Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, May 31.

There are no changes recommended for any of our Portfolios.

President Biden and House Speaker McCarthy made a deal to raise the debt limit over the weekend. As I’ve said all along, politics are messy, and this agreement is a compromise—there’s something for everyone to dislike in the bill. I’m pleased that this bill takes a government default off the table for the next two years, but let’s not pretend this puts our financial house in order for the long term—it’s a Band-Aid.

If we are really serious about addressing the deficit and debt, we need to make hard choices on taxes and “non-discretionary” spending programs. Why? Because (as the 1920s-1930s bank robber Willie Sutton is purported to have said), that’s where the money is. According to USASpending.gov, national defense accounts for 18% of government outlays. Social Security is another 15%, while Medicare and “Health” (which is mostly Medicaid) account for another 28%. With interest on our existing debt making up 9% of our outlays, well, that’s 70% or so of our spending right there.

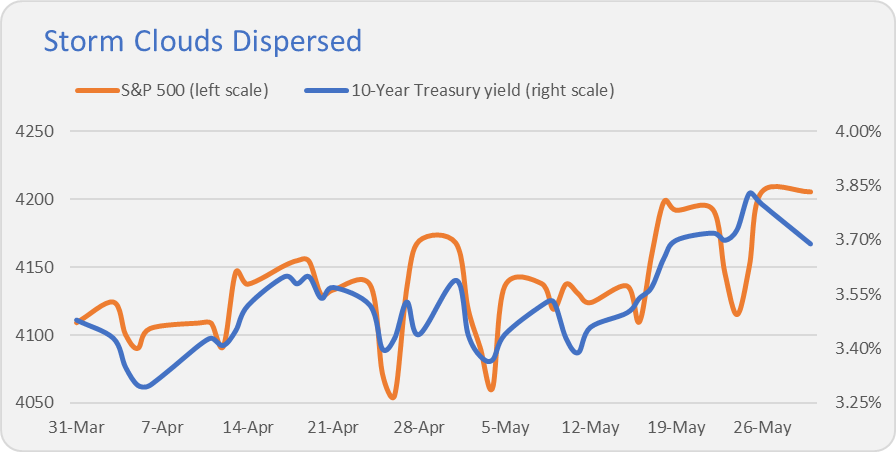

But that’s a political conversation. What matters for us investors is that the storm clouds that arrived last week appear to have dispersed. (I know, the debt-ceiling compromise is still working its way through Congress, but let’s assume it gets done in time.)

What’s remarkable is how the markets seemed to take the entire debt-ceiling debacle in stride. Here’s an update to the chart I’ve shared several times, which tracks the S&P 500 index and the 10-year Treasury yield over the past two months. Yes, bond yields were rising (and prices were falling), but stocks are decently higher since the end of March.

With debt ceiling worries (likely) behind us, the search is on for the next worry du jour. Will we go back to wringing our hands over recession? Inflation? Or maybe something that’s not on anyone’s radar? Time will tell … but so long as stocks continue to climb that proverbial “wall of worry,” I’m not going to. (Worry, that is.)

Vanguard Fires Itself

Last week, Vanguard fired its in-house active management team from both Growth & Income (VQNPX) and U.S. Growth (VWUSX). In both cases, Wellington Management took over the assets Vanguard had been managing. Premium Members can read my Quick Take (which I shared last Friday) on the change here. And if you’re interested in becoming a Premium Member, you can start a free 30-day trial using the button below.

Changing of the Guard

We’re in the midst of another changing of the guard, and I’m not talking about Vanguard’s firing and hiring. As the Baby Boom generation retires, the next generation of fund managers is stepping up and taking the reins.

The latest manager to announce they’ll be hanging it up is Wellington’s Ken Abrams. Abrams, maybe best known as the small-cap growth manager who ran a piece of Explorer (VEXPX) for over 25 years, will retire at the end of June 2024. He hasn’t managed a piece of Explorer’s portfolio since 2020. For the past three-and-a-half years or so, Abrams has co-managed International Core Stock (VWICX) alongside Halsey Morris.

Replacing Abrams will be Anna Lundén, a Senior Managing Director at Wellington. In our conversation with Abrams and Halsey last year (which Premium Members can find in the Archive: See page 12 of the October 2022 issue of our prior publication), Abrams hinted that Lundén was another key member of the investment team, saying,

… Halsey and I and Anna Lundén have one or two meetings before we assemble the whole group …

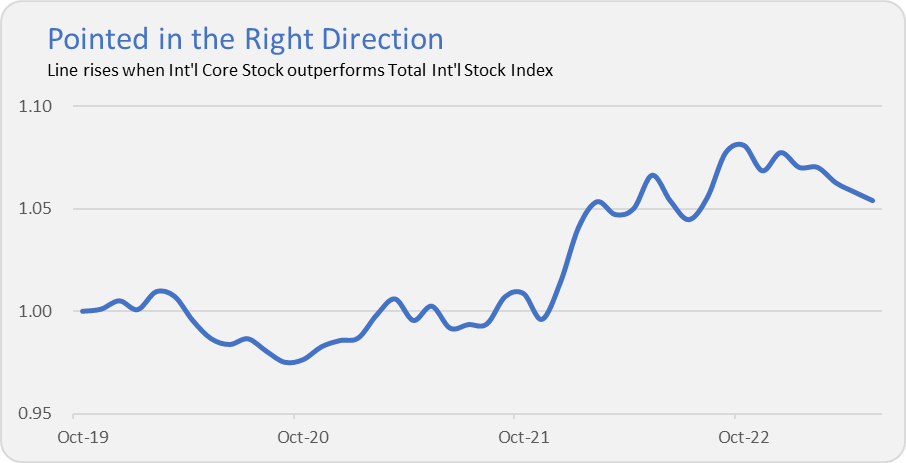

With less than four years under its belt, it’s relatively early days for International Core Stock. However, Abrams has helped steer this ship in the right direction. So far, the active fund has outpaced Total International Stock Index (VTIAX) by 1.6% per year since its launch.

I recommend International Core Stock in the Conservative Portfolio as a more risk-aware means of accessing foreign markets—and, yes, I own the fund personally—so will be digging into this change down the road. We’ve got time, as Abrams isn’t leaving for over a year. But it’ll be up to Morris and Lundén to keep the boat on course when the co-captain sails off into the sunset.

The More the Merrier?

In other Vanguard manager news: Emerging Markets Select Stock (VMMSX) picked up another couple of portfolio managers within its subadvisors. Janet Wang was named a co-manager on Oaktree Capital Management’s portion of the active fund, while Pzena Investment Management added Akhil Subramanian as a co-manager. That brings the fund’s manager ranks to 9 in total.

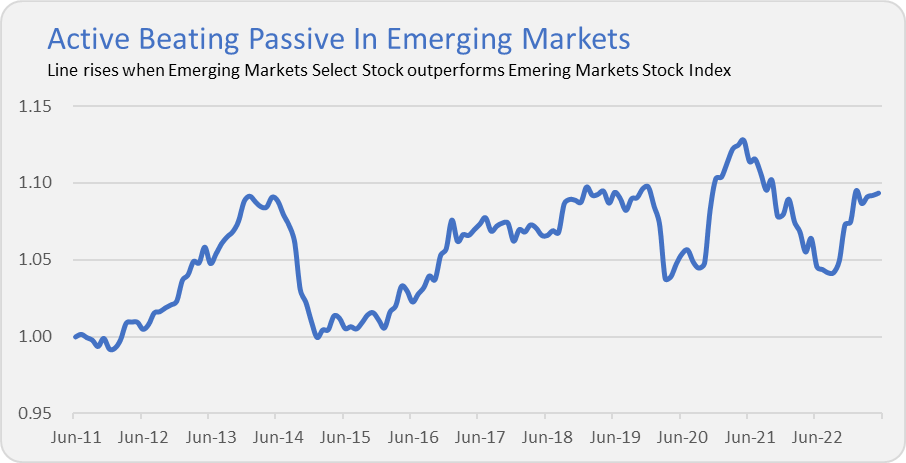

I’ve been skeptical of Emerging Markets Select Stock. Even before there were 9 managers plying at least four different strategies in the mix, I thought we’d end up earning index-like returns while paying active-management-level fees. But the active fund has outpaced the index fund by 0.8% annually since its 2011 launch. That’s not too shabby.

A Wrist Slap

The Financial Industry Regulatory Authority (Finra) nailed Vanguard with an $800,000 fine for issuing misleading account statements and then not responding when clients told them something was wrong. For the record, we covered these account statement issues in November 2020 in our previous publication. In particular, Dan noted that his account statement showed the same yield for New York Municipal Money Market (VYFXX) for over a year even though the fund’s month-end SEC yield ranged from 2.88% to 0.05% over that period. It’s taken Vanguard and Finra more than two years to sort through the issue.

Once again, Vanguard blamed the errors on computers and data feeds, but the bottom line is something that Dan always used to say about relying on Vanguard’s computer and account reporting: “No one is going to care more about your money than you do, so keep an eye on what Vanguard’s doing and reporting.”

While $800,000 sounds like a lot to you and me, it’s a slap on the wrist for Vanguard, which, according to Investment News, “did not admit or deny Finra’s findings.”

Our Portfolios

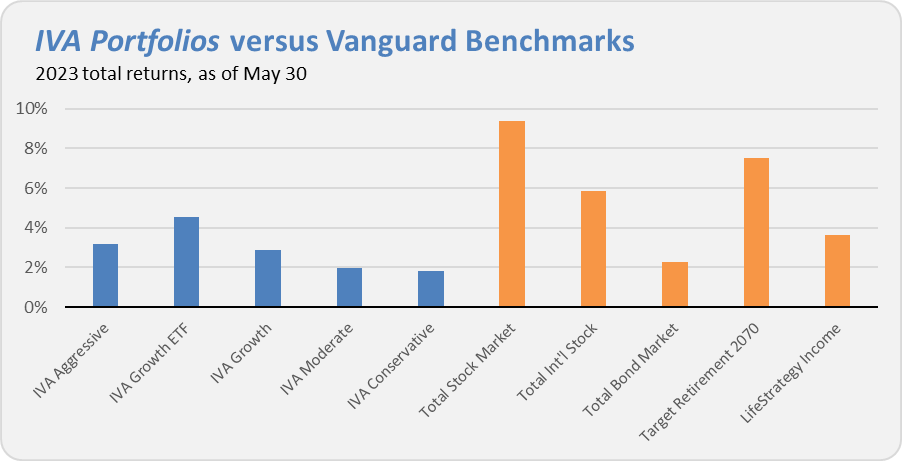

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 3.2%, the Growth ETF Portfolio is up 4.6%, the Growth Portfolio is up 2.9%, the Moderate Portfolio is up 1.9%, and finally the Conservative Portfolio is up 1.8%.

This compares to a 9.4% return for Total Stock Market Index (VTSAX), a 5.8% gain for Total International Stock Index (VTIAX), and a 2.3% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 7.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.6% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.