates. If bonds made sense as part of your portfolio at 1% to 2% yields, they should still play a role now that they yield 4% to 5%. As I said in my September recap, we must position our portfolios for the road ahead, not the one behind us.

Is Two Better Than One?

Vanguard certainly thinks so!

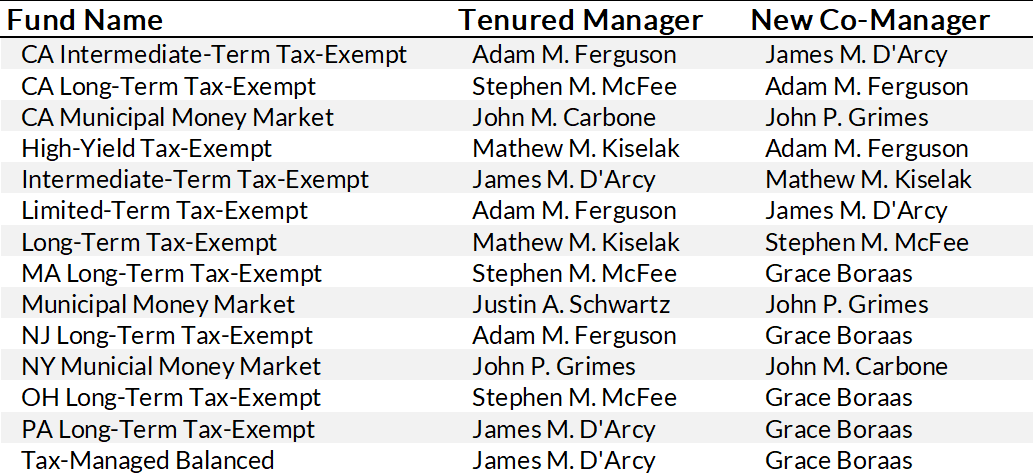

Due to an “internal realignment of the municipal bond team,” Vanguard added co-managers to almost all their tax-exempt funds on Tuesday. I listed each fund’s “tenured” manager and new co-manager in the table below.

Manager Additions

No. New York Long-Term Tax-Exempt (VNYTX) is not missing from the list. The fund has been steered by two co-managers—Adam Ferguson and Stephen McFee—since 2020.

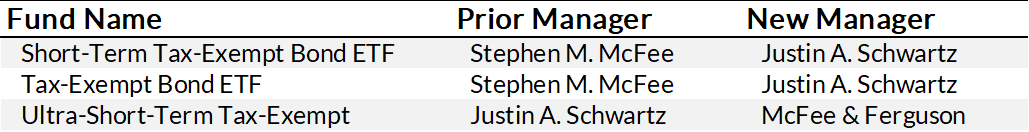

The exceptions to the co-manager setup are Vanguard’s two tax-exempt index funds—Tax-Exempt Bond Index (VTEAX or VTEB) and Short-Term Tax-Exempt Bond ETF (VTES). However, in this manager shuffle-up, Vanguard replaced Stephen McFee with Justin Schwartz as the portfolio manager of both index funds.

The final fund impacted by this realignment is Ultra-Short-Term Tax-Exempt (VWSTX), where Justin Schwartz has been replaced by his colleagues Stephen McFee and Adam Ferguson.

In response to a new SEC ruling, Vanguard made another change to the prospectus of its three municipal money market funds this week. Vanguard will no longer be able to impose a redemption gate—limit withdrawals—except in the event of a liquidation. However, Vanguard can charge a liquidity fee (of up to 2%) at the board’s discretion.

In short, if you want to get your money out when everyone else is scrambling for the exit, Vanguard will return your money but may charge you up to 2%.

I’m not worried by this tweak. It would take something extraordinary for Vanguard to impose those fees. Consider that Vanguard has forgone millions of dollars in fees over the past decade to keep their money market funds’s yields from slipping below 0%.

Vanguard is committed to keeping its money markets trading at $1.00 while providing the daily liquidity investors expect. Plus, Vanguard has decades of experience running its money market funds well.

Our Portfolios

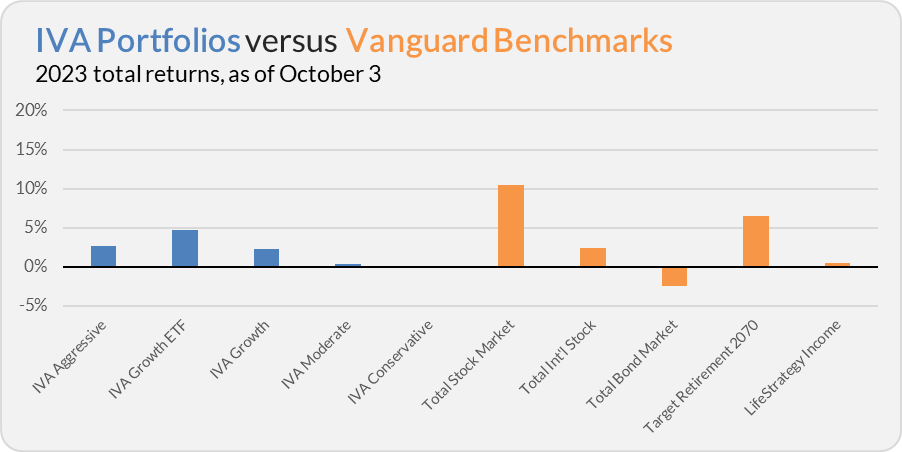

Our Portfolios are holding on to positive returns for the year through Tuesday. The Aggressive Portfolio is up 2.6%, the Aggressive ETF Portfolio is up 4.8%, the Growth Portfolio is up 2.3%, the Moderate Portfolio is up 0.4% and the Conservative Portfolio is up 0.2%.

This compares to a 10.5% return for Total Stock Market Index (VTSAX), a 2.5% gain for Total International Stock Index (VTIAX), and a 2.4% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.5%.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.