Repeat after me: there is always a good reason to avoid the market.

Even when investors appear most bullish, the naysayers always have a good argument for selling and sitting on the sidelines. And boy, were there a host of reasons to avoid stocks during the just-closed third quarter.

Tariffs. Questions about the Federal Reserve’s independence. A hiring slowdown. Stubbornly high inflation. Fears of a technology bubble 2.0. Wars and geopolitical shocks. And as the quarter came to a close, a government shutdown.

Take your pick—those are just a few of the perfectly good excuses we could have used to rationalize sitting on the market’s sidelines these past three months.

And yet … investors who stayed the course were rewarded.

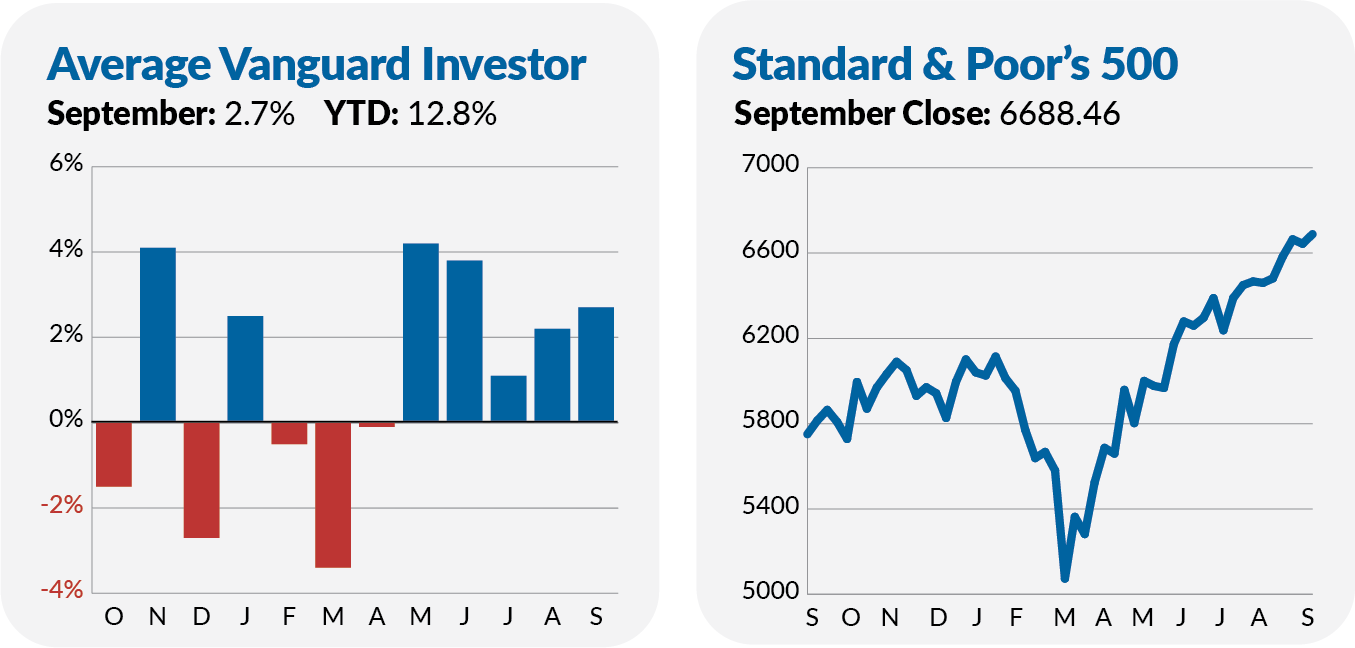

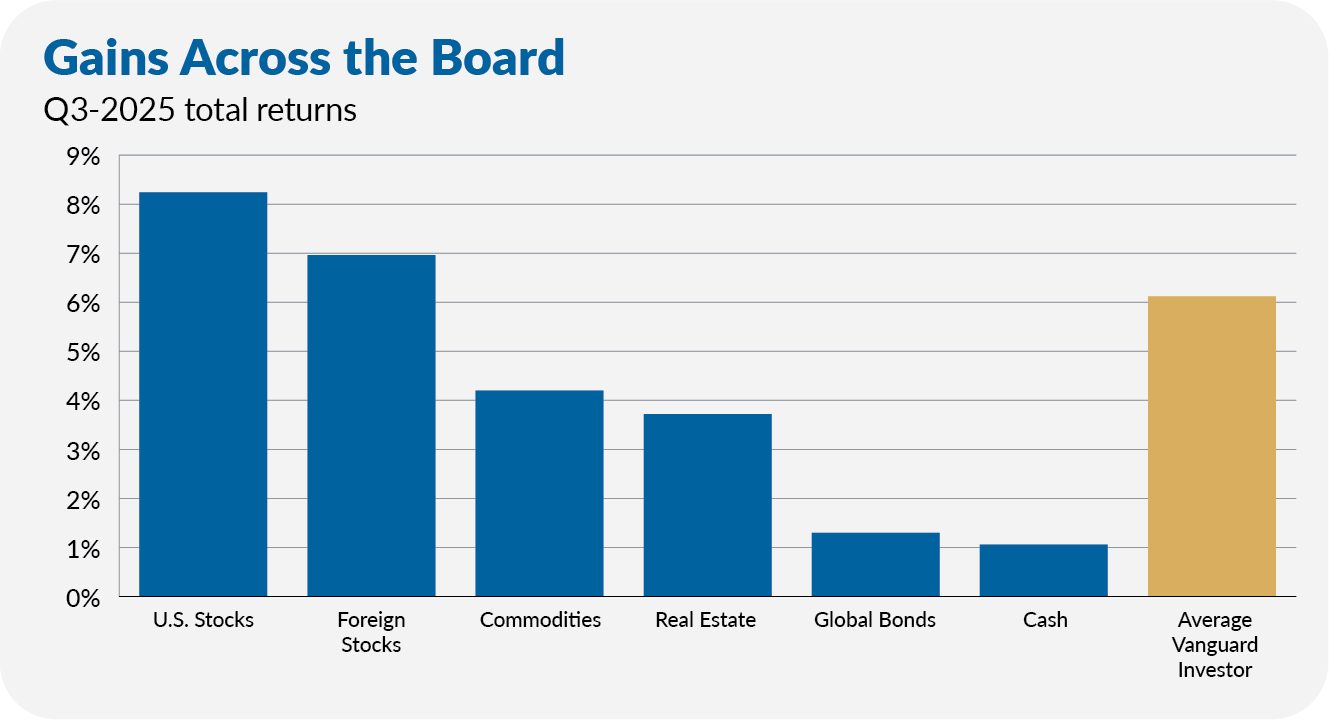

U.S. and foreign stocks both gained ground. Total Stock Market Index (VTSAX) returned 8.2%, while Total International Stock Index (VTIAX) gained 7.0%. Large and small U.S. stocks hit new highs, as did markets in the U.K., Germany, Japan, South Korea, Mexico and Brazil.

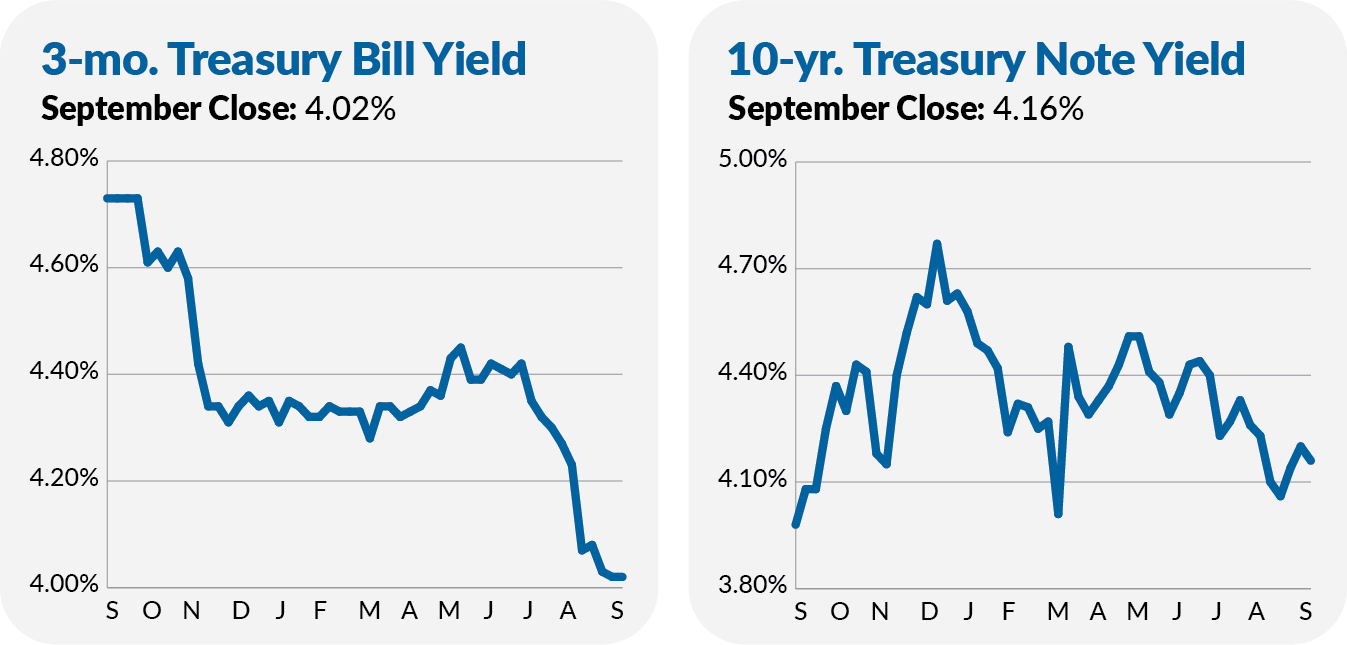

Bond investors had reason to cheer as well, despite the Fed’s quarter-point (0.25%) interest-rate cut. Federal Money Market (VMFXX) returned 1.1% and its yield remains at 4.08%, while Total World Bond ETF (BNDW) rose 1.3%. Hardly headline-grabbing numbers, but positive all the same.

Alternative assets also rallied. Real Estate Index (VGSLX) climbed 3.7%, Commodity Strategy (VCMDX) added 4.2% and gold reached a new record at $3,860.

All told, the average Vanguard investor’s portfolio grew 6.1% in the third quarter and now sits 12.8% higher than it did at the start of the year. Given these gains, the average Vanguard investor’s portfolio has never been larger.

I can’t tell you where the markets are going—no one can. The bull market may have room to run, or it may be running out of road. What I can say is this: a strategy of staying invested through thick and thin and an aversion to responding to every headline have once again paid off.

Discipline, not prediction, is what drives results. The headlines will keep changing, the list of worries will always be long—but staying invested remains the surest path to compounding wealth.

Shutting Down

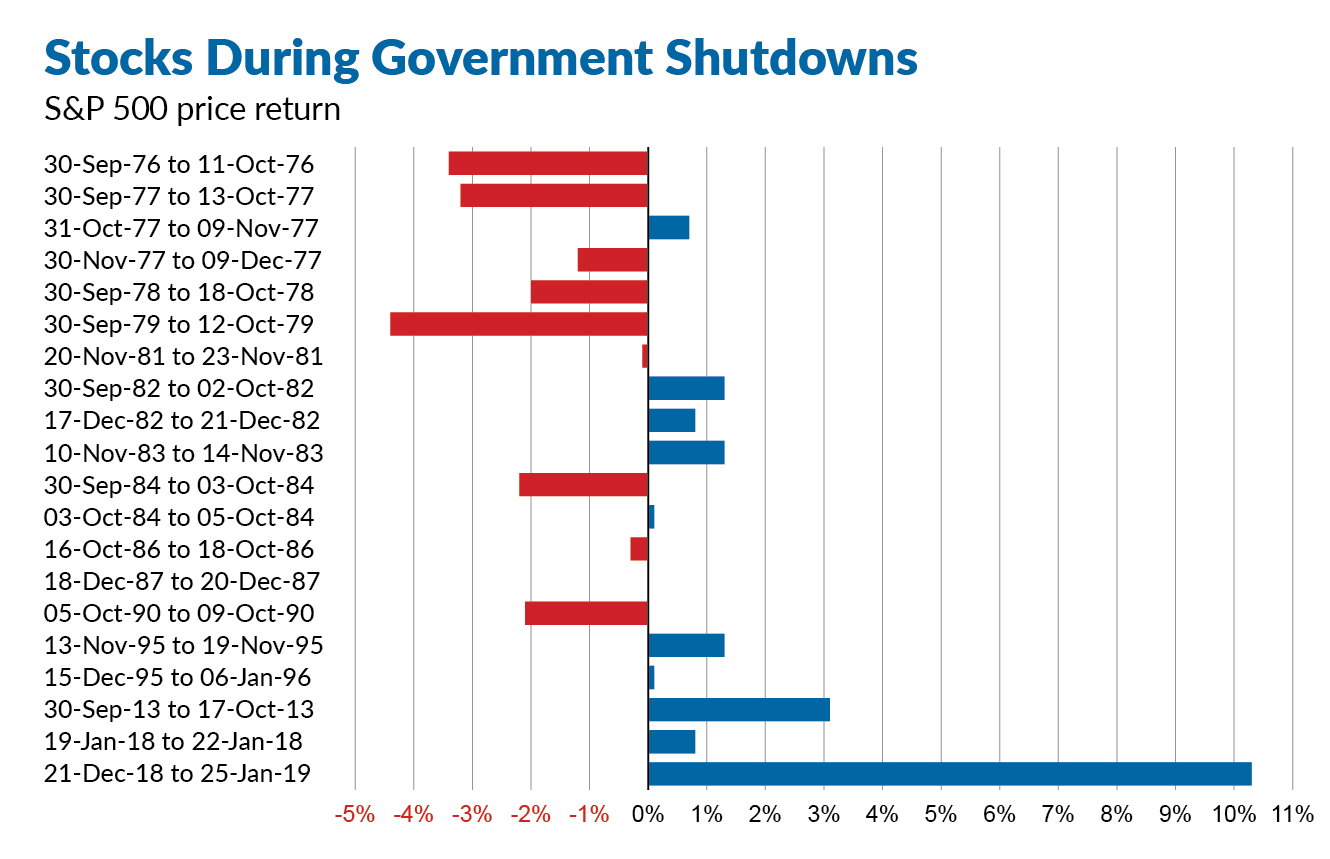

With Congress unable to pass a funding bill, parts of the U.S. government have shut down today.

I’ll leave the blame game to political commentators. What I can add is perspective for investors. Unfortunately, we’ve had plenty of shutdown experience to draw upon.

The U.S. government has shut down 20 times since the mid-1970s, according to data from the House of Representatives. The S&P 500 averaged a microscopic 0.04% gain during those closures. However, if we exclude one outlier—the 10% return during the 2018–2019 shutdown—the S&P 500’s average return falls from 0.04% to -0.49%.

In other words, the market sometimes dipped, sometimes rose, but it never cratered. In fact, stocks gained ground during half of all prior government shutdowns.

The lesson is the same as the one we just talked about. Don’t let headlines drive your portfolio decisions. Stay invested, keep your focus on the long term, and if the news cycle gets too noisy, tune it out and go for a walk.

Priming Private Assets for Retirement Funds

Earlier this year, I explained why you don’t need private assets in your portfolio. My argument, in a nutshell:

Alternative investment funds are expensive, opaque and illiquid. Their risk-reducing qualities are oversold. And unless you have access to the best managers, private investments are more likely to add complexity to your portfolio than improve performance.

So, why bring this up again? Because Vanguard’s recent “expert insight” makes the case for adding private assets to Target Retirement funds.

According to Vanguard’s research,

…hypothetical portfolios incorporating private assets (using a 10%–20% allocation split between private equity and private debt) within target-date funds (TDFs), assuming top-tier managers, could improve retirement wealth by 7%–22% and retirement income by 5%–15% (after fees) over 40 years.” [Emphasis added.]

Sounds great, right? Who wouldn’t want an extra, say, 15%?

But let’s be clear: For one thing, Vanguard is assuming that you own “top-tier managers.” I’m sorry, but by definition, the average retiree won’t—we can’t all be in the top quartile! This isn’t Lake Wobegon. And if you think the new crop of private funds aimed at the “retail market” are all going to be top-tier, well, I’ve got a bridge to sell you.

Also, note the fine print: These projected improvements show up after four decades. Even if we take Vanguard’s assumptions at face value, private funds might only make sense for young investors—not those approaching or in retirement.

Also, Vanguard’s numbers are incremental, not revolutionary. A 20% increase in wealth is the difference between, say, $1 million and $1.2 million. I don’t mean to shrug off $200,000, but while a nice boost, it’s not a life-altering amount. And if it doesn’t pan out, well …

My point is that Vanguard’s projections hinge on a heroic assumption about performance, involve a long time horizon and are far from guaranteed.

You’ll be hearing more about private assets in the media in the months and quarters ahead. I’ll share my take on it all, but here’s the bottom line:

You don’t need to chase opaque, expensive and illiquid funds that may or may not deliver a modest edge decades from now. Instead, you can achieve strong long-term results with the tools already at your fingertips: broad diversification, low-cost funds and the discipline to stay invested.

That formula may not sound flashy, but it’s proven—and it doesn’t require a 40-year leap of faith.

Don’t just take it from me. You can read about my mentor, Dan Wiener’s, personal experience with private investments here.

If you'd like to hear from me directly, I recently joined Chuck Jaffe on his Money Life with Chuck Jaffe podcast. You can find the full September 18, 2025, episode here, at the moneylifeshow.com website or on your favorite podcast app.

My can listen to my segment here and find a transcript of the conversation here.

Chuck and I covered a lot of ground: My approach to investing and manager research, how to think about diversification, and the corners of the market where Vanguard doesn’t play. We wrapped up with Chuck’s "Quick and Dirty" round—always a fun challenge—where I shared my take on several Vanguard funds.

Enjoy!

Backtracking on Crypto

In early 2024, when iShares and Fidelity rolled out their bitcoin ETFs, Vanguard took a hard line. Not only did Vanguard decline to launch its own bitcoin ETF, but it also banned all cryptocurrency-related products from its brokerage platform.

Here’s what I said at the time:

If you ask me, Vanguard is going a little overboard by blocking purchases of bitcoin ETFs—you can buy gold ETFs on its platform. (You can also buy options and trade on margin.) However, this decision, while somewhat inconsistent, is "on brand" for Vanguard and could quickly be reversed.

Vanguard’s refusal to launch its own bitcoin ETF could put it a step behind its peers. But this isn’t an existential risk to Vanguard. If bitcoin is gold 2.0, well, Vanguard has managed to get by just fine without a Vanguard-branded gold ETF. I suspect the firm will survive without a bitcoin ETF, too.

That still rings true to me today.

Why bring this up now? Because the rumor mill says Vanguard may soon open its platform to crypto ETFs. Don’t expect a Vanguard-branded bitcoin ETF anytime soon, but you might be able to trade competitors’ products in your Vanguard brokerage account before long.

It’s still just a rumor, but it would be a win for Vanguard investors who want to own crypto ETFs. The bigger question is: How much crypto exposure do you really need?

Most of the crypto space is complete nonsense—gamble at your own peril. Bitcoin is a bit different. It hasn’t lived up to its original purpose as a currency, but it has taken on a role as “digital gold.”

In full disclosure, I’ve speculated on bitcoin before (which I told you about here), but I don’t own any today. And I’m doing very well with my investments regardless.

Morningstar, CRSP and Vanguard

Morningstar is buying the Center for Research in Security Prices (CRSP). Why should Vanguard investors care?

Because CRSP supplies the indexes behind Vanguard’s core U.S. stock funds—think Total Stock Market Index (VTSAX), LargeCap Index (VLCAX), SmallCap Index (VSMAX) and Balanced Index (VBIAX).

To be clear, I don’t think shareholders of these funds need to worry. But there are three aspects to this deal to consider:

- Fees

- Ratings

- Conflicts

Fees

Vanguard (and every other fund company) pays licensing fees to use indexes from providers like S&P, MSCI, FTSE—and CRSP. A big reason Vanguard ditched MSCI in favor of CRSP back in 2012 was cost savings. Then-CIO Gus Sauter said the move would save “tens, if not hundreds of millions of dollars over time.”

Morningstar’s press release says that CRSP brings in $55 million in annual revenue. Since no other fund firm (that I’m aware of) uses CRSP benchmarks, Vanguard is likely on the hook for much of that sum. Granted, with over $2 billion in revenue, CRSP’s earnings are a rounding error on Morningstar’s income statement.

If Morningstar hikes those fees—and remember, this is no ivory tower research group but a profit-seeking company—that would put upward pressure on Vanguard’s expense ratios.

Ratings

Morningstar has developed its own suite of indexes over the years. In doing so, it has made a policy decision not to rate funds that track Morningstar indexes. That could lead to some complications for Vanguard index funds in the near future, as those funds may lose their “medalist” ratings. Total Stock Market Index, for instance, could see its Gold medal vanish.

Personally, I don’t rely on Morningstar’s ratings—I reach my own conclusions. But many investors and advisors do use them as a filter. Losing those medals could make Vanguard less visible in searches and screens.

Conflicts

Lastly, this deal adds to a web of potential conflicts that already bedevil Morningstar’s franchise. Morningstar, for instance, derives significant revenues from advertising from the same companies whose products it rates.

The company insists its ratings are independent, but Vanguard will now be paying Morningstar even more millions every year for the use of CRSP indexes—on top of the advertising dollars Morningstar already collects from the fund giant. The give and take in this relationship is complex, to put it mildly.

As a reminder, the only people who pay me are you—my readers.

Lanius Retires

One last piece of news to share with you since my previous Weekly Brief:

As announced in July, John C. Lanius—who ran Federal Money Market (VMFXX), Money Market Annuity and the internal Market Liquidity Fund—retired on September 24, 2025.

Nafis Smith, who heads Vanguard’s taxable money market team and manages the other taxable money market funds—Treasury Money Market (VUSXX) and Cash Reserves Federal Money Market (VMRXX)—will take over.

I see no cause for concern.