Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, November 2.

There are no changes recommended for any of our Portfolios.

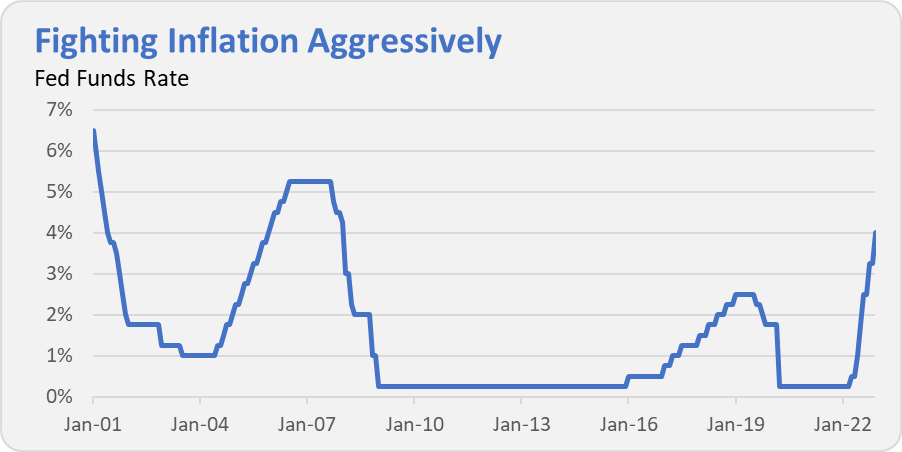

All eyes were on the Federal Reserve (Fed) today. As expected, policymakers hiked the fed funds rate by 0.75%. The upper end of their target is now 4%, a far cry from just 0.25% at the beginning of the year. The last time the fed funds rate was above 4% was January 2008. So, it’s been a while—and the Fed may not be done yet. Traders expect that the fed funds rate will reach 5% early next year.

If that happens, the Fed will have moved the fed funds rate from the near-zero-bound to 5% in roughly 12 months. That’s a huge move, and unlike anything we’ve seen the last two decades. But inflation is also running hotter than it has in a very long time.

With today’s move, the Fed has now hiked interest rates by 0.75% on four consecutive occasions. It seems likely that they will continue to hike the fed funds rate at the next meetings but by smaller amounts. Powell & Co. are in a bit of a pickle as inflation is still higher than they’d like, but the economic data is weakening, and as I discussed last week, there are signs of a recession on the horizon.

So, does the Fed keep tightening policy (hiking interest rates) to combat inflation or do they “pivot” and start easing policy to avoid (or at least lessen the impact of) a recession? It’s a tough spot to be in.

Turning to Malvern, Vanguard launched Global Environmental Opportunities (VEOIX) today. The fund is in a subscription period through November 15. This means that for the next two weeks, any investments in the fund will sit in cash before the managers start buying stocks and building out the portfolio. If the fund appeals, there’s no rush to have your money invested and sitting in cash.

Global Environmental Opportunities, sub-advised by Ninety One, is Vanguard’s latest addition to its ever-expanding ESG lineup. Remember, ESG stands for Environment, Social and Governance. As the name implies, this particular fund is geared towrad the environment. The portfolios managers, Deirdre Cooper and Graeme Baker, will typically own 25 companies that are involved with renewable energy, electrification and resource efficiency—getting more out of the materials we use today.

In short, if you’re concerned about the environment—and carbon emissions in particular—and you want to align your portfolio in that direction, well, Global Environmental Opportunities is the Vanguard fund for you—or should be.

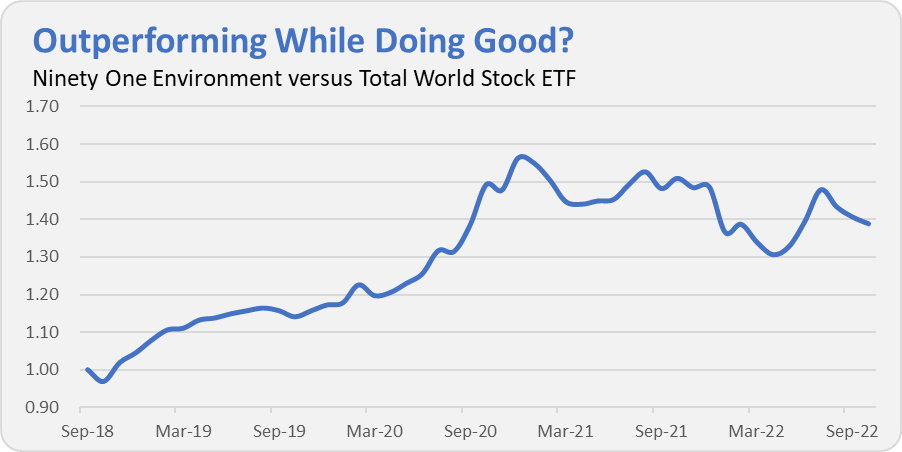

I’ll have a more detailed run down of the fund for Premium Members in the weeks ahead, but here’s a quick look at performance. Ninety One has managed a “decarbonization” strategy for private clients since 2018 and launched their own mutual fund in August 2021. I’ve linked up those track records to compare the strategy against Total World Stock ETF (VT).

From inception through October 2022, Ninety One’s 67% gain outpaces the global ETF’s 20% return by a good margin. However, as you can see in the chart, all of that outperformance was earned between late 2018 and the end of 2020. Since then, performance has been more mixed.

Given this is a concentrated portfolio—just 25 holdings—focused on a market niche, success will require lucky timing or patience. Even if the fund goes on to outperform over time, there will inevitably be periods of underperformance.

Vanguard now has three global, actively managed funds that target each of the E, S and G that make up the ESG moniker. Global ESG Select Stock (VEIGX) is geared to governance, Baillie Gifford Global Positive Impact Stock (VBPIX) is more about the social impact companies are having and Global Environmental Opportunities covers the “E.”

I think Vanguard is far from done when it comes to rolling out more ESG funds. How about ESG Target Retirement funds? Or how about more ESG options for bond investors?

I’m not holding my breath in anticipation for further ESG funds to come flying off the shelf, but I won’t be surprised when they do.

Finally, the performance of our Portfolios has picked up recently. Since the stock market bottomed on October 12 through Tuesday (November 1), 500 Index (VFIAX) has returned 7.9%. The biggest contribute to returns lately has been Dividend Growth (VDIGX), which gained 8.8% since October 12. The dividend fund is now down only 8.0% on the year—less than half the index fund’s 18.1% decline.

For the year through Tuesday, the Aggressive Portfolio is down 17.5%, the Growth ETF Portfolio is off 19.7%, the Growth Portfolio is down 16.2% and finally the Moderate Portfolio has declined 13.7%. This compares to a 19.0% decline for Total Stock Market Index (VTSAX), a 23.4% drop for Total International Stock Index (VTIAX), and a 15.6% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065 (VLXVX), is down 20.0% for the year and its most conservative, LifeStrategy Income (VASIX), is down 15.7% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is off 12.0%.

Until next week this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.