After two false starts, Vanguard’s Emerging Markets ex-China ETF (VEXC) is off to the races.

I predicted this launch two years before Vanguard filed plans with the SEC (in May 2025). The launch was initially slated for August but was delayed without explanation on August 12 and September 9. Now, Vanguard investors (finally) have a choice: Emerging markets—with or without China.

The new ETF charges the same rock-bottom 0.07% expense ratio as its older sibling, Emerging Markets ETF (VWO). The difference? The new ETF tracks the FTSE Emerging Markets ex-China index—broad exposure to emerging economies, minus China.

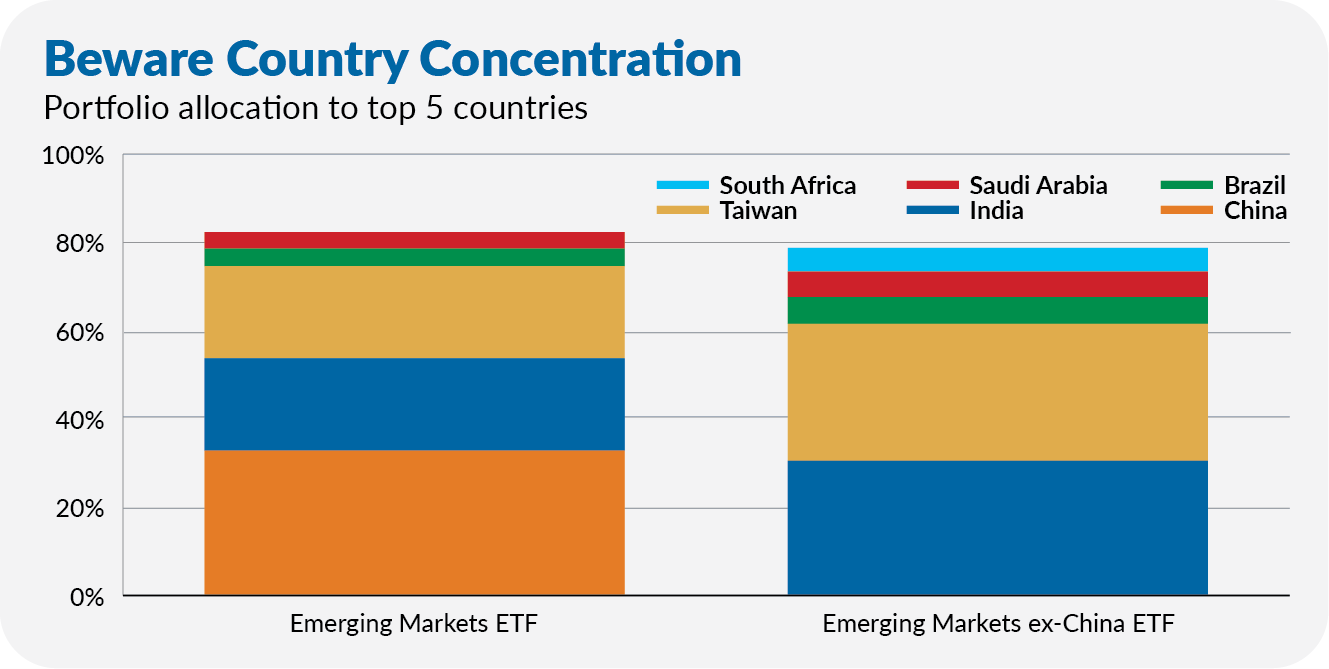

But don’t mistake “broad” for “balanced.” India and Taiwan make up about 60% of the index. Concentration risk comes with the territory in emerging markets. In the older (broader) index fund (VWO), China dominates. In the new fund, it’s India and Taiwan. Either way, you’re making a bet.

Relative results will hinge on China.