Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, April 3.

There are no changes recommended for any of our Portfolios.

It’s no April Fool’s joke; the markets got off to a rough start in April.

Only seven Vanguard funds (not counting the money market funds) gained ground in the first two trading days of the month. Energy ETF (VDE) was the best performer, with a 2.0% gain. Vanguard’s two emerging market stock funds—Emerging Market Select Stock (VMMSX) and Emerging Market Stock Index (VEMAX)—were among the winners, along with Commodity Strategy (VCMDX).

But just about everywhere else you looked, asset prices were down. 500 Index (VFIAX) slid 0.9%, MidCap Index (VEMAX) dropped 0.6% and SmallCap Index (VMSAX) fell 2.3%. Emerging market stocks may have gained ground, but Developed Markets Index (VTMGX) fell 1.0%. And it wasn’t just stocks that declined in price; Real Estate Index (VGSLX) dropped 3.0% and Total Bond Market Index (VBTLX) slid 0.8%. Oh, and bitcoin fell 7.5% over Monday and Tuesday.

But, as I said, it’s only two trading days. As I write this, stocks are recovering again. If you’re a trader, I suppose these day-to-day swings in the market are important. For long-term investors like us, it’s just noise.

Lost and Found

Vanguard’s technology is not at the level it should be.

The latest snafu involved the simple and regular task of paying out Short-Term Investment-Grade's month-end distribution.

As I told Premium Members earlier this week, several of your fellow IVA readers reported that Short-Term Investment-Grade's March distribution was missing from their accounts and statements. The issue was specific to the fund's Admiral shares (VFSUX), not its Investor shares (VFSTX).

On Monday, Vanguard corrected the problem, telling me that:

March dividends will be distributed tonight (4/1) with a 3/28 trade date. No further action from clients is needed.

In the normal course of business, Short-Term Investment-Grade’s shareholders reinvesting distributions would expect to see a trade and settlement date of March 28—the fund’s reinvestment date. This is what owners of the Investor shares experienced. However, for the Admiral shares, because Vanguard didn’t post the trade until Monday, shareholders should see a trade date of March 28 but a settlement date of April 1.

Vanguard has not explained how this happened, which leaves me wanting to know more…and worried that it could happen again.

If this were the only tech-related issue at Vanguard, I could wave it away. But it’s not. Here are a few other issues on my radar right now:

First, it’s been two months since I wrote to you about Vanguard’s inability to handle trading noncovered shares on its website. Based on my interactions with IVA readers, despite this being a “known problem,” Vanguard has not found a fix.

Second, on a smaller scale, the data on Vanguard’s site is getting stale.

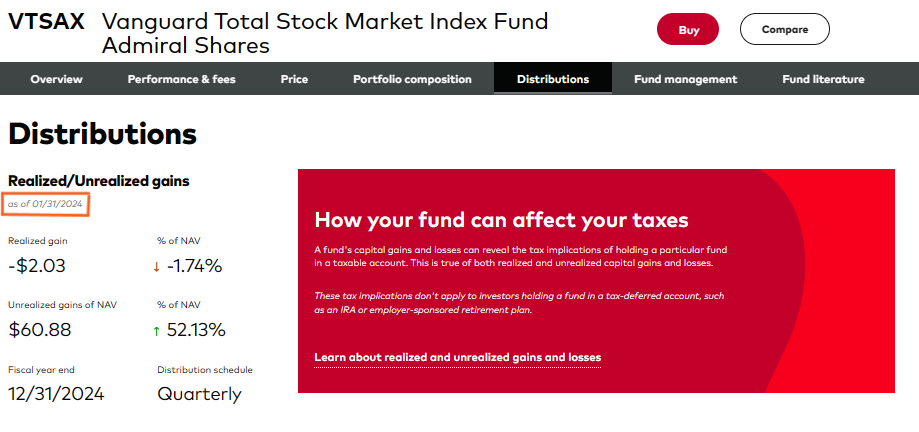

In particular, I’m talking about the realized and unrealized capital gain data that Vanguard typically reports each month. I have always lauded Vanguard for sharing this information regularly—every fund company should follow Vanguard’s lead. However, the data on Vanguard’s website is still “as of 1/31/2024.”

Did Vanguard forget to make the update in February? Or have they decided to stop reporting this useful information?

And on top of that, yesterday, an IVA reader told me that her Vanguard adviser canceled their 3 p.m. appointment because “all of Vanguard’s computers were down.”

I don’t mean to beat a dead horse here, but Vanguard’s technology and service have become the firm’s Achilles heel. There are some signs that Vanguard’s digital experience is improving, but Vanguard still has a lot of work to do.

As I’ve said, fixing Vanguard’s tech should be the first order of business for whoever replaces Tim Buckley as CEO next year.

No More Free Passes

I’m going to take us into the weeds and talk about regulation and oversight. Why? Vanguard’s core business—managing low-cost index funds—has been threatened. Or at least it could become more expensive to operate. Let me explain.

If you want to buy, say, 10% of the stock of a utility company or a bank, you’ll need to get regulatory approval. The hurdles vary from industry to industry, but the intent is the same—if you are going to be an influential owner of a company, the regulators want to know about it so they can put you on their radar.

Due to the trillions Vanguard manages for shareholders (through both its index funds and active funds), it holds large stakes (say, 5% or more) in pretty much every U.S. public company. (The same goes for BlackRock and, to a lesser extent, State Street.) Regulators have typically given Vanguard the green light to own large holdings in various companies and industries as a “passive owner.” Vanguard doesn’t go around agitating for new boards or lobbying to spin off companies, for example.

But the “we’re a passive index fund provider” defense has come under fire recently.

First, government regulators were worried about index funds’ utilities holdings.

In December 2022, a coalition of attorneys general petitioned the Federal Energy Regulatory Commission (FERC) to revoke Vanguard’s authorization to own more than 10% of any utility. They argued that Vanguard, through its membership in groups like the Net Zero Alliance, was no longer a passive investor.

Vanguard backed out of the Net Zero Alliance and ultimately was granted approval by FERC to continue purchasing and building large ownership stakes in U.S. utility stocks as a passive owner.

FERC has recently been reviewing its policy toward investment companies like Vanguard. Vanguard recently submitted a comment letter to the agency. I’ve included a copy of the letter below, should you want to read it.

The short story is that Vanguard is asking FERC to provide clear guidelines for passive investors. Vanguard proposes a few measures that align with the asset manager’s standard operating procedure—effectively, Vanguard is trying to set the bar at Vanguard’s level.

More important than any specific rule or guideline, what this tells me is that Vanguard seriously believed its ability to purchase utility stocks and track the indexes was at risk last year. With this letter, Vanguard is looking to remove (or at least reduce) the risk to its business model.

But in a game of regulatory Whack-a-Mole, the FDIC is now considering changing how it monitors and regulates firms like Vanguard and BlackRock. The two mutual fund giants each own more than 10% of the shares of many banks. Typically, they’d have to follow a host of rules as “bank holding companies,” but so far, they have been exempted as passive investors.

If Vanguard can’t buy more bank stocks, it can’t track the indexes. This isn’t an idle concern. Jonathan McKernan, the FDIC board member pushing for the change, is asking to pause Vanguard’s approval to buy shares above the 10% threshold while the matter is under review.

Even if Vanguard gets approval to buy additional bank stocks, it could come with increased oversight and hurdles—and that means higher costs! The rules that “bank holding companies” are typically subject to are onerous and include meeting certain capital and liquidity requirements.

While the proposal before the FDIC may or may not go anywhere, it’s clear that the days of index funds getting a regulatory “free pass” are over.

Our Portfolios

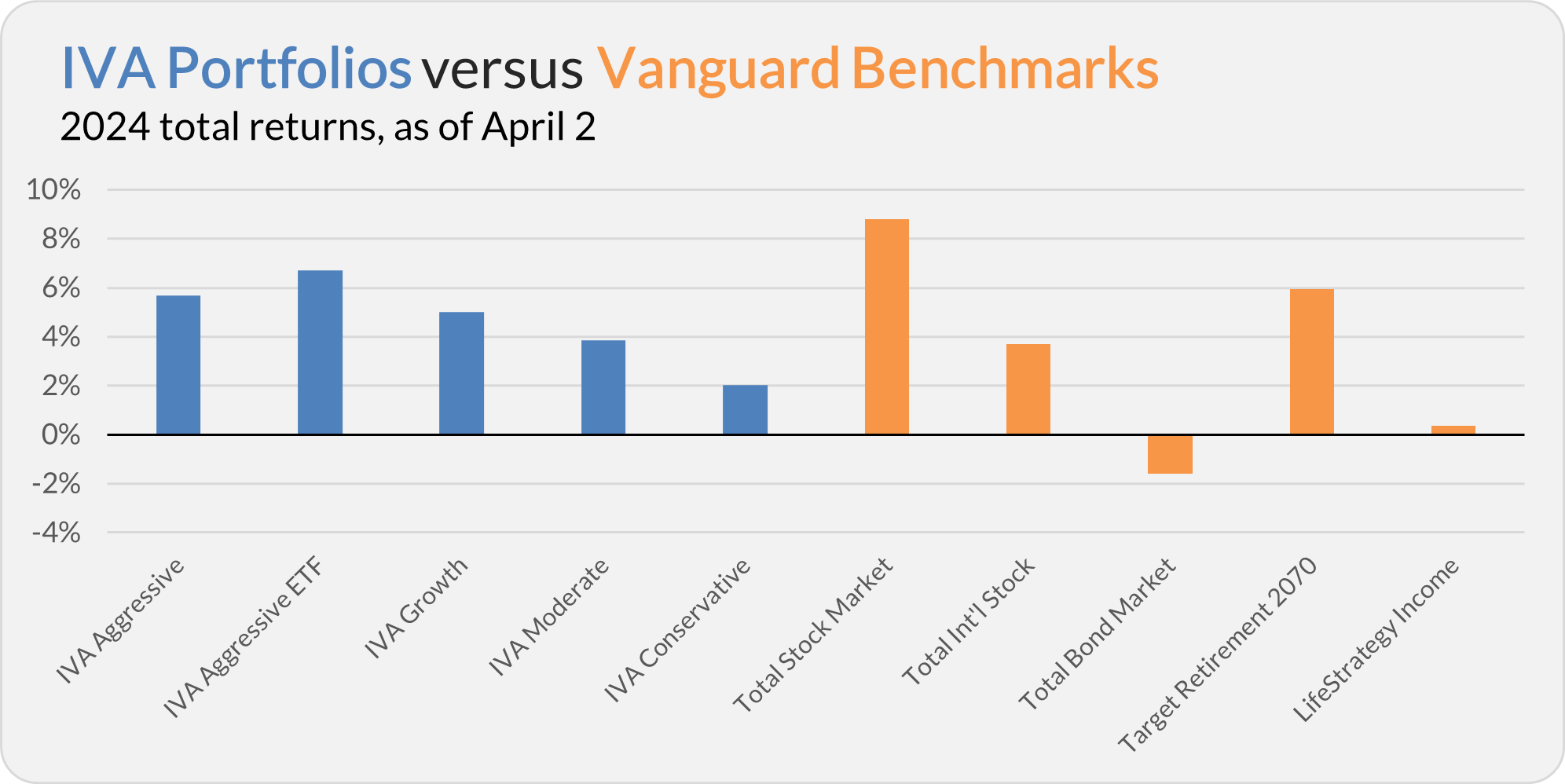

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.7%, the Aggressive ETF Portfolio is up 6.7%, the Growth Portfolio is up 5.0%, the Moderate Portfolio is up 3.8%, and the Conservative Portfolio is up 2.0%.

This compares to an 8.8% gain for Total Stock Market Index (VTSAX), a 3.7% return for Total International Stock Index (VTIAX), and a 1.6% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 5.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.3%.

IVA Research

Yesterday, in How to Invest for College, I shared my take with Premium Members on how to approach investing your 529 plan assets.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.