Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, October 11.

There are no changes recommended for any of our Portfolios.

The relative stability in the Middle East was upended when Hamas militants in the Gaza Strip attacked Israel on October 7. Israel has responded with airstrikes that may be a prelude to a ground assault. I’m saddened by the violence and hundreds of innocent deaths.

As I said last week, this isn’t a political newsletter. It’s also not a geopolitical newsletter, and I don’t pretend to have a solution to the conflict between Israel and Palestine. As always, I try to keep my investor hat firmly in place.

When it comes to the markets, in response to an outbreak of armed conflict in the Middle East, you’d expect to see the classic flight-to-safety trade (Treasurys and gold prices up, stock prices down) and oil prices on the rise. But that’s not exactly how the first two trading days have played out.

Oil prices on the rise? Check. Oil prices have jumped 3.4% in the past two trading days. Vanguard’s best-performing fund has been Energy Index (VENAX), with a 3.6% return.

Treasury prices up? Check. Intermediate-Term Treasury (VFITX) gained 0.7%. (All of Vanguard’s bond funds have gained ground in the past two days.)

Gold prices up? Check. Gold is up 1.6% since Friday’s close—though technically, gold prices fell marginally on Tuesday.

Stock prices down? Not so fast. All of Vanguard’s diversified stock funds gained ground over the past two days, ranging from Global Environmental Opportunities Stock’s (VEOIX) 0.7% return and SmallCap Growth Index’s (VSGAX) 2.0% advance. 500 Index (VFIAX) and Total International Stock Index (VTIAX) gained 1.2%.

The point is that investing based on geopolitical events is easier said than done—markets don’t always follow “the script.” Of course, I’ve discussed returns over two trading days. If I were a day trader, maybe two days would be meaningful. But I’m not.

Returning to Normal

The yield curve is returning to normal.

The yield curve maps the yields of Treasury bonds against their maturities—ranging from three months to 30 years. Most of the time, the curve slopes up and to the right, as bonds with longer maturities typically yield more than bonds with shorter maturities.

However, the yield curve inverts from time to time—meaning shorter-maturity bonds yield more than longer-maturity bonds. The yield curve has been inverted for the past year or so, depending on which part of the graph you are looking at.

Investors and pundits focus on the yield curve because an inverted yield curve has been a reliable early warning signal of a recession ahead. For a primer on the yield curve, see here.

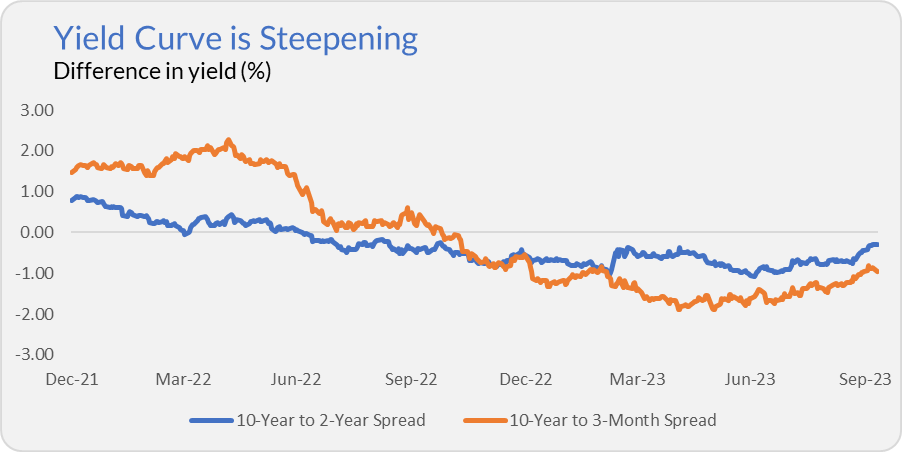

As I said, the yield curve is returning to normal. Yields on longer-maturity bonds have been rising and are catching up to yields of shorter-maturity bonds. You can see this in the graph below, where I track the difference in yields between 10-year and 2-year Treasurys as well as 10-year and 3-month Treasurys.

What are we to make of this return to normal? Does it mean that the yield curve was wrong this time?

Not necessarily.

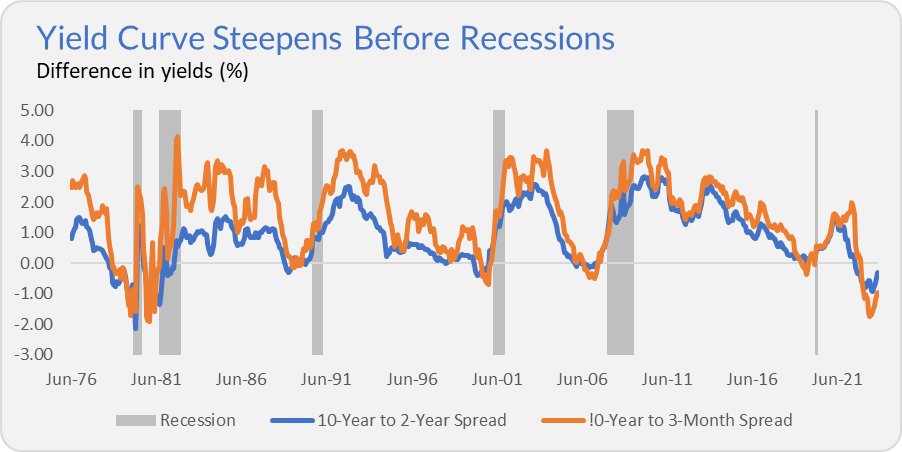

While the yield curve often gets a lot of attention when it inverts (goes from positive to negative), arguably, we should be on higher alert when the graph returns to normal (goes from negative to positive). In the past, the yield curve has steepened before the recession started.

No, I’m not about to upend my portfolio based on this data point. Forecasting a recession is easier said than done—the consensus got it wrong this year. Even if you can correctly time a recession, you must also correctly anticipate how the market will react to profit.

On Air

Last week, I had the pleasure of participating in the Money Life with Chuck Jaffe podcast. You can find my segment below. The entire October 6 episode is available on the moneylifeshow.com website.

We discussed my investment philosophy and approach to the markets. Chuck also puts me on the hot seat for my quick take on a bunch of Vanguard’s funds.

Our Portfolios

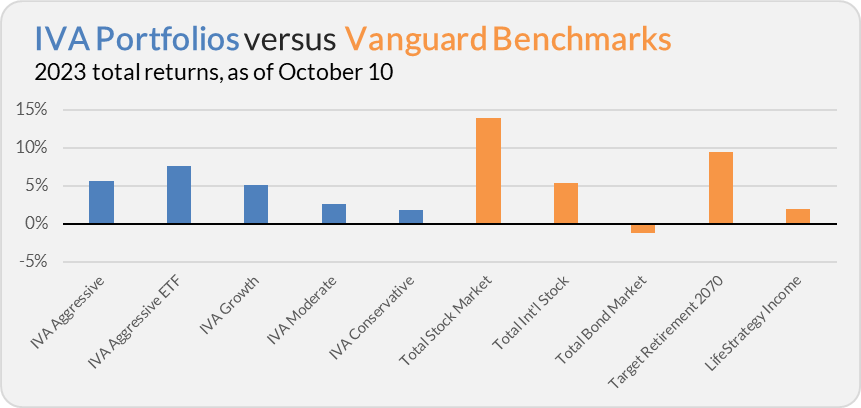

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.7%, the Aggressive ETF Portfolio is up 7.7%, the Growth Portfolio is up 5.1%, the Moderate Portfolio is up 2.7% and the Conservative Portfolio is up 1.9%.

This compares to a 14.0% gain for Total Stock Market Index (VTSAX), a 5.4% return for Total International Stock Index (VTIAX), and a 1.3% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 9.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.9%.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.