The risks that everyone is worried about rarely trip up the markets. It’s those Rumsfeld-ian “unknown unknowns”—the risks we aren’t talking about—that throw investors for a loop.

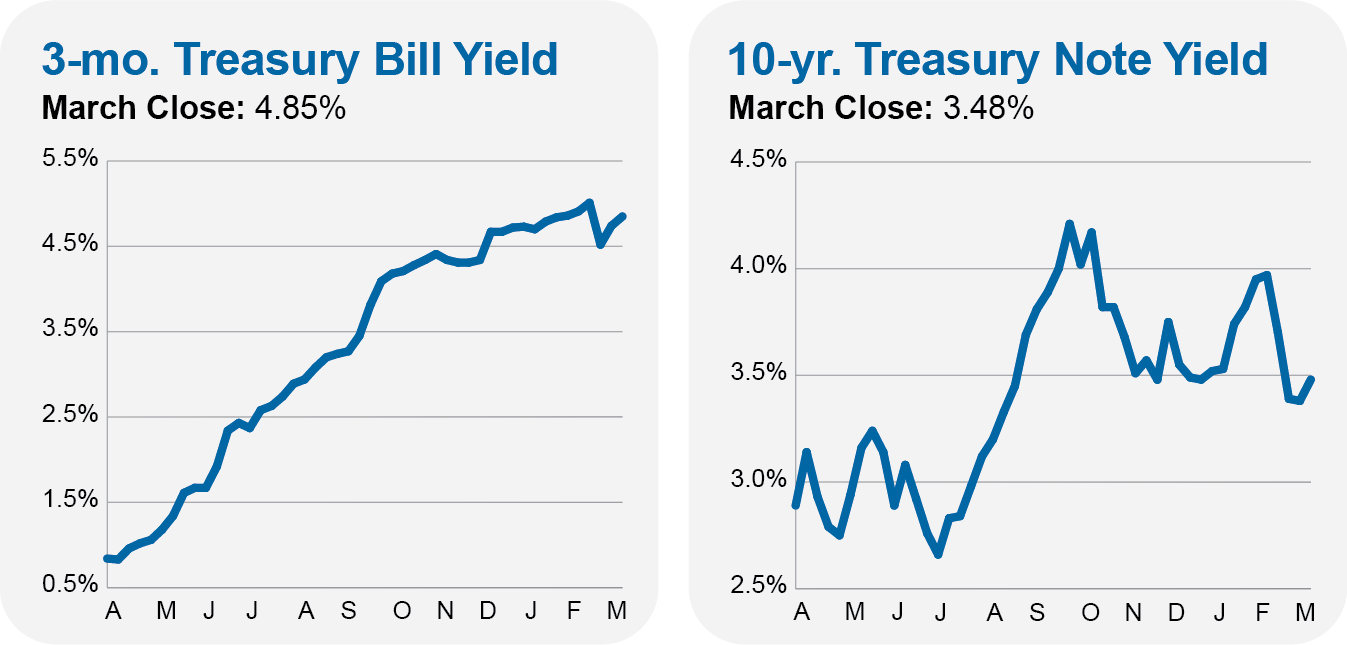

Consider the first three months of 2023. At the start of the year, the “big question” on everyone’s mind was whether the Federal Reserve (Fed) would raise interest rates too high and tip the economy into recession. So far, despite hiking the fed funds rate from 4.5% to 5.0% during the first quarter, a recession has yet to appear.

Instead, what became our “near and present danger” was an unforeseen run of bank failures, triggering a wholesale reassessment of the banking sector, in particular small- and mid-sized institutions.

Investors have been pulling cash from their checking accounts and flocking to money market funds. Peter Crane (of Crane Data) estimates that assets in Vanguard’s taxable money market funds increased by 5% in March while the firm’s municipal money market fund assets jumped by 12%. Those are some big moves in a month—we’re talking over $20 billion in motion at Vanguard.

Part of this influx relates to customer worries about the next bank run. But it also comes down to the fact that savers, who for years settled simply for a return of their money, are finally earning a return on their money.

According to the FDIC, the average checking account pays just 0.06% in interest. For another reference point, Schwab (where I have had a checking account for years) reports paying 0.45% in interest per year. (That’s not an endorsement of Schwab, just a data point relevant to me.) Those yields pale in comparison to Federal Money Market’s (VMFXX) 4.77% month-end yield.

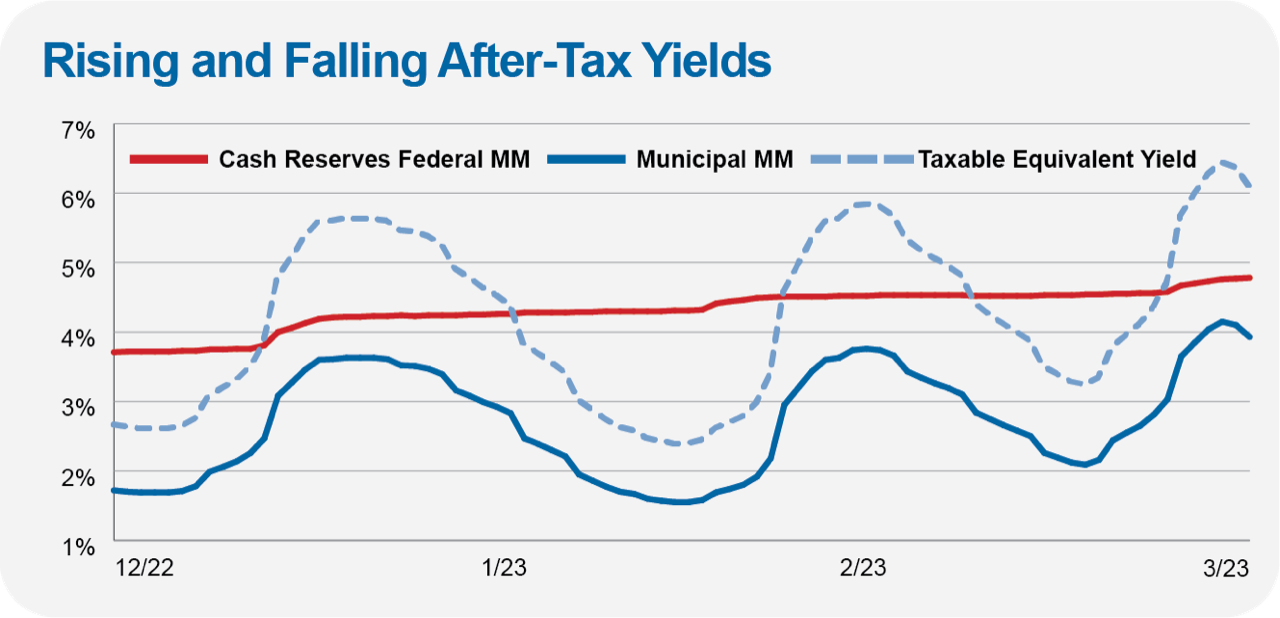

For tax-sensitive investors, I’ve written about the rollercoaster that municipal money market yields have been on several times in the past few months—most recently here. Over the past month, tax-exempt money market yields fell and then rose.

Today, they are at some compelling levels. To match Municipal Money Market’s 3.93% yield after taxes, Federal Money Market would have to yield 6.12%. (That’s assuming a federal tax rate of 35.8%.) I live in New York City, so the state-specific money market fund, which was yielding 3.89% at month-end, is even more attractive.

As you can see in the chart (which uses the same 35.8% federal tax rate for the taxable equivalent yield I used above), tax-exempt yields started to turn lower on the final two days of the month. That comes as no surprise to me—I expect over time to earn a similar return after taxes whether I choose the taxable or the tax-exempt fund. Or at least, the difference shouldn’t be as large as it has been (in both directions) over the past few months.

As I’ve cautioned several times in the recent past, I don’t think it’s worth chasing yields for every last penny or basis point. But if you have cash languishing in a checking account, it’s kind of a no-brainer decision right now. If you can earn 3% to 4% more without taking additional risk, why wouldn’t you?

The Last Shall Be First

Turning to March’s markets.

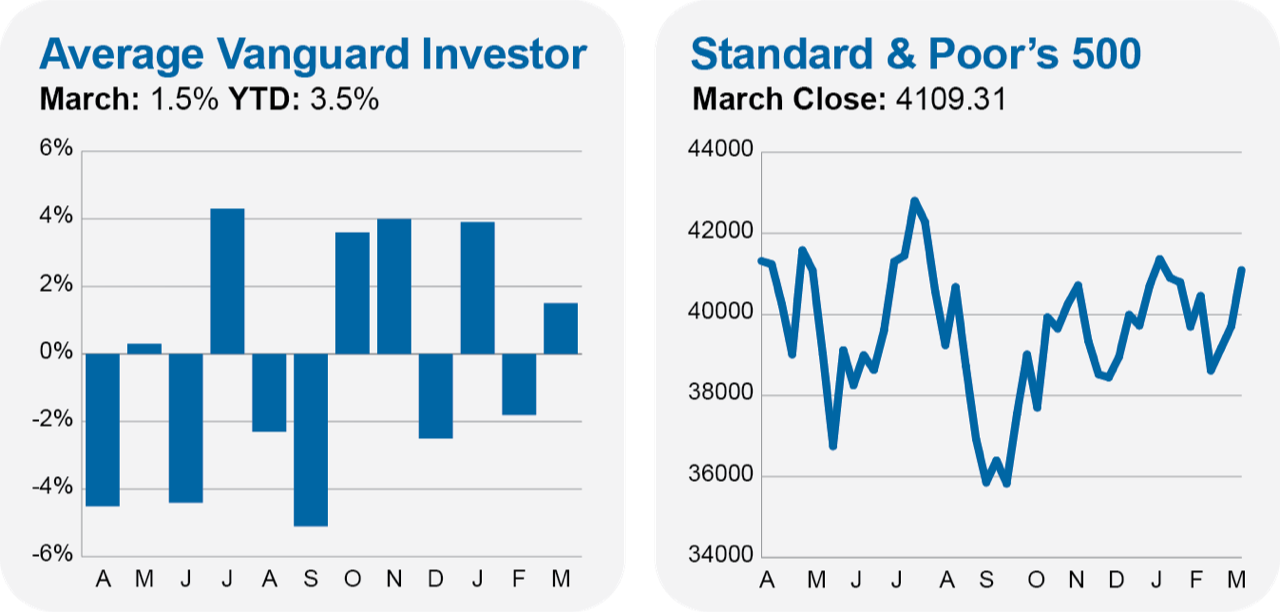

At the broadest level, everything looks good—gains were made all around: In the first three months, Total Stock Market Index (VTSAX) gained 7.2%, Total International Stock Index (VTIAX) returned 6.7% and Total Bond Market Index (VBTLX) advanced 3.2%.

But as usual, some of the market divergences are lost when looking at the total market funds. For example, larger stocks are beating small stocks. On the year, Large Cap Index (VLCAX) is up 7.7% while SmallCap Index (VSMAX) is up 3.7%. The two indexes really went their separate ways in March, as the large cap index gained 3.7% while the small cap fund fell 3.6%.

Or consider the difference in returns between growth and value stocks. In a reversal of relative fortunes from last year, Growth Index (VIGRX) has returned 17.2% so far while Value Index (VIVAX) is down 0.5%. You can see this divergence reflected in the performance of Vanguard’s sector ETFs. Technology, communication and consumer discretionary stocks were last year’s losers but top the charts this year.

When it comes to a reversal of fortunes, look no further than the bond market. Yes, bond funds have a long way to go to make up for last year’s losses, but every single one of Vanguard’s bond funds gained ground in the first quarter. That’s a good start.

What’s consistently in the red this year are Vanguard’s “alternative” funds. Market Neutral (VMNFX) is off 1.3% and Commodity Strategies (VCMDX) has declined 3.3%. Alternative Strategies (VASFX) is also underwater, but this fund is being liquidated in April, and judging by its recent performance, it holds mostly cash at this point. Okay, Real Estate Index (VGSLX) is up 1.8%, but the index fund was in the red until the final day of the month, and its foreign sibling is down 2.0%.

As I’ve said, adding complexity to your portfolio doesn’t guarantee better results.

Beware Point-in-Time Returns

Over the past few months, 500 Index’s (VFINX) three-year return has risen dramatically. At the start of the year, the index fund’s three-year return clocked in at a 7.5% annualized pace. At the end of March, the fund’s three-year return jumped to 18.4% per year.

The biggest factor in those improved numbers is simply that the pandemic panic returns are falling out of the calculation. 500 Index fell 8.2% in February 2020 and another 12.4% the next month. Remove those poor returns and start the clock at the market’s low point, and of course your returns are going to look a lot better.

If you want to be specific, the three anniversary of the pandemic market low was March 23, 2023. 500 Index’s three-year annualized return measured from the daily low point was 22.6%.

In the context I’ve presented here, you might think that a 7.5% annual return is particularly bad and an 18.4% per year return is abnormally good. Neither is correct.