Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, January 10.

There are no changes recommended for any of our Portfolios.

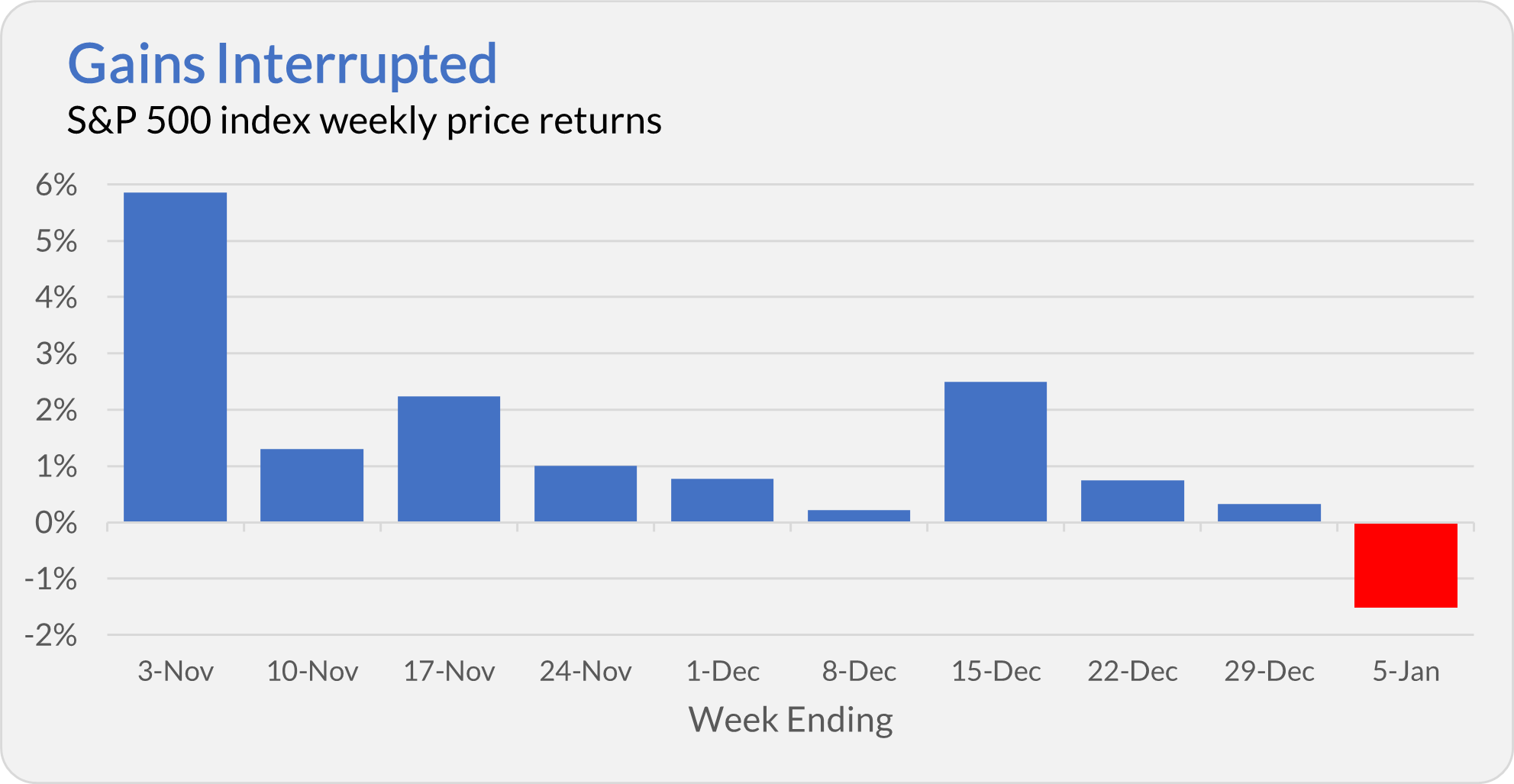

I warned last week that the S&P 500 index’s nine-week winning streak wouldn’t last forever. Lo and behold, the streak ended two days later. Despite all the hoopla in the media over this run, the fact is that nine weeks is merely a blink in time for long-term investors. Let’s move on.

Soft Landing

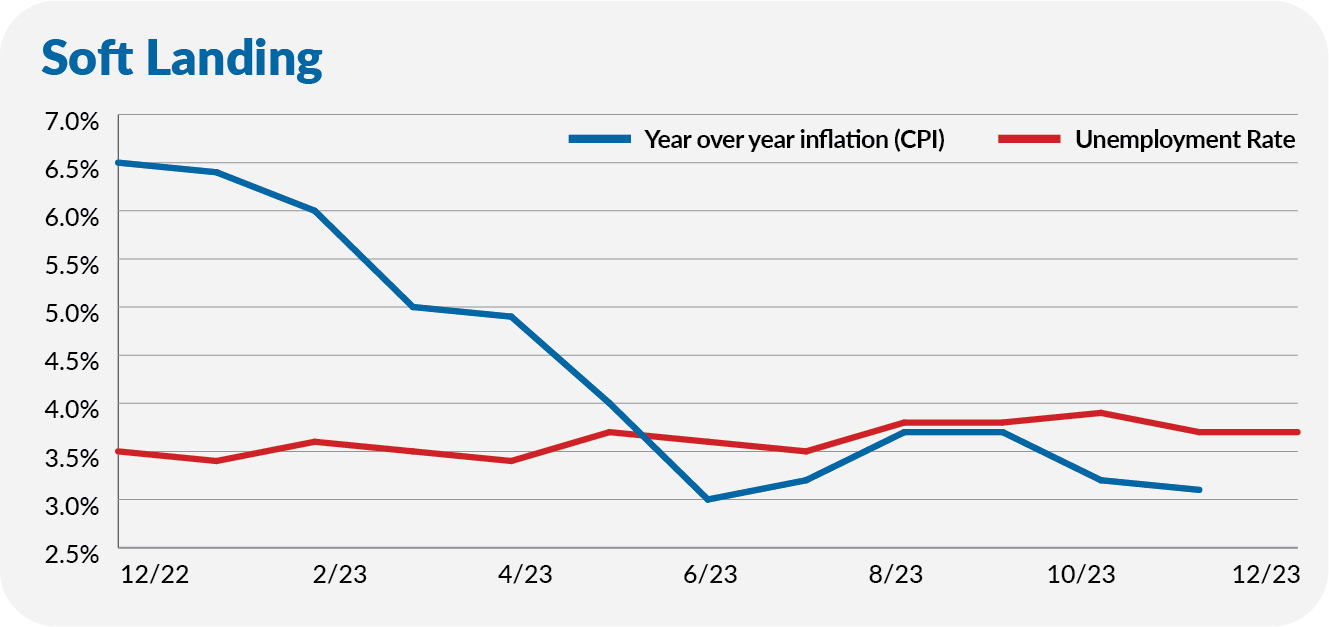

Last Friday, the unemployment rate clocked in at 3.7%. Despite calls for recession, jobs have been plentiful. As you can see in the chart below, the unemployment rate never rose above 4.0% in 2023.

And, as you can see in the chart above, inflation fell from 6.5% at the start of 2023 to 3% by June. Inflation was pretty stable—ranging from 3% to 4%—in the second half of the year.

This chart shows that the economy made a soft landing last year. Inflation was cut in half while unemployment held steady—you can’t ask for much better.

But what the chart also makes clear is that inflation and unemployment were stable in the second half of the year. The Federal Reserve (Fed) has dominated investors’ and traders’ attention for the past year or two. But policymakers have sat back and watched since August, which coincides with the economic data settling down.

If the economy has reached a more stable level—if inflation and unemployment are less volatile—then the Fed won’t have to tinker with interest rates as much. And if that’s the case, maybe investors can stop worrying about the Fed and focus on what really matters—earnings.

Working Out the Kinks

Last week, I told you that Vanguard’s systems needed extra time to close the books on 2023—statements and performance calculations were still being processed. Today, I logged into my account, and everything looks in order.

However, I heard from several subscribers about some lingering issues. For example, one subscriber ran into an error when trying to determine the amount of his 2024 RMD (required minimum distribution)—though Vanguard provided this information over the phone.

From the sounds of it, Vanguard’s systems are still playing catch up. If something doesn’t look right with your account or statements, contact Vanguard pronto.

Seeking a Bigger Audience

Vanguard is making its Cash Plus Account available to non-Vanguard customers.

Last May, I discussed Vanguard’s different cash options—Cash Deposit, Cash Plus Account, and its money market funds. But let me give you an update and my quick take on the options.

Cash Deposit is an alternative for cash in your investment account. For some reason, Cash Deposit’s 3.7% yield is a whole percentage point lower than Cash Plus Account’s 4.7% yield—both trail the firm’s taxable money market funds. I see no reason to use Cash Deposit over Vanguard’s default settlement fund, Federal Money Market (VMFXX). Talk to me if the Fed ever takes the fed funds rate back to the near-zero bound.

Cash Plus Account is Vanguard’s cash management account. It is nearly the solution to my frustration with low-yielding checking accounts—but it’s not quite there.

Vanguard has tweaked the program since I last wrote about it. With Cash Plus Account, you now have two options. You can put the money into Cash Plus—a bank sweep program offering high levels of FDIC insurance and (currently) a 4.7% yield. Or you can stash your cash (or just some of it) in one of Vanguard’s money market funds.

With Cash Plus Account, you’ll have a routing and account number to set up direct deposit and bill pay. You can also link it to payment apps like PayPal or Venmo. (Note: Only the money you have in the bank sweep program will be available for bill pay and the apps—any cash in the money market funds won’t be accessible.)

However, Cash Plus Account lacks an ATM card or the ability to write checks.

I would sign up in a heartbeat if Cash Plus Account had those features. I’m tired of having a checking account paying next to nothing, but I’m not ready to go cashless. As I can already buy the money market funds in my brokerage account, opening a Cash Plus Account doesn’t solve anything for me. Since I’d still have to keep my checking account open, Cash Plus Account would become just another account I’d have to keep track of.

Vanguard—if you’re listening—here’s my vote for adding an ATM card and check writing to Cash Plus Account.

A Bitcoin ETF?

Cryptocurrencies … I don’t spend much time on them in this newsletter because you shouldn’t waste your time or money on most—if not all—of them. Also, this is a Vanguard newsletter, and Vanguard hasn’t touched crypto with a ten-foot pole.

Nonetheless, some cryptocurrencies (like bitcoin) have survived despite the fraud and scandals. More importantly, the SEC may approve a spot bitcoin ETF any day now. Since you’ll be hearing a lot about this, I wanted to give you a bit of an explanation.

A “spot” bitcoin ETF is a fund that can hold bitcoin directly. Until a spot bitcoin ETF is approved, the only way to access bitcoin through an ETF is to buy one that holds bitcoin futures, which don’t track bitcoin prices precisely. Odds are that this is about to change.

First—and I want to be abundantly clear—you absolutely do not need bitcoin in your portfolio.

Bitcoin is a speculative asset, not an investment. I can as easily envision a time when bitcoin is selling for $100,000 as one where it’s selling for $1. And, if you forced me to choose one, I’d say the latter rather than the former—though it’s possible we could see bitcoin hit $100,000 before it hits $1.

Call me a skeptic, but I don’t see what role bitcoin serves unless you live in a country with an unreliable currency.

Second, I’ve seen articles suggesting money will surge into these new spot bitcoin ETFs, driving up bitcoin’s price. Maybe. But I don’t see how a spot bitcoin ETF changes the landscape all that much.

If you care about holding bitcoin on your own, in your own “wallet,” then an ETF isn’t for you. And if you want to “play” (or trade) bitcoin because you think its price will go up, you can buy a bitcoin futures ETF that will do that.

Third, if you are tempted by bitcoin, Vanguard won’t be able to help.

While Fidelity and iShares are in the running to launch the first bitcoin ETF, Vanguard hasn’t moved to launch a bitcoin (or cryptocurrency) fund. Vanguard has used blockchain technology to manage its index funds, but they (like me) view cryptocurrency as a speculative asset, not an investment.

That said, you’ll probably be able to buy these new bitcoin ETFs in your Vanguard brokerage account. While Vanguard has banned certain ETFs—mostly leveraged ETFs—you can buy a futures-based bitcoin ETF in your Vanguard account today. And, well, if you can buy a futures-based ETF, you’ll probably be able to buy the spot ETF.

But when it comes to a Vanguard-branded fund, well, Vanguard is more than happy to be late to the bitcoin party … if they show up at all.

All that said, I have a confession: I own some bitcoin (or rather bitcoin futures).

I bought some of the Grayscale Bitcoin Trust (GBTC) about seven months ago. Recently, I swapped out of the trust to buy the futures-based Proshares Bitcoin Strategy ETF (BITO)—I also took some money off the table as my timing has been fortunate. (As I said, you don’t need a spot bitcoin ETF to play bitcoin’s price.)

My bitcoin position is only about 2% of my overall portfolio, and I very much view it as a speculation—if it went to zero tomorrow, I’d be okay with it. My speculation was motivated by a few factors:

- Arbitrage. Seven months ago, the Grayscale Bitcoin Trust was trading at a significant discount, around 25%, and the possibility of the Trust converting to an ETF was a catalyst for that discount to close. (The discount has closed meaningfully.)

- Managing my “FOMO” (or fear of missing out). I’m generally not one to chase trends, but I’ve read a lot about bitcoin and listened to many podcasts, and yet, I’ve never owned it. I didn’t want to sit on the sidelines if it went on a big run (again).

- Recognizing that I could be wrong. I don’t see bitcoin’s long-term value, but it’s lasted a decade, so maybe I’m missing something.

The catalyst for my purchase—Grayscale’s Trust trading at a big discount—is no longer relevant. And, frankly, I’m not sure if reasons #2 and #3 are actually “good” reasons. So, I can’t say how long I’ll continue to own bitcoin.

Yes, my buying bitcoin somewhat contradicts my approach of spending time in the markets—which means investing in productive companies for the long run. But, well, the world is messy. I’m comfortable speculating from time to time on the fringes—I could argue it helps me stay disciplined and spend time in the market with the bulk of my portfolio.

Let’s put it this way: I am willing to gamble on bitcoin for now, but I wouldn’t buy it for my mom.

This isn’t a recommendation that any of you buy bitcoin either. But since I’m reporting on bitcoin, it only seems fair to disclose my ownership and share my thoughts. If you’re going to buy bitcoin (or any cryptocurrency), that’s up to you: Own the decision, know why you are doing it and don’t put in more than you’re willing to lose.

Our Portfolios

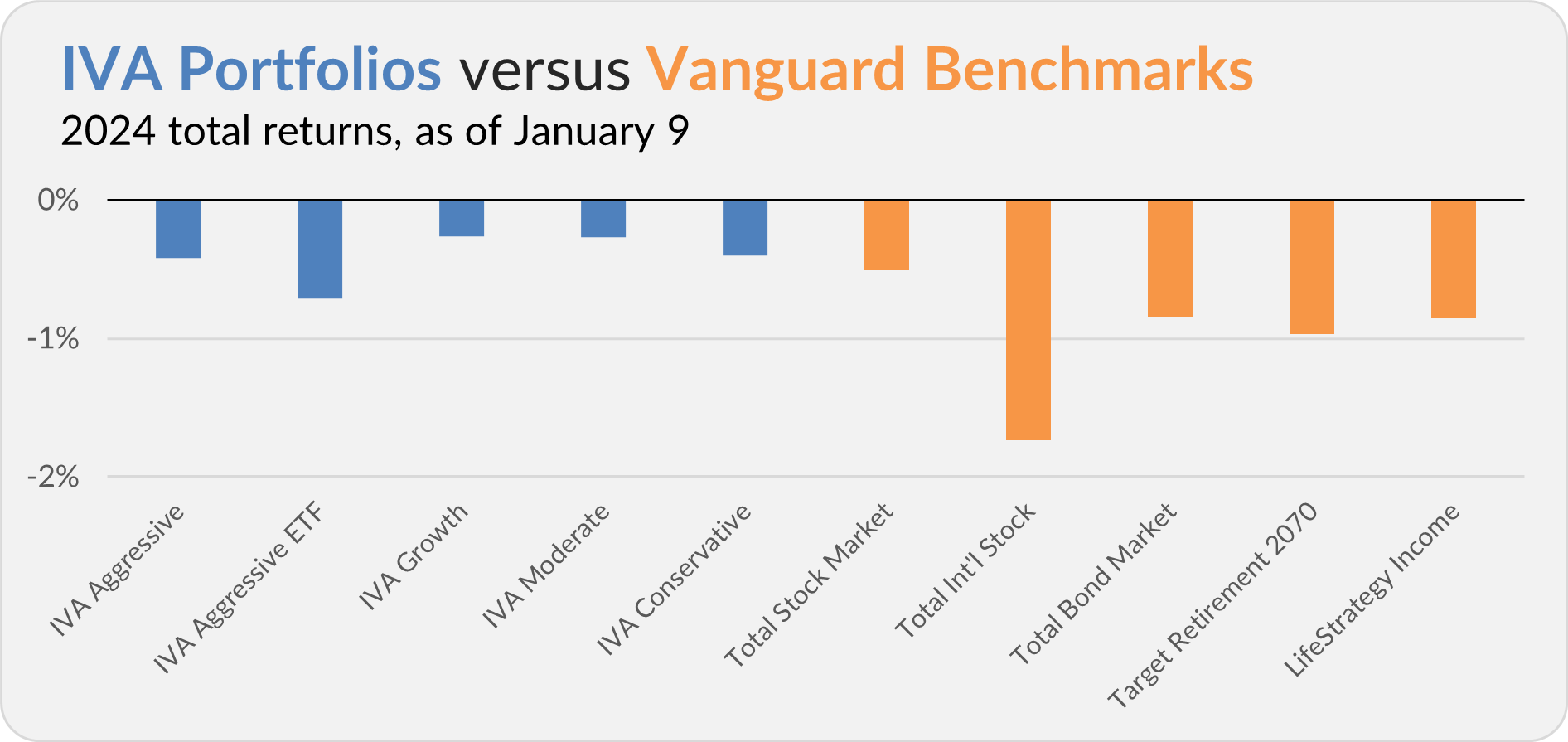

Our Portfolios are down slightly for the year through Tuesday. The Aggressive and Conservative Portfolios are down 0.4%, the Aggressive ETF Portfolio is down 0.7% and the Growth and Moderate Portfolios are down 0.3%.

This compares to a 0.5% decline for Total Stock Market Index (VTSAX), a 1.7% drop for Total International Stock Index (VTIAX), and a 0.8% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is down 1.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is off 0.9%.

For what it’s worth—and it’s only been six trading days, so it’s not worth that much—but one of last year’s laggards, Health Care ETF (VHT), is off to a fast start, up 2.7% this year.

IVA Research

Yesterday, I shared my self-evaluation of my 2023 Outlook with Premium Members.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.