Buy the manager, not the fund. But what if the manager changes? This question is on the minds of Dividend Growth's (VDIGX) shareholders like you and me as long-time manager Don Kilbride prepares to hand the reins of the fund to his colleague Peter Fisher at the end of the year.

I first reported on this changing of the guard here. And if you haven’t read it yet, I highly encourage you to check out my interview with Kilbride and Fisher. Coming out of that conversation, I gave myself a homework assignment: Review Peter Fisher’s track record as manager of Wellington’s global and foreign stock versions of Dividend Growth.

Why? Well, if Fisher is going to be calling the shots at Dividend Growth, I want some measure of his skill as a stock picker.

Here I am turning in my homework (with an assist from Wellington for providing the track records—thank you). Fair warning: This analysis will be a little heavy on statistics and charts. Also, all of the data runs through March 31 and is net of fees.

For those of you who simply want the bottom line, here it is:

Fisher has executed a “dividend growth” strategy well in global and foreign markets, which gives me great confidence that he can successfully wear Kilbride’s mantle at Dividend Growth. We’re in good hands, just as Kilbride told me when we spoke.

Before I lay out my findings in full, let’s start at the beginning and review Dividend Growth’s performance with Kilbride at the helm.

Battle Tested

Dividend Growth didn’t become the Dividend Growth we know (and own) today until Don Kilbride arrived on the scene. For the first decade of the fund’s life, it was called Utilities Income and focused solely on that industry. From late 2002 through early 2006, the fund targeted dividend growers and was managed by Wellington’s Minerva Butler.

Kilbride took the reins in February 2006 and put his stamp on the fund immediately. Kilbride’s goal is and always has been to compound wealth in a risk-aware manner. He aims to do this by building a portfolio that will produce a steady, growing stream of dividends. He looks for companies that have both the ability and the willingness to not only pay dividends but to increase those payouts over time.

It’s not about buying the highest-yielding stocks, but about finding companies that will grow their dividends. Kilbride typically owns around 50 stocks and keeps turnover very low. As Kilbride told me in April,

Turnover, to us, is in many cases the enemy.

Vanguard set up a horse race between man and machine when it launched Dividend Appreciation Index (VDADX) in April 2006—just two months after Kilbride took over Dividend Growth. (For simplicity and consistency, in the analysis that follows, I use April 2006 as my starting point.) The index fund aims to track the S&P U.S. Dividend Growers index, which includes companies that have a history of raising their dividends. Think of it as S&P’s attempt to distill the Kilbride approach into a rules-based mechanical investment strategy. (Spoiler alert: Kilbride won the race.)

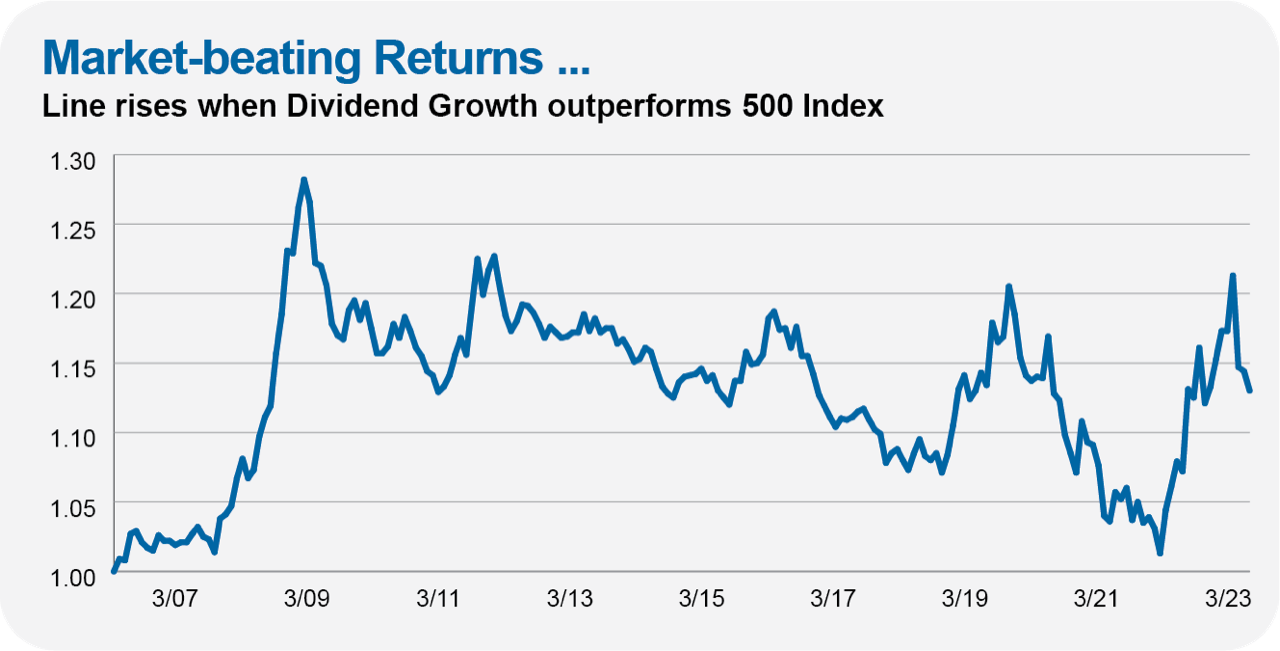

Let’s start with the broad market. The chart below shows how Dividend Growth performed relative to 500 Index (VFIAX). Over the almost 17-year period, Dividend Growth’s 9.9% annual return beat the flagship index fund’s 9.1% annual gain. Kilbride didn’t outperform all of the time—as he said in the interview, their style goes in and out of favor.

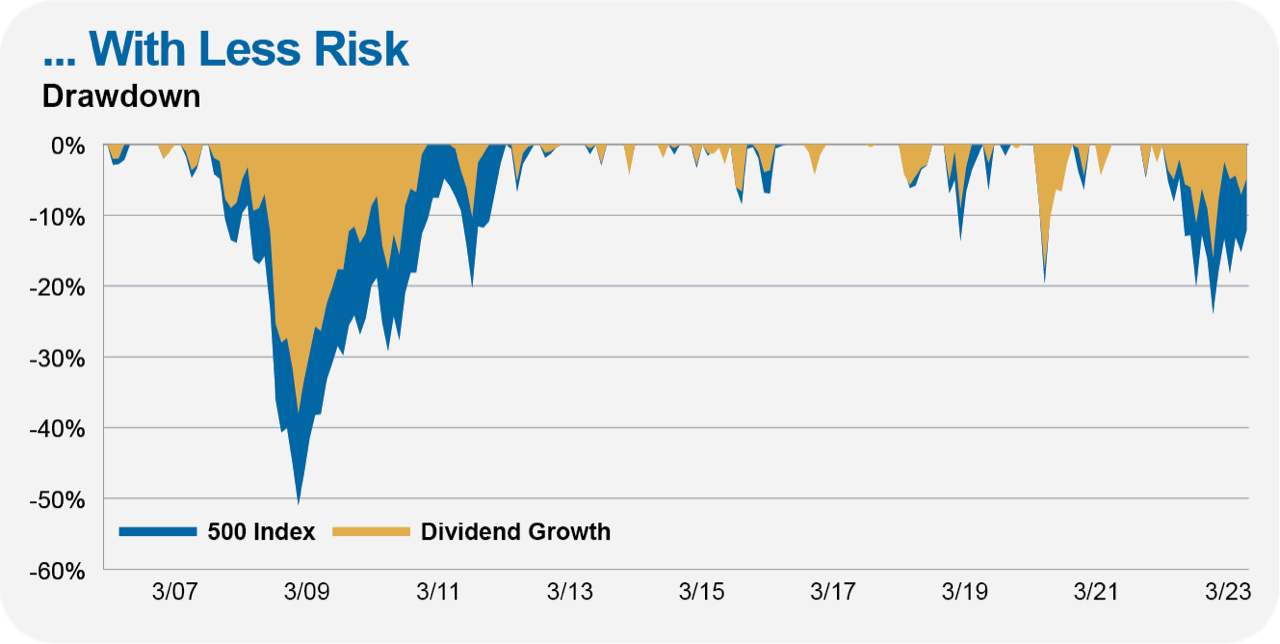

Beating the market is impressive, but what really stands out is that Kilbride did so with less risk, measured by smaller drawdowns. The next chart shows the drawdowns that Dividend Growth and 500 Index investors have experienced since early 2006.

Yes, a lot of Kilbride’s outperformance was generated by losing less during the Great Financial Crisis—that big jump in the line in the first chart. But even if you start the clock in, say, 2010, we are talking about market-like returns with less risk. Still impressive—plus, I wouldn’t be quick to dismiss the fund’s performance during what was arguably the defining moment of Kilbride’s tenure.

These stats reinforce what you should expect from Dividend Growth: The fund is likely to lag when the market is rallying but should hold up better in bear markets. That’s a good combination for a fund that I recommend as the core of a portfolio.

The logical question to ask is whether you could’ve earned similar results just buying Dividend Appreciation Index. After all, if an index can replicate an active approach at a lower cost, well, that deserves our attention.